Deciphering the Value of Technical Analysis Indicators: Useful or Useless?

Updated May 16, 2024

Technical analysis indicators are not foolproof and can lose effectiveness as market conditions change. It’s essential to constantly monitor and evaluate their efficacy to ensure they still provide accurate signals. When an indicator is no longer functional, adapting and finding new tools more relevant to the current market environment is essential.

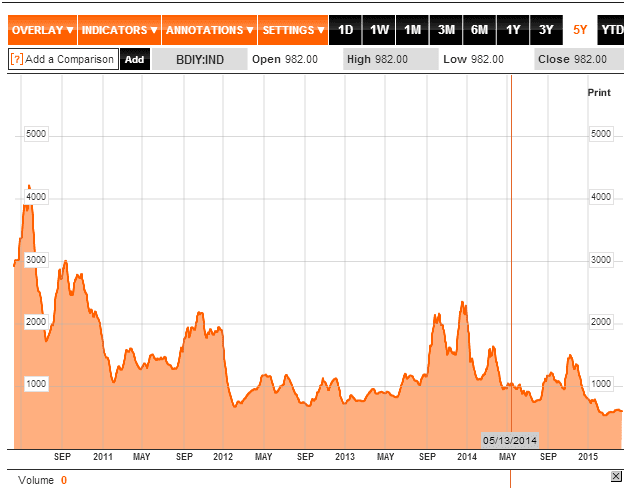

Let’s delve into the historical perspective of the Baltic Dry Index (BDI) from 2011 to 2015 and then examine its current state. The chart below shows that the BDI experienced a consistent downtrend during that period, signalling underlying issues. However, despite the BDI’s inability to surpass even 50% of its peak in May 2008, around 11,800 points, the stock market continued its upward trajectory. This discrepancy made some dismiss the BDI as ineffective or irrelevant, as it failed to provide accurate results.

To some extent, this claim holds. However, a deeper analysis reveals that the reason for the BDI’s failure lay in the Federal Reserve’s manipulation of the markets through the infusion of cheap money. By flooding the markets with virtually unlimited funds, the Fed could circumvent the BDI’s influence. Consequently, any indicator can be rendered useless in such substantial hot money inflows. It is worth noting that the Fed possesses access to an unlimited supply of funds.

Navigating the Baltic Dry Index (BDI)

The Baltic Dry Index (BDI), a key indicator of global economic health, currently trades at a staggering 90% below its peak in 2008. This significant decline suggests clear signs of financial distress, presenting challenges for the Federal Reserve to inject liquidity into the markets while combating inflation. The BDI’s message points to a weak global economy, prompting the need for the Fed to intervene by flooding the markets with money.

However, a contrarian perspective, incorporating the principles of Mass Psychology, reveals a potentially positive outlook. Mass Psychology suggests that one should consider taking actions opposite to the majority, especially when the prevailing sentiment aligns with one’s action. In this case, the BDI’s dire outlook aligns with Mass Psychology, indicating a potential contrarian opportunity.

It is important to note that the Fed’s policies since 2015 have limited the BDI’s efficacy as an indicator. Nevertheless, the data can still be utilized contrarily to strategize accordingly. This implies that any market sell-off should be embraced rather than feared, as it may present unique investment prospects.

As of June 2024, the BDI is starting to show signs of life. If it closes at or above 3,400, it will pave the way for a test of the 4,800 to 5,100 range. This development bodes well for dry bulk shipping stocks like CMRE, poised to continue their upward trajectory. However, investors should exercise caution and wait for CMRE to release some steam before committing new capital, as it currently trades in the overbought range on the weekly charts.

Furthermore, the BDI’s potential resurgence indicates that after a period of market consolidation, beaten-down sectors with strong long-term prospects, such as fertilizers and food stocks, are likely to soar. This presents an opportunity for astute investors to capitalize on the market’s cyclical nature and position themselves for substantial gains.

Incorporating the wisdom of renowned investors and philosophers can provide valuable insights into navigating the complexities of the BDI and market dynamics. Warren Buffett, the legendary investor, emphasizes the importance of being greedy when others are fearful. In the context of the BDI, this suggests that contrarian thinking and a long-term perspective can uncover hidden opportunities amidst market pessimism.

Benjamin Graham, the father of value investing, stresses the significance of thorough analysis and a margin of safety. By conducting rigorous research and identifying undervalued stocks in sectors poised for growth, investors can mitigate risk and position themselves for potential upside.

Moreover, the ancient Stoic philosopher Seneca reminds us to maintain a calm and rational mindset amidst market turbulence. By avoiding the pitfalls of emotional decision-making and focusing on long-term objectives, investors can navigate the challenges presented by the BDI and capitalize on emerging opportunities.

Critical Crossroads for the Baltic Index: A Defining Moment

One cannot fret over this; one has to adapt, bringing one of the essential sayings of the Tactical Investor to mind ” adapt or die”.

The Baltic Dry Index (BDI) was a reliable indicator of market direction. It would often top out or bottom out before the markets did, making it one of the select few technical analysis indicators consistently producing results.

However, this is no longer the case. The BDI, which worked well over the decades, is now useless and probably not good enough to use as toilet paper. It continues to trade at new lows, and the market continues to soar to new highs, proving market manipulation. Rather than fretting over this, it is crucial to adapt. At Tactical Investor, the saying “adapt or die” is essential.

A Fascinating Read: Does Technical Analysis Work? Unveiling The Truth

Two Economic Indicators: Comeback Or Burial Time?

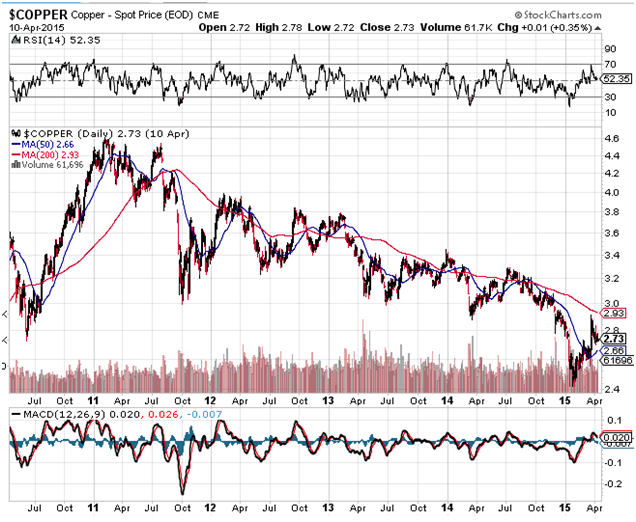

Copper has historically been a reliable indicator of the economy’s direction, but it is no longer as valuable due to the changing global economic landscape. The old rules and laws no longer apply as we enter a new phase of the worldwide currency wars. The market is in a state of maximum overdrive, and traders must adapt or die. The markets and copper prices no longer move in lockstep, and traders must be careful not to be misled by traditional indicators.

The current situation requires traders to be open-minded and embrace the new paradigm, even if it is difficult to understand. Market movements are not random but the result of calculated planning by those in power. It is essential to pay attention to others’ perceptions and plan accordingly to come out on top in any given situation.

Technical Analysis Indicators: Is it Time for Copper to Make a Comeback?

In 2022, copper prices hit record highs, indicating that the global economy was not dire. Instead, it resulted from poor political decisions by world leaders, with the United States policies being a prime example. Despite a brief setback, copper remained steady and surged beyond the 4.50 mark, revealing that issues with inflation and supply were merely symptoms of bad policies.

As a result, copper is gaining momentum and is set to trade past 4.50; this also means that the market will be range-bound for years, posing a challenge for long-term investors who focus on indices. However, this presents an excellent opportunity for traders who can use market psychology and technical analysis to their advantage. Tactical Investor May 2023

It traded up to and beyond $4.50, but it couldn’t maintain the gains. The next challenge is to achieve a monthly closing price at or above $4.60, which would set the stage for testing the $5.60 to $6.90 range.

Conclusion

In conclusion, while the BDI’s current state may appear grim, a contrarian approach rooted in Mass Psychology and the wisdom of renowned thinkers offers a path forward. By embracing market sell-offs, identifying undervalued sectors, and maintaining a long-term perspective, investors can benefit from the potential resurgence of the BDI and its implications for various industries. As the global economy navigates uncharted waters, a disciplined and contrarian mindset, combined with thorough analysis and a focus on long-term value, can be the key to unlocking substantial investment returns.

Articles That Nourish the Intellect and the Soul

Unraveling Crowd Behavior: Deciphering Mass Psychology

Dogs of the Dow 2024: Barking or Ready to Bite?

Zero to Hero: How to Build Wealth from Nothing

The Power of Negative Thinking: How It Robs and Bleeds You

Contrarian Outlook: A Pathway to Breakthrough or Breakdown

Mass Psychology Unveiled: The Hidden Keys to Financial Triumph

Overconfidence Bias: The Investor’s Blind Spot

Panic Selling is also known as capitulation in the markets

Examples of Groupthink: Instances of Collective Decision-Making

Herd Behavior: The Perilous Path to Market Missteps

Disciplined Growth Investors: Path to Maximum Gains

Stock Market Crash Forecast: Ignore the Hype, Focus on the Trend

Mob Mentality Psychology: Outsmart the Masses and Win Big

When is the Next Stock Market Crash Prediction: Does it Matter?

2020 COVID Stock Market Crash: Panic Meets Opportunity

Pack mentality- Never be part of the pack if you want to win

wo Key Indicators No Longer Work

Two Key IndiExtracted in part from April 15, 2015, market Updatecators No Longer Work