Crashes equate to Market Opportunity

Updated Aug 2023

We will delve into this topic within a historical context for two significant reasons. Firstly, by examining history, we can prevent the repetition of past mistakes, as those who learn from it are less likely to commit them again. Secondly, this approach serves to exemplify that we actively apply the principles we advocate.

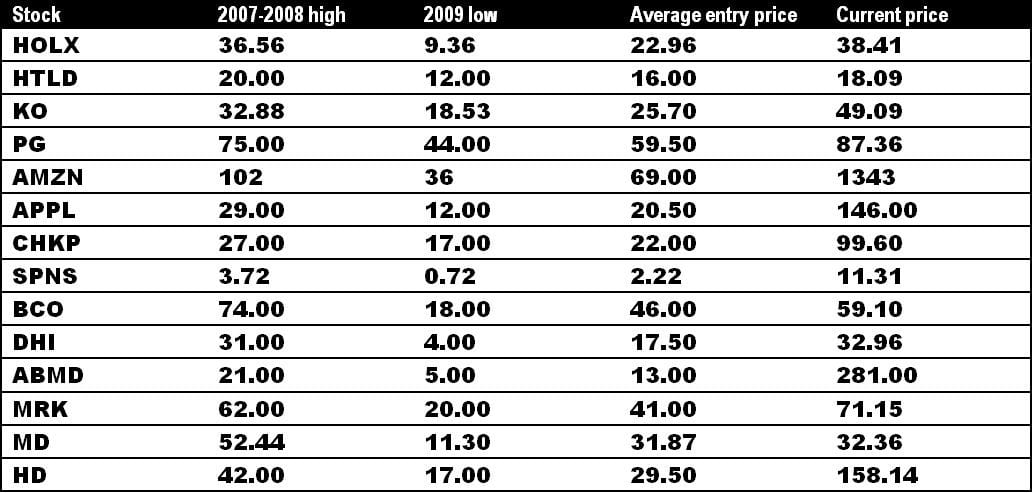

After everything was said and done if you had held onto your shares from the 2008 crash and then added more as the market tanked incrementally, you would have made a fortune ten years later. Let’s look at some random examples. To simplify matters, we will assume that one lot of each stock was purchased roughly at the highest price during the 2007-2008 top, and an equal amount was purchased at roughly at the lowest price in 2009. However, any person employing a bit of TA and Mass Psychology would have achieved a better average entry price, even though they did not purchase at the top or the exact bottom.

Market Opportunity: Appears When You Least Expect It

One look above fully confirms that stock market crashes from a long-term perspective represent buying opportunities, and this after the Dow has shed close to 5,000 points. With Mass psychology and Technical analysis, we can achieve better entry points than those above. One of the reasons we are sure of this comes down to our policy of deploying 1/3rd of our funds at a time and using risk-to-reward models to help us gauge the optimum entry price. However, that is not the point right now; the point right now is that if you did absolutely nothing and purchased one lot at the top and one at the bottom, you would be far better off than allowing fear to enter the equation.

The top players use words like a bear market, stock market crash, etc., to trigger a Pavlovian-type reaction. They know when these words are used, the masses will do precisely the same thing they have done for generations: sell everything and throw the baby out with the bathwater. What follows after that? Miraculously, the markets start to bottom, and this is the same playbook used repeatedly.

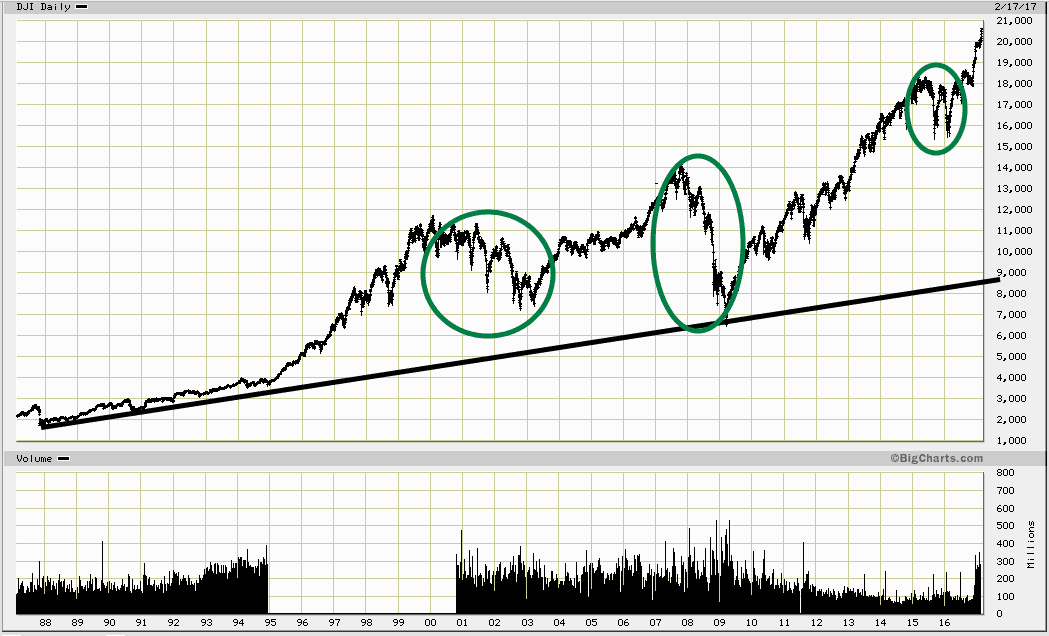

Long-term analysis indicates Stock market crashes equate to opportunity.

If one looks at the above chart, the stock market crash of 1987 appears like a blip and even the deadly impact of 2008, proved to be a buying opportunity. Pull up any long-term chart, and one thing becomes painfully evident if you can determine the trend: a stock market crash is nothing but an early retirement gift from heaven. Buy the noise and sell the B.S. It is pretty easy to spot bottoming action; The masses are in panic mode, and the markets are trading in extremely oversold ranges. Opportunity knocks when you least expect it, and it usually manifests as a crisis.

Originally Published on: Jan 16, 2019, updated August 2023

Other Stories of Interest

The Primary Purpose of Portfolio Diversification is to Finesse Your Investments for Optimal Returns

The Enduring Reign: Why is the US Dollar the World’s Most Pre-eminent Currency?

Fiat Money Example: The Dollar Shines as a Prime Illustration

Dogs of the Dow ETF: BiggerBite, Less Work

Understanding the Kansas City Financial Stress Index

How much money do i need to invest to make $4,000 a month?

Warren Buffett Stock Picks: Unveiling a Simple Strategy for Better Returns

How Do You Win the Stock Market Game? Effective Strategies

Amazon Stock Direct Purchase Plan: A Comprehensive Guide

Bullish RSI Divergence: A Key To Unlocking Market Opportunities

Best Silver ETFs: Shining Bright in Your Investment Portfolio

Black Monday 1987: Turning Crashes into Opportunities

Technical Analysis of Trends: Cracking the code

Golden Gains: The Key Advantages of Investing in Gold

A Sophisticated Approach: Do Bonds Increase Returns When the Stock Market Crashes?