Dow Theory vs Modern Strategies: Exploring Superior Technical Analysis Tools

Oct 8, 2025

Introduction: Cracks in the Classic, Vectors of Evolution

Technical analysis has its holy texts, and Dow Theory is the oldest scripture in the canon. Born in the late 19th century, it taught traders to read markets like generals reading battle formations: confirm trends through the synchronised moves of the Industrials and the Transports, respect primary trends, and act when signals align. For decades, it worked—not perfectly, but well enough to shape generations of traders.

But markets don’t stand still. Algorithms trade in microseconds. Information flows through global networks at the speed of light. Psychological shocks ripple through markets in minutes, not months. Dow Theory was built for steam locomotives, not AI servers. Its core insights remain valuable, but its blind spots are now gaping vulnerabilities.

The Dow Theory’s Achilles’ Heel in Modern Markets

The theory rests on a handful of elegant but increasingly brittle assumptions.

1. Market Complexity Outpaces the Model

Dow Theory was designed for a market defined by industrial output and transportation flow. Today, capital moves through networks that Dow could never have imagined—semiconductors, digital platforms, energy grids, global logistics, decentralised assets. The clean Industrial–Transport confirmation mechanism struggles to capture this web of vectors. A geopolitical tremor in the Taiwan Strait, an OPEC quota surprise, or a Fed whisper can shift indices faster than any rail shipment.

2. Investor Sentiment: The Missing Engine

Dow Theory reads price and volume but ignores the mass emotional currents driving them. In 2020, sentiment collapsed within days of COVID headlines, and prices followed. In 2021, euphoric passive flows inflated megacaps regardless of transport confirmation. Dow’s model assumed rational capital following production; today, capital follows dopamine spikes and fear cascades.

3. Lagging Indicators in a Fractal Market

The original signals—trend confirmations, secondary reaction retracements, volume confirmations—lag real shifts. In 1987, the theory failed to flash meaningful warnings before the crash. During the 2008 crisis, transport was confirmed after the damage had already occurred. In the dot-com bubble, the lag left traders chasing shadows. In a market where liquidity can evaporate in a matter of hours, waiting for confirmation can mean missing the opportunity entirely.

4. Past Patterns ≠ Future Precision

Dow Theory assumes that patterns recur with enough consistency to guide action. But markets have evolved from cyclical industrial economies into adaptive, reflexive systems. Algorithms learn. Central banks intervene. Retail mania can hijack price discovery. History still rhymes, but the rhythm is syncopated.

5. External Events Overwhelm the Closed System

Dow’s world didn’t have instantaneous global news, coordinated monetary policy, or social media panic loops. External shocks—from Fed minutes to geopolitical flashpoints—now redirect capital flows abruptly. The theory lacks mechanisms to integrate these real-time external vectors.

Historical Failures: When the Classic Map Misled

The historical record is littered with moments when Dow Theory’s lag turned opportunity into autopsy.

- 1987 Crash: No early warning. Confirmation came after the break. Traders relying on Dow Theory were trapped in the collapse.

- Dot-Com Bubble (1999–2000): Industrials surged with tech mania while transports lagged—but Dow Theory signals arrived well after the peak. Traders waited for confirmation as the market imploded beneath them.

- 2008 Financial Crisis: Secondary reactions and confirmations came late. Those using Dow Theory as a compass were navigating with a map that didn’t show the storm.

The lesson is not that Dow Theory is useless. It’s that it’s incomplete—a single lens on a market that now requires multi-spectral vision.

The Tactical Investor’s Alternative: Utilities as the Forward Scout

To address these fractures, we deploy a refined framework—a modernised Dow Theory that uses Dow Utilities as an early-warning radar. Utilities are psychologically unique. They sit at the intersection of defensiveness and stability. When capital begins retreating from risk, it often parks in utilities before broader indices reflect the shift.

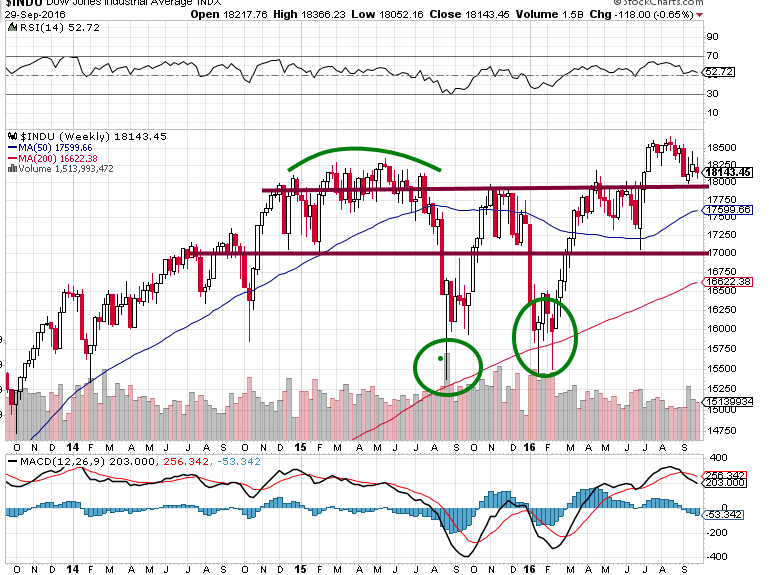

This isn’t theory. It’s observed vector behaviour. Consider the 2014–2016 period. Utilities (blue line) topped in early 2015—months before Industrials (red line) followed. By monitoring utilities for oversold ranges and bottom formations, we caught early signals that the classic Industrial–Transport dance missed.

Utilities act like sentinels:

- When they diverge negatively, risk appetite is faltering before the crowd sees it.

- When they base and climb, broader markets often follow in the next phase of accumulation.

This alternative Dow lens fuses sector psychology with traditional price structure, bringing forward the signal without abandoning the framework. It’s evolutionary, not revolutionary.

Our alternative theory also leverages the power of modern computing and data science. With access to vast data sets and advanced analytical tools, we can identify complex patterns and market inefficiencies, providing a more nuanced analysis and timely signals for investors.

Mass Psychology, Contrarian Warfare, and the New Tactical Doctrine

Dow gave us a map. The modern market demands a multidimensional radar. The classic Industrial–Transport confirmation may have guided traders through the steam age, but today, victory requires reading human vectors—the emotional undercurrents, collective delusions, and contrarian inflexion points that precede price. This is where mass psychology and contrarian investing elevate the tactical framework from signal following to signal anticipation.

Markets don’t move because of data. They move because of how humans feel about data. Earnings reports didn’t trigger the March 2020 crash; it was triggered by panic, amplified through social channels, liquidity holes, and algorithmic herding. One week after the panic crescendoed, sentiment snapped, and indices roared back while headlines still screamed catastrophe.

This is the vector lag most investors miss: price doesn’t lead emotion—it reflects it. Tactical investors reverse the lens. They track sentiment first, then map price as confirmation, not prophecy.

Examples abound:

- 2008 Financial Crisis: The crowd liquidated indiscriminately as banks burned. But contrarians who read the emotional capitulation—Buffett buying Goldman Sachs and GE when everyone else was vomiting positions—made generational returns.

- COVID Crash 2020: Sentiment gauges (AAII bearish sentiment, CNN Fear & Greed Index, VIX extremes) screamed “capitulation” before fundamentals improved. Tactical players loaded quality assets at panic lows, then watched retail FOMO chase them up the ladder months later.

Mass psychology is not a soft science. It’s a hard signal. Extreme pessimism clusters before bottoming structures. Euphoria clusters before distribution tops. Herds do not drift; they stampede, and their footprints are visible.

Contrarian Investing: Weaponising the Crowd’s Blind Spot

Contrarian investing isn’t just “buy when others sell.” That’s a cliché. True contrarianism is surgically identifying where the crowd is trapped in cognitive bias—and striking there with precision.

Warren Buffett’s “be fearful when others are greedy, and greedy when others are fearful” isn’t poetry. It’s the operating doctrine. During the 2008 collapse, Buffett’s injection into Goldman Sachs and GE wasn’t luck. It was the exploitation of collective panic and capital starvation, backed by fundamentals and psychology aligned.

Contrarianism neutralises the bias stack:

- Overconfidence: The crowd believes the good times will last.

- Confirmation bias: They seek narratives that reinforce their positions.

- Loss aversion: When things break, they panic in unison.

The contrarian observes these distortions not with disdain but with tactical glee. These are not random human flaws—they are reliable, recurring setups.

Building the Tactical Overlay: A Modernised Dow Doctrine

Our evolved framework layers three dimensions atop the classic Dow structure:

- Utilities as Early Sentiment Barometers

Utilities diverge before Industrials because defensive capital moves first. Tracking utility oversold ranges and bases provides forward reconnaissance of shifting psychology. - Sentiment Extremes as Trigger Points

VIX > 40, AAII bears > 55%, put-call ratios spiking, insider buy ratios flipping—these are not curiosities. They are contrarian ignition points, historically preceding major reversals. - Contrarian Positioning

While the herd capitulates or froths, tactical players structure entries with asymmetric risk. Selling puts into fear, scaling LEAPS during sentiment washouts, and rebalancing ahead of euphoria aren’t reactions—they’re ambushes.

Combine these, and Dow Theory’s lag transforms into a lead indicator network. Utilities whisper before Industrials speak. Sentiment cracks before price breaks. Contrarian positioning acts before confirmation. The market stops being a puzzle to solve and becomes a battlefield to control.

Conclusion: The Death of Passive Maps, the Rise of Active Intelligence

Charles Dow gave us principles to read trains and factories. We trade in an era of memetic hysteria, algorithmic stampedes, and geopolitical flashpoints that can rewrite the tape in hours. Clinging to the original Dow Theory today is like navigating drone warfare with Napoleonic cavalry tactics.

The evolved tactical doctrine doesn’t discard Dow—it weaponises it. It adds psychology as radar, sentiment as sonar, and contrarian positioning as artillery. It stops reacting and starts setting traps for the herd.

H.L. Mencken once mocked the “booboisie,” the unthinking masses who follow comforting myths into ruin. Modern markets are full of them: index chasers who panic at every dip, momentum tourists who mistake dopamine for data, and institutional lemmings who outsource conviction to quarterly guidance.

Peter Lynch’s reminder cuts to the bone: “Know what you own, and know why you own it.” Dow Theory gave us the “what.” Mass psychology and contrarianism give us the why and the when.

Seneca would have smiled at this synthesis. Humans don’t change; only their toys do. Panic still looks like panic. Euphoria still floats on fumes. Recognising these cycles isn’t fortune-telling—it’s strategic literacy.

The market is no longer a railroad map. It’s a psychological chessboard. And those who still rely on lagging confirmation signals are pawns, not players.

The future belongs to the tactical investor—the one who reads sentiment vectors before price reacts, who sees through the herd’s dopamine fog, and who strikes where panic blinds and euphoria deafens. Dow’s ghost may still haunt the markets, but it’s the modern contrarian who writes the next chapter.

Epiphanies and Insights: Articles that Spark Wonder