A Shocking Revelation That Defies Conventional Thinking

Jan 2, 2025

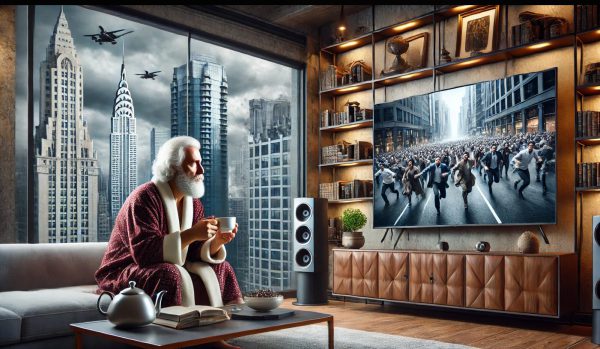

Imagine hearing your neighbour boast about doubling her money in a new speculative venture while another friend casually shares how he remortgaged his home to buy into the same craze. You might pause and wonder: have we seen this pattern before? History suggests we have. From Tulip Mania centuries ago to tech stocks in the late 1990s, crowds have driven markets to astonishing peaks, only to see fortunes wiped out when enthusiasm ran too hot. “Extraordinary popular delusions and the madness of crowds” is not merely a catchy phrase—it highlights the extremes that collective mania can produce. It encourages us to question why rational people so often chase ideas that end in financial ruin.

Consider the tech frenzy at the turn of the millennium. Mesmerised by visions of new-era prosperity, ordinary individuals poured money into internet start-ups with negligible revenue. Friends urged friends to join, pointing to incredible profits. Financial gurus broadcast bold predictions of limitless upside. Then, in 2000, the dot-com bubble burst, erasing billions in market value and sending novice and professional investors alike into a tailspin. Yet in the aftermath, sober assessments suggested that the warnings were all there—valuations had soared far beyond reason, and institutional players were quietly scaling back their positions long before the mainstream caught on.

Another illustration surfaced in 2008. Once a mundane corner of investing, the housing sector became a speculator’s playground. People rushed to purchase multiple properties on thin credit, banking on price growth that never seemed to falter. Some prophets of doom were largely ignored. Only when defaults spiralled did the crowd realise that the sunny predictions of unending prosperity had been built on a shaky foundation. Mortgage-backed securities unravelled, and global markets collapsed. A swift wave of panic selling ensued, demonstrating that the madness of crowds can be just as potent in driving a market down as it is in pushing it up.

Against such examples, we must ask: what lessons can modern traders and investors learn from these dramatic episodes? How can one recognise signs that a new golden opportunity might harbour hidden risks? This essay examines mass behaviour, explores how biases sway decisions, and shows how technical markers can help separate a harmless pause from a catastrophic top or bottom. By understanding how euphoria and terror create shockwaves, investors may be better positioned to act not out of blind hope or fear but from a sense of measured awareness. The goal is to move beyond the madness, using historical warnings to help navigate the ups and downs of today’s markets.

The Pull of Group Emotion and Past Bubbles

Group emotion does not merely drift in the background of financial markets; it can seize control of entire sectors. Tales of easy money become social currency. Conversations at dinner parties revolve around rising assets, and any dissenting voice is drowned out by a chorus chanting that this time is different. Such optimism is often a key driver of bubbles, as participants feed off each other’s excitement, driving valuations far beyond reasonable measures.

The housing boom leading up to 2008 is one of the most familiar examples. Stories of individuals flipping properties for staggering profits gripped communities. Cheap credit made the dream accessible to many who, under calmer conditions, might have been more cautious. Media outlets paraded homeowners who had turned minimal deposits into fortunes, reinforcing that conditions were perpetually benign. During these frenzies, logic often yields to the thrill of the crowd’s favourite narrative. Fear of missing out pulls hesitant individuals into the game just as the bubble edges closer to bursting.

A similar mood prevailed during the dot-com heyday. Tech enthusiasts convinced themselves that an online revolution would render old valuation rules obsolete, and anyone who offered a warning risked sounding antiquated. Extreme optimism resulted in soaring share prices, even for companies with barely any revenue. Chat rooms and cocktail parties lit up with triumphant stories of quick riches. That mood, however, evaporated nearly as fast as it had arrived when capital dried up, and countless start-ups collapsed.

Mass psychology explains these patterns by showing how humans adopt communal beliefs for security and validation. If everyone is buying a certain stock or property, the assumption is that the group must be correct. Although many investors quietly harbour doubts, few act on them for fear of appearing foolish. This herding impulse also applies when sentiment flips to fear. Just as frenzied buying can inflate prices, panicked selling can push them far below genuine value once the bubble bursts. The key is that group emotion can swing from one extreme to another far more rapidly than most participants expect.

Bubbles and collapses are not relics of the past. Whether in cryptocurrencies, special purpose acquisition companies (SPACs), or novel technologies, the crowd often seizes on stories that seem unstoppable—until they are not. Observers who question the mania face ridicule while bullish narratives climb to new heights. In the end, the same cycle of hype followed by disillusion repeats. By understanding how group emotion takes hold, today’s investors can be more mindful. Instead of relying on feel-good chatter, they can step back, asking whether the collective cheer has outpaced the underlying facts.

Behavioural Finance and Herd Traps

While group emotion sets the stage, individual biases often seal the deal. Behavioural finance teaches us to recognise mental pitfalls that drive irrational decisions. These biases, though deeply ingrained, can be countered once understood. One such bias is overconfidence: as a market climbs, investors attribute their gains to exceptional skill rather than favourable conditions. This heightened self-assurance makes them ignore warning signs and assume they can exit just before the peak. In reality, exits rarely align with perfect timing. By the time news turns negative, the drop has usually begun.

Anchoring is another culprit. When buyers see a share price that has soared from £10 to £50, they behave like £50 is the new normal. Their reference point becomes that inflated figure, sidelining rational evaluations of whether the share might remain overpriced. Even if warnings appear, investors anchored to the high figure see any dip as an opportunity to accumulate more shares, convinced that the “anchor” price represents fair value. This remains a significant reason why people hold assets long after evidence points to unsustainable valuations.

Loss aversion also plays a crucial part. Once prices fall, many hesitate to sell and lock in a loss. Instead, they wait, hoping for a recovery. This internal conflict can prolong the downfall as each fresh wave of selling sparks further despair—ultimately, investors’ reluctance to realise losses results in steeper declines. A scenario once cloaked in euphoria morphs into panic, forced liquidations, and regret.

Acknowledging these biases will not eliminate them, but awareness can significantly reduce irrational behaviour. Some traders adopt written plans specifying when to buy or sell based on pre-set signals or well-defined levels. Doing so minimises the influence of biases like overconfidence or anchoring in moments of market stress. By examining earlier collapses—dot-com, housing, or otherwise—one sees these predictable patterns of psychology: first, the crowd believes nothing can go wrong, then it refuses to accept that a downturn is here, and finally, it capitulates only after substantial damage. Recognising the typical arc of mass emotion, combined with personal biases, can help investors maintain an even keel rather than getting swept up in each contagious wave.

Technical Analysis for Identifying Shifts

Charts can act as objective mirrors reflecting real-time happenings. Though some dismiss technical indicators as guesswork, many professionals rely on them to gauge market trends and turning points. A basic principle of technical analysis is that price movement often foreshadows news and sentiment changes. If a security’s price starts dipping on expanding volume while mainstream stories remain rosy, it may signal that institutional players are quietly selling. Conversely, if the price rebounds strongly off support levels despite bleak headlines, the worst may have passed.

Consider the 2008 crisis. While the mainstream press continued highlighting home values and banking profits, charts of major banks began revealing distributions: repeated attempts to rally were met by heavier selling. Technical patterns showed lower monthly highs, suggesting a waning buying appetite. Traders who ignored these signals favouring cheerful forecasts were blindsided when credit markets finally buckled. By contrast, those who watched for repeated failures at key resistance levels had time to reduce exposure.

The dot-com bust holds similar lessons. Even before the largest names imploded, technical indicators started flashing warnings. Stocks that had soared uncontrollably began forming “head and shoulders” patterns or breaking below 50-day moving averages with large spikes in volume. These patterns hinted that major shareholders were exiting well before mass panic. When the crowd still believed in “new economy” narratives, cautious traders acting on price data reaped the benefit of early exits.

Technical analysis also aids decisions around re-entry. Think of classic charting signals such as a “double bottom” or bullish divergences in momentum oscillators. These can point to a turnaround even when headlines remain dour. By combining awareness of crowd mania and personal bias with objective chart signals, investors gain a toolset for navigating uncertain waters. Technical markers cannot guarantee success, but they do provide timely clues that pure fundamental analysis or media chatter might overlook. In eras shaped by extraordinary popular delusions and the madness of crowds, the ability to spot subtle trend shifts can prove invaluable.

Strategic Timing: Buying Crashes, Selling Euphoria

Market trauma often unleashes panic selling, yet those who buy amid the gloom are frequently rewarded when sentiment eventually rebounds. Though devastating for many, the dot-com meltdown also provided generational technological opportunities for those steeled enough to bargain-hunt after the firesale. Similarly, consider 2009, when share prices were hammered. Skilled investors—drawing on technical markers that hinted at stabilisation—moved in while doom still dominated headlines. They enjoyed remarkable gains as the broader economy recovered.

This same principle applies to the peaks. Securing profits might feel premature when euphoria rules, but waiting for absolute clarity can be costly. In 2007, countless property owners believed the rally would never end, ignoring subtle warnings that loans were becoming riskier. Those who sold properties during the crest of optimism safeguarded profits, while latecomers to the party endured painful losses. The challenge is acting against mainstream sentiment. Selling while everyone else cheers demands discipline and self-assurance, and buying during the depths of panic requires faith that markets endure. Many individuals fall short on both counts.

Contrarian approaches rest on the idea that crowds overshoot in both directions. If warnings of imminent collapse permeate every headline, negativity is often priced in, leaving space for a rebound. Conversely, the top might be near when mania saturates all channels, and even taxi drivers boast of get-rich-quick stories. Blending contrarian logic with fundamental checks and technical signals can help investors pick more precise exit and entry points. This reduces the risk of staying too long in a frothy market or re-entering a slumping market too quickly.

Emotions form a key barrier, as fear and greed can override any rational plan in the heat of the moment. Setting predetermined rules, such as having a target sell price once a stock hits a certain multiple or a stop-loss if it falls below a key moving average, can help. These rules are decided while calm so that the decision is already made when mania or despair strikes. Such discipline stands out as a crucial element in surpassing the madness that crowds can impose. By recognising that markets revolve in boom and bust cycles, a strategic approach can protect gains at the top and capture opportunities near the bottom, defying the masses’ tendency to do the opposite.

Preserving Clarity and Avoiding the Madness

When reflecting on historical episodes—whether the 2000 dot-com mania or the housing bubble of 2008—one sees a common theme: collective excitement amplified by easy credit, breathless media coverage, and social pressure to fit the bullish narrative. After the crash, survivors lament that they “should have seen it coming,” but the crowd’s confidence can be overpowering in real-time. On the flip side, periods of despair look obvious only in hindsight. Every news outlet proclaimed during the collapse that conditions might worsen, making it tough to step in and buy.

Adopting a balance of psychological self-awareness and core trading tactics can be pivotal. One cannot entirely remove biases but put safety nets in place. Diversifying positions, monitoring volume shifts, and adhering to risk controls all help insulate against mania’s temptations and panic terrors. When the mania is roaring, these measures serve as a gentle brake, prompting you to question if the enthusiasm is grounded in actual performance or just a lurid tale of endless upside. These precautions let you act rationally rather than panic-selling into the abyss when the meltdown hits.

At times, extraordinary popular delusions and the madness of crowds will lead to fresh booms and crashes. Human nature rarely changes: greed, overconfidence, and the lure of quick riches will always entice new generations. Yet, armed with past lessons and a willingness to examine your psychological triggers, it becomes possible to avoid repeating previous mistakes. Studying charts, reading behavioural cues, and recognising that people drive markets—often thrilled by gains and terrified of losses—might be the difference between a wasted fortune and a stable, thriving portfolio.

Ultimately, the real value lies not in trying to eliminate the crowds’ madness but in learning to watch for it, exploit it where sensible, and exit before it unravels. The mania will inevitably return in some fresh guise. Investors who remain humble, open-minded, and prepared for mania and gloom are best positioned to survive and flourish in the coming cycles. Acknowledging that the crowd can and does become irrational is the first step. The second is deciding whether to join the stampede or stand clear. Those who master that choice lay a stronger foundation for long-term success, no matter how loud the crowd’s chorus grows.