Hysteria definition: Current Overreaction Is The Perfect Example

Dec 25, 2024

“Panic is contagious, but so is the reason.”

Mass hysteria, or collective psychogenic illness, is a fascinating yet troubling phenomenon where imagined threats take root, spreading like wildfire through the collective psyche of a population. Whether fueled by whispers of danger or the relentless march of misinformation, it transcends the boundaries of psychology, medicine, and sociology, weaving itself into the fabric of culture and human behavior. From debilitating physical symptoms to collective delusions, hysteria challenges the delicate balance between reality and perception, revealing how deeply fear can manipulate the human mind.

Understanding this psychological dance between fear and reason has never been more critical in a world increasingly governed by rapid information exchange and amplified anxieties. As the current global climate underscores, the line between vigilance and overreaction is razor-thin, and the stakes are high.

Unravelling the Web: The Intricate Dance of Deception in the Disinformation Campaign

Today, over 22,000 individuals will tragically succumb to hunger, marking it as one of the most harrowing ways to meet one’s end. The toll from this year’s flu has already claimed 110,000 lives, while approximately 650,000 individuals annually lose their battle to respiratory-related diseases. Regrettably, 70,000 mothers have faced mortality while giving birth this year.

In another disheartening reality, the year has witnessed over 242,000 suicides, emphasizing the urgent need for mental health support.

Disturbingly, 7 million children under the age of five have met untimely deaths in the current year alone, a statistic that calls for intensified global efforts in child health. The following links highlight the gravity of these issues:

1. http://bit.ly/32wVaQA (7 million children’s deaths)

Addressing road safety concerns, 25 million people succumb to road crashes annually. Within this, more than 270,000 pedestrians have lost their lives this year, underscoring the importance of comprehensive road safety measures. For further insights, refer to:

2. https://bit.ly/2vId4UJ (Road crash statistics)

Additionally, in the United States, 88,000 individuals are projected to meet their demise due to alcohol-related causes, while 22,000 Britons are expected to succumb to prescription mix-ups. Explore more details here:

3. https://bit.ly/2QEW7BN (Alcohol-related causes and prescriptions mix-ups)

Medical errors, a critical issue, are estimated to result in the deaths of 250,000 to 440,000 individuals in America. A comprehensive understanding of this issue is crucial, and you can delve into the details here:

4. https://cnb.cx/33DF9cg (Medical errors)

Furthermore, a two-decade-long analysis indicates that over 100,000 Americans may lose their lives due to prescription drug-related complications. A recent study raises this figure to nearly 128,000. For in-depth information, refer to:

5. https://bit.ly/39cYtOw (Prescription drug-related deaths)

Lastly, a historical perspective is provided by an article from the NCBI database, dating back to 1999, stating that 100,000 Americans died as a result of medical errors. Explore this archival insight here:

6. https://bit.ly/3dxoRGy (Historical perspective on medical errors)

In 2018 alone, 5,000 Americans lost their lives to drug overdoses, highlighting the ongoing challenges in addressing this public health crisis. For more details, you can visit:

7. https://cnn.it/2xhpEL6 (Drug overdoses in 2018)

Does the coronavirus epidemic rightfully dominate the spotlight it receives? Cancer, smoking, and cardiovascular diseases, responsible for millions of annual deaths, remain conspicuously unmentioned. What about the daily toll on innocent children? Do their lives not warrant consideration? Surprisingly, deadlier viruses in the past didn’t garner comparable attention. One is compelled to question the state of contemporary media. Are today’s reporters mere mindless automatons?

Unleashing the Shadows: The Dance of Deception in the Disinformation Campaign

“Truth has no voice where fear reigns supreme.” Amid rampant disinformation campaigns, the fine art of perception manipulation has become a weapon of mass disruption. Markets, once grounded in fundamentals, now teeter on the whims of fear-driven narratives. Bid-ask spreads reflect chaos, not clarity—echoing the hysteria of a society gripped by anxiety.

To confront this haze of uncertainty, bold action was required. Venturing solo into the heart of Asia, I sought to unravel whether the Western world’s hysteria was justified or if calmer, steadier hands were guiding other regions. In Vietnam, Malaysia, Cambodia, Singapore, and Indonesia, the results were startling: a stark contrast in psychological fortitude. These nations, accustomed to enduring hardship, demonstrated an enviable ability to temper fear with practicality, offering a lesson in resilience.

Unleashing the Unruly: When Hysteria Defies Logic and Chaos Reigns

“Fear is the most insidious virus; it thrives in the absence of logic.” While Western nations descend into chaos, stocking shelves and hearts with dread, many Asian countries maintain surprising composure. Face masks vanish, but not reason. Even as Jakarta edges toward emergency declarations, panic remains muted. Borders close in Malaysia, yet the reaction is measured—a testament to a populace seasoned by adversity.

In this climate of contrasts, the role of leadership becomes undeniable. Where Western leaders stoke anxiety, their Asian counterparts steady the ship. The psychological divide highlights a hard truth: fear weakens more than just resolve—it undermines immunity and clarity. A culture habituated to uncertainty stands resilient while others crumble under the weight of overreaction.

The Turning Point: Fear’s Influence on Action

“Every crisis births a choice: succumb to fear or rise to reason.” Whether in markets or societies, hysteria operates as a catalyst for irrationality. The current landscape offers a stark reminder of how panic, when unchecked, can morph into a self-fulfilling prophecy. Understanding mass hysteria’s mechanisms allows us to intercept its cycle, reclaiming clarity before chaos takes hold.

In these turbulent times, embracing resilience overreaction could mean the difference between thriving and succumbing. If history teaches anything, hysteria feeds on vulnerability—but the antidote lies in fortitude, informed action, and a refusal to bow to the shadows of fear.

Videos Illustrating How China & South Korea handled Coronavirus outbreak

How China is Handling Corona Virus 1

China Using Drones To Assist With Coronavirus Outbreak

South Korea Using Army to Deal With Coronavirus

Stock Market Outlook

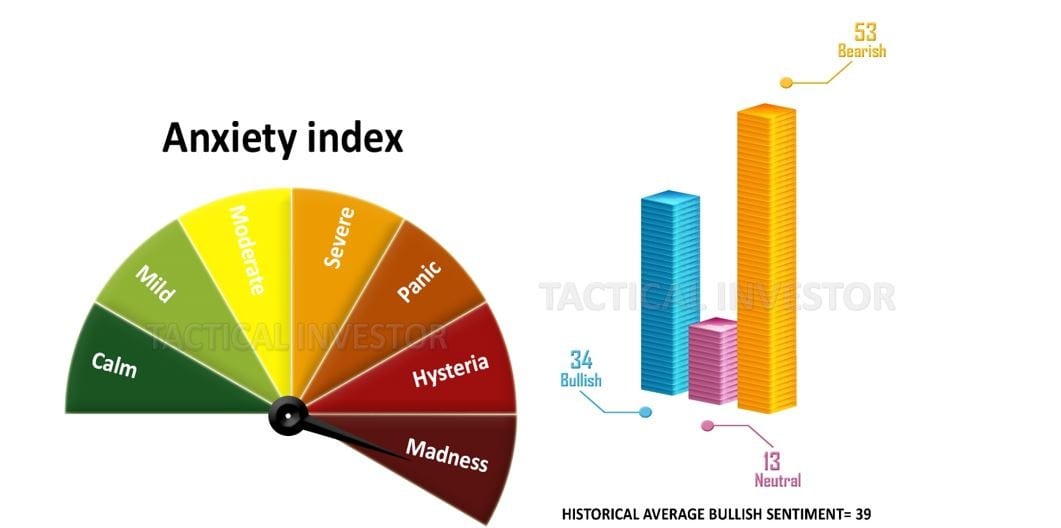

We’ve ventured further into the madness zone, witnessing a notable drop in neutral sentiment to levels not observed in years, currently trading at 13. In contrast, bullish sentiment remains relatively high, though below its historical average; ideally, there’s room for it to dip below 24. Encouragingly, bearish sentiment continues its upward trend, a positive sign. We’re on the brink of another potential “mother of all buy signals,” aligning with historical instances like 1987 and 2008. However, our indicators need a slight additional dip into the oversold ranges.

For the elusive “father of all buy signals,” the indicators must delve even deeper into the oversold ranges. The anxiety index gauge should approach the end of the madness zone, and bullish sentiment needs to drop below 22%. This signal, being generational, isn’t expected to manifest quickly.

Recalling December 2018, subscribers witnessed our enthusiasm when the number of new highs dropped to -10%. Despite the prevailing panic, we emphasized this as a positive development, indicative of a favourable trend. Examining current readings, they are nearing minus 20%, a level not even reached in 2008. This development is significant as the trend remains positive. When the tide eventually turns, the Dow could rally 3600 points in a single day, with a potential overshoot to 4200 points. While attention is fixed on the downward plunge, the upcoming melt-up promises to be spectacular, catching everyone, without exception, by surprise.

Unearth Unique and Valuable Reads