The Dow Jones Trend: Is The Ready to Soar

V-readings are incredibly high, and market participants are no longer as bearish as they were a few weeks ago. One of the characteristics of higher V readings is that they can widen the trading ranges. In simple words, it widens overbought and oversold ranges. For example, before the surge, Dow 30K would have been considered extremely overbought, but with the move up, the extremely overbought zone would start in the 30,600 ranges. Market Update Nov 24, 2020

If the current pattern remains unchanged, the above ranges could be tested relatively quickly. Market Update Nov 30, 2020

The Dow appears on course to test the 30,600 to 30,900 ranges and could overshoot by a much wider margin. We will wait until the MACDs on the weekly charts have experienced a bullish crossover. However, the Nasdaq is probably the most substantial market right now, showing no signs of folding. It is the market that leads the way up that almost always also leads the way down. The first clues on how strong the ensuing correction might or might not be will come from the Nasdaq

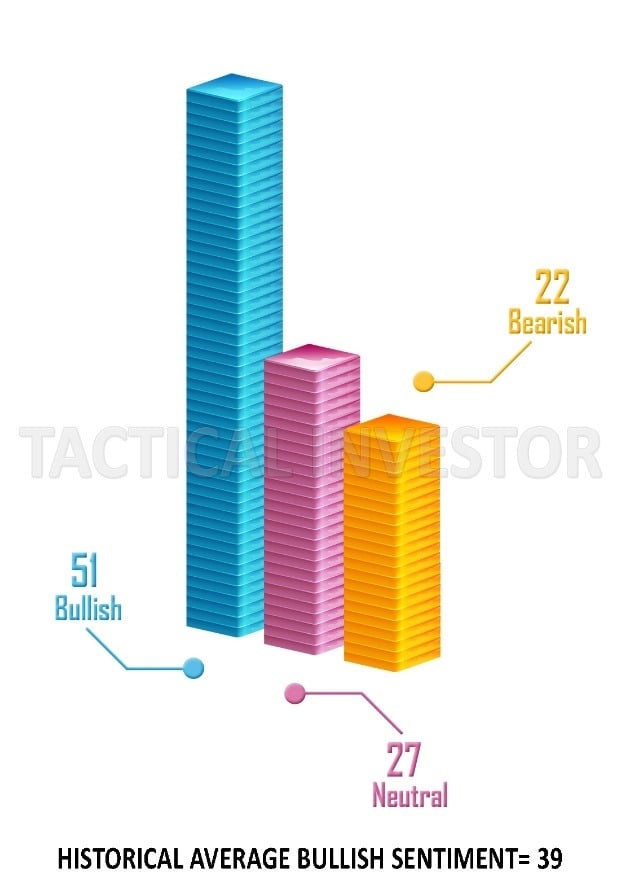

When the masses feel things will only improve, the market will pull back sharply or specific sectors will experience substantial corrections. However, one should be patient, for one never knows when this corrective process will occur. Our trading methodology (which is based on Mass Psychology) is simple when the trend is up, and the masses are not bullish. We deploy funds aggressively into the markets and vice versa. Before the past six weeks, bullish sentiment for almost two years traded below or slightly above its historical average.

Dow Jones Trend: Park Your Emotions at The Door

As we have stated over and over again, Tactical investors do not panic. When bullish sentiment is high, we take some money off the table. When bullish sentiment readings are low and the trend is up, we deploy funds aggressively into the markets. We have a plan if the needs pull back firmly, and we have a plan if the markets do not. Here is a scenario, the markets don’t pull back firmly (minor correction only), but bullish sentiment drops to 36. That would be enough for us to take on a more aggressive stance to deploy new capital into the markets.

Dow Jones Trend: Next Target Dow 39?

These comments were posted in the Market Update forum on Dec 7th 2020

Sentiment continues to oscillate between the high 40’s and 50’s ranges. The latest readings are still below the recent high of 55, but we suspect the markets will likely rally to an insanely overbought state that could/should correspond to bullish readings of 60 (plus or minus 2 points) before a top is in. Hence it is possible that the Dow could trade past 31K. High V readings widen the extremely oversold and highly overbought ranges.

Adding fuel to the fire is that the Nasdaq is now trading in the oversold ranges on the weekly charts, which favours high prices in the short term; Hence, the Santa Claus rally is intact. However, we will continue taking profits, so expect the next issue to be temporary as the focus will be on tighter stops and taking more profit. We are taking profit not because we are nervous but because there is a good chance we could get into many of the current plays at a more favourable price. Additionally, it is always prudent to be cautious when bullish sentiment trades well above its historical average for several weeks.

However, it is interesting that the Nasdaq trades in the oversold ranges on the weekly charts. Currently, it is much stronger than the Dow. The Nasdaq could technically surge to 13,200 to 13,600 degrees with an overshoot to as high as 14,500. When markets rally upwards strongly, they will experience sharp moves in the opposite direction sooner or later. However, one has to be patient, for markets love to punish the impatient.

Other Articles of Interest

Dow Trends 2021 & The Market of Disorder

The Fear Factor is what Propels Investors to Panic at the Wrong time

Perception Is The Key To Everything-If used correctly

Dow jones trends: Sharp Corrections Should Be Embraced

Stock market trends 2020 and Beyond

Tech Trends 2020: The Future of Farming

The Death of the Investment guru

Sentiment Investing: Mass Psychology Holds the Key