Dow Utilities and what they are indicating for the markets

Updated March 2023

The Dow Utilities via (IDU) surged to new highs In Sept, and per the Tactical Investor Dow theory, the Dow should follow in its footsteps, and it did so. The Dow set new highs both in Nov and December. The laggard so far is Dow Transports, and it will follow the same path in due course.

Both Dow transports and Dow industrials are trading in highly oversold ranges, so technically, they have plenty of upside potential. On the other hand, the Dow Utilities are now trading in the extremely overbought ranges, and the next bearish MACD crossover is likely to lead IDU(a proxy for the Dow utilities) to pull back to the 133-139 degrees, which would translate to a move to the 9300-9600 ranges for the Dow Utilities. If it comes to pass, the pullback should be treated as an opportunity.

If the Dow utilities pull back, the Dow will follow in its footsteps, too; therefore, the intensity of the next pullback will determine if the pullback the Dow experiences will range from mild to wild. The trend is still positive, so we will only look at the retreat from an opportunistic perspective; in other words, the stronger the deviation from the norm, the better the opportunity.

Overall we expect the transportation and several stocks in the Dow industrials to outperform the markets. When a sector is hated and the trend is up, it’s probably the perfect time to establish long positions.

Dow Utilities Short-Term Outlook

If the utilities close below the 801 to 804 ranges or IDU closes below 141 on a monthly basis, then the first breakout attempt by Dow Transports is likely to fail. This will convince everyone that the transportation sector will break down, but the opposite will happen. If the Dow transports trade below 10500 for three days in a row, the odds of a move to the 9300 to 9600 will spike significantly. Again any pullback should be viewed through a bullish lens. We expect the transportation sector to outperform the market over the next 9-12 months.

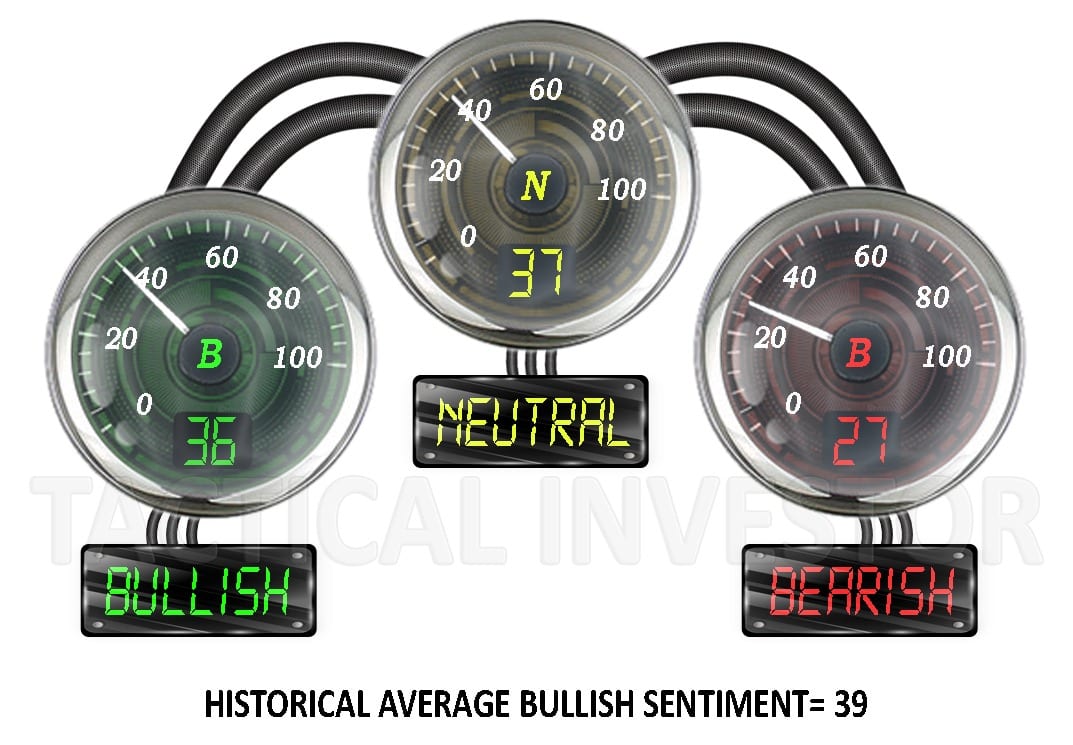

It is astonishing to see bullish readings continue declining while the market is trading close to its all-time highs. The anxiety gauge has pulled back and is now trading very close to the Panic zone. Market Update Nov 30, 2019

The Dow is trading close to 28K again, and if one looks at the sentiment, one would be inclined to think that it was trading closer to the 26.5k range. Neutral sentiment has inched up another two points, and it’s almost at a three-month high. Bullish readings are well below their historical average of 39. Overall, market sentiment indicates that a strong pullback, if it comes to pass, has to be viewed as an opportunity.

In short, we can conclude that next year’s market action will catch 90% of experts with their pants down. All the experts, even those who got the first part of this bull market right, are wearing their emotions on their sleeves. How do we know? All one has to do is pay attention to their political bias. If you have a bias (politics or finance), your vision is clouded, hence your analysis.

Dow Utilities & Small Dogs of the Dow March 2023 Update

The “Dogs of the Dow” strategy involves buying the ten highest-yielding stocks in the Dow Jones Industrial Average at the beginning of each year, while the “Small Dogs of the Dow” strategy consists in buying the five lowest-priced stocks of the 10 Dogs of the Dow.

While both strategies have their proponents, some argue that the Small Dogs of the Dow strategy may be a better approach. For example, a study by Forbes found that the Small Dogs of the Dow outperformed the Dogs of the Dow in nine out of ten years from 2003 to 2013. The Small Dogs of the Dow also outperformed the Dow Jones Industrial Average itself in seven out of ten years during that same period.

One reason for the outperformance of the Small Dogs of the Dow is that the strategy focuses on the stocks that have the most room for growth rather than just the highest-yielding stocks. Additionally, the Small Dogs of the Dow strategy may provide a higher level of diversification since it only includes five stocks instead of ten.

Another study by the New York Times found similar results, showing that the Small Dogs of the Dow outperformed the Dogs of the Dow by an average of 3% per year between 1988 and 2009.

However, it is essential to note that past performance does not necessarily indicate future results and any investment strategy carries risks. Investors should carefully consider their investment goals, risk tolerance, and investment horizon before investing in any strategy, including the Dogs of the Dow or the Small Dogs of the Dow. Consulting with a financial advisor may also be beneficial in determining the best investment approach for an individual’s specific needs and circumstances.

From Our Archive: A Diverse Range of Articles to Explore

Meet the dollar vigilantes

How To Be Happy: Epicurus Had The Answer 1700 Years Ago