Unleashing the Potential: The Impending Gold Breakout

Originally published in Nov 2015 and updated in February 2020, this article offers enhanced insights and analysis.

In August, we came out and openly stated in an article titled The Gold Bull is Dead that it was not the time to buy Gold. Many analysts were calling for the bottom and much higher prices then. We stated that there was a high probability that Gold would move lower before bottoming out. Fast forward, and that outlook has come to pass.

So let’s see what picture fundamentals paint.

Demand for Gold is soaring, according to the World Gold Council’s latest report.

The latest report shows worldwide demand for Gold soared by a whopping 33%.

Americans are jumping into the foray also; U.S. retail demand for Gold soared to 32.7 metric Tons, 200% more than in the same period last year.

The report also states that Gold demand in China Surged by 70% to 52 metric tons.

Europeans also appear to be loading up on Gold. Demand increased by 35% to 61 metric tons.

The Gold Price Conundrum: Why Aren’t Prices Soaring?

Based on fundamentals, the dollar should have crashed long ago, as the U.S. Fed has created more money in the last ten years than in the last 100. Fundamentals would have had you jumping into energy and oil stocks just when they tanked. Up unit the very moment oil crashed, all the experts were screaming about a shortage of oil and surging demand in Asia. The overall market in Asia continues to rise, but the same individuals are now signing a different song. Instead of less oil, they are now singing the oversupply song; oh, how fast they jump ship.

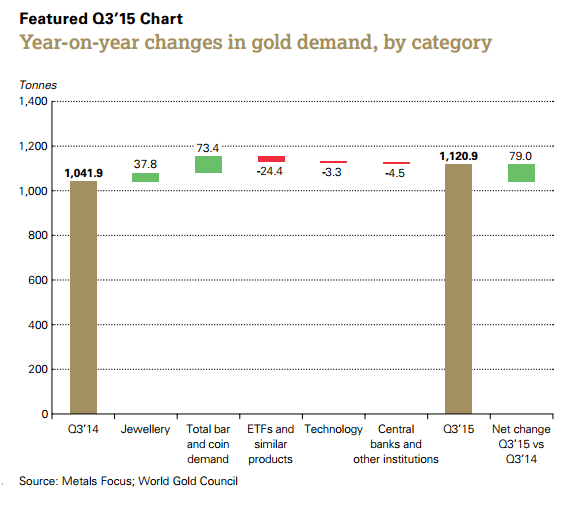

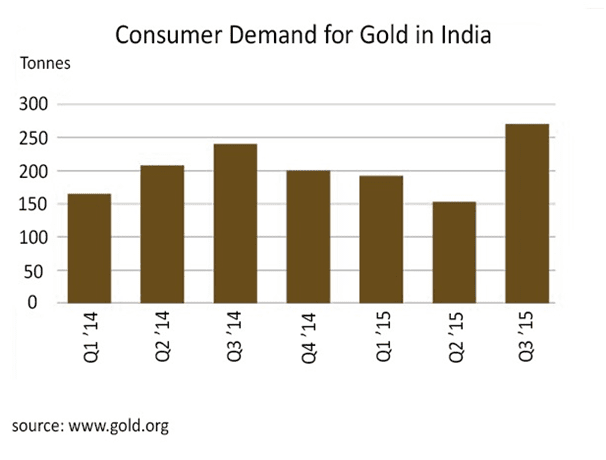

The following charts illustrate that Gold demand is increasing, so what gives?

Investors Eyeing Gold as Breakout Looms

The chart from the World Gold Council indicates that demand for this precious metal is rising.

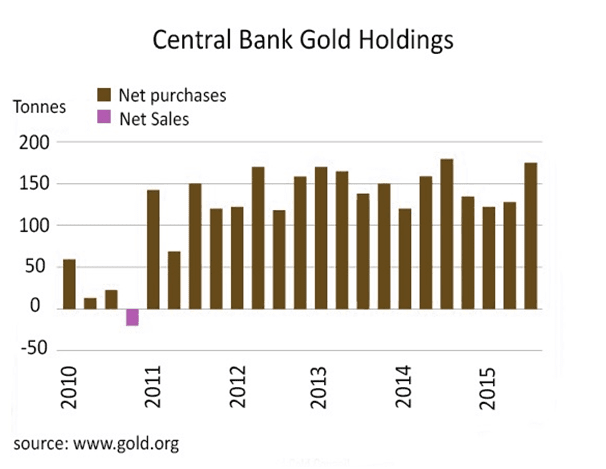

Central bankers are busy loading up on the metal. The main buyers are Russia and China. Perhaps they are privy to information that the general public is not. Whatever the reason, central bankers appear to be aggressively stocking up on Gold.

Hasten slowly, and ye shall soon arrive.

Milarepa

India Joins Gold Rush: Surging Repurchases

Gold Breakout On The Event Horizon?

Fundamentals do not drive the market; they just provide a picture to justify your biased views. What causes the market is emotions, and some technical indicators can pick up on these emotional changes. Crowd psychology is probably one of the best and least utilized tools for spotting topping and bottoming action. We are not talking about the timing of the exact top or the bottom. This endeavour is best left to fools who have nothing better else to do with their precious time. Right now, many people are embracing Gold, but the crowd is still silent. When the crowd joins the pack, the situation will move from quiet to explosive.

The technical picture indicates that an absolute bottom could be close at hand. In August, in an article titled “The Gold Bull is Dead”, we stated the following:

From the Technical analysis perspective, gold has one more leg down, but the last leg might or might not be too steep. Every bull market undergoes a back-breaking correction, and Gold is no exception.

What’s next?

So far, most of this has come to pass. Our trend indicator is not bullish yet, so until it turns bullish, Gold will not mount a significant rally. However, if you loved Gold in 1800, you should be nuts that it’s trading at $1100. The Gold camp is in disarray, and despair is beginning; this is the ideal time for a bottom to take hold.

When Gold topped in 2011, the Gold camp was jubilant and could only envision higher prices. Gold is not on the verge of a breakout yet, but it could be on the point of putting in a bottom, and that would be a move in the right direction. To indicate that a base is in place, Gold cannot close below 1050 on a weekly basis; failure to hold above this level should lead to a test of the 1000 range, with a possible overshoot to $950.

A good idea, plus capable men cannot fail; it is better than money in the bank.

John Berry

Interesting Articles

Is Value Investing Dead? Shifting Perspectives for Profit

What is the Bandwagon Effect? Exploring Its Impact

Stock Market Chaos: A Trap for the Ignorant and Uninformed

Benefits of Investing Early: Wealth and Serenity

Contrarian Thinking: The Power of Challenging the Status Quo

Black Monday 1987 Cause: Stupidity and Greed

Stock Market Predictions Today: Ignore the Noise, Follow the Trend

Share Market Fear and Greed Index: Ignore It, Focus on the Trend

Mob Psychology: Breaking Free to Secure Financial Success

Why is Inflation Bad for an Economy: Enriching the Few, Hurting the Many

What to Do When the Stock Market Drops: Back the Truck Up and Buy

Stock Market Timing Strategies: Patience and Discipline Required

Dow Jones Forecast: Navigating the Ups and Downs

Best Time To Buy Stocks: Embrace Panic & Seize Opportunity