Jerome Powell: Misjudging Inflation While Markets Pay the Price

April 19, 2025

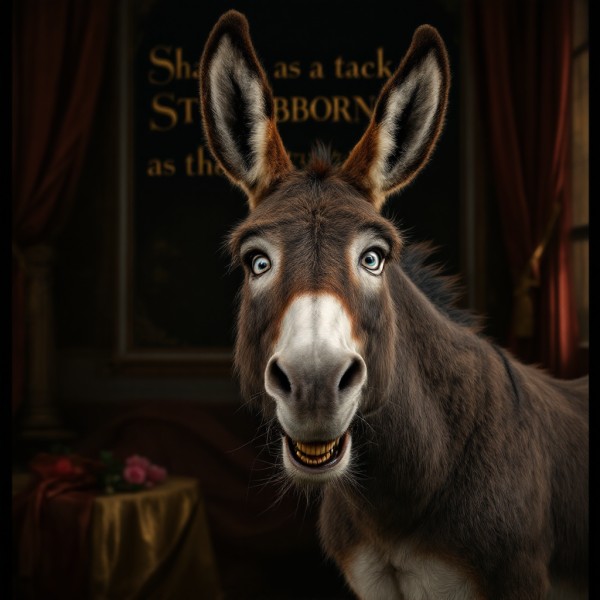

Introduction: Unmasking the Foolish Moves of Fed Chair Jerome Powell

Jerome Powell isn’t navigating the economy—he’s lurching through it, eyes wide shut, hands on levers he barely understands. After the COVID crash, he didn’t just stimulate; he detonated a liquidity bomb. Trillions poured into a system already high on sugar. Asset prices levitated, zombie companies danced, and Powell declared that a bit of inflation was “healthy.” But this wasn’t health—it was hysteria in a lab coat.

Now the monster’s loose, and Powell is chasing it with a broomstick. The same man who poured gasoline on dry timber is now blaming the flames. To call him misguided would be diplomatic. To call him reckless is closer to the truth. His erratic maneuvers have warped the entire macro landscape and pushed the system toward a recessionary cliff—while gaslighting the public into thinking he’s saving them.

The damage? Everywhere. Companies, especially small and mid-cap, are firing to survive. Profit margins are eroding under the weight of input costs. Supply chains, once resilient, are now twitchy and volatile. Consumers aren’t confident—they’re coping. Powell’s Fed has manufactured not recovery, but delusion.

The Contradictions of a Central Banker on Tilt

Powell isn’t fighting inflation; he’s fighting the ghost of his past miscalculations. He’s made monetary policy so reflexive it’s bordering on emotional whiplash. One moment he’s dovish, the next he’s hawkish, reacting not to deep structural shifts but to market tantrums and lagging indicators. The Fed isn’t a forward-looking institution anymore—it’s a trauma-reactive one.

The fallout is both psychological and economic. Technicals don’t behave like they used to. Fundamentals are fractured. What once worked—value signals, trendlines, momentum indicators—now decay on contact. The system’s feedback loops have been rewired. Powell’s decisions have distorted the signal so badly that most investors are trading shadows.

That’s why sentiment analysis—real, gritty, contrarian sentiment work—is the last compass left. It’s not about data. It’s about instinct. Who’s panicking? Who’s euphoric? Who’s been sitting in cash and is now stampeding back in? The tipping point isn’t when prices move—it’s when the crowd feels like they’ve figured it out. That’s when you bet against them.

The Market Isn’t Dying—It’s Letting Off Steam

We’re not entering death. We’re venting pressure. That’s what Powell doesn’t get—market corrections aren’t tragedies, they’re thermodynamic necessities. Like tectonic plates releasing tension, pullbacks create momentum for the future. But Powell sees tremors and reaches for nukes. He’s applying 1970s tactics to a 2020s system built on AI, derivatives, and meme-fueled liquidity cycles.

Let’s break it down with updated vectors:

Housing Market

- Existing home sales as of January 2024 fell to their lowest point in over a decade.

- Yet new home sales remain resilient, hovering around 600,000 per month. Why? Institutional buyers and rent-to-own plays are changing the floor under demand.

- Mortgage rates spiked, yes—but not enough to crash the system. Just enough to freeze the dream of homeownership for Millennials.

Consumer Confidence

- Dropped sharply in September 2023, but rebounded mildly by July 2024. The data looks flat—but underneath, it’s oscillating between hope and fatigue.

- More people expect a recession. But they’re not acting like it. Spending continues. Travel is up. Credit card delinquencies are climbing, but not collapsing.

- This isn’t classic fear. It’s burnout. And that’s harder to read.

Inflation Expectations

- As of July 2024, inflation expectations sit at 5.4%. That’s down from the peak—but still miles above the 2% fiction Powell claims to target.

- Real inflation—energy, insurance, groceries—is sticky. Not in the numbers, but in the psyche. The average person feels poorer, even if wage data says otherwise.

Interest Rate Expectations

- The percentage of people expecting higher rates in 12 months fell to 50.3%, the lowest since early 2024.

- Translation: markets are beginning to call Powell’s bluff. They sense he’ll blink.

Powell’s Global Wrecking Ball

Emerging markets have become collateral damage in Powell’s war on inflation. This isn’t new—it’s just the latest chapter in a long history of U.S. monetary policy exporting chaos abroad.

Currency Chaos

- As the dollar surged, emerging markets bled. Local currencies in countries such as Argentina, Nigeria, and Turkey plummeted under debt stress.

- Dollar-denominated debt? Now a ticking time bomb. Repayment costs are exploding as exchange rates collapse.

Imported Inflation

- A weak currency means pricier imports. That’s not just a cost issue—it’s political dynamite. Food inflation topples regimes.

- Bulgaria, South Africa, even Mexico—all facing pressure as U.S. policy whiplash ripples through trade channels.

Hot Money Outflows

- Capital is fleeing emerging markets at the first whiff of U.S. rate hikes. Sovereign bond markets are drying up. Liquidity is evaporating. The same speculators that Powell fueled during QE are now abandoning ship and crowding into Treasuries.

And here’s the kicker—Powell either doesn’t understand this global feedback loop or he doesn’t care. Either way, it’s negligence on a planetary scale.

The New Playbook: Embrace Chaos, Ignore Powell

If you’re still listening to Powell for market direction, you’re playing checkers in a quantum casino. His speeches aren’t forecasts—they’re lagging sentiment indicators. He waits for the pain, then reacts. That’s not leadership. It’s bureaucratic panic dressed in economic jargon.

The real play is behavioural. Watch the crowd. Study positioning—measure conviction. When the retail crowd rushes in with Robinhood confidence and TikTok certainty, prepare to sell. When the same crowd is bloodied, silent, and curled into a psychological fetal position, start buying.

Pullbacks aren’t punishment. They’re prepping. The market is conditioning participants to stop reacting emotionally and start thinking cyclically. You either evolve your mindset or you get wrecked.

And Powell? He’s still trying to solve problems in a linear world with exponential challenges. He’s still pretending the Fed has control when the markets are driven by swarm intelligence, algorithmic reflex, and emotional contagion. He’s not a leader. He’s the fool at the edge of the parade, still waving while the crowd moves on.

Emerging Markets and the Vector Shockwave

Powell’s reckless rate hikes weren’t isolated tremors—they sent shockwaves through the global system, warping the trajectory of emerging economies already navigating chaotic geopolitical currents. The dollar’s rise became a wrecking ball for nations tethered to external debt, forcing them to dance on the edge of solvency.

- Crushing Capital Flows: U.S. rate hikes triggered capital flight from emerging markets, draining liquidity as investors fled toward perceived safety. Countries such as Argentina, Egypt, and Turkey faced intensified financial instability, caught in the storm of the Fed’s tightening crusade.

- Currency Whiplash: The dollar’s sharp appreciation crushed local currencies. The Indian rupee, South African rand, and Chilean peso faced downward pressure, which inflated import costs and contributed to domestic inflation. Emerging markets were now forced to fight imported inflation with depleted reserves and rising internal dissent.

- Uneven Vector Impacts: Those with export-heavy economies or resilient remittance inflows (e.g., Mexico, Vietnam) managed the stress better than debt-heavy nations dependent on foreign financing. There was no linear outcome—Powell’s moves split economies across strange attractors: growth in some, slow-motion collapse in others.

The Myth of Risk-Free Tightening

Markets weren’t built for clean narratives. They’re fluid, non-binary organisms, driven less by spreadsheets than by crowd noise and cascading emotions. Powell’s approach—hike fast, ask questions later—misread the market’s true mechanics.

Volatility wasn’t just a side effect. It was baked in.

Emerging market equities became uncharted. Traditional metrics failed. Mean-variance analysis broke. Why? Because the map no longer matched the terrain. Investors chasing signals found static. Powell’s blunt force distorted the field.

The result? A world of phantom correlations and liquidity illusions. Technical patterns decayed before they could form. Narrative-driven money flows collided with fiscal desperation. And underneath it all, the dissonance between policy and perception widened.

The Silver Lining: Where Fools See Chaos, Contrarians See Pattern

This isn’t just macroeconomics—it’s theatre. Every rate hike is a psychological trigger, a test of collective memory. And markets, contrary to the myth, don’t price in future fundamentals. They price in crowd anticipation, fear, and group mimicry.

Powell’s Rate Hikes: The Unintentional Catalyst for Deep Value

- Corrective Chaos: Rate hikes create selloffs not because fundamentals shift overnight, but because sentiment does. Weak hands fold. Margin calls hit. Algorithms pile on. But underneath the forced liquidation lies value no model can quantify.

- Contrarian Entry Points: These aren’t dips. They’re ruptures—momentary openings where consensus collapses and opportunity roars in. Energy, emerging tech, distressed financials: the post-hike landscape is a graveyard to the crowd but a hunting ground to the few.

Market Psychology: The Invisible Puppeteer

- Bandwagon Effect: The herd doesn’t think. It reacts. A rate hike drops? Sell. Inflation down? Buy. It’s binary. It’s Pavlovian. But the real move happens when you play against the expected reflex.

- Loss Aversion: Investors sell too soon to avoid paper losses—ironically locking them in. They chase confirmation, not truth. This is where the contrarian thrives: when discomfort reaches its apex, and the charts look like cliff dives, they buy.

The Rebellion Within: Contrarians, Prepare for Ascent

Munger and Livermore weren’t just wise—they were psychological cartographers. They mapped the internal landscapes of greed, fear, and delusion. Powell? He’s still playing checkers on a multidimensional board.

Markets don’t move because of Powell. They move because of how people interpret Powell. His rate hikes are just catalysts—what follows is crowd choreography.

- There is no neutral rate. It’s a myth. Every rate shift hits different demographics, asset classes, and global systems with unpredictable force. It’s a vector field, not a dial.

- There is no consistent Powell doctrine. Sometimes dovish, sometimes hawkish, always reactive. A Fed Chair more obsessed with optics than outcomes.

What Powell doesn’t understand is that sentiment is upstream of policy. You don’t fix inflation by brute force. You fix expectations, narratives, and behaviours. But those require finesse—something his Fed lacks.

Conclusion: Powell the Catalyst, Not the Compass

Let’s stop pretending Jerome Powell is the adult in the room. He’s the arsonist who lit the house on fire, then showed up with a half-empty hose. His policies aren’t policy—they’re panic responses. A technocrat whiplashed by lagging indicators and public perception.

But in his chaos, there’s opportunity.

Because markets aren’t about precision—they’re about perception. Perception is crowd-based, emotionally charged, and susceptible to extremes. That’s where the contrarian steps in.

This is the moment of divergence.

When the majority stares into Powell’s policy abyss and sees danger, the few see discounted assets, mispriced risk, and sentiment ready to snap back. When most confuse tightening for doom, contrarians prepare for the slingshot.

It’s not about being right. It’s about being early.

And Powell? He’s the foil. The perfect villain in a market psychodrama. Not because he’s evil, but because he’s predictable.

He’s not playing 4D chess. He’s just another bureaucrat in a crisis costume.

So let the fools panic. Let the crowd scream recession. Let Powell keep swinging.

Because the smart money? It’s already quietly buying the ashes.