Apr 15, 2024

Introduction

The stock market in 2023 has been a rollercoaster ride, leaving investors both elated and anxious. As we delve into the intricacies of this year’s market performance, the burning question is, “How much has the stock market gone up in 2023?” To answer this question, we must examine the various factors influencing the market, the strategies employed by seasoned investors, and the data that paints a picture of the current market landscape.

Market Performance Overview

According to the S&P 500 index, the stock market has experienced a notable uptick in 2023, with a year-to-date return of 12.7% as of September 30th. This growth can be attributed to several factors, including the continued recovery from the COVID-19 pandemic, the stabilization of global trade relations, and the accommodative monetary policies implemented by central banks worldwide. The Federal Reserve’s decision to maintain low-interest rates and continue its bond-buying program has provided a supportive environment for equities, encouraging investors to allocate more capital to the stock market. Additionally, the successful rollout of COVID-19 vaccines and the gradual reopening of economies have boosted consumer confidence and spending, further fueling the market’s growth.

However, the market’s journey has not been without its challenges. Geopolitical tensions, such as the ongoing trade disputes between the United States and China, have periodically dampened investor sentiment. Inflationary pressures, driven by supply chain disruptions and rising commodity prices, have also raised concerns about the potential impact on corporate profits and consumer spending. Moreover, questions regarding the sustainability of the economic recovery, particularly in light of the emergence of new COVID-19 variants, have contributed to periods of volatility. Despite these hurdles, the overall trend has been positive, with the Dow Jones Industrial Average and the Nasdaq Composite also posting impressive gains of 10.9% and 15.3%, respectively.

To put the 2023 stock market performance into historical context, it is worth noting that the current gains are reminiscent of the bull market that followed the Global Financial Crisis of 2008-2009. During that period, the S&P 500 index experienced a cumulative return of approximately 400% between March 2009 and February 2020, before the onset of the COVID-19 pandemic. While the current market environment differs in many respects, the resilience and adaptability of companies and investors have been key factors in driving the stock market’s recovery and growth in 2023, much like in the post-financial crisis era.

Insights from Renowned Investors

To navigate the complexities of the 2023 stock market, it is essential to seek wisdom from those who have weathered countless market cycles. Ray Dalio, the founder of Bridgewater Associates, emphasizes the importance of diversification and risk management in his approach. In a recent interview, Dalio stated, “The key to success in the current market environment is maintaining a well-balanced portfolio that can withstand the inevitable ups and downs. By spreading your investments across different asset classes and geographies, you can mitigate risk and capitalize on opportunities as they arise.”

Another luminary in the investment world, Cathie Wood, the CEO of ARK Invest, has been a vocal advocate for disruptive technologies and innovation-driven growth. Wood’s strategy has yielded impressive results, with her flagship ARK Innovation ETF (ARKK) delivering a staggering 47% return in 2023. Wood attributes this success to focusing on companies at the forefront of technological advancements, such as artificial intelligence, robotics, and genomics. “The companies that are driving the future will be the ones that reap the greatest rewards in the long run,” Wood asserts.

Alternative Analytical Tools

While traditional valuation metrics like price-to-earnings and price-to-book ratios remain relevant, the 2023 stock market demands a more nuanced approach. One such tool is the “Meme Stock Index,” which tracks the performance of stocks that have gained popularity through social media platforms like Reddit and Twitter. This index has proven to be a valuable barometer of retail investor sentiment and has shed light on the growing influence of individual investors in the market.

Another crucial aspect to consider is the impact of environmental, social, and governance (ESG) factors on stock performance. As consumers and investors become increasingly conscious of their choices’ societal and environmental impact, companies with firm ESG profiles have begun outperforming their peers. The MSCI World ESG Leaders Index, which tracks companies with high ESG ratings, has delivered a 16.2% return in 2023, outpacing the broader market.

The Role of Sector Rotation

The Role of Sector Rotation: One key driver of the stock market’s growth in 2023 has been the rotation between sectors. As the global economy recovers, cyclical sectors such as industrials, energy, and financials have experienced a resurgence. The Industrial Select Sector SPDR Fund (XLI) has gained 18.6% year-to-date, while the Energy Select Sector SPDR Fund (XLE) has soared 32.1%. This rotation can be attributed to the pent-up demand for goods and services and the rising commodity prices, which have bolstered the performance of companies in these sectors. For instance, the surge in oil prices, with West Texas Intermediate (WTI) crude oil reaching a multi-year high of $75 per barrel in July 2023, has significantly benefited energy companies.

Moreover, the reopening of economies and increased infrastructure spending by governments worldwide have provided a tailwind for industrial companies. A real-life example of this is the proposed $2 trillion infrastructure plan in the United States, which, if implemented, could further boost the performance of industrial stocks in the coming years. Similarly, the financial sector has benefited from the steepening of the yield curve, which has improved the profitability of banks and other financial institutions. How much has the stock market gone up in 2023? The answer lies not only in the overall market performance but also in the relative performance of individual sectors.

However, this sector rotation has also highlighted the importance of adaptability in investment strategies. The once-dominant technology sector, which led the market’s recovery after the pandemic, has seen a relative cooldown in 2023. The Technology Select Sector SPDR Fund (XLK) has still managed a respectable 11.4% return, but it has lagged behind other sectors. This can be attributed to the normalization of demand for technology products and services and the regulatory scrutiny faced by some of the largest tech companies. For example, the antitrust lawsuits filed against Google and Facebook in late 2020 and early 2021 have weighed on the sentiment surrounding these companies.

This underscores the need for investors to remain agile and adjust their portfolios in response to shifting market dynamics. A hypothetical scenario illustrates this point: An investor who had a significant allocation to technology stocks in 2020 and early 2021 might have benefited from the sector’s outperformance during that period. However, if the same investor failed to recognize the shifting market dynamics and did not rebalance their portfolio to include cyclical sectors in 2023, they would have missed out on the substantial gains in industries such as energy and industrials.

Conclusion

The stock market in 2023 has demonstrated resilience and growth, with the S&P 500 index rising 12.7% year-to-date. This growth has been driven by factors including the ongoing economic recovery, accommodative monetary policies, and the rotation between sectors. However, the market has faced its fair share of challenges, from geopolitical tensions to inflationary pressures.

Satisfy Your Intellect with These Delectable Reads

What Does Serendipity Mean? It Favors the Informed

How To Get Financial Freedom Fast: Escape the Herd for Lasting Success

The Dance of Investor Sentiment: Unveiling the Impact on ETF Flows and Long-Run Returns

Robot Love: Machine Affection or Mechanical Risks

6 brilliant ways to build wealth after 40: Start Now

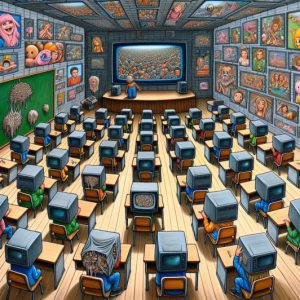

Why Is the US Education System So bad: Rubbish In, Rubbish Out Phenomenon

How can bond funds help with portfolio diversification more than individual bonds?

Russia vs USA: Timeline of US Actions Provoking Russia

Harmony Sex Doll: Redefining Intimacy and Companionship

October 1987 Stock Market Crash: The Astute Get Rich, While the Rest Suffer

Black Monday 1987: Turning Crashes into Opportunities

The Golden Symphony: Unveiling the Dynamics of the Gold to Silver Ratio

Golden Gains: The Key Advantages of Investing in Gold

Best ETF Strategy: Avoid 4X Leveraged ETFs like the Plague