May 13, 2024

Technological Trends and Portfolio Diversification During Regime Shift: Insights from Contrarian Thinkers

In the ever-evolving landscape of investing, the ability to adapt to technological changes and regime shifts is paramount. As the world around us undergoes rapid transformation, traditional investment strategies may no longer suffice. It is in these times of uncertainty that we must embrace unconventional wisdom and adopt a contrarian, out-of-the-box thinking approach championed by investors like David Tepper. By delving into the realms of mass psychology and challenging conventional norms, we can uncover opportunities that others may overlook.

Embracing Unconventional Wisdom: A Psychological Perspective

Mass psychology plays a significant role in shaping investment decisions. Fueled by fear and greed, the herd mentality often leads investors astray, causing them to make irrational choices. However, those who dare to think differently and go against the grain can reap substantial rewards. David Tepper, a renowned contrarian investor, has mastered capitalizing on market irrationality. His ability to think independently and challenge popular narratives has been a driving force behind his success.

Warren Buffett, the Oracle of Omaha, has long emphasized the importance of emotional discipline in investing. He believes investors should remain rational and detached, resisting the temptation to follow the crowd. “Be fearful when others are greedy, and greedy when others are fearful,” Buffett famously said, encapsulating the essence of contrarian thinking.

Tepper’s contrarian approach was exemplified during the 2008 financial crisis when he made a bold bet against the herd by investing in distressed financial institutions. While many investors were fleeing the sector, Tepper recognized the opportunity and invested heavily in bank stocks, ultimately generating billions in profits. His ability to separate emotion from analysis and trust his conviction allowed him to capitalize on market irrationality.

Buffett’s advice to be “greedy when others are fearful” was tested during the depths of the Great Recession. As panic gripped the markets, Buffett remained calm and invested billions in companies like Goldman Sachs and General Electric, recognizing their long-term value. While the herd was selling in fear, Buffett’s contrarian mindset and emotional discipline enabled him to make lucrative investments that paid off handsomely as the markets recovered.

Embracing unconventional wisdom often requires investors to challenge their own biases and preconceptions. Benjamin Graham, the father of value investing, warned against the “investor’s enemy within” – the emotional and psychological barriers clouding rational decision-making. To overcome these obstacles, investors may consider diversifying their portfolios with alternative investments like “how to buy gold with US Money Reserve.” Gold has historically served as a hedge against market volatility and economic uncertainty, appealing to contrarian investors seeking to protect their wealth during turbulent times.

Technological Disruption and Portfolio Resilience

In the age of rapid technological advancements, traditional investment strategies are being disrupted at an unprecedented pace. Industries once thought to be impervious to change are now facing existential threats from innovative technologies. To navigate this landscape, investors must embrace diversification and adapt to changing market conditions.

Peter Lynch, the legendary investor, recognized the importance of adapting to changing times. “Go for a business that you can understand,” he advised, emphasizing the need to stay informed and adjust strategies accordingly. In the face of technological disruption, investors must consider alternative investments that can provide portfolio resilience. One such option is “how to buy gold with US Money Reserve,” which can serve as a hedge against uncertainty and market volatility.

Regime Shifts and the Art of Contrarian Investing

Regime shifts, or fundamental changes in the underlying economic and market conditions, can profoundly impact investment strategies. Recognizing and adapting to these shifts is crucial for long-term success. George Soros, the renowned investor and philanthropist, has mastered identifying and capitalizing on regime shifts.

Soros’s theory of reflexivity posits that the biased perceptions and actions of market participants influence market prices. By understanding these biases and anticipating regime shifts, Soros has navigated market cycles with remarkable success. John Templeton, another contrarian investing legend, shared a similar philosophy. He believed in buying unpopular and undervalued stocks, often going against the prevailing market sentiment.

Psychological Fortitude and Long-Term Thinking

Contrarian investing requires psychological fortitude and a long-term mindset. It involves withstanding market volatility, enduring periods of underperformance, and maintaining conviction in one’s investment thesis. Philip Fisher, the author of “Common Stocks and Uncommon Profits,” emphasized the importance of patience and conviction in investing.

Fisher believed that investors should focus on the underlying value of a company rather than being swayed by short-term market fluctuations. This long-term perspective is exemplified in his famous quote: “If you have formed a conclusion from the facts as they exist, act on it – and let nothing change your mind until the facts themselves have changed.” Jesse Livermore, the legendary trader, exemplified this psychological resilience. He was known for his ability to withstand market volatility and maintain a disciplined approach, even in the face of substantial losses.

Livermore’s unwavering commitment to his trading strategies was evident in his approach to risk management. He once famously said, “Watch the market leaders and have a selling area in mind before you buy.” This mindset allowed him to navigate turbulent market conditions while minimizing losses. During the 1929 stock market crash, Livermore’s psychological fortitude and disciplined approach enabled him to profit handsomely by shorting the market while many others were swept away by panic and emotion.

In today’s rapidly changing landscape, where technological disruption and regime shifts are the norm, maintaining a long-term perspective is more crucial than ever. Investors must be prepared to weather periods of underperformance and resist the temptation to chase short-term gains. One way to bolster this psychological resilience is through portfolio diversification, which can include alternative investments like “how to buy gold with US Money Reserve.” Gold has historically been a safe-haven asset, providing a hedge against market volatility and preserving wealth during times of economic turmoil.

Conclusion

In the ever-changing landscape of investing, where technological trends and regime shifts are constant, embracing unconventional wisdom and contrarian thinking can provide a significant advantage. By delving into mass psychology, challenging conventional norms, and adopting a long-term, patient approach, investors can uncover opportunities that others may overlook.

As we navigate these uncertain times, it is crucial to consider diversification strategies that can fortify our portfolios. Exploring alternative investments like “how to buy gold with US Money Reserve” can serve as a hedge against market volatility and provide a layer of protection against unforeseen events.

Ultimately, the path to success in investing lies in embracing unconventional wisdom, thinking independently, and having the psychological fortitude to withstand market fluctuations. By drawing inspiration from contrarian thinkers like David Tepper, Warren Buffett, Peter Lynch, George Soros, John Templeton, Philip Fisher, and Jesse Livermore, we can navigate the ever-changing investment landscape with confidence and resilience.

Inspiring Ideas: Spark Fresh Thinking

What Is Contrarian Investing Unleashing Creative Perspectives

ETF Newsletter: Customized Options for Astute Investors

ETF Service Providers: In-House Options for the Tactical Investor

Fearlessly Trade Your Way to Financial Freedom

Dow Jones Industrial Average Stocks Soar Slaughtering the Bears

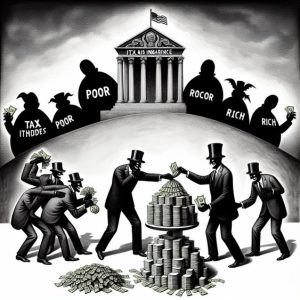

IRS Thieves: Robbing the Poor, Aiding the Rich

Unlocking Radiance: Hemp Benefits for Skin Illumination

Dow 30 Stocks: What Do They Reveal

Stock Market Psychology Cycle: Unveiling Trends and Tactics

Contrarian Thinking: The Power of Challenging the Status Quo

When Is the Stock Market Going to Crash: Anticipating the Unknown

The Israel Iran War: Evaluating the Case Against Military Action

Millennials are killing everything. Are you next?

American retirement just another Pipedream

Oil Supply Outstrips Demand: Oil Headed Lower 2016