Elevating Your Investment Prowess: Strategic Steps to Become a Superior Investor

Updated Oct 13, 2023

The next type of attack via the stock market will be to trigger a stampede consistently. At some point, 3600 to 4500 point moves in the Dow will become standard operating procedure. Market Update, April 30, 2021

This current pullback could end up being the first time the above strategy is put into use. The Dow could shed between 7 to 11 per cent from its highs. Taking the midpoint, it would translate to a move to the 30,450 to 31,800 range. The Dow could shed up to 3,700 points on the high end, meaning the above strategy would be in play.

Before continuing, remember that the only thing to fear is fear itself when the trend is up. We have been through this before, and we came out mostly unscathed. Nothing, at least in the foreseeable future, can compare to the COVID-19 crash. Most importantly, we came out swinging hard. We banked massive gains due to the opportunity that the crash provided us.

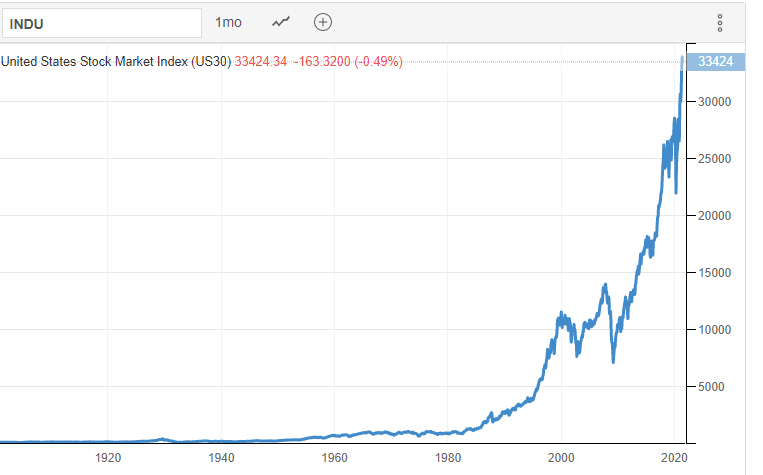

What about the “it’s different” argument this time? Rubbish!! That is all we have to say to anyone coming up with that line. Look at the above chart. Can you even pinpoint the great depression or the so-called deadly crash of 1987? Every crash gave birth to a new baby bull. The key to banking vast sums of money is always to have cash and, most importantly, never over-commit funds to a single position. As long as the trend is on our side, we must view every pullback through a bullish lens. If you are new or still allow your emotions to do the talking, then you best reread Aesop’s fables. No other book will help you get a better grip on investing than this simple book. Start with the hare and the turtle. Emotions are running high on some threads in the Market Update and AI Trend trader forums.

To be a better investor: Think out of the box.

We examined each of the 30 stocks via their respective monthly charts. Given the strong moves the market has experienced, logic would dictate that most of the Dow stocks would be trading in the overbought ranges. However, the results were somewhat surprising. Fifteen stocks were trading in the oversold ranges, and one was trading in the neutral range. So, 53% of the Dow components sold in the oversold or neutral ranges.

One could draw two conclusions from this observation:

- The odds of the Dow experiencing a solid correction are lower than usual; instead of a 10-15 per cent correction, it might pullback in the 5 to 9 per cent ranges

- Or it continues to trend higher until over 70% of the stocks are trading in the overbought ranges. Still, specific sectors will experience sharp corrections, otherwise known as a silent correction.

The main piece of data to walk away from this analysis is that we have yet another confirmation that no matter how strongly the market corrects, it would make for a buying opportunity. As we have stated many times in the past, Tactical Investors should hope or even pray for a sharp pullback, for it’s akin to being given free money when the trend is up. Market Update, Feb 14, 2021

Random Insights on Being A Better Investor

The phase of waiting patiently tends to challenge the average investor, especially those who rely solely on their degrees or high IQ for market advantage. While PhD traditionally stands for Doctor of Philosophy, we’ve coined a more fitting term at the Tactical Investor: “permanent head damage,” reflecting the struggles many economists with PhDs encounter. In the market, possessing an open mind and a grasp of basic mass psychology principles proves more valuable than degrees. Technical analysis serves as a tool for refining entry points.

Wise investors recognize that the critical phase is the waiting period, often called the “Patience and Discipline” stage. Excessive trading results in mediocre gains or losses and significantly increases stress, sometimes fourfold or more. Considering the adverse impact on health, any financial gains are negated. Savvy investors prioritize health as their primary investment, with everything else trailing far behind.

The timing of profits, whether in the initial four months or the final three months of the year, holds little significance for those who comprehend this fundamental principle. Understanding this can lead to a consistent 20% annual return with minimal effort and stress. Ultimately, health emerges as the ultimate investment. Losing health renders even a billion-dollar fortune less valuable than good health. Conversely, with optimal fitness and a modest sum of 50k to 100K, there’s potential to transform it into a significant fortune, establishing a solid foundation with the most critical asset intact—health.

Originally Published on October 13, 2021, and Enhanced in October 2023

Unveil the Hidden Gems: Explore More

Oil Supply Outstrips Demand: Oil Headed Lower 2016

Oil Crash: Crude oil price heading lower 2016

Essentials of understanding Psychology: How To Make Money

Oil market crashes but oil tanker market raking in profits

Longest Bull Market Destined To Run Longer & Trend Much Higher

Hype and financial deception around the block

Oil Tankers trading higher: NAT & FRO TOP Tanker stocks

Mass Psychology & Financial Success: An Overlooked Connection