Unlocking the Power of Cash on the Sidelines

Updated Nov 8, 2023

The greatest insights, particularly in life and financial investments, stem from our historical experiences. Gaining knowledge from the past helps us evade repeating errors and capitalize on emerging possibilities. Exploring historical knowledge can uncover the essential wisdom for achieving success.

In the financial landscape, a remarkable phenomenon has been unfolding as sidelined cash reserves are soaring to unprecedented heights. BlackRock, an economic behemoth, has estimated this figure to exceed $50 trillion. This colossal sum encompasses a myriad of financial metrics, ranging from central banks’ reserves to ordinary consumers’ savings accounts. However, BlackRock is not alone in its assessment, as various other measures corroborate this substantial influx of cash into the sidelines.

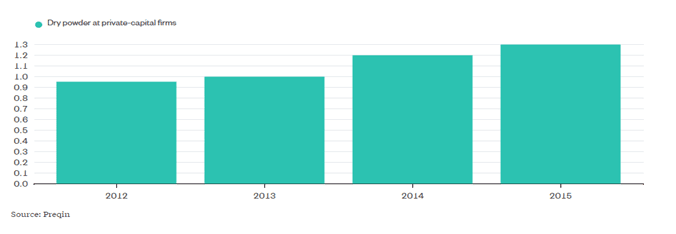

A notable aspect of this cash surge is the private equity sector, where firms stockpile substantial liquid assets. Blackstone, a prominent player in the private equity domain, has disclosed that nearly one-third of its total assets are held in cash, signifying a significant shift towards liquidity. The motivations behind such cash hoarding are multifaceted, ranging from hedging against market uncertainties to preserving capital for future opportunities.

This phenomenon extends its influence to the broader investment landscape. Fund managers responsible for the financial well-being of many have significantly bolstered their cash reserves within their portfolios. These cash allocations have reached levels reminiscent of the early 2000s, reflecting an inclination towards safety and liquidity. Investors appear to be cautious, mindful of the uncertainties that persist in global markets and geopolitical dynamics.

In sum, the surge of sidelined cash signifies more than just a statistical trend. It underscores a prevalent sentiment in the financial world characterized by caution, preparedness, and a deliberate approach to financial strategies. As these immense cash reserves await their deployment, the timing and manner in which they re-enter the market will significantly influence the dynamics of the economic landscape. Full Story

Cash on the sidelines: Impact on Markets and the Economy

The presence of substantial cash reserves on the sidelines can have significant implications for the financial markets and the broader economy. Here are a few key points to consider:

1. Potential Market Impact: The large amount of cash on the sidelines could have the potential to impact market dynamics. When investors hold a significant portion of their portfolios in cash, it represents a pool of potential capital that can be deployed into the market. As market sentiment improves or investment opportunities become more attractive, this sidelined cash may start flowing into various asset classes, such as stocks, bonds, or real estate. Such inflows can stimulate market activity, increase liquidity, and potentially drive asset prices higher.

2. Economic Stimulus: Substantial cash reserves can also be a potential economic stimulus. When investors deploy their cash into the market, it can increase investment and business activity. This, in turn, can spur economic growth, job creation, and consumer spending. As the cash on the sidelines finds its way into productive investments, it can positively affect the overall economy.

3. Market Volatility and Investor Sentiment: The high levels of cash reserves held by various entities, such as central banks, financial firms, and fund managers, reflect a cautious sentiment among investors. Uncertain market conditions, geopolitical tensions, or concerns about overvaluation may prompt investors to hold more prominent cash positions as a defensive strategy. However, this cautious sentiment can also contribute to market volatility. Sudden shifts in investor sentiment or changes in economic conditions can lead to a rapid cash deployment into the market or a rapid increase in cash holdings, potentially amplifying market swings.

4. Investment Opportunities and Timing: The presence of significant cash reserves on the sidelines presents both challenges and opportunities for investors. For those holding cash, the critical question is when and where to deploy it. Timing the market and identifying attractive investment opportunities can be challenging as market conditions and asset valuations constantly evolve. Investors must carefully assess market dynamics, conduct thorough research, and consider their risk tolerance and investment objectives when deciding how and when to deploy their sidelined cash.

5. Overall Economic Confidence: The level of cash reserves held on the sidelines also reflects the overall confidence and sentiment in the economy. When investors hesitate to deploy capital and hold large cash positions, it may indicate a lack of confidence in the economic outlook. Conversely, when investors deploy their cash reserves, it can signal growing confidence and optimism in the market and economic conditions.

The Market’s Extraordinary Path: The Pursuit of Infinite Inflation

This reaffirms the signals our psychological and sentiment indicators have consistently conveyed – a sense of apprehension prevails among the masses, despite the market hovering near its peak.

The unfolding scenario is nothing short of extraordinary, indicating that this bull market possesses the potential to surge to heights that might seem fantastical to the sober observer. Gradually, the phrase “inflate to infinity” will creep into the lexicon of mainstream media; covertly, it appears to be the Federal Reserve’s newfound slogan. The consequence of this pursuit extends beyond the devaluation of the US dollar; it aspires to undermine other global currencies. In this grand illusion, the Dollar, while deteriorating, will continue to appear robust since it is simply outlasting its counterparts in the race to the bottom. In a world where you compare one depreciating currency to another, the perception of strength is easily manipulated.

The Impact of Cash on the Sidelines: Nervous Sentiment and Market Dynamics

The presence of substantial cash reserves on the sidelines can have significant implications for the financial markets and the broader economy. It is evident that private equity firms have been steadily building up their cash reserves, anticipating what they perceive as a fair-valued market. However, assigning a fair value in today’s market climate is challenging, as various factors have made it difficult to assess market conditions accurately. Manipulations in earnings per share (EPS) have altered vital data, leading to a sense of scepticism in the market. Instead of focusing on traditional valuation metrics, market participants emphasise mass sentiment and technical indicators.

Many investors await the optimal entry point, anticipating a significant market pullback. However, the likelihood of such a pullback is uncertain, and those waiting may be forced to chase the market’s upward trajectory. The abundance of cash on the sidelines reflects a cautious sentiment among investors and serves as a potential floor for the market. This cash acts as a reserve that can be deployed when market conditions become favourable or investors gain more confidence in the outlook.

The large amount of cash on the sidelines also provides clear evidence that the masses are nervous and skittish about the market’s direction. Instead of taking on excessive risks, investors are holding onto cash, waiting for more clarity and favourable opportunities. This nervous sentiment can influence the path of least resistance in the market, potentially leading to increased volatility as sentiment shifts.

Unleashing the Cash: Secrets of Market Volatility

The presence of substantial cash reserves on the sidelines can have an impact on market volatility. Here are a few ways in which the presence of cash reserves can influence market volatility:

1. Liquidity Effect: Cash reserves represent a pool of potential capital that can be deployed into the market. When investors hold a significant amount of cash, it adds to the overall liquidity in the market. Higher liquidity can help absorb selling pressure during market downturns, potentially mitigating the extent of price declines. Conversely, when investors start deploying their cash into the market, it can increase buying pressure and potentially drive up asset prices, contributing to increased volatility.

2. Investor Sentiment: The level of cash reserves investors hold can reflect their sentiment and risk appetite. In times of uncertainty or economic instability, investors may hold more prominent cash positions as a defensive strategy. This cautious sentiment can increase market volatility as investors react to changing market conditions or news events. Sudden shifts in investor sentiment can lead to significant buying or selling activity, amplifying market swings.

3. Timing and Deployment: The timing and manner in which cash reserves are deployed can impact market volatility. When cash is deployed gradually and measured, it can help stabilize market movements by providing consistent demand for assets. However, if a large amount of cash is deployed simultaneously, it can lead to sudden price movements and increased volatility. How currency is deployed through systematic investment strategies or market orders can also influence market dynamics and volatility levels.

4. Market Perception and Confidence: Substantial cash reserves on the sidelines can influence market perception and confidence. When investors hold significant cash positions, it may indicate a lack of confidence in the market or uncertainty about prospects. This cautious sentiment can increase market volatility as investors react to changing news, economic data, or geopolitical events. Conversely, when investors start deploying their cash and demonstrating confidence in the market, it can increase market stability and potentially reduce volatility.

Unveiling Investment Opportunities in Cash-Ready Markets

Cash on the sidelines has historically presented buying opportunities for investors. Here are a few reasons why:

1. Market Corrections and Pullbacks: When market corrections or pullbacks occur, investors with cash reserves can take advantage of lower asset prices. These periods of market downturns often result in attractive valuations, offering buying opportunities for those with available cash. By deploying their sidelined cash during these market downturns, investors can acquire assets at discounted prices, positioning themselves for potential future gains as the market recovers.

2. Market Timing: Holding cash reserves allows investors to time their investments strategically. Investors who patiently wait for favourable market conditions, such as when valuations are more attractive or when sentiment improves, can deploy their cash at opportune moments. By carefully monitoring market trends and indicators, investors can identify potential turning points or undervalued assets, allowing them to make well-timed investments and benefit from subsequent market appreciation.

3. Capitalizing on Fear and Pessimism: When market sentiment is predominantly negative, and fear or pessimism prevails, investors with cash on the sidelines can capitalize on the emotions of others. During such periods, market prices may be driven down by excessive selling pressure or panic selling. Investors with cash reserves can act as contrarians, taking advantage of the market’s negative sentiment and acquiring assets when others sell. This contrarian approach can lead to attractive entry points and the potential for long-term gains as market sentiment eventually improves.

4. Flexibility in Asset Allocation: Holding cash reserves allows investors to adjust their asset allocation in response to changing market conditions. During market exuberance or overvaluation periods, investors can choose to hold higher cash positions to reduce risk and preserve capital. Conversely, when market conditions become more favourable or specific sectors or asset classes show attractive prospects, investors can deploy their sidelined cash to rebalance their portfolios and allocate capital to areas with potential growth opportunities.

5. Long-Term Investment Strategies: Cash on the sidelines can be part of a disciplined, long-term investment strategy. By maintaining a portion of their portfolios in cash, investors can take advantage of market volatility and deploy capital when opportunities arise. This approach allows investors to keep a prudent allocation, manage risk, and capitalize on market fluctuations over the long term.

Initially published on November 15, 2016, and continually updated over the years, with the most recent update in November 2023.

Expand Your Perspective: Dive In!

Neocon Perceptions and the Illusion of Nuclear Warfare

Stocks To Buy Today Reddit – Focus on the Trend, Ignore the Noise

12 Best Tropical Paradises to Visit for Your Dream Getaway

Neocon 2023: Debunking the Nuclear War Myth

Gold Spot Price History: Will Gold Continue Trending Upwards

Mastering the MACD Strategy: A Powerful Tool for Investors

Surviving the Death of Education: Navigating the New Age of Learning

AI wars: The battle for Supremacy

Why Is Inflation Bad for the Economy? Demystifying the Menace

Chinese ChatGPT Rivals: Threat to Industry Dominance?

Rethinking Education: Embracing AI and its Implications

Yen Crash: Approaching the Bottom or Further Decline Ahead?

Puppet Master: China Vs USA: Who Is The Spider

Decoding the Enigma: What Are Gold Bugs

Long-Term Gold Targets: Exploring the Path to the Moon

Revamping the 60 40 Rule: Unleashing New Strategies for Success