Hysteria definition: Current Overreaction Is The Perfect Example

Updated Feb 15, 2024

In sociology and psychology, mass hysteria, also known as mass psychogenic illness, collective terror, group hysteria, or collective compulsive behaviour, is a captivating phenomenon that spreads collective illusions of threats, whether real or imaginary, throughout a population in society. It arises due to rumours and fear, intertwining the fabric of culture with enigmatic threads of anxiety and uncertainty.

In medicine, “mass hysteria” describes the spontaneous manifestation of the same or similar hysterical physical symptoms by multiple individuals. It is a captivating occurrence when a group of people firmly believes they are afflicted by a shared disease or ailment, giving rise to what is sometimes referred to as mass psychogenic illness or epidemic hysteria. This intriguing phenomenon blurs the boundaries between the mind and the body as the power of suggestion and collective consciousness intertwine to shape the very fabric of reality.

Unravelling the Web: The Intricate Dance of Deception in the Disinformation Campaign

Today, over 22,000 individuals will tragically succumb to hunger, marking it as one of the most harrowing ways to meet one’s end. The toll from this year’s flu has already claimed 110,000 lives, while approximately 650,000 individuals annually lose their battle to respiratory-related diseases. Regrettably, 70,000 mothers have faced mortality while giving birth this year.

In another disheartening reality, the year has witnessed over 242,000 suicides, emphasizing the urgent need for mental health support.

Disturbingly, 7 million children under the age of five have met untimely deaths in the current year alone, a statistic that calls for intensified global efforts in child health. The following links highlight the gravity of these issues:

1. http://bit.ly/32wVaQA (7 million children’s deaths)

Addressing road safety concerns, 25 million people succumb to road crashes annually. Within this, more than 270,000 pedestrians have lost their lives this year, underscoring the importance of comprehensive road safety measures. For further insights, refer to:

2. https://bit.ly/2vId4UJ (Road crash statistics)

Additionally, in the United States, 88,000 individuals are projected to meet their demise due to alcohol-related causes, while 22,000 Britons are expected to succumb to prescription mix-ups. Explore more details here:

3. https://bit.ly/2QEW7BN (Alcohol-related causes and prescriptions mix-ups)

Medical errors, a critical issue, are estimated to result in the deaths of 250,000 to 440,000 individuals in America. A comprehensive understanding of this issue is crucial, and you can delve into the details here:

4. https://cnb.cx/33DF9cg (Medical errors)

Furthermore, a two-decade-long analysis indicates that over 100,000 Americans may lose their lives due to prescription drug-related complications. A recent study raises this figure to nearly 128,000. For in-depth information, refer to:

5. https://bit.ly/39cYtOw (Prescription drug-related deaths)

Lastly, a historical perspective is provided by an article from the NCBI database, dating back to 1999, stating that 100,000 Americans died as a result of medical errors. Explore this archival insight here:

6. https://bit.ly/3dxoRGy (Historical perspective on medical errors)

In 2018 alone, 5,000 Americans lost their lives to drug overdoses, highlighting the ongoing challenges in addressing this public health crisis. For more details, you can visit:

7. https://cnn.it/2xhpEL6 (Drug overdoses in 2018)

Does the coronavirus epidemic rightfully dominate the spotlight it receives? Cancer, smoking, and cardiovascular diseases, responsible for millions of annual deaths, remain conspicuously unmentioned. What about the daily toll on innocent children? Do their lives not warrant consideration? Surprisingly, deadlier viruses in the past didn’t garner comparable attention. One is compelled to question the state of contemporary media. Are today’s reporters mere mindless automatons?

Unleashing the Shadows: The Dance of Deception in the Disinformation Campaign

In the short term, technical analysis grapples with the challenge of identifying support levels amid what can be described as market madness. Recognizing this, we’ve introduced a new level in the anxiety index. Complicating matters further is the scarcity of liquidity, evident in the bid and ask prices on specific options that appear unreal—such as a bid of 1.40 and an ask of 5.00. This scarcity gives a handful of significant players the leverage to sway the markets in any direction.

Amidst a rampant disinformation campaign, I felt compelled to investigate directly, aiming to provide Tactical Investors with a clearer perspective on the unfolding situation. Taking a calculated risk, I embarked on a solo journey to Asia without prior announcement. My objective was to ascertain whether the perceived overreaction in the US and the West, in general, was justified and if Asia exhibited a more practical approach on the psychological front.

Having visited Vietnam, Malaysia, Cambodia, Singapore, and Indonesia thus far, I can confidently state that these Asian nations are managing to control the panic factor far more effectively than we are witnessing in the US.

Unleashing the Unruly: When Hysteria Defies Logic and Chaos Reign

People aren’t frantically clearing shelves in every direction; the only items flying off the shelves appear to be face masks. This relative calm may stem from the fact that many third-world and developing nations are accustomed to dealing with hardships, unlike developed countries like the US. The contrast in how Asians are psychologically handling the situation is significant.

Take Jakarta, for instance, on the verge of declaring an emergency, yet there’s no widespread panic. In Malaysia, where borders are closing, the most notable reaction was Malaysians working in Singapore rushing home to gather extra supplies before returning to Singapore for an extended stay. Many Malaysians commute daily between the two countries, and the prospect of closed borders prompted them to ensure they had sufficient provisions for an extended stay in Singapore.

If Western leaders, particularly in the US, could adopt a similar approach to instil calm in the population, the overall reaction might differ. There are no lockdowns, at least not yet (except in China), and the infection rate is not spiralling out of control. It’s essential to recognize that fear heightens stress, and stress, in turn, weakens the immune system.

Videos Illustrating How China & South Korea handled Coronavirus outbreak

How China is Handling Corona Virus 1

China Using Drones To Assist With Coronavirus Outbreak

South Korea Using Army to Deal With Coronavirus

Stock Market Outlook

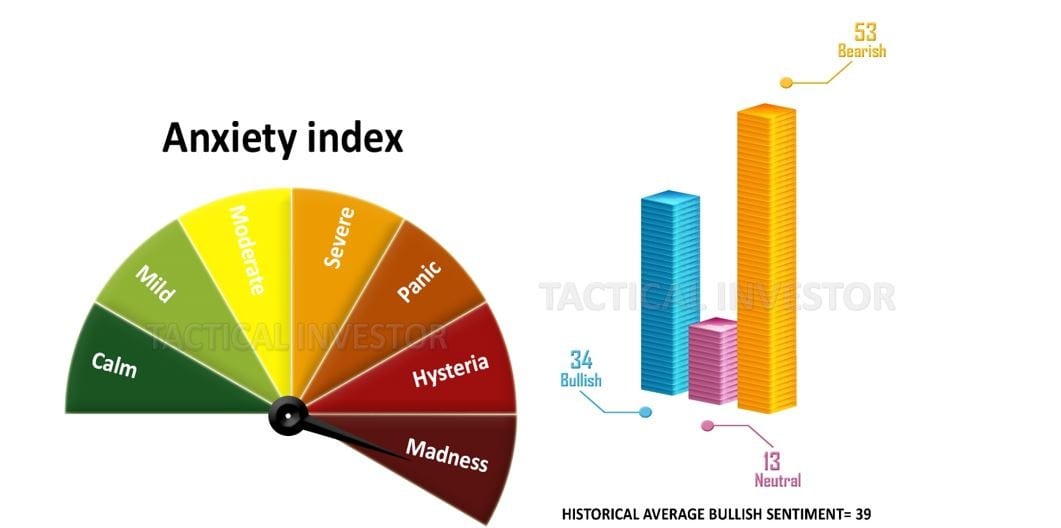

We’ve ventured further into the madness zone, witnessing a notable drop in neutral sentiment to levels not observed in years, currently trading at 13. In contrast, bullish sentiment remains relatively high, though below its historical average; ideally, there’s room for it to dip below 24. Encouragingly, bearish sentiment continues its upward trend, a positive sign. We’re on the brink of another potential “mother of all buy signals,” aligning with historical instances like 1987 and 2008. However, our indicators need a slight additional dip into the oversold ranges.

For the elusive “father of all buy signals,” the indicators must delve even deeper into the oversold ranges. The anxiety index gauge should approach the end of the madness zone, and bullish sentiment needs to drop below 22%. This signal, being generational, isn’t expected to manifest quickly.

Recalling December 2018, subscribers witnessed our enthusiasm when the number of new highs dropped to -10%. Despite the prevailing panic, we emphasized this as a positive development, indicative of a favourable trend. Examining current readings, they are nearing minus 20%, a level not even reached in 2008. This development is significant as the trend remains positive. When the tide eventually turns, the Dow could rally 3600 points in a single day, with a potential overshoot to 4200 points. While attention is fixed on the downward plunge, the upcoming melt-up promises to be spectacular, catching everyone, without exception, by surprise.

Unearth Unique and Valuable Reads

SPY 200-Day Moving Average Strategy: Learn, Earn, and Prosper

Understanding Herd Mentality: Lessons from the 2017 ICO Boom

Stock Market Bubble: Embrace Sharp Corrections

Navigating Stock Market Uncertainty: Pythagorean Insights for Stock Investors

Michael Burry Stock Market Crash: All Bark, Zero Bite

Why Contrarian Investing Triumphs: Bullish Divergence MACD Analysis

What Causes Market Volatility: Contrarian Investing Against Expert Opinions

What is Logical Positivism: Breaking Free from Herd Mentality

Market Turbulence: Turning Chaos Into Profit in the Investing World

TSM Stock Price Projections: Forecasting the Next Big Moves

What are some psychological biases that act as barriers to effective decision making?

The Valley of Despair: Mass Psychology vs. Experts

How Do You Win the Stock Market Game? Effective Strategies

Harnessing Emotional Discipline for Unparalleled Trading Success

Financial Insights: Mastering the Game of Investing

Mastering Stock Chart Analysis: A Guide to Effective Techniques

Bearish Sentiment Meaning: Essential Knowledge for Traders