Unmasking the Foolish Moves of Fed Chair Jerome Powell

Updated March 30, 2023

Jerome Powell, the Chairman of the Federal Reserve, has proven to be a fool of epic proportions. After the COVID crash, he pushed an unrelenting quantitative easing program that led to a boom phase. He even had the audacity to state that a bit of inflation was good. But now that he got his wish and inflation is running rampant, he wants to battle the monster he created. To call him an idiot would be an act of kindness. His incompetence could push us into a recession, and companies continue to fire people.

The Fed’s monetary policy profoundly affects the economy, and Powell’s misguided actions are causing significant harm. His approach to monetary policy has been nothing short of reckless. Rather than addressing the root causes of the economic downturn, Powell flooded the market with money, creating a false sense of prosperity.

This approach has not worked, and we now see his actions’ consequences. Inflation is rampant, and businesses struggle to keep up with rising costs. Many companies have had to lay off workers to stay afloat, and the unemployment rate is still high.

But perhaps the most frustrating aspect of Powell’s leadership is his inconsistency. After creating inflation, he is now trying to destroy it. This could push us into a recession and cause even more harm to the economy. It is a classic case of “too little, too late.”

Fed Chair Jerome Powell: Destroying Inflation He Created

To make matters worse, Powell’s actions have made it difficult for investors to make informed decisions. Market technicians, contrarians, and value investors have all been fooled by the new market system. Traditional indicators no longer provide accurate predictions of the market’s movements. This applies to both fundamental and technical analysis.

To deal with the swings, investors must take a contrarian approach. They must examine the speed at which the masses are jumping in, how many of them are jumping relatively to the volume that was doing nothing just a few months ago, how much staying power they have, and so forth.

This sentiment analysis is crucial for investors to make informed decisions. If the masses are jumping in after sitting out for a long time, assuming they have collected a lot of money while sitting on the sidelines would be fair. The sentiment must reach the boiling point, and everyone must be foaming at the mouth before the market puts in a long-term top. It would not be prudent to take a cautious approach at this time.

Markets are likely to test their 2022 Lows.

After conducting a thorough analysis of current market trends and the psychology of market participants, it has become increasingly clear that the markets may soon test the lows witnessed in 2022, and there is a possibility of at least one index trading to new lows. In this scenario, it would be wise to exercise caution and remain primarily in cash while waiting for a more opportune moment to open long positions.

While jumping into the market during a downturn can be tempting, the current situation calls for a more calculated approach. Considering the bigger picture and the potential risks associated with the market’s volatile nature is essential. By staying patient and strategically waiting for the right moment, investors can position themselves to take advantage of the market’s eventual upswing while minimizing potential losses.

Federal Reserve Chair Jerome Powell’s actions have contributed to the current state of the market, and his recent efforts to combat inflation may result in further instability. As investors, we must remain informed of significant developments that may impact the market’s trajectory and adjust our strategies accordingly.

Decrease in home sales.

Continuing the discussion on the impact of Fed Chair Jerome Powell’s rate hikes, it’s important to note that the housing market has also been affected. The rise in interest rates has made it more difficult for potential homebuyers to secure affordable mortgages, leading to a slowdown in the housing market. This has resulted in a decrease in home sales and a decline in home prices in some areas.

Bond market impact

Furthermore, the rate hikes have also affected the bond market, with bond prices falling as interest rates rise. This has led to losses for investors who hold bonds in their portfolios, particularly long-term ones. The impact of these losses can be significant, especially for retirees who rely on fixed-income investments for their income.

Negative impact on emerging markets

Powell’s aggressive approach to rate hikes has also hurt emerging markets. As the US dollar strengthens, it becomes more expensive for emerging market countries to service their dollar-denominated debt. This can lead to decreased investment in these countries and a decline in their economies.

Criticism of Powell’s Approach to monetary policy

It’s important to note that Powell’s actions have not gone unnoticed, and his approach to monetary policy has been criticised. Some experts argue that his focus on inflation is misguided and that he should prioritize job creation and economic growth instead. Others argue that his approach is too aggressive and that he should take a more measured approach to rate hikes.

Uncertainty over the effectiveness of Powell’s strategy

Despite the criticism, Powell has defended his actions, stating that the rate hikes are necessary to combat inflation and maintain economic stability. But it’s still unclear whether his strategy will effectively achieve these objectives.

Fed Chair Jerome Powell’s aggressive approach to rate hikes has significantly impacted the economy, the stock market, the housing market, and emerging markets. While his focus on combating inflation is understandable, his approach may be too aggressive and could lead to further instability. As investors, we must remain informed of these developments and adjust our strategies to mitigate potential losses.

In conclusion, trading requires a strategic and disciplined approach to navigate the ever-changing landscape of the stock market. Staying informed, patient, and disciplined while diversifying our investments can lead to long-term success and mitigate potential losses.

FAQ

Q: How does Fed Chair Jerome Powell’s rate hikes impact the economy?

A: Powell’s aggressive approach to rate hikes has caused significant harm to the economy. Inflation is rampant, and businesses are struggling to keep up with rising costs. Many companies have had to lay off workers to stay afloat, and the unemployment rate is still high. The rise in interest rates has also made it more difficult for potential homebuyers to secure affordable mortgages, leading to a slowdown in the housing market. This has resulted in a decrease in home sales and a decline in home prices in some areas. Furthermore, the rate hikes have also affected the bond market, with bond prices falling as interest rates rise. This has led to losses for investors who hold bonds in their portfolios, particularly long-term ones.

Q: What is Powell’s view on inflation?

A: Powell stated that a bit of inflation was good, but now that inflation is rampant, he wants to battle the monster he created. This inconsistency has made it difficult for investors to make informed decisions.

Q: How has Powell’s approach to monetary policy affected the stock market?

A: Powell’s actions have made it difficult for investors to make informed decisions. Traditional indicators no longer provide accurate predictions of the market’s movements. This applies to both fundamental and technical analysis. The impact of these losses can be significant, especially for retirees who rely on fixed-income investments for their income.

Q: What is the impact of Powell’s rate hikes on emerging markets?

A: Powell’s aggressive approach to rate hikes has had a negative impact on emerging markets. As the US dollar strengthens, it becomes more expensive for emerging market countries to service their dollar-denominated debt. This can lead to a decrease in investment in these countries and a decline in their economies.

Q: Why did Powell implement a quantitative easing program?

A: After the COVID crash, Powell implemented a quantitative easing program that led to a boom phase. However, this approach created a false sense of prosperity and did not address the root causes of the economic downturn.

Q: How do Powell’s rate hikes impact the bond market?

A: The rate hikes have affected the bond market, with bond prices falling as interest rates rise. This has led to losses for investors who hold bonds in their portfolios, particularly long-term ones.

Q: What is the best approach for investors in the current market?

A: Investors must take a contrarian approach and examine the speed at which the masses are jumping in, how many of them are jumping relatively to the volume that was doing nothing just a few months ago, how much staying power they have, and so forth. By staying patient and strategically waiting for the right moment, investors can position themselves to take advantage of the market’s eventual upswing while minimizing potential losses.

Other Articles Of Interest

Becoming a Better Investor: Key Strategic Moves

Investing in a Bear Market: Ignore the Naysayers

Buy the Dip: Dive into Wealth with this Thrilling Strategy

Resource Wars: Navigating a Shifting Global Landscape

The Prudent Investor: Prioritizing Trends Over Speculation

Optimal Strategies for The Best Stocks To Invest Long Term

Seizing Dominance: The Relentless Rise of Mental Warfare

What is Inflation? Unveiling Effects and Strategies for Mastery

The Cycle of Manipulation in Investments

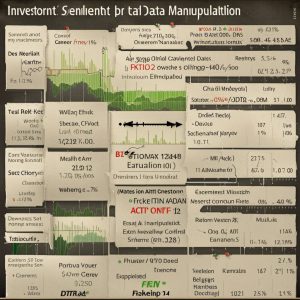

Investor Sentiment Data Manipulation: Unveiling Intriguing Insights

Stock Buybacks: Exploring Their Detrimental Effects

US Dollar Rally: Is it Ready to Rumble?

Stock Books For Beginners: Investing Beyond the Pages

Psychological Manipulation Techniques: Directed Perception