A genius can’t be forced, nor can you make an ape an alderman. Thomas Somerville

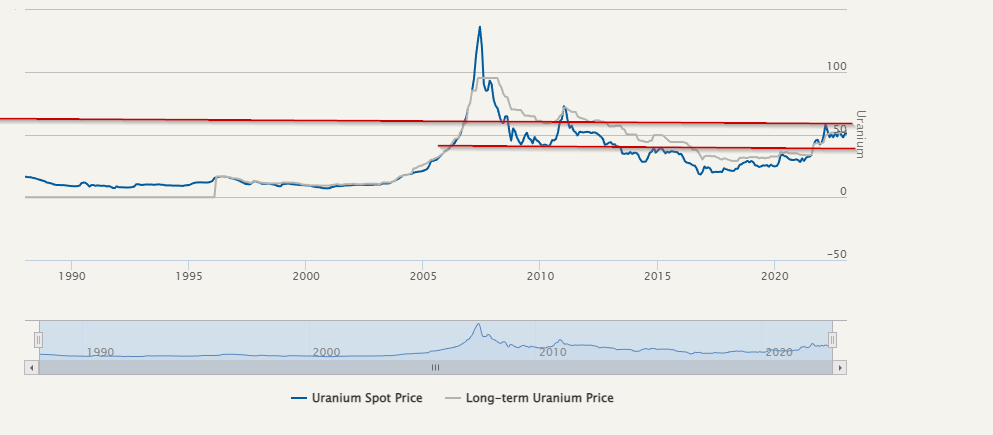

Uranium Price Market Dynamics: Shifting Landscapes and Rising Potential

Updated Jan 31, 2024

Uranium, the indispensable raw material for nuclear power, is experiencing a significant shift in its market dynamics. The uranium price and supply landscape is being reshaped by a combination of factors that point towards a potential surge in its value.

The uranium market has been stressed for many years due to underinvestment in new production capacity, mainly due to low uranium prices following the Fukushima accident. This underinvestment, coupled with the high geographical concentration of mines, has resulted in an inherent lag time for new primary supplies to enter the market. Recent geopolitical events and disruptions due to the COVID pandemic have further contributed to an uncertain supply landscape.

On the demand side, nuclear power is a key and growing component of the global clean-energy strategy. With global energy consumption forecasted to nearly double in the next 20 years due to rapid population and economic growth and a drive towards carbon-free power, nuclear sources are set to provide the required baseload power. This implies a significant increase in the demand for uranium.

Moreover, advancements in Small Modular Reactor (SMR) technology have expanded nuclear power’s potential uses beyond electricity generation to include water desalination, hydrogen production, and heat generation. This development is expected to further bolster the demand for uranium.

In conclusion, the uranium market is characterized by a sustained supply gap and a rapidly growing demand. This combination and the long-term positive market view for price appreciation suggest that uranium prices are headed higher. Even without considering the tremendous future demand outlook for nuclear power, the current market structure supports the anticipation of imminent higher prices to incentivize new supply and bridge the supply gap.

Uranium Price: Is Uranium Ready To Rally

The uranium market is extremely oversold, but the trend is neutral and presents a fantastic long-term opportunity. Despite being at dangerously low levels, uranium supplies have not increased; nuclear plants cannot function without them.

The US and EU rely heavily on Russian uranium imports for energy. Uranium has a strong support layer at the 36 to 39 range; if it holds above these levels every month, the outlook remains neutral with a bullish bias. A monthly close at or above 48 would pave the way for much higher prices, and trading above 56 for three weeks would virtually ensure a test of the 84 to 90 range.

Courtesy of cameco.com

Demand exceeds supply

In the past seven years, the uranium market has faced a supply deficit of approximately 50 million pounds, leaving mine production unable to meet demand, which sits at 180 million pounds. Despite this, the deficit has been filled annually with 50 million pounds from alternative sources. In addition, the Sprott Physical Uranium Trust and Yellow Cake have acquired a further 70 million pounds.

While 90% of uranium demand is met through primary production from mines, secondary supplies from recycling and stockpiles supplement the market. Unlike other mineral commodities, uranium has not followed the long-term trend of declining real prices due to cyclical fluctuations. Depressed prices in the 1980s and 1990s were followed by a recovery from 2003 to 2009 before weakening again.

Most uranium trade occurs through long-term contracts of 3-15 years, with prices tied to the spot price at the time of delivery. Despite the recent supply deficit caused by the Ukraine conflict, CEO Ian Purdy of Paladin Energy Ltd. expects a record year of term contracting. The company plans to restart the Langer Heinrich mine in Namibia by the first quarter of 2024. Industry veterans believe uranium prices still need to increase to spur significant mine restarts or capital-intensive builds.

EIA’s Bullish Outlook on Uranium Prices

In 2021, the owners and operators of U.S. civilian nuclear power reactors purchased 46.7 million pounds U3O8e of uranium from U.S. and foreign suppliers at a weighted average price of $33.91 per pound U3O8e, which is 4% lower than the 2020 total. Most of the uranium delivered in 2021 was of foreign origin, with Kazakhstan being the top source. COOs purchased three types of uranium from 32 sellers, with 19% of the uranium delivered being purchased under spot contracts and the remaining 81% being purchased under long-term contracts.

COOs signed 27 new purchase contracts with deliveries in 2021, and at the end of 2021, the maximum uranium deliveries for 2022 through 2031 under existing purchase contracts for COOs totalled 180 million pounds U3O8e. However, unfilled uranium market requirements for 2022 through 2031 totalled 182 million pounds U3O8e, suggesting that the market requirements for COOs will be high in the next ten years. In 2021, COOs delivered 34 million pounds U3O8e of natural uranium feed to U.S. and foreign enrichers, with U.S. enrichment suppliers receiving 43% of the feed.

COOs purchased 14 million separative work units (SWU) under enrichment services contracts from 11 sellers for $99.54 per SWU in 2021, with foreign-origin SWU accounting for 81% of the purchases, including 28% from Russia. EIA.Gov

Uranium Price Outlook

Uranium prices are a cause for concern as it costs around $67 per pound, but mining companies can barely sell it for $40 a pound. This could lead to more mines shutting down, and bringing an inactive mine back online takes time.

However, countries like Japan and Germany cannot give up nuclear energy as coal is the only other option, and they claim to be fighting global warming. The fundamental perspective is compelling for companies such as CCJ, BHP, DNN, UEC, UUU, etc.

Ability is of little account without opportunity.

Napoleon Bonaparte

Originally Published on August 29, 2016, it has been updated multiple times over the years, with the latest update completed in Jan 31, 2024

Other Articles of Interest

Panic Selling Mastery: Buying the Fear & Selling the Joy

Catch the Wave: Decoding Trading Cycles with the Esoteric Edge

Are Economic Indicators Finally In Sync With the Stock Market

Perception Manipulation: Mastering the Market with Strategic Insight

Market Uncertainty: A Challenge for Investors

Stock market basics for beginners: Adapt or Die

Richard Russell’s Dow Theory: Is It Still Valid?

DJU Index: To Buy or Flee? Unraveling the Market Mystery

Stock Market Psychology 101: Learn, Thrive, and Profit

In 1929 the Stock Market Crashed Because of Greed

Unshackling Minds: The Journey to Remove Brainwashing

Mob Psychology: Breaking Free to Secure Financial Success

Unveiling the VIX Fear Indicator: A Case Study in Market Volatility

Mind Games: Unmasking Brainwashing Techniques in Institutions & Media

The Gamblers Mindset: The Enigmatic Urge to Embrace Loss

What is Index Investing? -A Sophisticated Approach to Portfolio Management