Has the Stock Market Bottomed? Opportunity Doesn’t Wait

Dec 25, 2024

Introduction

Trying to pinpoint the exact market bottom is a losing game. Instead of obsessing over whether stocks have hit rock bottom, the real focus should be on investor psychology—because that’s where the biggest opportunities emerge.

Market cycles are driven more by emotion than logic. When fear peaks and the masses capitulate, history shows that it’s often the best time to buy. Conversely, when optimism runs rampant, valuations become stretched, and risks rise. The herd is almost always wrong at extremes.

Bottom fishing is a distraction. What matters is recognizing when panic creates undervalued opportunities and when euphoria signals caution. The real winners aren’t those who perfectly time the bottom but those who capitalize on mass psychology to position themselves ahead of the next major move.

Has the Market Bottomed? Unravelling the Million Dollar Question

In pulling off this feat, the bears would throw in the towel, propelling the markets higher due to short covering. The bulls thinking that all is well, would buy the rip, and then when everything looks fine and dandy, the guillotine is likely to fall. Tactical Investor

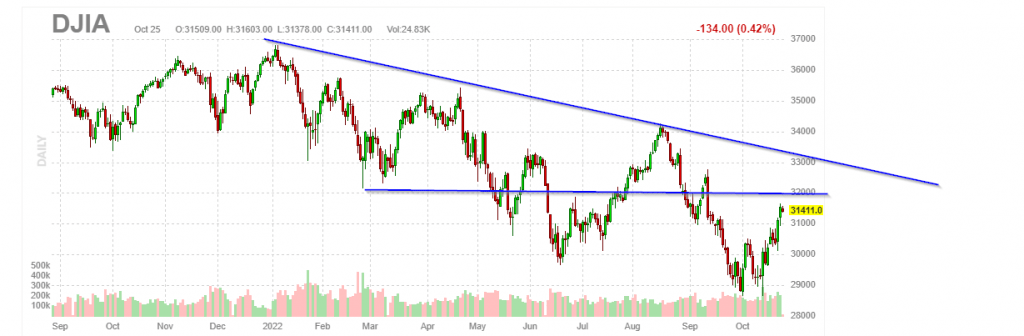

This chart provides an overview of how the big players will probably try to set both the bulls and the bears for a massacre. They don’t make as much coin when they target only one group. How would they do this? One sure way to trick the bears and the bulls would be to make the Dow and several other indices break through their downtrend lines and create the illusion of a new bull. In this case, this would correlate to a move to the 34,300 to 34,650 range. In pulling off this feat, the bears would throw in the towel, propelling the markets higher due to short covering. The bulls, thinking that all is well, would buy the rip, and then when everything looks fine and dandy, the guillotine is likely to fall.

The Borrowed Playbook: Lessons from 2008-2009

Interestingly, despite the strong rally the markets have mounted, bullish sentiment is trading significantly below its historical average, informing us that the big players borrow from the playbook used during the 2008-2009 correction. More importantly, it seems to be working magnificently, we might add.

Has the market bottomed, and what is the playbook? Scare the masses so severely that they refuse to invest in the Market for years. While the masses sit on the sidelines, the big players can continue accumulating shares in the best companies at a fraction of their original price. This technique can’t be used all the time. Otherwise, the crowd would catch on. It appears that it is employed every 12 to 14 years.

Confusion and Opportunities in Market Sentiment

Another factor contributing to confusion in the market is the recent attempt by the AAII Investor Sentiment site to create their version of a “Greed Indicator.” While measuring the spread between the Bulls and the Bears may be a commonly used method, we believe it is not the best measure of fear. Instead, we suggest combining the neutral camp with the bearish camp and subtracting that total from the number of bulls to get a more accurate picture of investor sentiment.

The neutral camp comprises individuals who are hesitant to take a position, including defanged bears and dehorned bulls. By overlooking these individuals, we risk misinterpreting the market sentiment. However, this confusion can also provide opportunities for savvy investors to build long-term positions.

Common Sense and Behavioral Investing: Timing Fear, Not Bottoms

One of the most critical elements in successful investing is understanding human behaviour, especially during market downturns. Common sense tells us that trying to time the exact market bottom is often a fool’s errand. Instead, the focus should be on gauging the peak of fear. As Warren Buffett famously said, “Be fearful when others are greedy and greedy when others are fearful.” The time to buy is not when the market has bottomed but when fear has reached its apex.

Historical data supports this notion—major buying opportunities arise when the market is gripped by panic, often called when “blood is flowing in the streets.” When the market hits bottom, the best opportunities may have already passed. Therefore, investors should shift their focus from asking, “Has the market bottomed?” to “Is fear peaking?”—because that is when the smart money starts to enter.

Contrarian Investing: Combining Common Sense and Technical Analysis

Contrarian investing, paired with technical analysis and behavioural insights, is a proven method for outsmarting the masses. Going against the grain requires courage and common sense, but the rewards can be significant. For instance, during the 2008 financial crisis, while the masses were panic-selling, contrarian investors quietly accumulated shares of companies like Apple and Amazon at steep discounts. Technical indicators such as the MACD or RSI can further refine entry points during these panic-driven selloffs.

A contrarian approach dismisses the pointless question of whether the market has bottomed and instead focuses on technical patterns, sentiment analysis, and mass psychology. When fear and uncertainty dominate, the best opportunities arise. The masses will always ask if the market has hit rock bottom—savvy investors, however, will recognize that the real question is whether the panic has reached its peak, and that’s when it’s time to act.

Final Thoughts

The crowd will always flinch at the extremes—panicking at bottoms and euphoric at peaks. The sharp investor recognizes this cycle for what it is: opportunity disguised as chaos.

Fear signals potential entry points, not exits. Caution is warranted when the masses remain composed, and unbridled enthusiasm often foreshadows a reckoning. Market bottoms are less about pinpointing a perfect price and more about clarifying sentiment shifts.

Success belongs to those who act—not those who wait for certainty that never arrives. Understanding mass behaviour isn’t just a strategy; it’s a necessity. The wise move when others hesitate, securing positions before the tide inevitably turns.