Boom and Bust Cycles: The Dance of Fiat Money and Economic Fluctuations

Updated Nov 30, 2023

George Washington’s wisdom rings true across the ages: “Paper money has had the effect in your state that it will ever have – to ruin commerce, oppress the honest, and open the door to every species of fraud and injustice.” These words, spoken centuries ago, mirror the monetary systems we have today.

Fiat money, the central banker’s weapon of choice, is the cornerstone of this intricate dance. It’s a tool they wield with ruthless precision, capable of inflicting misery and death on the unsuspecting masses. Since its inception, fiat money has been used to feed off the pain of humanity. The central banks orchestrate a symphony of boom and bust cycles with the cruel efficiency of a maestro.

The fiat-driven boom cycle unfolds with central banks flooding the markets with abundant money. This monetary deluge ignites rapid economic growth, enticing both individuals and corporations into a fevered dance of borrowing, investment, and spending. In this phase, the allure of financial gain is irresistible, and the masses are lured into the waltz.

But as history has shown time and again, this boom is merely the prelude to the inevitable bust. It’s a cycle as old as time itself. Central banks, like the Fed, flood the markets with more money, and the dance begins anew, with the masses once again lured into the whirlwind, only to face the harsh consequences when the music stops.

Life revolves around dollars, with the central bankers reaping the rewards while the masses suffer the consequences. Money trumps everything, and life becomes just another statistic on a piece of paper. George Washington’s warning echoes ominously in this context: “Paper money will invariably operate in the body of politics as spirit liquors on the human body. They prey on the vitals and ultimately destroy them.”

Boom and bust cycles, these recurring patterns of economic expansion and contraction, are the result of a complex interplay of factors. These cycles are characterized by periods of rapid economic growth (booms) followed by economic declines (busts). The causes of these cycles are multifaceted and can be influenced by monetary and fiscal policies, market conditions, and human behaviour.

Central banks, with the power to create money out of thin air, are often at the centre of this economic symphony. During the boom phase, they may lower interest rates and engage in expansionary monetary policies to fuel economic growth. However, if not carefully managed, these policies can lead to excessive risk-taking, asset bubbles, and unsustainable debt levels.

The climax of the boom phase often leads to the bust. Asset bubbles burst, causing sharp declines in asset prices and financial instability. Economic contractions, rising unemployment, and waning confidence follow suit.

Critics argue that the cycle perpetuates itself as central banks respond to the bust by implementing expansionary policies once again, initiating a new boom cycle. This cycle continues, with the general population bearing the consequences while central banks and financial institutions may benefit.

The role of fiat money in these cycles remains a subject of ongoing debate among economists and policymakers. They strive to find ways to mitigate the negative impacts of boom and bust cycles and create a more stable and sustainable economic environment.

“But if in the pursuit of the means we should, unfortunately, stumble again on unfunded paper money or any similar species of fraud, we shall assuredly give a fatal stab to our national credit in its infancy. Paper money will invariably operate in the body of politics as spirit liquors on the human body. They prey on the vitals and ultimately destroy them. Paper money has had the effect in your state that it will ever have, to ruin commerce, oppress the honest, and open the door to every species of fraud and injustice.” — George Washington in a letter to Jabez Bowen, Rhode Island, Jan. 9, 1787

Thomas Jefferson On Boom and Bust Cycles

“I believe that banking institutions are more dangerous to our liberties than standing armies. Already they have raised up a monied aristocracy that has set the government at defiance. The issuing power (of money) should be removed from the banks and restored to the people to whom it belongs properly.” Thomas Jefferson, U.S. President

Central bankers have repeatedly shown that they are willing to sacrifice lives and inflict untold suffering on millions of people, all in the name of profit. Their actions are devoid of humanity, driven only by the lust for wealth and power.

People are treated like mere commodities, to be bought and sold at the whims of these bankers, who see them only as numbers on a ledger. The callous and calculated approach to monetary policy has led to countless deaths and ruined lives, leaving a trail of destruction in its wake.

The desire for profit has become so great that the very foundations of society are being eroded, and the future looks increasingly bleak. It is time to wake up and realize that these bankers are not the benevolent custodians of the economy they claim to be. Instead, they are the architects of a cruel and heartless system that benefits only a few. The time has come to demand change and hold these bankers accountable for their actions, lest we fall victim to their insatiable greed.

Navigating Boom and Bust Cycles: The Financial Rollercoaster

The Boom Phase: Riding the Waves of Prosperity

To set the stage for a boom, the financial architects flood the markets with an abundance of money, and when it’s time to usher in the bust, they tighten the spigots, sending the economy into a tailspin. This dynamic was the driving force behind the dot.com bubble and its subsequent burst, as it played a significant role in the housing bubble’s ascent and descent. And guess what? We’re currently witnessing history repeating itself once more. They might tweak the details, change the music, or alter the dance, but the core mechanics remain eerily consistent.

In this particular scenario, what’s striking is the persistence of historically low-interest rates. It’s as if they’ve hit the rewind button on the same old tune. Yet, there’s a twist in this saga. The unthinkable has become a reality; they’ve embraced negative rates, a bold move that’s both intriguing and unsettling.

The first act of this cycle unfolds with corporations leveraging massive sums of borrowed money to repurchase their shares, artificially inflating their earnings per share (EPS). It’s akin to a financial magic trick – making it seem like all is well when, in reality, nothing substantial is improving. It’s a smoke-and-mirrors show where the number of outstanding shares dwindles, creating a deceptive illusion of profit growth that wouldn’t exist without these share buyback programs. The yield on many fronts would have undoubtedly plummeted without this clever financial manoeuvre.

So, as we navigate this rollercoaster ride through the boom and bust cycles, it’s crucial to recognize the recurring patterns, the music changes, and the dance variations. The key to success in this financial whirlwind is not just to go with the flow but to understand the underlying mechanics that drive these turbulent phases.

Lower Interest Rates Fuel boom and Bust Cycles

The Corporate world is drooling at the prospect of Negative rates, like a crack addict given a new dose of super crack. Unfortunately, the consequences of these actions will be dire for the masses. History shows that the con never changes; only the outfits change, and the ones left holding the empty bag are always the sheep (otherwise known as the masses).

Lower interest rates have long been hailed as a tool to stimulate economic growth and investment. However, recent developments have raised concerns about the potential consequences of this approach. As the corporate world eagerly anticipates the possibility of negative interest rates, it is essential to consider the broader implications for the masses.

Historical patterns reveal a troubling truth: the tactics may change, but the outcome remains. Whether it is the dot-com bubble, the housing market crash, or any other boom and bust cycle, the ultimate losers are often ordinary people who find themselves left holding an empty bag. The allure of seemingly free markets is shattered when one realizes the extent of control and manipulation.

While the Federal Reserve initially projected steadfastness in its commitment to lower interest rates, recent developments indicate a shift in approach. The Fed is now reconsidering its stance, acknowledging the potential risks associated with prolonged low rates. This admission reflects a growing awareness of the delicate balance between short-term economic stimulation and long-term stability.

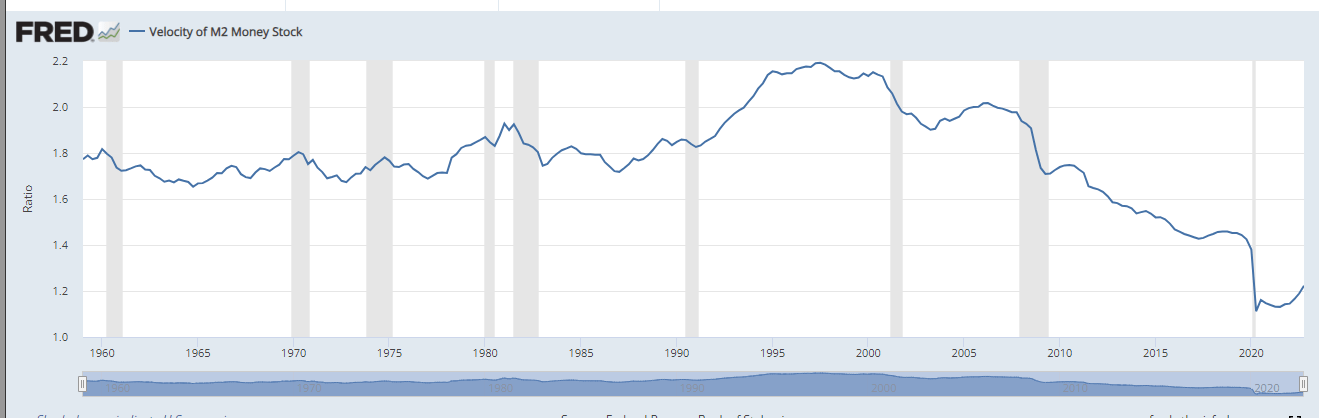

The chart below serves as a stark reminder that the current state of the economy is far from robust. It appears alarmingly frail, heavily reliant on substantial injections of hot money to sustain its facade of recovery. The consequences of withdrawing this artificial support would be severe, potentially resulting in the collapse of the illusory economic progress made thus far.

As the debate surrounding interest rates intensifies, it becomes crucial to weigh the benefits against the potential drawbacks. While low rates may fuel immediate growth, they also contribute to the creation of speculative bubbles and the misallocation of resources. The challenge lies in finding a delicate equilibrium that promotes sustainable economic development without succumbing to the allure of short-term gains.

Ultimately, the consequences of lower interest rates extend far beyond the corporate realm. The decisions made by central banks have profound implications for individuals and communities, shaping the economic landscape in which they operate. Policymakers must consider the long-term consequences of their actions, ensuring that the interests of the masses are not sacrificed in the pursuit of temporary prosperity. A measured and balanced approach is necessary to navigate the complexities of the global economy and mitigate the potential risks of boom and bust cycles fueled by interest rate policies.

Commodities are perking up.

In contrast to the uncertain outlook for equities, commodities are showing signs of renewed strength, positioning themselves for potentially lucrative long-term bull markets. This shift in sentiment towards entities underscores the allure of alternative investment options beyond traditional stocks and bonds.

The historical price chart of commodities reveals a notable peak in 2000, followed by a prolonged downtrend. However, between 2009 and 2019, there was a temporary respite as prices experienced a modest recovery. Unfortunately, this recovery proved short-lived as the chart formed a bearish lower high, signalling a subsequent deterioration in commodity prices.

Despite the increase in the money supply, there are concerns that the benefits are not trickling down to the masses. This approach, employed by the Federal Reserve, aims to mitigate the effects of inflation and appears to be effective in the current context. However, to create a significant bubble, it becomes imperative for the Fed to channel this money into the hands of the broader population.

One area where the Fed’s strategy is being tested is the auto market, with indications of a subprime bubble on the horizon. This potential bubble, if left unchecked, could have far-reaching consequences reminiscent of the housing market crash that triggered the global financial crisis in 2008. It serves as a reminder of the delicate balance policymakers must strike to avoid excessive risk-taking and the subsequent bursting of speculative bubbles.

As commodities show signs of perking up, investors must carefully evaluate the potential for long-term growth and assess the associated risks. While these markets offer enticing opportunities, it is crucial to exercise caution and conduct thorough due diligence to avoid falling victim to volatile price swings and speculative excesses.

The current landscape presents a dynamic environment where decisions made by central banks and market participants will shape the trajectory of commodities and the broader investment landscape. A comprehensive understanding of the underlying factors driving commodity prices and a prudent approach to risk management will be instrumental in navigating this evolving market.

The next forage will be to find a way to put this money into the hands of the masses for various general expenditures, like opening a new business or, better yet, creating the next housing bubble. The demand for housing is rising, but most people cannot qualify for a mortgage. Imagine what would happen if they suddenly made it easier to get a loan. The slogan would be “Buy now and cut your rent”; for a time, this slogan would be accurate as it’s far costlier to rent than owning a home today in most parts of America.

Economic recovery is illusory.

The current economic recovery is increasingly being called into question, and the persistent low-interest-rate policy maintained by the Federal Reserve only adds to the sense of an illusory rebound. If the recovery were truly grounded in organic growth and stability, interest rates would be allowed to rise naturally, without the need for continuous intervention to prop up the stock market. However, the reality is that the Fed’s involvement has become a necessary crutch to sustain the illusion of a thriving economy.

Without direct Fed intervention, the corporate world has stepped in with a controversial practice: illegal stock buybacks. Rather than focusing on fundamental improvements to their operations and profitability, companies have resorted to artificially boosting their earnings per share by using their profits to repurchase their own shares. This scheme is an enticing one, requiring little effort while resulting in significant financial gains for those involved.

With interest rates remaining at historically low levels, the incentive for companies to borrow substantial sums of money to continue these stock buyback practices has only intensified. The allure of quick financial gains and the pressure to appease shareholders can push companies towards engaging in these potentially unsustainable activities. The consequences of such behaviour may be far-reaching, leading to an alarming surge in stock buybacks that may eventually be regarded as irrational and unsustainable.

The prevalence of these practices raises concerns about the integrity and stability of the financial system. It highlights the need for regulatory scrutiny and reevaluating corporate governance practices to ensure that companies prioritize long-term sustainable growth over short-term financial engineering.

As investors and market participants, it is crucial to maintain a critical perspective and exercise caution when evaluating the true health of the economy. Questioning the authenticity of the recovery and being mindful of potentially unsustainable practices like illegal stock buybacks can help navigate the complexities of the market and avoid being caught off guard by unexpected downturns or market disruptions.

Gold: A Valuable Hedge in an Uncertain World

Gold has long been regarded as a valuable hedge in times of uncertainty and global currency debasement. It serves as a reliable store of value and can act as a safeguard against the erosion of purchasing power. While maintaining a core position in gold is prudent, relying solely on this precious metal may not be the optimal approach. Timing the market is crucial for success, and many individuals lack the staying power to bet against the actions of central banks, often resulting in significant losses.

The importance of diversification cannot be overstated, especially in a world characterized by boom and bust cycles. While investing in gold may seem like an obvious choice given the prevailing economic conditions, it is essential to avoid the temptation of concentrating all investments in a single asset class. History has shown that even those who accurately predicted market outcomes have faltered due to a lack of solvency and the inability to weather prolonged downturns. The tombstones of Wall Street serve as a sombre reminder of the perils of overconfidence and inadequate diversification.

As the currency war rages on, the consequences of central bank actions loom ominously over the masses. The Federal Reserve itself has been forced to backtrack from its previous firm stance, acknowledging the challenges and uncertainties that lie ahead. The enthusiasm with which the corporate world embraces negative interest rates further contributes to the illusion of an economic recovery, albeit one that fails to reach the broader population. This strategy, aimed at mitigating the effects of inflation, has resulted in a disparity between the increased money supply and its actual impact on the lives of ordinary individuals.

Furthermore, stock buybacks continue to artificially boost earnings per share, offering corporations a seemingly perfect scam. While the surge in stock buybacks may appear irrational and unsustainable in the long run, investors must maintain a diversified portfolio and avoid becoming overly reliant on any single investment strategy. By spreading their investments across different asset classes, investors can mitigate risks and navigate the unpredictable nature of financial markets.

While gold is a valuable hedge in uncertain times, it is essential to exercise caution and diversify investments to protect against the volatility of boom and bust cycles. The world of finance is rife with examples of the dangers of overreliance and the need for a balanced approach. By maintaining a diversified portfolio and avoiding the temptation to concentrate investments in a single asset, investors can position themselves more effectively to navigate the complexities of the global economy and strive for long-term financial success.

Hedging Against Boom and Bust Cycles with the Timeless Value of Gold

The Federal Reserve has a history of fostering boom and bust cycles by raising or lowering interest rates, and recent years are no exception. The Fed’s easy monetary policies since 2008, including quantitative easing and near-zero interest rates, have created a hot money environment, driving stocks to new highs and causing corporations to engage in risky behaviour, such as the illegal use of stock buybacks.

The Fed’s policies have also led to a currency war, with central bankers worldwide trying to destroy their currencies. The consequences of these actions could be dire for the masses, with commodities gearing up for long-term bull markets and the corporate world embracing negative rates with enthusiasm. The Fed is already backtracking from its firm stance last year, indicating that the economic outlook is weaker than expected, and they will have no option but to join the rat pack.

While low-interest rates foster speculation and a bubble economy, it is not sustainable in the long run. The monetary base chart shows that the economy is far from healthy and is being forcefully kept alive through massive injections of hot money. The illusory economic recovery will crumble without hot money. The corporate world’s focus on stock buybacks instead of improving the bottom line is a perfect scam, and we can expect stock buybacks to surge to levels that will appear crazy one day.

Investors should have a core position in gold, which will react strongly to currency debasement. However, no matter how good an investment appears, one should never put all their eggs in one basket. The Fed’s actions and the market’s behaviour are beyond an individual’s control, and betting against the Fed may not be a successful strategy in the long run. Investors should be aware of the trend and adapt their strategy accordingly.

Boom and Bust Cycles: The Fed’s Thrilling Economic Ride

The Federal Reserve’s role in fostering boom and bust cycles through interest rate manipulation is a subject of debate and scrutiny. Critics argue that the Fed’s actions, or lack thereof, have played a significant role in creating financial crises. To understand this perspective, let’s examine the Fed’s actions and their potential motives.

One of the primary tools at the disposal of the Federal Reserve is the manipulation of interest rates. By adjusting the federal funds rate, the rate at which banks lend money to each other, the Fed aims to influence borrowing costs, economic activity, and inflation levels. When the economy is in a downturn, the Fed typically lowers interest rates to stimulate borrowing and spending, thus encouraging economic growth. Conversely, when the economy overheats, and inflation becomes a concern, the Fed raises interest rates to cool down the economy and prevent excessive inflation.

Critics argue that the Fed’s interest rate manipulation can result in unintended consequences, leading to boom and bust cycles. Lowering interest rates during periods of economic weakness can create an environment conducive to excessive risk-taking and speculation. These low rates make borrowing cheaper, leading to increased leverage and the potential for asset bubbles to form. These bubbles eventually bursting can trigger severe economic downturns and financial crises.

Furthermore, critics suggest that the Fed’s motives may not solely be focused on economic stability but also influenced by political and institutional factors. Some argue that the Fed is susceptible to pressure from political leaders and powerful interest groups, leading to decisions that prioritize short-term economic gains over long-term stability. This perceived lack of independence may exacerbate boom and bust cycles by delaying necessary policy adjustments or leading to inappropriate interventions.

The Federal Reserve’s interest rate manipulation has been criticised for its potential role in fostering boom and bust cycles. Critics argue that the Fed’s actions, driven by various motives, can lead to unintended consequences such as excessive risk-taking and asset bubbles. However, it is essential to recognize that the Federal Reserve operates in a challenging environment and aims to balance multiple objectives, including economic stability and inflation control. Understanding the intricacies of monetary policy and its potential impact on the economy is crucial for a comprehensive assessment of the Fed’s role in boom and bust cycles.

Shaping the Financial Landscape: The Evolution of the Fed’s Policies

Historical Context:

The Federal Reserve, often referred to as the Fed, stands as a cornerstone of economic governance in the United States. Throughout its history, the Fed’s mission has remained a constant beacon – to foster financial stability and promote economic growth. However, how it has pursued this mission has undergone a fascinating evolution.

In the wake of the seismic financial crisis of 2008, the Fed introduced a transformative strategy known as quantitative easing (QE). This bold move wasn’t merely a policy shift but a watershed moment in monetary policy. QE aimed to breathe life into the sluggish economy by orchestrating a symphony of measures. It produced a concerto of interest rate reductions and a crescendo in the money supply. The result was a surge of liquidity that coursed through the economic veins, injecting vitality into a world teetering on the brink of economic uncertainty.

This dramatic shift didn’t merely lower interest rates; it recalibrated the financial landscape. It rewrote the financial script, offering an exhilarating spectacle of change. In this grand theatre of economic policy, the Fed has consistently sought to fine-tune its role, showcasing a dynamic performance that continues to capture the world’s attention.

Quantitative Easing: The Federal Reserve’s Economic Roller Coaster

While undeniably influential, the Federal Reserve’s policy evolution has not been without its share of dramatic plot twists. As it sought to reinvigorate the economy after the 2008 financial crisis, the Fed’s approach, specifically the implementation of quantitative easing (QE), triggered a roller coaster of economic highs and lows.

QE, as an ambitious monetary tool, was designed to lower interest rates and supercharge the money supply. While it successfully breathed life into the economy, it also had unintended consequences, like a thrilling ride with unexpected loops and turns. One of these unexpected outcomes was the inflation of asset bubbles and the increased risk of a financial crisis.

In this gripping narrative, the Fed’s actions, or lack thereof, have been both protagonist and antagonist. They have been associated with fostering boom and bust cycles, akin to the ebb and flow of high-stakes drama. The Fed inadvertently fueled moments of exuberance followed by severe downturns by creating an environment of easy credit and financial speculation. The economic stage became a battleground where fortunes rose and fell, and the world watched with bated breath.

The boom and bust cycles, a central theme in this economic saga, highlight the Fed’s challenge of maintaining stability while navigating the unpredictable terrain of the financial world. These cycles serve as a reminder that the Fed’s role in shaping the economy is not just a measured symphony but also a heart-pounding crescendo in the drama of finance.

Interest Rate Manipulation: The Fed’s Economic Lever

The Federal Reserve wields an influential tool in steering the economy: interest rates. The Fed can orchestrate substantial impacts on the economic landscape by controlling interest rates.

When the goal is to stimulate economic growth, the Fed makes borrowing more affordable. This is achieved by lowering interest rates, effectively easing economic expansion’s wheels. Lower interest rates incentivize borrowing, investment, and spending, fostering an environment of increased economic activity.

Conversely, the Fed tightens its grip on the reins when aiming to curb inflation or slow down an overheated economy. This translates to raising interest rates, which acts as a brake on economic growth. Higher interest rates make borrowing more expensive, which, in turn, leads to reduced spending and investment. This counteractive measure helps maintain financial stability by preventing runaway inflation and unsustainable growth.

Unveiling the Fed’s Devilish Agenda in Fostering Boom and Bust Cycles

The Federal Reserve’s actions, far from benign, are subject to intense scrutiny. It’s not a mere allegation but a firm belief held by many that the Fed strategically manipulates interest rates to further its calculated agenda. In their eyes, this agenda isn’t designed for the greater good but benefits a privileged few while inflicting harm on the masses.

According to this perspective, the Fed wields interest rates to create deliberate economic booms and busts. This isn’t a mere claim; it’s a declaration that these actions contribute to currency devaluation. They argue that the wealthiest and most influential individuals are the ones who profit, while the middle class and the less fortunate bear the heavy burden of these consequences.

The Federal Reserve’s policies, often lauded for their role in economic stability and growth, are under relentless fire. Critics assert that these policies, especially the manipulation of interest rates, have paved the way for an environment characterized by easy credit, financial speculation, and a decline in currency value. This is no hypothetical debate; it’s a live battlefield where calls for further research intensify, all to uncover the true extent of the Fed’s sway over the U.S. economy.

However, let’s not overlook the banks in this narrative. When the Federal Reserve lowers interest rates, it ignites a lending frenzy among banks. This frenzy contributes to a dangerous debt bubble that’s bound to burst. Banks are not passive observers in this financial saga; they are active players where profit and peril walk hand in hand, ultimately shaping the grand storyline of economic cycles.

This account isn’t just a thought experiment; it demands answers and accountability. It urges us to delve deeper into the intricate world of finance and scrutinize the nexus of power, wealth, and economic influence without hesitation.

Banks play a significant role in fostering boom and bust cycles through their ability to create money through lending.As the Fed lowers interest rates, banks are encouraged to lend more money, creating a bubble of debt that eventually pops.

Navigating the Choppy Waters of Interest Rate Risk in Banking

Interest rate risk isn’t just a peripheral concern for banks; it’s a formidable adversary that can shake their financial foundations. In this essay, we’ll dive deep into the complex world of interest rate risk and explore the savvy strategies banks employ to weather the storm and thrive in these turbulent financial waters.

Interest rates, like tides in the financial ocean, ebb and flow, and it’s the banks’ responsibility to ensure they don’t get swept away by these changes. This isn’t a hypothetical challenge; it’s a tangible threat impacting a bank’s profitability, asset quality, and overall financial stability.

Banks must navigate this multifaceted challenge with precision. They can’t afford to be passive observers; they need a proactive approach. This means meticulously assessing the risks associated with fluctuations in interest rates and formulating comprehensive strategies to mitigate these risks.

One of the primary strategies at their disposal is asset-liability management. Banks carefully balance their assets and liabilities to minimize the adverse effects of interest rate changes. This proactive approach ensures that their income and expenses are aligned, reducing the vulnerability to interest rate shifts.

Derivatives are another powerful tool in the arsenal of banks. They use interest rate derivatives to hedge against fluctuations, protecting their portfolios from potential losses. These instruments allow banks to control and manage risk with precision.

Stress testing is yet another critical element in their risk management toolbox. Banks simulate various interest rate scenarios to assess their portfolios’ performance under stress. This helps identify potential weaknesses and equips them to make informed decisions to mitigate risk.

Additionally, banks often diversify their asset portfolios. A mix of fixed-rate and variable-rate assets can cushion against interest rate volatility. By spreading their risk, they reduce their exposure to the extremes of interest rate fluctuations.

It’s not just about defence; banks can also go on the offence. Some banks trade interest rate products to capitalize on rate movements actively. This approach can be profitable but comes with its own risks, which banks must manage effectively.

Interest Rate Risk

Interest rate risk poses one of the most pernicious perils for banks. Fundamentally, banks generate profits from their net interest margin—the difference between the interest rates received on loans and other assets compared to the rates paid on deposits and other liabilities. Ideally, banks want to fund longer-term fixed-rate assets with shorter-term lower-cost deposits and borrowing. However, fluctuating interest rates can disrupt this careful balancing act and squeeze margins.

When economic conditions cause interest rates to rise, banks often find their funding costs increasing faster than the interest earnings from assets already on the books at lower pre-existing rates. This repricing mismatch comprises net interest margins until assets can be replaced or repriced to higher yields. The same challenge occurs in reverse when policymakers cut rates—liabilities held by customers with interest rate floors may reprice down more gradually than floating rate assets. If rates fluctuate suddenly or unpredictably, it is difficult for banks to immediately restore the interest rate spread upon which they depend for profits.

To mitigate these risks, banks utilize tools like gap analysis to measure differences in re-pricing periods between rate-sensitive assets and liabilities. They employ hedging strategies using derivatives contracts tied to benchmarks like LIBOR to offset some exposure. However, imperfect hedges still leave “basis risk” since the underlying indices for assets may diverge from hedging instruments. Prudential regulations further aim to buttress banks by requiring stress testing and adequate capital buffers to withstand unexpected rate scenarios that could otherwise destabilize bank balance sheets and threaten solvency.

As demonstrated by the 1980s savings and loan crisis triggered primarily by interest rate volatility, lack of robust risk management poses catastrophic dangers for individual banks and potentially the entire financial system. Ongoing close supervision seeks to uphold prudent practices and stability, mindful of history’s lessons regarding interest rate risk’s profound capacity to impact short-term earnings and long-term viability for banks everywhere.

The Impact of Rising Interest Rates

The impact of rising interest rates on banks is a multifaceted challenge that significantly affects their financial operations. As interest rates ascend, banks face intricate issues that necessitate careful management.

When interest rates climb, the primary concern is that banks’ funding costs tend to reprice upwards more rapidly than the interest they earn on existing fixed-rate loans and securities with lower coupons. This situation results in a short-term squeeze on net interest margins. This condition persists until these assets are repaid, refinanced, or replaced with higher-yielding alternatives in line with the new rate environment.

To address this issue, banks employ techniques such as gap analysis to assess any discrepancies between their rate-sensitive assets and liabilities across various periods as interest rates fluctuate. Banks with liability-heavy short-term gaps tend to experience more acute margin pressure.

Furthermore, the increase in interest rates tends to dampen the demand for loans as financing becomes more expensive for both consumers and businesses. This can temporarily impede the growth prospects of interest income.

Banks often utilize derivatives to hedge their repricing exposures. However, mismatches in the indices used for these hedges can expose them to basis risk. Capital buffers are maintained to mitigate the impact of temporary margin declines.

For some banks with solid balance sheets, a steeper yield curve resulting from rising interest rates can lead to higher profit spreads in the long run. However, the risk of rapid or unforeseen rate hikes can pose stress, as seen in past financial crises, such as the 1980s savings and loan (S&L) collapse, driven in part by rate volatility.

In light of these challenges, prudent risk management and regulatory supervision play a crucial role in ensuring that banks can withstand repricing dislocations without jeopardizing their solvency or contributing to the fragility of the broader financial system.

Challenges During Falling Rates

Banks encounter a distinct set of challenges during falling interest rates that demand prudent risk management and strategic adaptation. As rates decrease, various aspects of a bank’s operations are affected, contributing to a complex financial landscape.

One notable challenge is that many of a bank’s liabilities, such as deposits, often have interest rate floors, preventing an immediate downward repricing. Conversely, many assets, including variable-rate loans and securities, can reprice downward on short notice. This discrepancy in repricing creates a situation where net interest margins are squeezed, with the rates received from assets declining faster than the rates paid out.

Replacing maturing liabilities with new deposits at lower rates to fully match asset repricing is a daunting task for banks. While tools like gap analysis are used to assess timing differences, achieving a perfect hedge is complicated due to the limitations of indexed instruments.

Additionally, rate cuts may trigger more prepayments and refinancing of longer-term fixed-rate loans as customers seek cheaper financing. This accelerates the repricing of banking book assets, further exacerbating short-term margin compression.

Over time, banks can adjust their asset-liability management strategies and targets to adapt to the changing interest rate environment. However, the challenges posed by unexpected or rapidly declining rates can strain the repricing dynamics.

In light of these challenges, regulatory oversight ensures that banks maintain robust balance sheets and liquidity to withstand temporary margin declines without jeopardizing their capital or overall stability. Therefore, effectively managing the mirror repricing of falling rates necessitates prudent risk management practices within banking institutions.

The Impact of the Financial Crisis

The financial crisis profoundly impacted banks’ exposure to interest rate risk, revealing vulnerabilities and prompting significant changes within the banking industry. During this crisis, interest rates experienced drastic downward shifts as the Federal Reserve aggressively cut rates to counteract economic contraction. These sharp interest rate swings posed acute repricing challenges for banks, especially those with significant investments in fixed-rate mortgage securities and loans. The crisis disrupted the expected patterns of asset repricing, primarily due to the collapse of housing markets.

Banks holding subprime assets were particularly vulnerable, as they faced a double exposure. They had to deal with declining asset valuations and the faster repricing of liabilities compared to the distressed assets they held. This situation was exacerbated by rapid rate cuts, which complicated the hedging of fixed-rate assets that underperformed relative to repricing liabilities.

The crisis laid bare significant shortcomings in banks’ risk management models. These models failed to adequately factor in the possibility of housing price declines and correlated defaults. As a result, many institutions discovered they were ill-prepared to withstand severe rate shocks and disruptions in the mortgage market, leaving them dangerously exposed to substantial risks. This revelation underscored the need to fundamentally reevaluate risk assessment and mitigation strategies within the banking sector.

Impaired assets squeezed capital levels as earnings margin pressures mounted due to repricing imbalances. In response to these challenges, regulators mandated more substantial liquidity and capital buffers to enhance resilience during severe yet plausible stresses. The crisis underscored the limitations of banks’ interest rate risk measurement and mitigation approaches in eigenvalue environments, highlighting the urgency of reform and enhanced risk management practices.

Currency Debasement

Moreover, the ongoing race to the bottom and perpetual currency debasement can severely affect the global economy. As a result, owning precious metals such as gold, silver, and palladium can hedge against the ill effects of currency debasement. These metals have a track record of maintaining their value over time and can act as a safe haven during economic turmoil.

Additionally, some experts argue that banks’ actions are part of a broader effort to devalue the currency, benefiting the wealthy and powerful at the expense of the middle class and the poor. In this context, owning precious metals can provide financial security and protect against the potential downsides of currency devaluation.

Banks’ actions in fostering boom and bust cycles through interest rate manipulation raise concerns about the financial system’s stability. Owning precious metals can safeguard against the adverse effects of currency debasement and provide financial security during economic uncertainty.

Other Articles of Interest:

Panic Selling Mastery: Buying the Fear & Selling the Joy

Catch the Wave: Decoding Trading Cycles with the Esoteric Edge

Are Economic Indicators Finally In Sync With the Stock Market

Perception Manipulation: Mastering the Market with Strategic Insight

Market Uncertainty: A Challenge for Investors

Stock market basics for beginners: Adapt or Die

Richard Russell’s Dow Theory: Is It Still Valid?

DJU Index: To Buy or Flee? Unraveling the Market Mystery

Stock Market Psychology 101: Learn, Thrive, and Profit

In 1929 the Stock Market Crashed Because of Greed

Unshackling Minds: The Journey to Remove Brainwashing

Mob Psychology: Breaking Free to Secure Financial Success

Unveiling the VIX Fear Indicator: A Case Study in Market Volatility

Mind Games: Unmasking Brainwashing Techniques in Institutions & Media