Stock Investing for Kids: The Smart and Easy Way

Updated April 2, 2024

The fundamental tenets of Mass Psychology, Mob psychology, and contrarian investing highlight the extreme peril of embodying a lemming in financial health matters. As Mark Twain once remarked, “Whenever you find yourself on the side of the majority, it is time to pause and reflect.” Adopting a lemming-like approach to ensure your portfolio’s well-being is unequivocally detrimental; no alternative stance exists. Plutarch, the ancient Greek biographer, wisely stated, “The mob is the mother of tyrants,” emphasizing the dangers of blindly following the crowd.

The masses, akin to lemmings, persistently believe that anything valuable necessitates arduous learning or acquisition. This notion could not be further from reality. As Peter Lynch famously said, “The simpler it is, the better I like it.” One need not master intricate formulas or intricate strategies to amass wealth. What does prove essential, however, is cultivating Patience and Discipline. The Greek philosopher Pluto once remarked, “The measure of a man is what he does with power,” highlighting the importance of self-control and wise decision-making.

It is worth noting that patience and strenuous effort stand in stark contrast to each other; indeed, numerous impatient individuals demonstrate commendable diligence, yet they perpetually falter in the realm of investing. Similarly, many patient individuals do not exert excessive effort but consistently manage to secure profits. As Lynch astutely observed, “The key to making money in stocks is not to get scared out of them.” Twain further emphasized the value of patience, stating, “The secret of getting ahead is getting started. The secret of getting started is breaking your complex overwhelming tasks into small manageable ones and starting on the first.”

By heeding the wisdom of these great thinkers and understanding the pitfalls of herd mentality, young investors can set themselves on the path to financial success. Cultivating patience, discipline, and a contrarian mindset will serve them well in navigating the stock market and building long-term wealth. As Plutarch aptly said, “The mind is not a vessel to be filled, but a fire to be kindled.” By igniting a passion for learning and a willingness to go against the grain, children can develop the skills and mindset necessary to thrive in investing.

Stock Investing For Kids Tip 2: The Next Vital Ingredient – Discipline

Having discussed the importance of patience in the investment journey, let’s delve into the next crucial ingredient – discipline. As Socrates wisely said, “The secret of change is to focus all of your energy not on fighting the old but on building the new.” In investing, discipline is the ability to adhere steadfastly to a predetermined investment plan, regardless of external influences. This could include the opinions of friends, loved ones, experts, or even adversaries.

Discipline in investing is akin to the compass that guides a ship through stormy seas. It helps you stay on course, even when market conditions are volatile or popular opinion is swaying in a different direction. As Warren Buffett famously remarked, “The stock market is a device for transferring money from the impatient to the patient.” It’s about making informed, rational decisions based on your investment strategy rather than being swayed by emotions or short-term market fluctuations.

Socrates also emphasized the importance of self-knowledge, stating, “To find yourself, think for yourself.” The only time one should consider altering the investment plan is when it consistently fails to yield results over a significant period. However, if you adhere to the fundamental principles of investing that we have outlined, the likelihood of such a scenario is highly remote.

Discipline also extends to personal finance management. As Buffett advises, “Do not save what is left after spending, but spend what is left after saving.” You can accelerate wealth accumulation if you have a stable job and are willing to live one to two standards below your means. This involves making conscious choices to save and invest rather than spending on non-essential items or lifestyle upgrades.

By consistently setting aside a portion of your income for investments, you can build a substantial nest egg much faster than you might think. This disciplined approach to saving and investing can set the foundation for financial independence and wealth creation in the long run. As Socrates aptly said, “The unexamined life is not worth living.” Examining your financial habits and committing to a disciplined investment strategy can pave the way for a life of economic freedom and abundance.

Have a Long-Term Game Plan: The Path to Financial Independence

Retirement should not be viewed as a period of inactivity or idleness; rather, it should be seen as an opportunity to engage in activities you genuinely enjoy. As Archimedes famously said, “Give me a lever long enough and a fulcrum on which to place it, and I shall move the world.” In the context of financial independence, your long-term game plan is the lever, and your disciplined approach to investing is the fulcrum. It’s about transitioning from doing what you must to earn a living, often tasks you might not enjoy, to doing what you love. To make this transition, you need to break free from the traditional 9-5 work schedule, and the key to achieving this is gaining financial independence.

Financial independence lets you control your destiny, allowing you to choose based on your passions and interests rather than economic constraints. As Nathan Rothschild, the renowned banker, once stated, “Who controls the money supply of a nation controls the nation.” Taking control of your financial future allows you to break free from the constraints that bind most people. However, achieving this freedom requires a long-term game plan and a disciplined approach to investing.

The first step towards financial independence is mastering your emotions. Investing is not just a financial journey but also an emotional one. Market fluctuations can trigger various emotions, from fear during downturns to euphoria during upswings. However, succumbing to these emotions can lead to impulsive decisions that derail your investment plan. As Archimedes wisely noted, “Eureka! I have found it!” When you discover the power of emotional discipline in investing, you’ll have found the key to unlocking your financial potential.

Instead of following the crowd, you need to chart your course. This requires being resolute in your investment decisions and sticking to your game plan, regardless of market sentiment. When the masses panic during market downturns, they view it as an opportunity to invest in quality assets at discounted prices instead of joining in their fear. As Baron Rothschild famously said, “Buy when there’s blood in the streets.” Conversely, exercise caution when the crowd is overly optimistic during market upswings. Over-enthusiasm can often lead to overvalued markets and subsequent corrections.

Having a long-term financial plan and being emotionally disciplined is essential for economic independence. By sticking to your strategy and making informed decisions, you can create a robust investment portfolio that will give you the financial freedom to pursue your dreams in retirement. As Archimedes declared, “There are things which seem incredible to most men who have not studied mathematics.” By studying investing principles and applying them with discipline, you can achieve what may seem incredible to others – true financial independence.

Mastering Emotions and Knowledge: The Keys to Successful Investing for Kids

To succeed in investing, mastering your emotions and acquiring knowledge are crucial. Emotional control is a skill that requires practice and patience. When making investment decisions, avoid acting on impulse or anger. Instead, wait until you’ve calmed down to make rational choices.

Remember Baron Rothschild’s wise words: “Buy when there’s blood in the streets.” This means investing when others are fearful, and the market is down. Conversely, be cautious when the masses are celebrating, as this often indicates an overvalued market.

Knowledge is power in investing. Take the time to understand the investment landscape and identify your preferences, such as specific industries or sectors. Focus on companies with high quarterly earnings or impressive revenue growth rates and those with innovative, hard-to-replicate products.

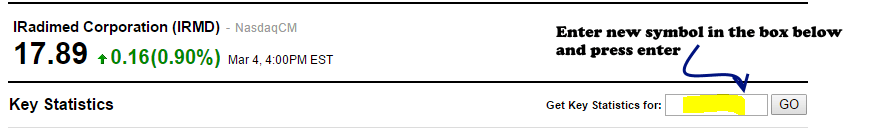

To begin your research, use tools like Yahoo Finance. Input a stock symbol in the Key Statistics section to access essential information. For example, you can explore the stock IRMD by visiting https://finance.yahoo.com/q/ks?s=IRMD+Key+Statistics.

Facts:

1. Emotions can lead to impulsive decisions that negatively impact investment outcomes.

2. Baron Rothschild’s quote emphasizes the importance of contrarian investing.

3. Yahoo Finance provides valuable information for researching stocks, such as key statistics and financial data.

By mastering your emotions and acquiring knowledge, you’ll be better equipped to make informed investment decisions and navigate the complex investing world.

You should seek quarterly earnings growth or revenue rates exceeding 10%. A simple measure is:

15%-20% = Good

25%-40% = Very good

50% plus = Excellent

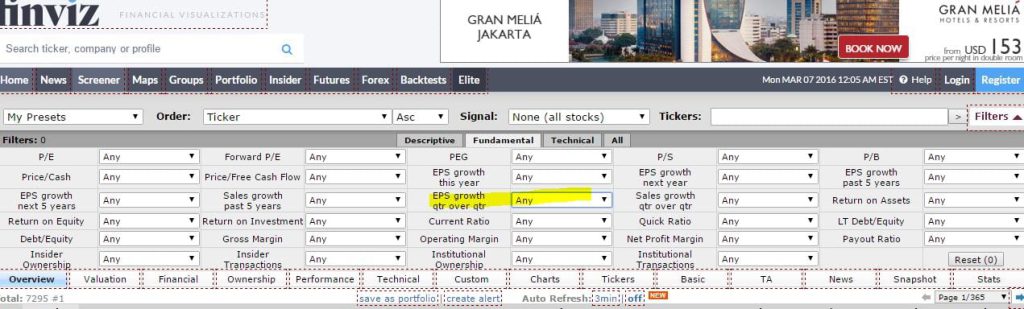

However, the above process could be cumbersome unless you are familiar with some fast-growing companies. Most individuals will need to find a good stock screener. Finviz is a site that provides a reasonably robust stock screener, and it has both Fundamental and technical analysis screening tools built in.

Investing for Kids: Mastering Stock Screeners, Portfolio Management, and Stops

Stock screeners are powerful tools for identifying potential investment opportunities that align with your strategy. They allow you to filter stocks based on specific criteria, such as market capitalization, dividend yield, and price-to-earnings ratio. When teaching kids about investing, emphasize the importance of using stock screeners as a starting point and conduct further research on the companies identified.

After compiling a list of stocks, it’s crucial to exercise patience and discipline. Wait for significant pullbacks in the corresponding stocks before investing fresh capital. As Warren Buffett famously said, “Be fearful when others are greedy, and greedy when others are fearful.” This means being cautious when the market is overly optimistic and seeing market downturns as potential buying opportunities.

Portfolio management and the use of stops are essential aspects of investing. A well-managed portfolio should be diversified, containing various investments to spread risk. It should also be regularly reviewed and adjusted based on changes in the market and the investor’s financial goals. As Peter Lynch once said, “Know what you own, and know why you own it.”

Stops are risk management tools that limit potential losses on trade by triggering a sale if a stock’s price falls to a certain level. This safety net is crucial in avoiding a bad trade from draining an investor’s portfolio. As Benjamin Graham, the father of value investing, advised, “The essence of investment management is the management of risks, not the management of returns.”

Facts:

1. Stock screeners can filter stocks based on various criteria, helping identify potential investment opportunities

2. Diversification is a crucial principle in portfolio management, spreading risk across different investments

3. Stop-loss orders are risk management tools that limit potential losses on trade by triggering a sale if a stock’s price falls to a certain level

By mastering stock screeners, portfolio management, and using stops, kids can develop a solid foundation for successful investing. Combining the wisdom of renowned investors like Warren Buffett, Peter Lynch, and Benjamin Graham, they can confidently and skillfully navigate the complex investing world.

Mastering Technical Analysis: Insights from the Best Market Technicians

Technical analysis evaluates securities by analyzing market statistics, such as past prices and volume, to identify patterns and trends that can help predict future price movements. The basic assumption is that a security’s market price accurately reflects all available information and represents its fair value, implying that past price patterns can be reliable indicators of future behaviour.

While not foolproof, technical analysis can help identify potential entry and exit points for trades. For example, a technical analyst might use this information to time their trades if a stock has historically bounced back after reaching a certain price level.

Standard tools used in technical analysis include:

1. Chart patterns

2. Trend lines

3. Support and resistance levels

4. Moving averages

5. Technical indicators (e.g., RSI, MACD)

Examples:

1. W.D. Gann, a renowned market technician, used geometric angles and time cycles to predict market trends. He believed that specific mathematical relationships could be used to forecast future price movements (Investopedia, 2021).

2. Richard Wyckoff, another influential technician, developed the Wyckoff Method, which involves analyzing market structure, supply and demand, and price-volume relationships to identify potential trading opportunities (StockCharts, 2021).

Gann and Wyckoff’s techniques, such as Gann angles and the Wyckoff Accumulation Schematic, are still widely used by modern technical analysts.

While technical analysis is a powerful tool, it should be used with fundamental analysis and other research methods for a comprehensive approach to investing. As with any investment strategy, risk management is crucial, and techniques like stop-loss orders can help limit potential losses. If you want to learn more about technical analysis, this is an excellent place to start: Introduction to Technical Analysis.

Stock Investing for Kids: Essential Factors for Success

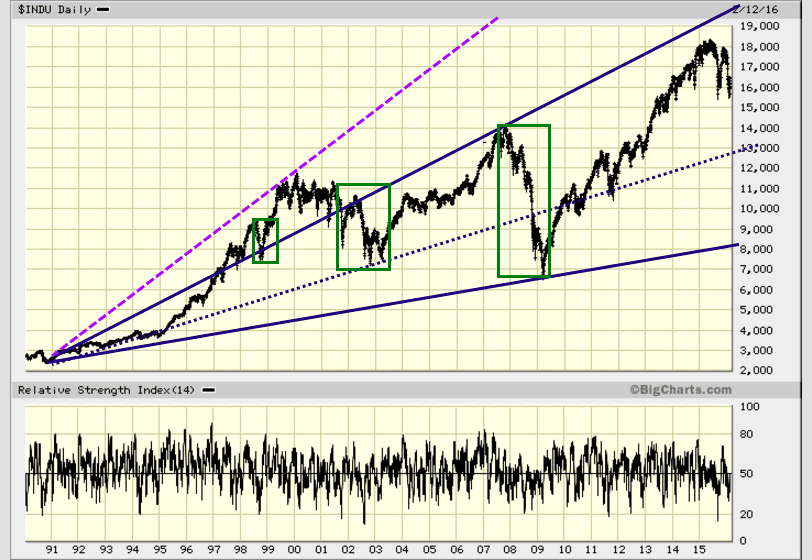

Once armed with a list of top-notch stocks, you wait for strong market pullbacks to add or open new positions. Looking at any long-term chart, you will see that the market always rebounded and soared higher no matter how strong the pullback.

Don’t jump in as soon as the markets start to pull back. Wait for the panic levels to hit the stratosphere, and then begin opening positions in your selected stocks. The chart below clearly illustrates that all strong pullbacks should be embraced.

Other related articles:

Contrarian Thinking: The Power of Challenging the Status Quo

Mastering Technical Analysis Of The Financial Markets

Unraveling the Enigma: The Dark Allure of Mob Mentality

Contrarian Outlook: A Pathway to Breakthrough or Breakdown

Financial Freedom Book: A Pinch of Salt, a Splash of Whiskey

Unleashing the Power of Small Dogs Of the Dow

Stock Market Forecast for Next 3 & 6 Months

Bank Loans and Financial Freedom in USA: US Financial Liberty Under Siege

Unmasking Deceit: Examples of Yellow Journalism

Mastering the Trading Range: Unlocking the Potential for Explosive Gains

Investment Journal: Charting the Course Toward Financial Triumph

Trading Success: From Riches to Rags and the Rise to Wealth Mogul

Dow theory Forecasts: Alternative could be better

Contrarian Definition: Tactical Investor Trading Methodology

Blooms and Busts: Navigating the Tulip Bubble Chart Phenomenon

Mastering Finance: Beware the Pitfalls of Fear Selling