Gold’s Future: Still Shining Bright!

Dec 31, 2024

Hasten slowly, and ye shall soon arrive. Milarepa

For now, it’s a race between gold and crypto. Depending on the amount of new money flowing into gold and silver, they could surpass the initial targets we issued. Gold, for example, should have dropped to around 2200 by now, but instead, it’s trading near its 52-week highs after surpassing 2600. Long-term, this is bullish for gold, but it will make the ride more volatile in the short term. In simple terms, when it comes to precious metals, embrace sharp pullbacks. Market update September 15, 2024

Gold pulled back and tested the 2500 range twice in November, but despite the surge in the dollar, it has not dropped to the 2200 range, where it should have tested several times by now. The ideal setup would have it test the 2400 range 2-3 times. This would shake out the weak hands and allow gold to build momentum to surpass the 2900 to 3000 range.

If it drops to the 2100 to 2200 range, it will prove to be an even bigger opportunity. It’s interesting to see how well gold has held up in the face of a stronger dollar.

Don’t get me wrong, the strength gold exhibits is quite remarkable, especially given the huge surge in the dollar. When discussing ideal setups, I’m referring to the optimal entry points. These setups provide the best risk-to-reward scenarios, allowing for larger gains. On the other hand, optimal entry points don’t always present themselves.

So, what’s the catch? Why aren’t Gold prices skyrocketing?

Fundamentally, the dollar should have crashed long ago since the U.S. Fed has been churning out more money in the past ten years than in the previous century. Fundamentals would have had you investing in energy and oil stocks at just the time when they plummeted. Until oil plummeted, all the experts were hollering about the dearth of oil and the burgeoning demand in Asia. The general market in Asia continues to ascend, but those same individuals have now switched tunes. Instead of warning about an oil shortage, they preach the oversupply gospel. How quickly they change sides!

Golden Prospects: Unraveling the Bright Future of Gold

US Dollar Index

In a word, the US dollar. The dollar has been experiencing a massive bull run, something we predicted. We made the bold proclamation nearly two years ago that the USD would trade on par with the Euro, and this has now come to fruition.

The dollar is currently trading in a highly overbought range and is poised to reach a multi-year peak that could last up to 11 years. As such, discerning investors should immediately start acquiring positions in precious metals like Gold, Silver, and Palladium. Time waits for no one, so it’s best to take action today. Remember, today is the tomorrow that you promised to change yesterday.

We estimate that the minimum upside targets for Gold over the next 15 to 24 months will fall within the 2400 to 2700 range, with the possibility of overshooting to the 3000 range. There are several good stocks to consider in this sector; two that come to mind are RGLD and DRD.

Central Bankers are buying Gold hand over fist.

Central bankers are keeping themselves occupied with the accumulation of this precious metal. The principal purchasers include the nations of Russia and China. These financial authorities may have access to information not readily available to the public. Whatever the rationale behind it may be, these central bankers seem to be unreservedly amassing significant amounts of gold.

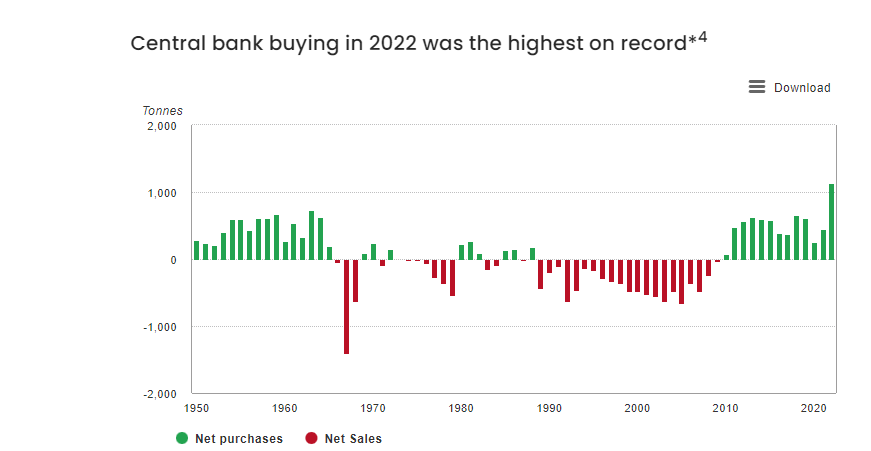

Two years after hitting its lowest point in a decade, central bank demand for gold has made a robust comeback. Last year, demand from this sector increased yearly, with net purchases totalling 1,136t.

This marked a significant milestone in central bank buying as it was the thirteenth consecutive year of net purchases and the highest annual demand on record back to 1950. The last quarter of the year saw central bank net purchases of 417t, lifting H2 total buying to 862t. The year’s final quarter data combined reported purchases and a substantial estimate for unreported buying.1 These estimates may be revised if more information about this unreported activity becomes available.

Central Bankers love the Yellow Stuff.

Gold has been a favourite amongst central banks since they became net purchasers annually in 2010. The most recent annual Central Bank gold survey highlights two critical drivers of Central Bank’s decisions to hold gold: its performance during times of crisis and its role as a long-term store of value. It’s hardly surprising then that central banks opted to continue adding gold to their coffers at an accelerated pace in a year scarred by geopolitical uncertainty and rampant inflation.

Moreover, emerging market central banks accounted for most of last year’s reported demand.

Two crucial factors can explain central bankers’ chase for gold. Firstly, gold has proven to be a reliable asset during times of crisis, making it an essential hedge against economic uncertainties. Secondly, gold serves as a long-term store of value, providing central banks with a safe haven for their reserves. These factors have made gold an attractive option for central banks, leading them to continue buying gold acceleratedly, particularly in emerging markets. Recent purchases by the People’s Bank of China and the Central Bank of Turkey have cemented gold’s position as a preferred asset amongst central bankers. Gold.org

Glimmers of Gold: A Promising Outlook for Future Prices

The lacklustre action in the Gold markets may seem surprising despite positive fundamentals, but it is essential to remember logical factors do not solely drive that market behaviour. Emotions and crowd psychology are crucial in market movements; technical indicators can help identify these emotional changes. The timing of market peaks and bottoms is challenging to predict, but paying attention to the crowd’s behaviour can be helpful. While some people may be bullish on Gold, the crowd has not fully embraced it. When the crowd does jump on board, the situation could become explosive.

Our Projections: A Look Back in Time

In August, we boldly declared in an article entitled “The Death of the Gold Bull” that it wasn’t the opportune moment to purchase Gold. During that time, numerous analysts were predicting the nadir, with many stating that the future of gold prices was excellent. Many boldly proclaimed that they would skyrocket. Nonetheless, we asserted with conviction that Gold would probably plummet further before bottoming out. And now, as we fast-forward, our prophetic vision has come to fruition.

So, let’s examine what the fundamentals reveal.

The World Gold Council’s most recent report shows that the demand for Gold is skyrocketing. The worldwide demand for Gold surged by a colossal 33%. Even Americans have joined the fray; U.S. retail demand for Gold skyrocketed to 32.7 metric tons, a 200% increase compared to last year.

The report also revealed that Gold demand in China surged by 70% to 52 metric tons, while Europeans also seem to be stocking up on Gold. Demand increased by 35% to 61 metric tons.

Now is the time to start building long-term positions in the precious metals sector.

A good idea plus capable men cannot fail; it is better than money in the bank.

John Berry

Articles of Interest: