Coronavirus: Is it time to panic?

The Coronavirus issue is going to be blown out of all proportions and it will be made to look like the mother of all pandemics. In fact, we are seeing individuals that are not qualified to make projections on the rate this virus will spread, stating that millions upon millions will be affected. This could be true, but most of the experts making these proclamations have no background in biology or virology; their main qualification is that they have a PhD in BS.

We feel this is a test by the big players that control most of the media outlets to see how far the truth can be stretched and so far it’s working marvellously. It is estimated that eight corporations control the bulk of the media in the US.

Now people are being checked with thermometers to see if their temp is above normal and an above-normal temperature has now become the litmus test for the Coronavirus; voodoo science at its best. This is one of the most retarded medical tests of all time, but no one seems to notice; a real-life depiction of “Pluto’s Allegory of the cave”.

Statistics from the CDC

CDC estimates that the burden of illness during the 2018–2019 season included an estimated 35.5 million people getting sick with influenza, 16.5 million people going to a health care provider for their illness, 490,600 hospitalizations, and 34,200 deaths from influenza (Table 1). The number of influenza-associated illnesses that occurred last season was similar to the estimated number of influenza-associated illnesses during the 2012–2013 influenza season when an estimated 34 million people had symptomatic influenza illness6. http://bit.ly/2UMJjMG

In comparison to the flu virus, the Coronavirus has caused a minimal amount of damage yet it has received 100X more coverage than the flu virus, which resulted in 34.200 deaths (and only US data is being used); the current death toll of the Coronavirus stands at 1113 (based on the latest data). It’s no laughing matter, but it still pales in comparison to those caused by the flu. Even more sinister is the Worldwide death toll from smoking:

Worldwide, tobacco use causes more than 7 million deaths per year.2 If the pattern of smoking all over the globe doesn’t change, more than 8 million people a year will die from diseases related to tobacco use by 2030. http://bit.ly/2wcEl1s

Many of the masks that individuals are wearing are not that useful against viruses and even the masks that might provide protection need to be worn correctly. http://bit.ly/2HklQKB. Other experts state that masks are useless as the virus is spread through the eyes. http://bit.ly/2SCjfkw

Coronavirus and the boy who cried wolf

We feel the technique being used here is the one that comes from the story “the boy who cried wolf” from Aesop’s Fables. The idea here we think is to push the crowd to the edge over a situation that while troublesome is not as bad as it is being made out to be. When the masses discover this, they won’t be too happy so the next time it happens, they won’t react in the same manner as the assumption will be “this is a big fuss over nothing” and that is precisely when things will run amok. For the record, we hope we are wrong.

At some point in time, something is bound to occur as humans are destroying this planet at an unprecedented rate. If any other creature took the same path, it would be labelled a virus, but “humans” are the so-called chosen ones so they can do whatever they see fit to do.

The equation must balance, and it always does; it just a question of time. However, time is also the only teacher that kills all its students without fail. This discussion is beyond the scope of this publication, so we will stop here.

The markets were extremely overbought

Hence we feel that everyone, including individuals we once thought based their ideas on logic, are pushing out information with one goal in mind; they want to create a stampede, and they succeeded as the masses always fall for the same ploy. The mass mindset refuses to look at the data in a cool manner after the seeds of doubt are implanted; it’s just a matter of time before the crowd cracks and gives in to far-fetched scenarios

There is always one backbreaking correction before the end of the bull market as this bull market is extremely unusual in terms of its duration, it will likely experience two such events before dying of old age. The current correction could fall under the backbreaking category. The coronavirus is just the trigger for such an event. If it were not the coronavirus, some other event would have been found to justify the correction.

What’s going to happen now is that the masses will panic and regret it when the markets recoup. However, they will then falsely assume that the next mega correction will follow the same path, and when its time to bail out, they will continue to buy, and we all know what happens after that. At a certain point, buy the dip does not work, and that point is reached when the masses turn euphoria.

Bull Markets and Corrections

Backbreaking corrections are always painful; hence the term backbreaking; however, unlike the old days, one can’t tell which correction will turn into the backbreaking event. Look at how many times the market conned the bears over the past ten years into shorting and 90% of those shorts turned to massive losses as the market reversed course just as fast.

Even if you have one big home run, it will not cover the 90% lose rate, and more importantly, we doubt that most of the bears had the staying power to hang in there until their bets paid off. The markets are controlled by machines now, and these machines are programmed to start selling when specific targets are hit, and one selloff selling triggers another set of selling until the cycle ends. The cycle will end, and the markets will rise for no bull market has ended on a note of uncertainty. However, keep in mind these machines are programmed by humans; hence, the only difference now is that instead of humans pressing the sell button, machines are doing it.

The media will push massive stories now talking about the upcoming bear market, ignore this noise and focus on one event; the masses were not euphoric when the markets started selling off.

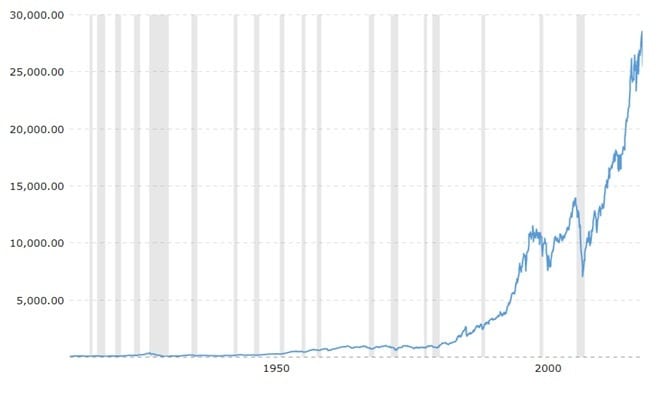

Look at this chart

source: Macrotrends

Now try to spot the great depression, Black Monday.etc. Every one of this end of the world events proved to be a buying opportunity, and that includes the notorious crash of 2008, which proved to the mother of all buying opportunities. If you look at all those “end of the world” events closely, they are blips in an otherwise massive upward trend.

There are always going to be days, weeks and sometimes months when the markets are down, but ultimately the market has trended in one direction and that is “up”. Massive fortunes were made by viewing these disaster type events through a bullish lens. We also have Mass Psychology and the Trend Indicator on our side, both of which indicate that this downtrend at most could turn out be the backbreaking correction we spoke of recently. Every Bull Market experiences at least one and 90% of the traders falsely assume that this event marks the beginning of an extended bearish trend.

The markets always return to the mean and hence the saying the greater the deviation from the mean the better the opportunity. History clearly illustrates that ultimately, the market trends in one direction only (up).

Don’t Fall For This Rubbish

The guys predicting the demise of the world will have to crawl under the rock they emerged from when this incident passes away as has been the case with all the previous end of the world scenarios. The current pullback/crash should be viewed through a bullish lens for the long term trader.

This could prove to be a fantastic buying opportunity for traders willing to take a risk. Don’t focus on the short term but on the long term, history indicates that the markets have an uncanny ability to trend upwards. Bears that have been beating the markets will crash have a dismal long term record. Markets trend upwards once the dust settles and this time will prove to be no different

Take a look at how many people die a day from other causes and the flu http://bit.ly/32wVaQA

Other stories of Interest

Volatility Index Readings & Stock Market Trends (Feb 22)

Brain Control: Absolute Control Via Pleasure (Jan 20)

Indoctrination: The Good, The Bad and the Ugly (Jan 15)

Dow Transports Validating Higher Stock Market Prices (Dec 30)

Global Trading Volume is Declining & It’s A Non Event (Dec 20)

Dogs Of The Dow Jones Industrial Average (Dec 10)

Trump Stock Market: Will Impeachment Hearings Derail This Bull (Nov 21)

Negative Thinking: How It Influences The Masses (Nov 15)

Leading Economic Indicators: Finally in Syn With The Stock Market? (Oct 28)

Dow Stock Market Outlook: Time To Dance or Collapse (Oct 25)