Copper Forecast 2024: Bullish Market Signal

Updated Feb 17, 2024

Introduction

Many pundits believe that higher copper prices are a sign of inflation. However, this metric is often misinterpreted. Higher copper prices are usually a positive indicator of an improving economy.

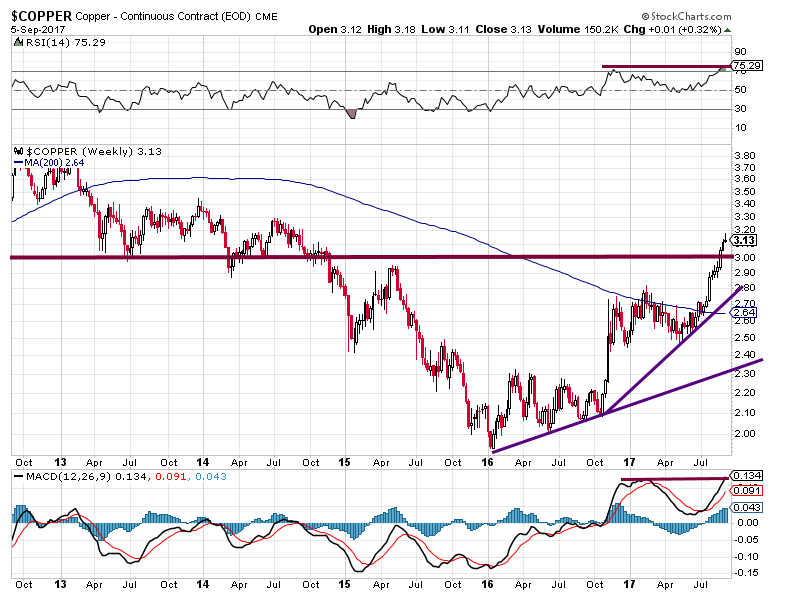

Copper traded above the initial resistance point of $3.300 and has managed to close above this level monthly. This bodes well for the long-term outlook of copper, which is now bullish. As long as it does not close below $3.00 on a monthly basis, this bullish trend is likely to continue.

Currently, copper faces resistance in the 3.90 to 4.05 range and is trading in the slightly overbought range on the weekly charts. Therefore, it is likely to consolidate before attempting to break past 4.05. zone. Overall, the outlook for copper is positive, and it will likely continue to serve as an indicator of economic growth.

Navigating Copper’s Prosperous Future: A Comprehensive Outlook with Price Forecast

Copper is at a pivotal juncture, grappling with the challenge of surpassing the 3.90 mark. An intriguing forecast unveils a potential dip to the 3.60 range before embarking on the formidable journey towards the 4.20 to 4.44 range. The intricate dance between fundamentals, technical analysis (TA), and psychological factors creates a harmonious trifecta, signalling a bullish trajectory in the long run.

Surprisingly, a lower valuation for copper might be a cause for celebration. As counterintuitive as it may seem, a downward shift would elevate the already bullish scenario into an exceptionally bullish one.

The surge in demand for copper emerges as a key player, driven by its integral role in electricity-related technologies and the ongoing energy transition. In 2022, global electric vehicle (EV) sales exceeded a remarkable 10 million, with notable brands like XPeng witnessing a doubling of their EV sales in June 2022. This upward trend sets the stage for a positive trajectory, projecting global EV sales, including battery-electric vehicles (BEVs) and plug-in hybrids (PHEVs), to reach 14.1 million units in 2023. This 34% growth in EV sales compared to 2022 anticipates a significant surge in copper demand.

Looking ahead, the continued expansion of the EV-charging ecosystem, coupled with the sustained growth in EV sales, suggests an enduring and potentially escalating demand for copper in the foreseeable future.

The narrative of 2024 is indeed marked by a significant copper deficit, a situation brought about by strained South American supply streams and escalating demand pressures. The market is grappling with a supply-demand imbalance as the increasing demand for copper in various technologies collides with an anticipated shortage in supply. This intricate interplay and psychological factors paint a compelling and bullish long-term narrative for the copper market.

Looking ahead to 2025, the supply-demand dynamics are expected to continue to evolve. The demand for copper is projected to remain robust, driven by its critical role in green technologies and electric vehicles. On the supply side, the constraints due to mining issues and geopolitical tensions could ease, but the overall supply will likely remain tight.

This ongoing imbalance between supply and demand is expected to continue to exert upward pressure on copper prices, making it a compelling opportunity for investors.

Copper Prognosis 2023: March 2023 Update

It’s essential to remain focused on the trend rather than being swayed by the noise, as the trend is our ally while everything else can be considered our foe. The recent copper price increase could be a positive sign that the economic recovery is gaining momentum, and we should continue to monitor this closely.

Let us not be distracted by the noise; instead, let us focus on the trend, for it is our friend, and everything else is our foe. The rising price of copper could be a positive sign that the economic turmoil is due to “manflation” and not real inflationary forces. However, as the dollar is expected to peak for several months in 2023, North America will finally understand the true meaning of the word inflation.

Inflationary environments tend to boost stocks, but the action can be volatile. The initial stage of the next breakout is likely to be volatile and rangebound, which will test the patience of most market participants. However, this range-bound action will create the foundation for a mother of all buying opportunities or a father of all buying opportunities.

Copper is a leading economic indicator, and the monthly charts suggest that the MACDs are about to experience a bullish crossover. The upward trend in copper is encouraging for the overall stock market. Astute investors may want to consider deploying capital in copper stocks such as FCX, SCCO, and CPPMF for speculative plays.

Now lets look at the situation through a historical lens

Since copper has now surpassed the $3.00 threshold on a monthly basis, the Federal Reserve deserves recognition for its role in reinforcing the perception of an authentic economic recovery. Copper is regarded as a significant indicator of economic growth, so this achievement may persuade sceptics to accept the existence of this recovery. Thus, the Fed’s success in pulling off this feat may lead to an increased acceptance of the economic recovery.

Sentiment Suggests Market Correction, Not Crash

When we consider the information provided and the activity in the copper markets, we can infer that the stock market is more likely to experience a correction than a complete crash. This is due to the historical correlation between higher copper and stock market prices, suggesting that the long-term trend is stable.

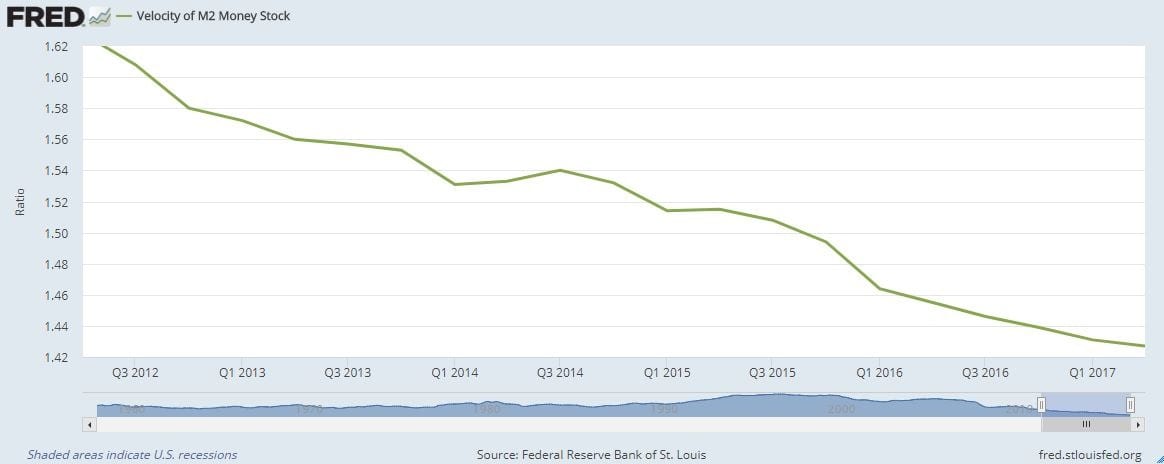

Furthermore, the copper forecast chart below refutes the argument that higher copper prices indicate inflation. If inflation were a concern, the velocity of M2 money stock would be on the rise, which is not currently the case. As a result, attention should be focused on the possibility of higher stock market prices as the copper markets continue to signal the persistence of the long-term trend.

It also clearly indicates that the next crash will break a lot of backs, but it will pave the way for the mother of all buying opportunities. The preferred word at TI is Back Breaking correction. Tactical Investor August 19, 2020.

The above has since come to pass.

Concluding thoughts

Macroeconomic factors, including rising inflation, increasing energy costs, and climbing interest rates, impacted copper in 2022, putting pressure on prices. Copper prices hit an all-time high in 2022, surpassing the US$10,000 per metric ton mark for the first time, but were unable to sustain these gains and were volatile for most of the year.

However, the world is currently facing a global copper shortage, fueled by increasingly challenging supply streams in South America and higher demand pressures. The deficit will inundate global markets throughout 2023, and one analyst predicts the shortfall could extend throughout the rest of the decade.

Copper is a leading pulse check for economic health due to its incorporation in various uses, such as electrical equipment and industrial machinery. A copper squeeze could indicate that global inflationary pressures will worsen and compel central banks to maintain their hawkish stance for longer. Copper’s price collapsed alongside major stock indices in 2022 as international monetary policy tightened. A strong correlation between the S&P 500 and copper exists because copper acts as a bellwether for economic health.

Although the current copper price trend is volatile, copper stocks will likely rise. In light of the global shortage, investors should focus on copper stocks such as FCX and SCCO. The increasing demand for copper and supply shortages are expected to drive the stocks of companies that produce the base metal as copper becomes an increasingly sought-after commodity.

FAQ – Copper Forecast 2024

Q: What is the current outlook for copper prices?

A: The outlook for copper is positive, with higher prices often indicating an improving economy. Copper recently surpassed a key resistance point of $3.00 and has managed to close above this level on a monthly basis, suggesting a long-term bullish trend.

Q: What is the correlation between copper prices and the stock market?

A: A historical correlation between higher copper prices and stock market prices suggests that the long-term trend is stable.

Q: Does higher copper prices indicate inflation?

A: Higher copper prices are usually a positive indicator of an improving economy and not necessarily inflation. The velocity of M2 money stock would rise if inflation were a concern, which is not currently the case.

Q: What is the copper forecast for 2024?

A: The world is facing a global copper shortage, and the deficit is expected to inundate global markets throughout 2024. one analyst predicts the shortfall could extend throughout the rest of the decade. The monthly charts suggest that the MACDs are about to experience a bullish crossover, which is encouraging for the overall stock market.

Q: Which copper stocks should investors consider?

A: Astute investors may want to consider deploying capital in copper stocks such as FCX, SCCO, and CPPMF for speculative plays. In light of the global shortage, investors should focus on copper stocks such as FCX and SCCO, as the increasing demand for copper and supply shortages are expected to drive the stocks of companies that produce the base metal.

Other Articles of Interest

Fed Head Will Shock Markets; Expect Monstrous rally

In The Midst of Chaos There is Opportunity

Central Bankers World Wide embrace race to the Bottom

Currency Wars & Negative Rates Equate To Next Global Crisis

Control Group Psychology: Stock Crash of 2016 Equates To Opportunity

Erratic Behaviour Meaning:Dow likely to test 2015 lows

Little Bird’s Trading Plan To Wealth

The Smart Investor IS buying While The Dumb Money selling

Working Poor: Masses struggle while Fed Bails Out Banksters