Sentiment Analysis states major stock market corrections equate to opportunity. Sol Palha

Stock market crash 2008 & Stock Market Crash 2016?

Updated Jan 2023

If the markets crash in 2016, what will they have in common with the stock market crash in 2008? The common factor is that the mass media and the crowd will once again be sitting on the wrong side of history. All stock market crashes to date proved to be nothing but buying opportunities.

The central driving theme has always been to put the fear of God into the masses the moment the markets start to correct. As the correction picks up steam, the talking heads scream louder and louder. If the masses would just pause for a second, they would realise that this is nothing but Groundhog’s dog. These same idiots made the same proclamation if they were alive during the last stock market sell-off and as always, the masses were left holding the empty can, while the smart money made out like bandits.

Stock Market Outlook 2016: A Striking Resemblance to the 2008 Stock Market Crash?

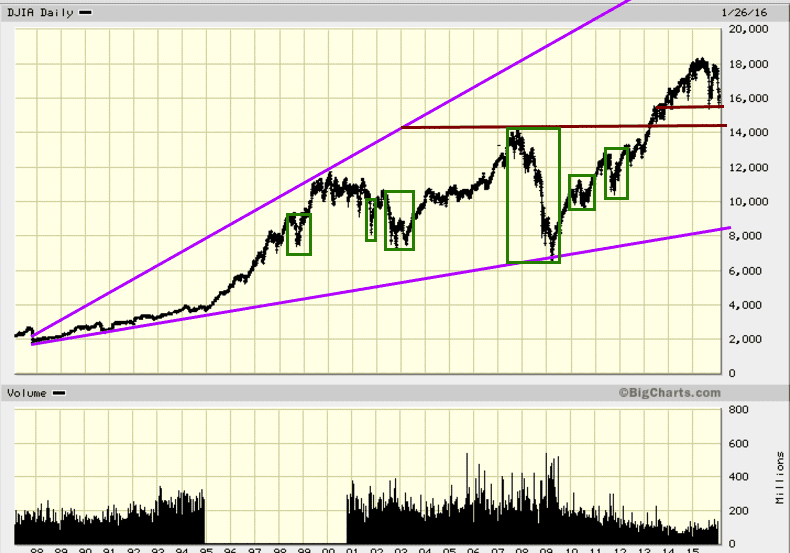

Instead of wasting a thousand words to explain the situation, we will let an image to the talking. The chart below clearly illustrates our point that every sharp pullback/correction is nothing but a buying opportunity.

The current situation is simply a repeat of past patterns, and as was the case with the stock market crash in 2008, the next crash will prove to be a splendid buying opportunity.

There is nothing new here. The mass hysteria and reaction from the media are the same. This is nothing but Déjà vu. The theme never changes. It’s like a broken record repeating the same nonsense repeatedly.

It goes likes this; something terrible is going to happen a stock market crash is imminent, take cover and run for the hills. Sure, in the short-term, the markets have experienced some violent moves, but fast forward, in every case, the markets recouped and traded higher. People will mention Japan as an example of a market that is still trying to play catch up decades later. Well, what happened in Japan happened in a different era?

Tactical Investor’s Stock Market Outlook for 2016

We are now in the era of massive currency wars; in other words, every nation is hell-bent on debasing its currency, or it is being forced to because major players have jumped on the bandwagon. In such an environment, normal rules do not apply, and central bankers usually respond by flooding the markets with money. Regardless of this issue, look at this long-term chart of the Dow, and it clearly illustrates that every so-called disaster was nothing but a buying opportunity.

For amusement purposes, we will list all the nonsense many of the naysayers are using to validate their arguments that stocks are headed lower

Ultra-low oil prices Could lead to Stock Market Correction

We are told that low oil prices are bad for the economy. Hold on, was it not too long ago they were telling us that high oil prices were bad for the economy, so which one is it. Many oil companies will go bankrupt, but the ones that are left will emerge strong and be ready for the next bullish phase.

Because oil prices are low, car sales jumped and set a record last year; 17.5 million vehicles were sold, and many consumers started purchasing Gas guzzlers they were avoiding before due to high gas prices. Ultra-low oil prices are the equivalent of central bankers injecting roughly $1 trillion dollars into the global financial system, as that is how much the global economy will save at these rates.

The China factor could be the switch that triggers a Stock Market sell-off

The claim here is that China’s economy is slowing down, and as a result, have a negative impact on our economy. U.S. Corporations export roughly $500 billion per year worth of goods to China. We have an $18 trillion economy; hence, this is a non-event in our books, unless you have plenty of time your hands to waste on useless endeavours. Focus on the trend, not the noise, for the trend is your friend, and everything else is you your foe.

Uncertainty after the Fed’s raised rates could lead to a significant Stock Market Correction

For heaven’s sake, the Fed only raised rates by a paltry 0.25%, so what is all the fuss about? In our opinion, even another 2-3 rates will do nothing to derail this economy as rates are being raised from ultra-low levels. We think that the Fed will be forced to come out with another stimulus sooner than later as this economic recovery is nothing but an illusion.

The Fed’s only function is to create boom and bust cycles artificially. Other than that they have no other function in the market. They are a parasitic organisation, and if we had decent politicians, they would have abolished the Fed long ago. However, to find out more on the real function of the Fed, consider reading this article. Federal Reserve Bank-Most Dangerous Criminal Enterprise In the World.

In the interim, until Fiat is abolished every strong market correction has to be viewed as a buying opportunity as banks and the elite money players take a perverse delight in fleecing the masses from the little they have. To control the masses, they have to make sure that they have just enough to survive but not enough to think. Hence the term “rat race’: people are hustling and bustling, but at the end of the day they are going nowhere. Like Hamsters, they run faster and faster, but only the wheel spins faster; exhausted, they get off the wheel too tired to realise that have not even advanced one centimetre.

Stock Market Outlook 2016: Strategies for Navigating Market Sell-Offs

March to your drumbeat; do not listen to the Doctors of Doom. As we stated in several of our past updates, we expect 2016 to be the most volatile year on record to date. Now is the time to build up a nice list of stocks you always wanted to own but felt were too expensive to buy. History indicates that the stronger the markets deviate from the norm, the better the buying opportunity. Here is a small list of stocks that have held up remarkably well during the current sell-off; PBY, IGLD, PRMW, MCD, MO, CALM, etc.

Stock market outlook 2016: A Trump win will delay Stock Market Correction

A Trump will drive the masses to stampede as the media outlets will serve them extra doses of fear, and like fools, they will jump off the cliff without a worry in the world. If this should transpire, don’t fall for the Garbage; as we have repeatedly stated, the trend is up, and until the trend changes, every strong pullback has to be viewed through a bullish lens. The advice we offered our paying subscribers back in May of 2015 still stands:

When you think logically and or use old parameters to gauge this market, every single bone in your body probably screams out that this market should crash and burn. That is true, but it is also true that as nothing is real, logic has no place in the illusory.

How can you use logic (which is based on using real and compelling data) to judge an event that is illusory in nature? Every statistic imaginable has been, is being or will be manipulated to satisfy whatever picture the manipulators want the masses to believe in.

It takes two to tango, one to cry and three to have a party, thus the crowd is as complicit in this game as are the manipulators. The most likely outcome is that the markets will trade higher than anyone expects as long as the trend remains up. Market Update May 31, 2015

Do not fixate on the Stock market outlook 2016 or the Stock Market outlook 2017, as the players that fixated on the stock market crash in 2008 found out the hard way. They swallowed the lie that the world would end, but the only thing that took a beating was their trading accounts. Focus on the trend and on the masses. If the masses are panicking, it is time to buy and vice versa. The movement is your friend, and everything else is your foe. So if a stock market crash 2008 event-type scenario unfolds again, don’t panic but jump in with both feet and buy all the quality stocks you can buy. Then sit down on them for a few years and retire.

Latest from Tactical Investor: August 2019 Update

We have simplified the most important aspect of investing: identifying the trend of the markets. If you ask any investor, who has put money into the markets, what’s the most challenging part of investing, they will answer without hesitation that determining the trend is the hardest part of the investing process. Many individuals don’t fully understand how much time and effort we allocate to nailing the trend. It is a complex process that entails examining several factors, and then all these separate pieces of data are combined to help determine the direction.

Once the trend is identified, the rest of the investing process is relatively easy. We issue many plays, and the reason for this is simple. It allows every new trader to identify plays that appeal to them. It is not easy to eliminate past conceptions and embrace new ideas. This process takes time; therefore, we are trying to make it easier by providing a vast array of plays. Now instead of being overwhelmed by the number of plays, one should understand that one does not need to open a position in all the plays. Choose those that appeal to you and ignore the rest until you get used to our methodology. As you gain confidence, you can deploy larger amounts of capital.

Originally published on August 9, 2020, this continually updated piece has undergone multiple revisions over the years, with the latest update in January 2023.

Other related stories:

Raytheon Company setting up bullish pattern (Jan 27)

What’s behind the crash in Crude oil prices? Mass Psychology (Jan 26)

Economic Illusions: Economy Improving but wages dropping (Jan 25)

Median Household Income declining: Obama Economic Recovery a sham (Jan 24)

Deadly Conflict In Syria: Blood, Guns and Money (Jan 23)

No U.S Economic Recovery:1 in five children on food stamps (Jan 23)

Crude oil Market Crash: Technical Outlook for 2016 (Jan 21)

Belt & Road Initiative: Taking China’s culture beyond borders (Jan 15)