What is Financial Stress? The Surprising Opportunity for Savvy Investors

May 15, 2024

Introduction

Financial stress is often perceived as an opposing force that can wreak havoc on personal finances and mental well-being. However, financial stress can present a unique set of opportunities for savvy investors. Market conditions often become volatile during economic stress, leading to decreased liquidity and lower asset prices. While this environment can be daunting for the average investor, those with a long-term perspective and a willingness to embrace risk can find significant opportunities for substantial returns. By understanding the dynamics of financial stress and its impact on market behavior, investors can strategically position themselves to capitalize on undervalued assets and market dislocations. This essay explores the concept of economic stress and how it can be leveraged as a hidden goldmine for investors.

Contrary to popular belief, financial stress can present a unique opportunity for savvy investors in the stock market. While it’s true that high levels of financial stress can cause investors to become more risk-averse and sell off assets, leading to decreased market liquidity, increased volatility, and lower stock prices, it also creates an environment where lower valuations and market dislocations can be found. Financial stress can be a source of significant returns for investors with a long-term perspective and a willingness to embrace volatility. So, don’t fear financial stress – instead, use it to your advantage and reap the rewards in the stock market.

The Psychological Impact of Financial Stress on Market Behavior

Financial stress often triggers a cascade of psychological reactions among investors, leading to increased caution, risk aversion, and sometimes panic selling. Behavioural finance theories, such as Prospect Theory and Herd Behavior, explain why investors might sell off assets at a loss during periods of high financial stress. Prospect Theory suggests that people value gains and losses differently, leading to irrational decision-making, especially under stress. Herd Behavior, on the other hand, describes how individuals in a group can collaborate without centralized direction, often amplifying market volatility. Understanding these psychological impacts can help savvy investors anticipate market movements and identify buying opportunities when others are driven by fear and uncertainty.

Historical Case Studies: Profiting from Financial Stress

Historical market downturns, such as the 2008 financial crisis and the dot-com bubble burst, offer valuable lessons on how financial stress can create investment opportunities. During the 2008 crisis, for instance, while the market saw a massive sell-off and widespread panic, astute investors like Warren Buffett advised buying into fundamentally strong companies at significantly reduced prices. Similarly, the aftermath of the dot-com bubble provided opportunities for those who could distinguish between overhyped tech stocks and genuinely valuable technology companies. This section will analyze these periods, highlighting the strategies employed by successful investors to turn financial stress into substantial returns. It will also discuss the importance of patience, due diligence, and a long-term perspective.

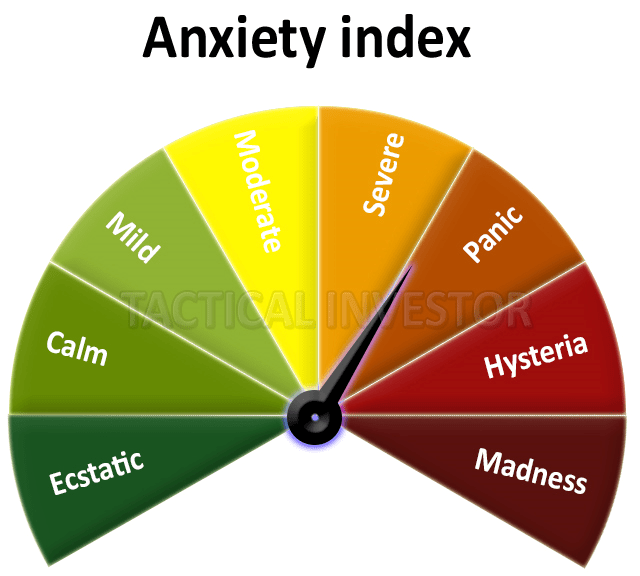

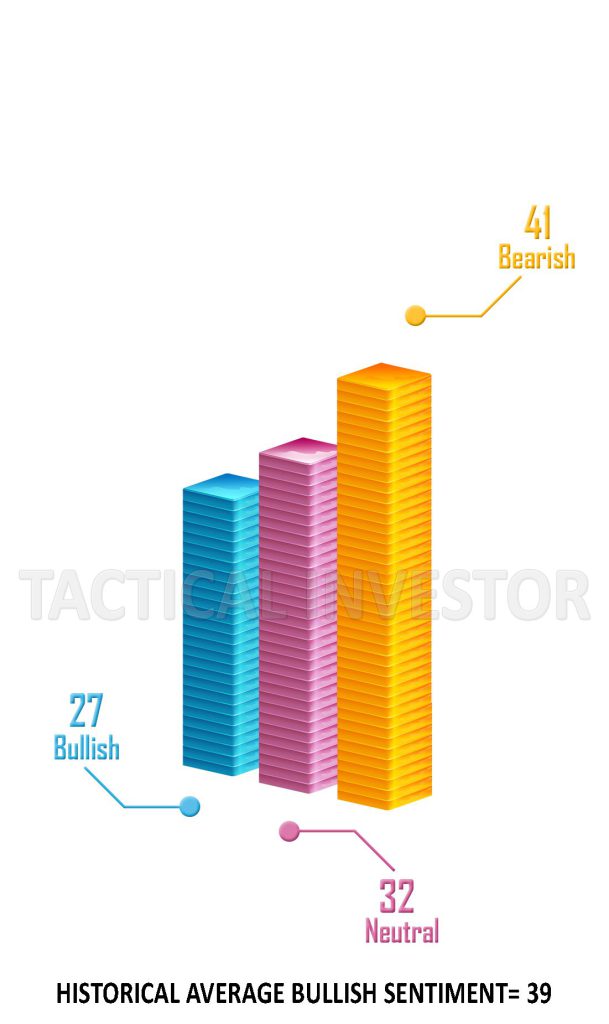

Bullish sentiment has been trading at abnormally low levels for an extended period. Market Update November 9, 2022

It is uncommon to see such a strong market rally with low bullish sentiment, as the Dow has demonstrated substantial growth of 20% from its low to its recent high. Over the past year, the bullish sentiment readings have consistently remained below the historical average of 39, fueling financial anxiety among investors. This discrepancy highlights a need for significant market disruption to shift investor sentiment. In other words, a sudden, drastic change may be necessary to shake up the current market dynamics and alleviate financial anxiety among investors. Translation: This means that the only cure is a hard slap. In other words, the remaining players must be blasted out of the water and this universe.

What’s going on Is that the crowd is trying to outguess the big players. The only way for the big players to deal with this challenge is to teach the masses a lesson. The best way to achieve this objective is to cement the old false belief that buying during times of crisis is dangerous. This development provides additional support for the second correction argument. If the crowd continues this line of thinking, a repeat of what occurred between 1973 and 1974 and 08 to 09 is highly likely. Market Update November 9, 2022

Uncertainty helps contribute to Financial Stress.

The current market scenario is intriguing, as the bullish sentiment remains low despite a significant market rally, suggesting that Financial stress remains elevated. According to the latest sentiment readings, investors seem cautious despite the market’s upward trend, particularly in the Dow. This suggests that the Market is climbing a “wall of worry,” increasing the likelihood of continued upward momentum and a potential test of the 35K range. The Dow has already closed above its August high of 34,281, with other indices following suit, except for the Nasdaq. If the Nasdaq continues to lag, it could serve as an early warning signal for potential market concerns.

Developing a Strategic Mindset to Capitalize on Financial Stress

Navigating financial stress requires more than just understanding market dynamics and historical patterns; it demands a strategic mindset that can turn challenges into opportunities. This section will provide practical advice on how investors can cultivate such a mindset. It will discuss the importance of staying informed, maintaining emotional discipline, and developing a robust investment plan.

Investors should focus on comprehensive research, seeking out undervalued assets, and diversifying their portfolios to mitigate risk. Additionally, the section will emphasize the value of patience and the ability to keep a long-term perspective, even when short-term market conditions seem unfavourable. By approaching financial stress strategically, investors can make informed decisions rather than reacting impulsively, thereby positioning themselves to take advantage of market dislocations and undervaluations.

Other Articles of Interest

Unraveling Crowd Behavior: Deciphering Mass Psychology

Dogs of the Dow 2024: Barking or Ready to Bite?

Zero to Hero: How to Build Wealth from Nothing

The Power of Negative Thinking: How It Robs and Bleeds You

Contrarian Outlook: A Pathway to Breakthrough or Breakdown

Mass Psychology Unveiled: The Hidden Keys to Financial Triumph

Overconfidence Bias: The Investor’s Blind Spot

Panic Selling is also known as capitulation in the markets

Examples of Groupthink: Instances of Collective Decision-Making

Herd Behavior: The Perilous Path to Market Missteps

Disciplined Growth Investors: Path to Maximum Gains

Stock Market Crash Forecast: Ignore the Hype, Focus on the Trend

Mob Mentality Psychology: Outsmart the Masses and Win Big

When is the Next Stock Market Crash Prediction: Does it Matter?

2020 COVID Stock Market Crash: Panic Meets Opportunity

How Did Panic Selling Affect the Stock Market? A Tale of Financial Ruin for the Masses