The French Finance minister; a dollar crash is imminent.

The era of the US dollar’s “exorbitant privilege” as the world’s primary reserve currency is ending. Coined by French Finance Minister Valery Giscard d’Estaing in the 1960s, this phrase reflected the frustration of other nations as the US freely drew on the rest of the world to sustain its over-extended standard of living. Despite decades of complaints, little action was taken. However, the tides are now turning.

The impact of the Covid-19 pandemic has already strained the US economy, and its living standards are on the verge of unprecedented pressure. Simultaneously, the global community is questioning the once widely accepted notion of American exceptionalism. Currencies act as a delicate balance between a nation’s domestic economic fundamentals and foreign perceptions of its strength or weakness. This equilibrium is undergoing a shift, and there is a looming possibility of a crash in the value of the US dollar.

Due to a lack of domestic savings and a desire for investment and growth, the US has heavily relied on the dollar’s status as the world’s primary reserve currency, attracting substantial foreign savings to reconcile its economic needs. However, this advantage has come at a cost. To entice foreign capital, the US has consistently run a deficit in its current account, which encompasses trade and investment, since 1982.

No end to the Borrowing in sight

The continuous reliance on borrowing from abroad to sustain its economy raises concerns about the sustainability of the US dollar’s position. The accumulation of debt, coupled with uncertainties surrounding the nation’s economic trajectory and global perceptions, creates a precarious situation. If foreign investors lose confidence in the dollar, it could trigger a significant devaluation and crash.

The implications of a dollar crash would reverberate globally. As the world’s primary reserve currency, the US dollar is crucial in international trade, finance, and investments. A sharp decline in its value would impact the United States and economies worldwide, particularly those heavily reliant on dollar-denominated assets.

The changing dynamics necessitate a reevaluation of the global financial system. Countries may seek alternatives to the US dollar for their reserves, diversifying their holdings to mitigate potential risks. The rise of digital currencies, such as cryptocurrencies or central bank digital currencies (CBDCs), also adds complexity to the evolving landscape.

In conclusion, the era of the US dollar’s dominance as the world’s primary reserve currency is facing significant challenges. The US’s dependence on foreign savings and its mounting debts contribute to a vulnerable position. While the precise future remains uncertain, it is crucial for nations and stakeholders to anticipate potential shifts in the global financial order and adapt to a new economic landscape that may emerge. https://yhoo.it/3ffMkvN

Tactical Investor Response

Yawn, what a tedious argument, all talk and no action. One could have made the same claim decades ago, yet the dollar reigns supreme. There are so many flaws with this argument that this chap would be better qualified for the post of janitor than finance minister. Everything stated is true regarding the US abusing its power due to the dollar’s world reserve currency status. However, what currency is going to replace the dollar.

The Euro, or the Yuan, are equally shaky as the economies in both regions are far from healthy. Moreover, most of the World is not ready for a replacement, and the trillion-dollar challenge is that if these nations sell their dollars and move into another currency, the dollar’s value will plunge. In doing so, the reserves of all these countries will drop significantly. The collapse of the dollar without a valid successor will lead to a crisis that will make the 1929 crash look like a big party. Market update June 12, 2020

All these comrades fail to consider that the US is the leader in almost all the key industries. AI, robotics, Social Media, Weapons production, Semiconducting, etc. Having the biggest guns and all the top players in the AI sector, the US is positioned to dominate the future in an array of the most powerful industries. The US controls the media and AI sectors, and it has the world’s most powerful army. Let’s not forget that the US dollar is still the World’s reserve currency, so sadly, it’s game over before even a bullet is fired.

On a side note, let’s not forget what happens to those challenging the Fed. Roughly this is what occurred.

On June 4th, 1963, JFK ordered the printing of Treasury dollar bills instead of Federal Reserve notes (Executive Order 11110). He also ordered that once these had been printed, the Federal Reserve notes would be withdrawn and the Treasury bills put into circulation. A few months later, on November 22nd, 1963, he was killed in broad daylight.

Once again, indicating that a good Samaritan always ends up as a dead Samaritan. Trying to help the masses always leads to a negative outcome. A look back at history clearly illustrates that outcome is almost always negative when someone goes out of their way to help the blind and the deaf, AKA the crowd. How do you help the crowd when they don’t know the problem?

Dollar Crash, we don’t think so: what is the dollar’s fate?

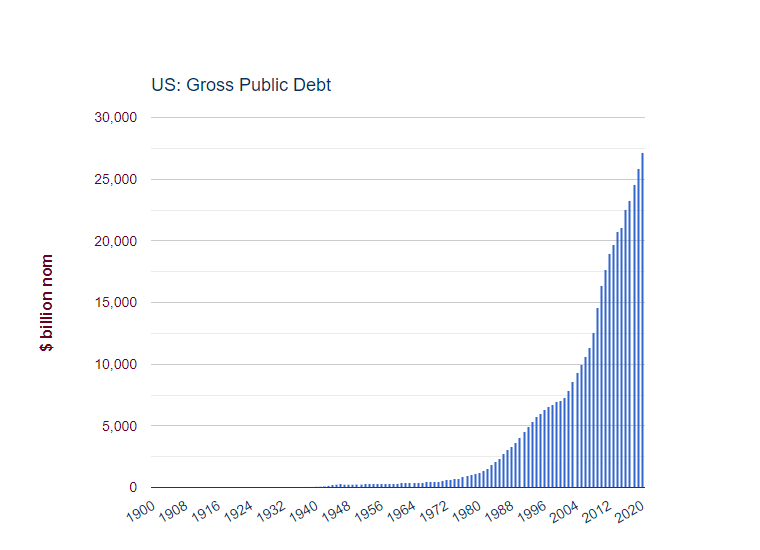

The dollar, by logic, should drop as the Fed is pumping out insane amounts of money, but let’s not forget that the Fed has forced almost every other nation to take the same route. Another argument that one could make is that the US debt is too high. Well, that argument could have been made decades ago. Once upon a time, the deficit was less than a billion dollars.

Around 1901 the total debt was 4.1 billion dollars; hence in comparison, today’s debt is already insane. It all comes down to perspective. We now live in an era where the masses are asleep; they are in a deep coma. Hence, as we have stated before, they are unlikely to notice anything until the debt touches the 100 trillion mark.

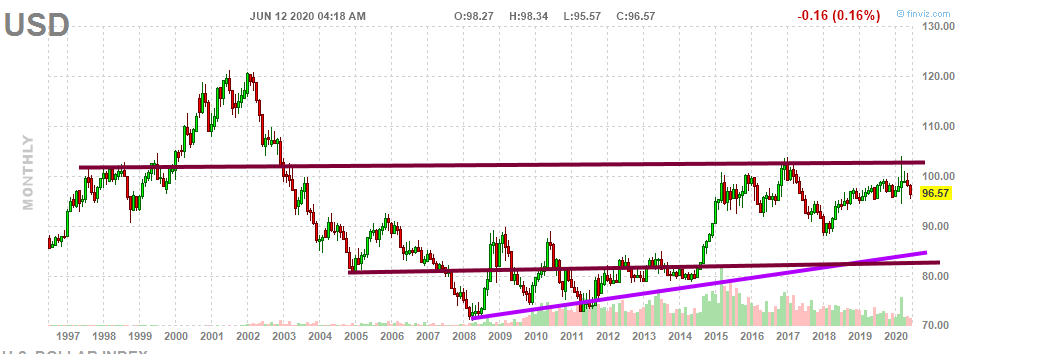

The US dollar is trading in a wide channel formation. Notice that when Greenspan increased the money supply, instead of the dollar losing its value, it surged, so there goes the hard money argument. The most illogical analysis would be to suggest that the dollar is building a base to rise to new highs: that would be utterly preposterous. And that is why this outlook is more likely to come to pass than the one that states a dollar crash is all but imminent.

In the intermediate time frames, the dollar is likely to continue consolidating. Currencies such as the Oz dollar and Loonie should outperform the USD. Still, if one factor in the gains one can lock in the US markets, the profits might not amount to anything unless you invest in equally strong stocks in Canada or Australia.

We expect the dollar to bottom out and trend higher after the current consolidation is over. A monthly close above 105.00 will pave the way for the dollar to test the 116.70 to 118 range with a strong possibility of trading to or past 120.00. Everyone forgets the impact AI and AI-related technologies will have on earnings going forward, and the US dominates this sector. Let’s not forget the Medical industry, especially the biotech sector, where AI will be used to create a host of new life-extension therapies. The dollar is toast story broadcasted for over five decades is getting old. Sadly the odds of the gold bugs having their day in the Sun are quite slim.

For them, a day in the Sun means Gold surging past 5K and at this point, we can’t see Gold trading past 2.5K, which is an extreme target. Precious metals, when examined from a long-term perspective, will continue to trend upwards. Hence allocating a portion of one’s cash to bullion is fine, but betting the house on this sector indicates that one might require shock therapy.

Other Articles of Interest

US bank stocks and Psychological Ploys in the stock market (Sep 23)

US jobless claims No Longer Connected To Stock Market (Sep23)

Easy Money Environment Fosters Price Manipulation (Sep23)

How to Become A Better Trader? (Sep23)

What is deflation? A Bigger Problem Than Inflation (Sep23)

Missed opportunity and the Mother of All Buy signals (Sep23)

Market Opportunity: Embrace crashes like a lost love (Sep23)

Market insights: Fight the Fed & End Up Dead (Sept 22)

Investment Pyramid: Valuable Concept Or ? (Sept 2)

Successful Investing; Never Follow the Crowd (Sep2)

Define Fiat Money: The USD Is A Great Example (Aug 13)

Deflation Economics: The Art of Twisting Data (Aug 12)

BTC vs Gold: The Clear Winner Is … (Aug 11)

Cash is king during Coronavirus Pandemic Based Sell off (Aug 10)

Russell 2000: Great Buy Signal In the Making (Aug 9)

Strong buy stocks: Use the sell-off to load up on Top Companies (Aug 8)

Best Chinese Stocks: Focus on America Instead of China (Aug 7)

Strange Weather Pattern’s Set to Plague the Planet (Aug 7)