A fanatic is a man that does what he thinks the Lord would do if He knew the facts of the case. Finley Peter Dunne

Navigating the Markets: Strategies for Bulls and Bears

Stock Market Crash stories are based more on hype than reality; if the market should crash jump in and buy

The stock market has always been an unpredictable beast, with the forces of bulls and bears battling it out for supremacy. While a stock market crash may sound like a scary proposition, savvy investors know that it can be a golden opportunity to buy low and reap the benefits later on.

In the days of yore, the stock market was a simpler affair, with transactions taking place in a more straightforward and less frenzied manner. However, in modern times, the stock market has become a fast-paced, dynamic arena where fortunes can be made or lost in a matter of seconds.

The prevailing sentiment around the stock market crash is often based more on sensationalism than reality. In fact, if the market should crash, it would be wise to take advantage of the situation and buy up the undervalued stocks.

The trends in the market are often driven by sentiment, and in a bull market, sentiment is typically positive. However, when the bears come out to play, it can be easy to succumb to panic and make rash decisions.

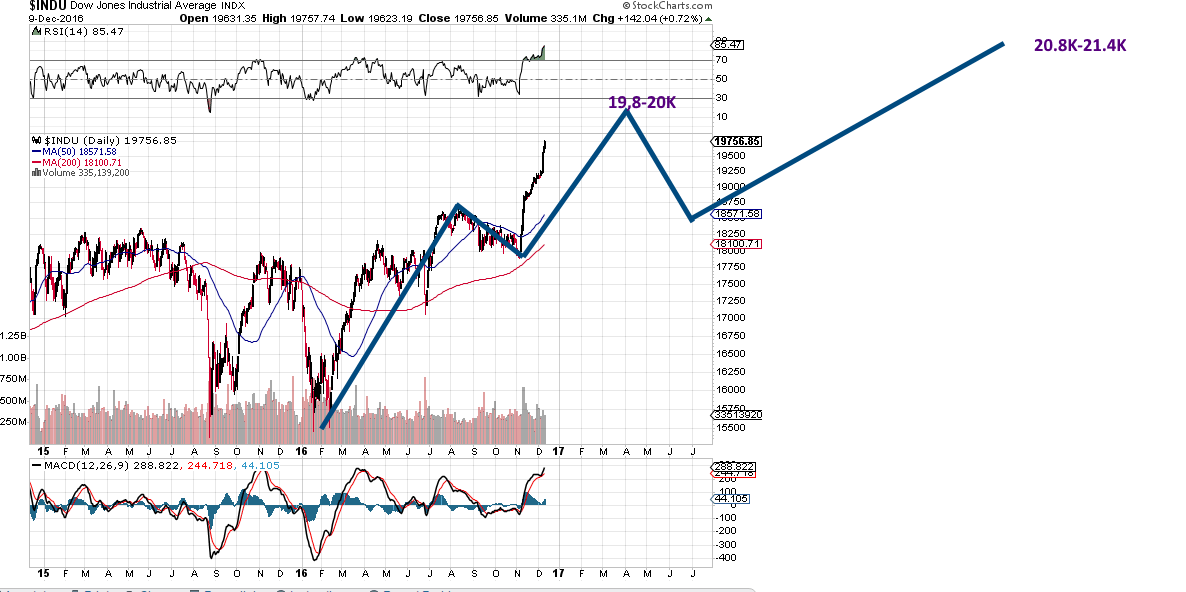

As we have seen recently, a stock market crash can often prove to be a buying opportunity, as was the case after the Trump win in 2016. The experts may have been bearish, but we maintained our bullish outlook and advised our subscribers to invest in the Dow, which yielded promising results.

Bull and bears mistake Corrections for Crashes

Indeed, the stock market is a world where the bulls and bears are constantly in a state of flux. As shown in the chart above, the Dow Jones Industrial Average (Dow) has been on a remarkable run, surging past 20,000 and hitting targets many experts had dismissed as unattainable.

While some experts predicted the end of this bull market at the 20,000 level, we maintained our bullish outlook and advised our subscribers to stay invested. We recognized that the sentiment had turned quite bullish at the time and saw this as a sign of further growth to come.

However, it is worth noting that the pace of growth has been faster than we anticipated. We are cautious about labelling this as the last stage of a bull market, as the crowd is not yet euphoric. Instead, what we see may be described as fanaticism or madness, with the markets operating outside reality.

The current state of the stock market defies explanation, with the bulls and bears locked in a fierce battle for dominance. As always, we remain vigilant and adaptable to changing market conditions, ready to make the most of any opportunities that may arise.

Trends to Follow During Times of Market Fanaticism for Bulls and Bears

It is imperative to note that even in this state of madness, the bears and the bulls still have a role to play. The bulls would continue to push the markets higher, while the bears will be waiting on the sidelines, looking for opportunities to pounce.

However, in the end, the outcome will be the same. Both sides will lose, and only those who remain level-headed and don’t fall prey to this madness will come out on top. It is crucial to remember that the stock market is not a casino, and investing is not gambling. One must approach it with a long-term outlook and focus on preserving capital rather than chasing gains.

The stock market is currently experiencing a state of fanaticism that makes it hard to predict its next move. The bulls and the bears may be confused, but one thing is for sure, a stock market crash is a low-probability event. Nonetheless, one must remain cautious and be prepared to take defensive action in case the markets correct sharply. By doing so, investors can preserve their capital and wait for the markets to return to some degree of normality.

Why Relying Solely on Data Can Lead to Faulty Bull and Bear Trades

It is important to remember that in times of fanaticism, the bulls and bears become irrelevant. There appears to be no rhyme or reason for the market’s actions, which can confuse both the bulls and the bears. This setup can be dangerous for both groups, as they stand to lose a lot of money.

While the markets may continue to rise in the short term, it is essential to be prepared for a correction. Corrections are typically sharp and vicious, much like watching a car spin out of control before crashing. It is wise to focus on preserving capital during such times rather than chasing hot stocks.

It is essential to pay close attention to the action of the markets and individual stocks, as they can provide valuable clues as to the market’s next move. Prudent traders should tighten their stops and consider investing in companies trading at a discount or in the oversold range. Doing so can limit their risk if the markets suddenly pull back. While a stock market crash in 2017 is far from a sure thing, it is important to remain cautious and not let arrogance take over.

We do not want to let arrogance take over. Moreover, common sense, which we value highly, dictates that caution, and not fear, is warranted. Thus, prudent traders would do well to tighten their stops, and if they commit new funds, look for companies selling at a considerable discount or trading in the extremely oversold ranges. If the markets pull back suddenly, your risk will be limited.

Differentiating a Market Correction from a Crash

This market will pull back, and when it does, we are sure the naysayers label it as “Stock Market Crash 2017” in action. Don’t listen to them, for their advice would have bankrupted you several times over if you had paid heed to any of their nonsense. No one call tell the markets when to pull back, especially when the primary emotion driving this market is fanaticism.

It is relatively easy to determine a market’s trajectory if the emotion is Euphoria or Fear, but Fanaticism is something different. As stated, it is a form of madness, and insanity is not easy to spot, especially if it is in stealth mode.

We will not pen another thousand words telling you why this Stock Market should crash or soar or anything like that. The bottom line is the market does not care about what-if scenarios. What if scenarios are for people with too much time to talk about useless concepts that most likely will not come to pass? Hence, don’t focus on the Stock Market Crash scenario that the masters of doom are pushing at innocent bystanders.

The Perils of Ignoring Market Sentiment

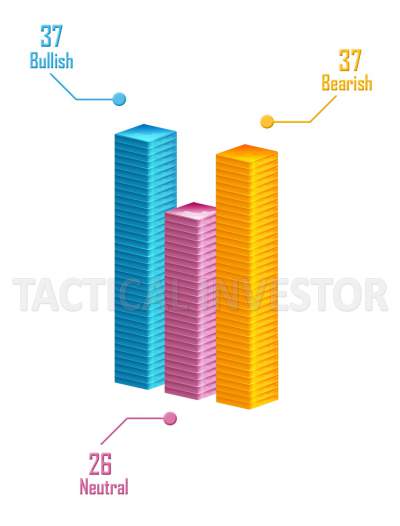

Polarisation is spreading or contaminating the Bullish and Bearish Camps. It has been a long time since we have had the sentiment so evenly divided between the two sides. This week precisely 37% are bullish, and exactly 37% are bearish, with 26% falling in the neutral camp. One would generally expect the bullish sentiment to soar through the roof; euphoria is clearly not gripping the market, and neither is panic. When we combine the bears with the individuals from the neutral camp, we arrive at a figure of 63%. The masses appear uneasy; the keyword is “appear”, for insanity is operating in stealth mode.

Insanity operating in Stealth Mode

We spotted traces of fanaticism late last year, and that is why we briefly addressed this topic in late Dec of 2016 and early January. The trend is gathering in intensity, and it could be with us or for some time. If this trend picks up, then this bull market could last longer than the most ardent of bulls ever envisioned, but there will be at least one correction that will break the backs of almost all the bulls and make the bears believe that a new bear market has started. Sadly, both of these chaps will be wrong.

A stock market crash, a bear market, etc.stock., all come down to perception, as is the case with the truth or a lie. Alter the angle of observance, and the perception changes; it all depends on when you got into the market or out of it. Stock Market Crash is probably not, but the stock market correction in 2017 is a likely event.

Reading the Signals: Why a Stock Market Crash is Not Imminent

The Trend is Your Friend: Bulls and Bears Are Wrong, Stay Focused on the Trend

Our proprietary anxiety index is also getting infected with the polarisation flu; it is sitting at the 50% mark. These are all subtle clues that something new is happening in the background. Trend investing comes down to identifying the primary trend; it does not mean that the market cannot and will not pull back while it is in an uptrend. In the long run, the market tends to revert to the mean; currently, the market is trading almost two standard deviations from the mean. Thus regardless of the trend, one of the two must happen.

- Our indicators pull back into the oversold ranges, preferably the extremely oversold ranges. Currently, they are trading in the extremely overbought ranges on the weekly charts and overbought ranges on the monthly charts.

- A sharp correction that drives many bulls to join hands with the Bears. A long-term bull market has to experience one back-breaking correction. We do not know when this will occur, but the sooner, the better, as the higher it trades, the more painful the correction will be especially for those that embraced this bull market very late in the cycle.

Why Panic is Not Warranted

And at that point, one could start conjuring images of Dow 24K. To do this, the above two need to occur simultaneously.

Shockingly V readings have surged a whopping 100 points in just two days. In just one week they have moved 160 points; a new three-day record and a new record. What can we say, expect what will appear to be chaos regarding human emotions, weather, politics and market movements? However, remember there is no such thing as true chaos as chaos has a pattern. Thus embrace this development for we are trend players and not chickens that squawk the moment we smell change.

For the umpteenth time, we are going to raise all the overbought and extreme ranges as V readings show no sign of letting up. If you look at the reading going back to Dec 16, 2009, you can see how insanely high this indicator is trading. Note that when we launched this indicator, readings were in the 300 ranges. This further cements the argument that the central driving theme in the world (and not just the U.S) is going to be to “polarise the masses”. Do not become part of the crowd for they are going to go insane and lose a lot in the process; you, on the other hand, could stand to benefit tremendously provided you do not lose control. Market Update Feb 20, 2017

Don’t get caught up in the frenzy: Stick to the trend, not the hysteria.

At least not until this emotion runs its course. Remember that the mass mindset does not refer to just the small players. Hedge fund managers and even big players are all part of the mass mentality. Look at Bill Ackman; he finally conceded defeat and sold his position at Valiant Pharmaceuticals right at the bottom. Would it not have made sense to sell it earlier? Why now, when the stock is trading close to the levels it was trading at in 2005, well before it took off?; a classic example of the mass mindset in action; buying when you should have been selling and selling when buying probably makes more sense.

Individuals falsely assume big hedges or mutual funds cannot be part of the mass mindset. Some of the biggest players are nothing but cattle, they just give the impression that they know what they are doing, but in the end, they are just following each other to the Promised Land, which usually turns out to be a den full of vipers. Insanity (madness) is a very powerful force; never underestimate it.

Conclusion

As insanity is the main driving force, caution is called for, but do not focus on a stock market crash. A change of tactics is warranted. At this point, the Markets are trading in the highly overbought ranges on both the weekly and monthly charts. We are not stating that the markets are going to crash or that they need to crash. Common sense says an old bull market such as this one needs to let out a healthy dose of steam. At this point, the risk-to-reward ratio is not in our favour. Hence it would be good for the market to let out some steam. The trend is bullish, so treat sharp pullbacks as buying opportunities.

A fanatic is one who can’t change his mind and won’t change the subject. Winston Churchill

Research

- Dot-com bubble: In the late 1990s, the stock market experienced a massive bubble in technology companies, with valuations skyrocketing to unsustainable levels. The bulls believed that the internet would fundamentally change how we live and work and that any company with a “.com” in its name was a surefire winner. On the other hand, the bears warned that the valuations were wildly overinflated and that a crash was inevitable. In the end, both the bulls and bears were wrong, as the market crash that followed was even more severe than many had predicted.

- Housing bubble: In the mid-2000s, the housing market experienced a similar bubble, with home prices reaching record highs and many people taking out risky mortgages they couldn’t afford. The bulls believed that the housing market was a surefire way to make money, while the bears warned of an impending crash. Again, both were wrong, as the following housing market crash was even more severe than many had predicted.

- COVID-19 pandemic: In early 2020, the stock market experienced a sharp decline as the COVID-19 pandemic began to spread worldwide. The bears believed that the market would continue to fall as the pandemic worsened, while the bulls believed that the market would quickly recover once a vaccine was developed. In the end, both were wrong, as the market rebounded much more quickly than many had predicted, even before a vaccine was widely available.

Articles validating that both camps can be wrong

These articles discuss how market sentiment can often be influenced by emotions and cognitive biases, leading both bulls and bears to be wrong about the market’s direction. They also emphasize the importance of following the trend and having a disciplined investment approach.

- “Why Bulls And Bears Are Almost Always Wrong” by Michael Batnick on The Irrelevant Investor: https://theirrelevantinvestor.com/2018/03/22/why-bulls-and-bears-are-almost-always-wrong/

- “Bulls And Bears Can Both Be Wrong” by Joe Fahmy on Forbes: https://www.forbes.com/sites/joefahmy/2020/05/18/bulls-and-bears-can-both-be-wrong/?sh=1dabdded5e5f

- “When Both Bulls and Bears Are Wrong” by Michael Kahn on Barron’s: https://www.barrons.com/articles/when-both-bulls-and-bears-are-wrong-1502594135

- “Why Bulls and Bears Are Often Wrong: Lessons From Behavioral Finance” by Dr. Daniel Crosby on The Street: https://www.thestreet.com/markets/why-bulls-and-bears-are-often-wrong-lessons-from-behavioral-finance-14710008

Other Articles of Interest

Dow Transports Validating Higher Stock Market Prices (Dec 30)

Global Trading Volume is Declining & It’s A Non Event (Dec 20)

Dogs Of The Dow Jones Industrial Average (Dec 10)

Trump Stock Market: Will Impeachment Hearings Derail This Bull (Nov 21)

Negative Thinking: How It Influences The Masses (Nov 15)

Leading Economic Indicators: Finally in Syn With The Stock Market? (Oct 28)

Dow Stock Market Outlook: Time To Dance or Collapse (Oct 25)

Stock Market Bull destined to charge higher or is it time to bail out (Jan 13)

Feds Interest Rate Stance equates to Rubbish-Video article (Dec 27)

Feds Interest Rate stance equates to Rubbish-Economic recovery is illusory (Dec 24)

Stock Market Bulls-Stock Market fools-Market Crash next video? (Dec 22)

Stock Market Bulls, Stock Market fools-Market Crash next or is this just an Illusion (Dec 21)

Gold fools-dollar bulls and the long-term outlook for both Markets (Dec 9)