Winning the Stock Market Game: Strategies for Success

Feb 23, 2025

“The early bird gets the worm; the late bird gets the bullet.” – Sol Palha

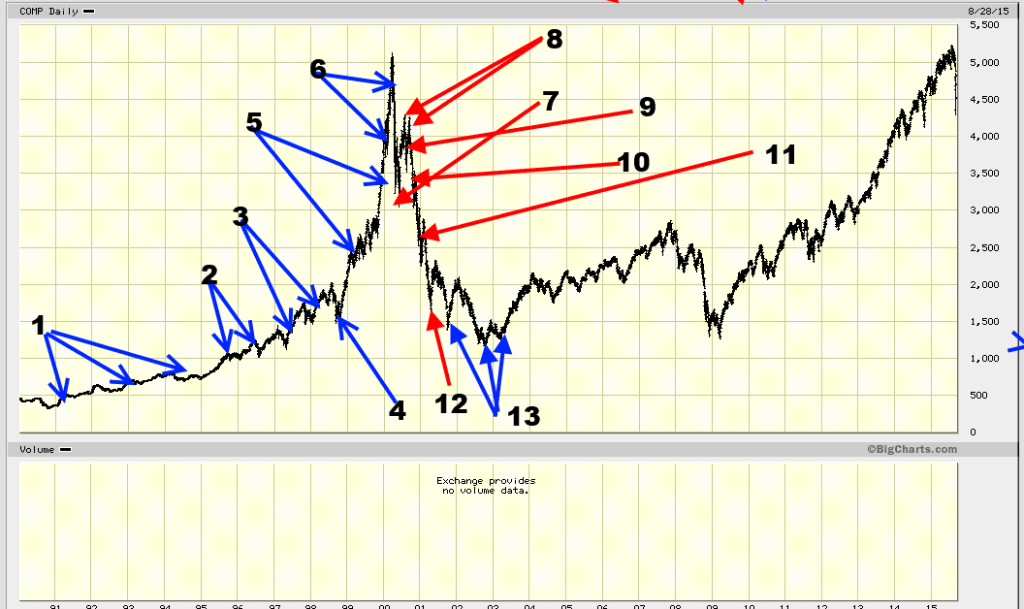

We first covered this topic years ago using a chart from CMGI—a relic of the dot-com era that serves as a cautionary tale. This time, we’ll use the NASDAQ to dissect the brutal psychology that governs market movements. The chart below (illustrating the 13 phases of the mass mindset) is not just an academic exercise—it’s a map of how fear, greed, and blind optimism shape every market cycle. Whether it’s GOOGL, AAPL, WMT, IBM, NTES, BIDU, BABA, BYDDY,MSFT, or any other ticker, the rules remain the same.

Most Investors Are Cannon Fodder—Here’s Why

The brutal truth? Most investors are walking into a slaughterhouse. They binge-watch CNBC, skim a few books, and parrot the talking heads, thinking they’re ready for battle. Meanwhile, the market, an apex predator with a 90% win rate, feasts on their naivety. The scoreboard is simple: 90% lose, 10% win.

That 10%? They don’t just play the game—they own it.

How to Win the Stock Market Game – Rule #1: Ditch the Herd Mentality

Every failed investor has one thing in common—they follow the herd. They buy euphoria and sell panic, unknowingly playing the role of exit liquidity for the big players. The market is an emotional minefield, and if you don’t have the psychological discipline to think independently, you’re already a statistic.

Rule #2: Kill Emotion or Get Killed

Emotions are your enemy. Fear makes you sell too soon. Greed makes you buy too late. Hope blinds you to reality.

Your job? Eliminate them.

Most people invest with hope and hype—two of the most expensive emotions in the market. The elite investors? They operate with cold, calculated precision.

Example: The 2008 financial crisis was a bloodbath. The herd fled. But those who saw the wreckage for what it was—an opportunity—bought AAPL, AMZN, MSFT, and turned thousands into millions. Fear blinds, logic illuminates.

Another example: The 2020 COVID crash wiped out billions in days. The weak panicked. The strong bought Tesla at $70, NVDA at $50, and turned five-figure trades into six-figure wins.

The lesson? You either control your emotions, or the market will do it for you—brutally.

Rule #3: The Market is a Rigged Casino—So Play Like the House

Retail traders chase price. Professionals sell premium. This is why selling cash-secured puts on high-quality stocks during extreme fear is one of the most lucrative strategies. You’re getting paid to buy stocks at a discount while the emotional crowd pays for overpriced options.

The real pros sell fear and buy panic.

- 2008: Panic selling created once-in-a-decade bargains. Those who bought crushed the next bull run.

- 2020: The pandemic crash wiped out trillions. Smart money scooped up blue chips while CNBC screamed “end of days.”

The cycle of pain

- This stock is going nowhere; it is hardly moving, and the fundamentals are weak.

- It was pure luck. The fools who jumped in will regret it. This is a false breakout. This stock is going to drop to new lows.

- Holy smokes, the stock is still going up. Earnings are terrible, long-term fundamentals are not great, and the technical outlook is far from perfect.

- Thank goodness I did not buy it; I knew it would crash. Instead of focusing on the fact that the stock is letting out some steam and building momentum for the next leg up, the mass mindset sees only what it wants to see.

- Wait a minute, what’s going on here? The market was supposed to crash. Maybe I made a mistake in not buying.

- I was wise to wait until things improved; the markets would take off.

- What is going on? Why is the market dropping? It’s only a pullback; I will not fall for this game again.

- There you go. I knew it would turn around, and I should have put more into the market.

- It’s going down again. Opportunity is knocking, and it’s time to load up.

- The market is hit with bad news and pulls back very strongly.

- If you panic now, fear will take hold.

- Damn it; the market is dead. I am getting the hell out of the stock market.

- The market is going through a slow bottoming phase. Once this phase ends, a new uptrend will begin.

How to Win the Stock Market Game: Insider Tip 4

“Misery loves company, but stupidity demands it.” – Sol Palha

The market doesn’t reward emotions—it punishes them. Fear and greed destroy investors. The moment you let emotions cloud your judgment, you’re already losing.

Stop chasing tops and bottoms. The herd is always late. Instead, master the subtle shifts in sentiment that signal tops forming and bottoms stabilizing. When the crowd panics, you stay calm. When they’re euphoric, you prepare to exit.

Detach. Stay sharp. Ignore the noise. Only those who think independently and act rationally thrive in chaos.

“The world can be your oyster, or you can be an oyster in the world.” – Sol Palha

Integrating Smart Investment Techniques with Fundamental Analysis

The patient crush the impulsive. Dollar-cost averaging (DCA) and fundamental analysis are weapons against volatility and herd-driven madness.

- DCA: Buy consistently, no matter the market mood. When prices fall, you buy more. When they rise, you buy less. Over time, your cost averages out, beating market timers.

- Fundamental Analysis: Numbers don’t lie. Strong financials, durable growth, and solid management beat hype every time. Benjamin Graham built fortunes by focusing on intrinsic value, not fleeting trends.

During the 2008 crash, disciplined investors who ignored fear, stuck to their DCA plans, and picked strong companies saw massive gains when the dust settled. Buffett preaches patience for a reason—it wins.

DCA isn’t just a strategy; it’s a mindset. It builds long-term wealth, forces discipline, and removes emotion from investing. The market rewards those who stay the course.

Technical Analysis + Mass Psychology: The Winning Combo

Numbers show the patterns. Psychology reveals the trigger.

- VIX (“Fear Index”) spikes = Market panic → Opportunity.

- March 2020: VIX hit 85.47 (near 2008’s 89.53) → Market bottomed, Nasdaq surged 7.3% on April 6.

- Sentiment extremes signal reversals.

- Bullish sentiment below 15% or bearish sentiment above 55% = Market bottom forming.

- Oscillators confirm the turn.

- RSI <30 or Stochastic <20 = Oversold, fear-driven selloff, prime buying zone.

October 2022: Market was deeply oversold, but sentiment wasn’t extreme → Short-term bounce, not a full reversal.

Lesson? Market cycles are driven by mass hysteria. Recognize the fear. Exploit the euphoria. Move before the herd.

The Ultimate Contrarian Playbook: Triple-Threat Warfare in Market Chaos

When markets collapse and fear peaks, the elite don’t panic—they strike. This is financial warfare, executed with precision.

1. The Put-Selling Machine: Profiting from Panic

When markets crash, option premiums explode. In 2020, MSFT put premiums soared 300-400%. Use this volatility to generate massive income.

Tactical Execution:

- Target blue-chip stocks down 40%+ (AAPL, GOOGL, AMZN).

- Sell puts 15%, 25%, 35% below market to create a cascading income stream.

- Size positions to own shares if assigned—fortress balance sheets only.

2. The Call Option Accelerator: Exploiting Recovery

When VIX spikes above 35 and fear rules, load up on long-dated call options in high-quality stocks trading 30%+ below highs.

Strategic Play:

- Buy LEAPS (18-24 months expiry) on sector leaders with strong cash flows.

- Scale in as volatility peaks.

- Target strikes 15-20% above market.

- Fund with 30-40% of put premium income.

3. The Direct Purchase Protocol: Building Core Positions

Deploy capital like a general commanding troops:

- Buy at 30% down.

- Double at 40%.

- Triple at 50%.

- Keep 25% cash for extreme moves.

Only buy companies with:

✅ Market dominance

✅ Strong cash flows

✅ Low debt

✅ High insider ownership

✅ Aggressive buybacks

Tactical Execution:

- Set automatic buy orders—execute without hesitation.

- Increase position size as fear spikes.

- Track insider and institutional buying.

Final Thought: Wealth is Built-in Silence—Not in Euphoria

When CNBC screams ‘Market in Crisis,’ that’s your green light. Stanley Druckenmiller said it best: “The best investors don’t diversify. They bet big when the odds are stacked in their favor.”

This is how legends are made. Put-selling funds your call options. Calls capture rebounds. Direct stock buys build generational wealth.

The market’s chaos is your greatest ally—if you have the guts to act.

The true winners in this game don’t follow trends—they anticipate them. They don’t chase hype—they exploit it.

Confucius said, “Real knowledge is to know the extent of one’s ignorance.” The herd chases what they think they know. The elite question everything.

The question is, are you ready to think differently?

Interesting Reads