Market Trends: Navigating Fluctuations and Maximizing Growth Potential

Updated May 08, 2024

Market trends are an integral part of the financial landscape, and it’s essential to understand their nature and implications. While the current market situation may seem challenging, it’s essential to recognize that market fluctuations are not unprecedented. Despite the initial inclination to perceive it as a completely new event, panic often arises. Experts may even argue that this time is different and attempt to sow fear.

However, it’s worth questioning the credibility of such claims. If these experts possessed accurate foresight, they would focus more on taking action than engaging in excessive speculation. Being overly bearish can be perilous because, historically, markets have consistently exhibited an upward trajectory over the long term.

Cyclical patterns of growth, decline, and recovery characterize market trends. Although temporary setbacks and downturns occur, they are typically followed by periods of resurgence and expansion. This is not to diminish the significance of economic challenges or dismiss the importance of sound investment strategies. Instead, it emphasizes the need for a balanced perspective that acknowledges short-term fluctuations and long-term growth potential.

Investors aware of market trends understand that staying invested and maintaining a long-term perspective can yield favourable outcomes. While it’s natural to experience emotions like panic during periods of market volatility, it’s crucial to maintain a rational mindset and focus on the bigger picture. This entails recognizing that market downturns often present unique opportunities for those who are prepared and patient.

Strategic Approaches to Market Trends: Navigating Volatility for Long-Term Success

Successful investors approach market trends strategically, utilizing tools such as diversification, risk management, and thorough research. They recognize that short-term market movements should not dictate their investment decisions. Instead, they align their portfolios with long-term financial goals and adapt their strategies accordingly.

It’s important to remember that many factors, including economic indicators, geopolitical events, and investor sentiment, drive markets. Understanding the interplay of these variables and staying informed about market trends can provide valuable insights for making informed investment decisions.

Ultimately, navigating market trends requires discipline, knowledge, and a comprehensive understanding of the forces at play. By maintaining a long-term perspective, managing risks, and being adaptable, investors can position themselves to benefit from the markets’ inherent growth potential.

Identifying Buying Opportunities Amidst Economic Crises and Market Downturns

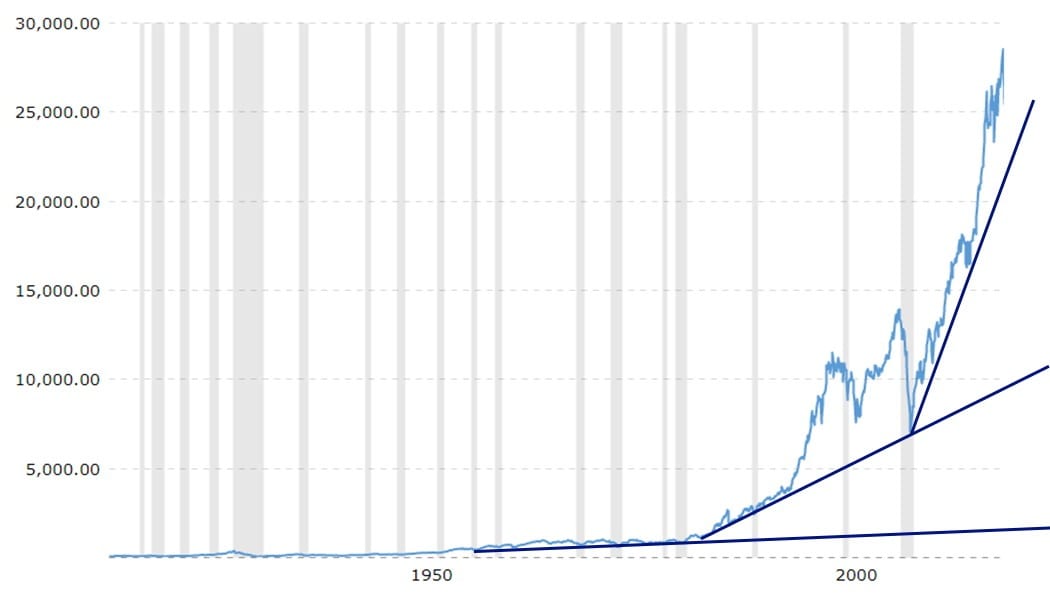

Now, try to spot the Great Depression, Black Monday, etc. Every one of these end-of-world events proved to be a buying opportunity, including the notorious crash of 2008, which proved to be the mother of all buying opportunities. If you look at all those “end-of-world events” closely, they are blips in an otherwise massive upward trend.

There will always be days, weeks and sometimes months when the markets are down, but ultimately, the market has trended in one direction: “up”. Massive fortunes were made by viewing these disaster-type events through a bullish lens. We also have Mass Psychology and the Trend Indicator on our side, both of which indicate that this downtrend, at most, could be the backbreaking correction we spoke of recently. Every Bull Market experiences at least one, and 90% of the traders falsely assume that this event marks the beginning of an extended bearish trend.

Market Trends: Focus on Fact And Not Fiction

Let’s consider a significant event that many remember: the Great Recession. Even if you happened to enter the market prematurely and started opening long positions well before the Dow hit its bottom, you would currently be enjoying substantial gains.

Therefore, it is crucial to view panic-driven selling from a bullish perspective, particularly now that we are in the era of ongoing quantitative easing (QE). Most importantly, remember that the general public was not euphoric when this market downturn began.

There is a specific time to sell, and that time arrives when the masses are in a state of extreme excitement. During market sell-offs, numerous opportunities emerge. Instead of succumbing to panic, it is advisable to create a list of stocks you have always desired to own.

The markets always revert to their average values, and consequently, the greater the deviation from the mean, the more favourable the opportunity becomes. Historical evidence demonstrates that the market trends in one direction over time: upwards.

Harnessing Ancient Wisdom in Modern Investing

The ancient philosophers and thinkers have left us with wisdom that transcends time and can be remarkably applicable to modern investing. For instance, the Stoic philosopher Epictetus taught, “Wealth consists not in having great possessions, but in having few wants.” This principle is vital for investors who aim to build wealth through the stock market. Individuals can accumulate wealth more effectively by focusing on minimizing unnecessary expenses and prioritizing savings and investments.

Aristotle said, “Patience is bitter, but its fruit is sweet.” This resonates deeply with the concept of long-term investing. The stock market can be volatile in the short term, but historically, it has provided substantial returns to patients who hold their investments over long periods. Investors should embrace patience as a virtue, understanding that significant wealth accumulation takes time and the rewards of compound interest are realized in the fullness of time.

Applying Timeless Strategies to Contemporary Market Challenges

Sun Tzu’s “The Art of War” offers timeless strategies that can be adapted for financial markets: “During chaos, there is also opportunity.” During market downturns and economic crises, while many investors react emotionally and sell off their assets, the wise see these moments as opportunities to purchase quality stocks at lower prices. This approach requires a disciplined mindset to counteract the prevailing market sentiment and capitalize on the fear of others.

Similarly, the ancient Chinese philosopher Lao Tzu stated, “Those who know, don’t predict. Those who predict don’t know.” This is particularly relevant in today’s complex financial markets, where predicting short-term movements is nearly impossible and often unproductive. Instead, savvy investors focus on acquiring knowledge about the companies and industries they invest in, building a portfolio based on strong fundamentals rather than speculative forecasts.

By integrating these ancient philosophies with modern financial practices, investors can navigate the complexities of the market with wisdom and insight, turning challenges into opportunities for growth and wealth accumulation.

Conclusion

In conclusion, understanding market trends is vital for successfully navigating the financial landscape. While market fluctuations may seem daunting, it’s essential to recognize that they are not unprecedented. Rather than succumbing to panic or falling prey to fearmongering claims, investors should maintain a balanced perspective that acknowledges short-term fluctuations and long-term growth potential.

Successful investors approach market trends strategically, utilizing tools such as diversification, risk management, and thorough research. They align their investment decisions with long-term financial goals and adapt their strategies accordingly. By maintaining discipline, knowledge, and a comprehensive understanding of the forces at play, investors can benefit from the markets’ inherent growth potential.

Articles of interest: