Bull & Bear Markets: Unraveling the Power of Perception

Updated March 2023

This article delves into the historical context of profiting from bear markets and stock market crashes by considering them potential buying opportunities. We will explore the years 2018, 2019, and 2020, focusing on the COVID crash of 2020. Throughout each instance, especially during the tumultuous events of 2020, you will witness how adopting a different perspective could have paved the way for immense fortunes.

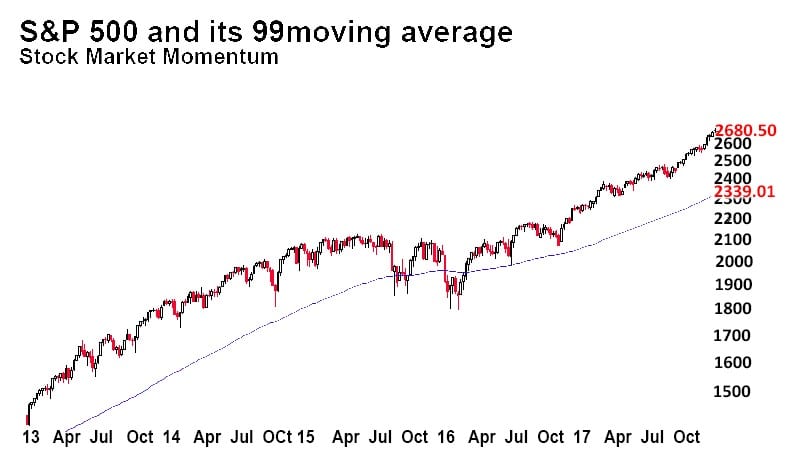

Before we get into any commentary, look at the images and charts below. Remember that the best time to buy from a long-term perspective is when blood flows freely in the streets and is flowing now. It is important to remember that we have consistently advocated for crashes to be seen as lucrative buying opportunities in the long run. One cannot help but reach the same conclusion by examining a long-term chart. The strategy employed by major players is to divert individuals’ attention towards terms like a bear market, crash, and doomsday scenarios. In doing so, the crowd fixates on individual trees and fails to see the entire forest.

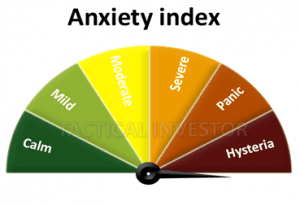

The anxiety gauge has redlined, and the indicator is trending in unchartered territory, setting an all-time high. Bearish sentiment is approaching the seven-year high level. Fear and hysteria are trading at off-the-chart levels. Mass psychology states that stock markets never crash when the masses are in a state of panic. Bull markets emerge when the masses panic, so forget what happens if the stock market crashes scenario? If it does crash, run out and buy all the top companies; from a long-term perspective, stock market crashes are fantastic buying opportunities.

Source: emarketer.com

If things were declining, retail sales would not be improving. Holiday season retail sales are set to exceed the $ one trillion mark for the first time.

Navigating Market Noise for Profitable Investments

The correction of 2008 was warranted as the masses were euphoric regarding the housing sector; it took a turn for the worse when the Lehman Brothers were purposely thrown to the curb by the Fed. Regardless of this development, you can see that the markets were trading in highly overbought ranges, and the masses were euphoric.

The exact sequence of events occurred during the dot.com bubble and the not-too-late Bitcoin bubble. If there were charts, we could demonstrate the same setup going back to the tulip bubble. The masses are not euphoric, and the markets are not overbought; hence the current pullback most likely falls into the “opportunity” category. Forget about the Bull & Bear Market theory; instead, focus on the trend as it is your friend. Everything else falls under the category of noise.

Aug 2019 Commentary update

When the SPX (Standard & Poor’s 500 Index) is significantly above its 99 EMA (exponential moving average), it typically undergoes a corrective pullback or enters a consolidation phase. As a result, our indicators indicate oversold conditions, enabling us to assume higher levels of risk. Our risk-to-reward models adapt entry points based on the current market conditions.

These indicators fall into the category of secondary indicators, and while they help identify minor irregularities, their ability to determine the overall trend is limited. Many of these secondary indicators, including the one mentioned, indicate that the markets are trading in highly overbought territories. However, it is essential to note that being in an overbought range does not necessarily imply an immediate pullback in the markets. When we consider the monthly charts, the markets are still trading within oversold levels, which means any significant corrections should be interpreted from a bullish perspective.

Unveiling Bull & Bear Markets: March 2020 Update

During the ongoing coronavirus pandemic, when the market conditions are highly unfavourable, and panic is prevalent, investing cautiously in stocks with a long-term perspective may be prudent. Rather than deploying all your funds at once, it is advisable to invest in smaller increments. This approach allows for a reduction in the average entry price if the stock experiences further declines.

At the Tactical Investor, our investment strategy does not revolve around short-term gains. Our minimum holding period is typically several months, even in normal market conditions. However, given the current circumstances, our time frames extend further due to the potential for significant profits. In the short term, the market may appear tumultuous, but it is precisely in such an environment that exceptional opportunities arise, often heralding the start of the next bull market.

While it may be tempting to buy stocks when everything seems favourable, the challenge is that most assets are priced at a premium during such periods. During times of pessimism and gloom, the most attractive bargains can be found, offering the potential for substantial returns.

Originally published on Jan 16, 2019, and updated in March 2023, this article offers enhanced insights and analysis.