Unlocking the Definition and Formula for Velocity of Money

Dec 29, 2024

A key economic indicator, the velocity of money, measures the rate at which money circulates in an economy. It’s calculated by dividing the GDP by the money supply, with a higher velocity suggesting a more active economy.

Psychological Factors Influencing Velocity

Dr Richard Thaler, Nobel laureate in economics, emphasizes the role of behavioural economics in understanding money velocity. He notes, “Consumer confidence and spending habits are deeply rooted in psychological factors, which can significantly impact the velocity of money”. This insight helps explain why velocity fluctuates with the business cycle:

- Economic Upturns: Increased confidence leads to higher spending and velocity.

- Downturns: Spending slows, decreasing velocity.

Practical Application: Calculating Money Supply

To demonstrate, let’s solve an example:Given:

- Real output (Q) = $9,000

- Price level (P) = 2

- Velocity of money (V) = 3

To determine the money supply, we can use the equation of exchange:

MV = PQ

Where:

M = Money supply: V = Velocity of money: P = Price level

Q = stands for the quantity of goods and services produced.

Using the equation of exchange (MV = PQ), we can calculate:M * 3 = 2 * $9,000 M = $18,000 / 3 M = $6,000Thus, the money supply is $6,000.

The Federal Reserve’s Stance on Velocity of Money

The Federal Reserve’s observations on the velocity of money have challenged traditional assumptions and led to a reevaluation of monetary policy frameworks.

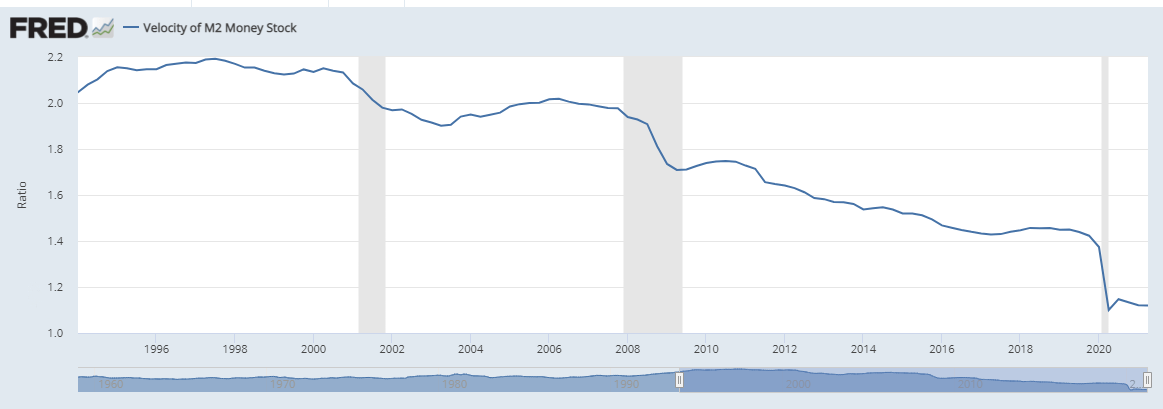

Unexpected Low Inflation: Between 2008 and 2013, despite the money supply growing at an average pace of 33% per year while output grew by just under 2%, inflation remained persistently low, below 2%. This contradicted projections based on the standard velocity formula, which suggested inflation should have been around 31% annually.

Dr Jerome Powell, current Federal Reserve Chair, explains: “The breakdown of the traditional relationship between money supply growth and inflation has forced us to reconsider our models and policy approaches. We’ve had to look beyond simple monetary aggregates to understand inflationary pressures.”

Factors Contributing to Low Velocity

- Liquidity Trap: Dr. Paul Krugman, Nobel laureate economist, argues that the U.S. entered a liquidity trap post-2008: “In a liquidity trap, conventional monetary policy loses its effectiveness. Increases in the money supply fail to stimulate the economy as expected, leading to lower velocity.”

- Behavioural Shifts: Dr Richard Thaler notes: “The 2008 financial crisis induced lasting changes in consumer and business psychology. Increased risk aversion and precautionary saving have dampened the circulation of money in the economy.”

- Global Economic Factors: Former Fed Vice Chair Dr. Stanley Fischer points out: “Globalization and technological advancements have fundamentally altered how money moves through the economy, complicating our understanding of velocity.”

Policy Implications

The Fed’s experience with unexpectedly low velocity and inflation has led to significant policy shifts:

- Forward Guidance: The Fed has increasingly relied on communication to influence expectations and behaviour.

- Unconventional Monetary Policy: Tools like quantitative easing have become more prominent.

- Flexible Average Inflation Targeting: Adopted in 2020, this framework allows inflation to run above 2% to compensate for periods of below-target inflation.

Dr. Lael Brainard, Federal Reserve Governor, summarizes: “Our evolving understanding of money velocity has underscored the need for a more holistic approach to monetary policy. We now pay closer attention to broader economic indicators and financial conditions.”This expanded section provides a more comprehensive view of the Federal Reserve’s stance on the velocity of money, incorporating expert opinions and explaining the policy implications of their observations.

Let’s zoom in

The Sluggish Velocity of Money: Implications for Economic Prosperity and Psychological Factors

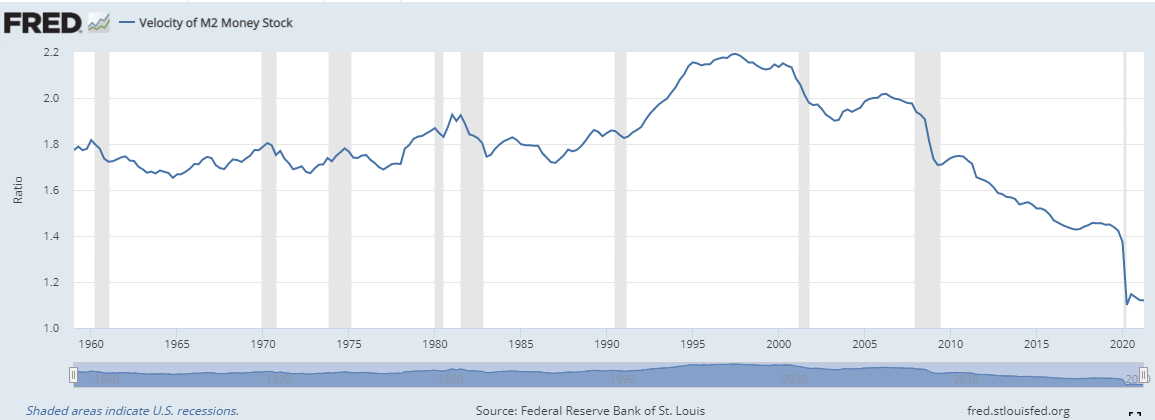

The velocity of money, a crucial economic indicator, has been experiencing a significant slowdown in recent years, raising concerns about its impact on economic growth and prosperity. Despite the Federal Reserve’s expansionary monetary policies, which have substantially increased the money supply, the velocity of money has plummeted to historically low levels.

Understanding Velocity and Its Decline

Former Federal Reserve Chair Dr. Janet Yellen explains: “The velocity of money measures how quickly money circulates in the economy. A higher velocity typically indicates a more active economy with frequent transactions.”

However, recent data from the Federal Reserve Bank of St. Louis (FRED) shows a troubling trend:

– Velocity declined from 1.53 in 2014 to 1.12 in 2021

– This is a stark contrast to much higher historical levels

Psychological Factors Influencing Velocity

Dr Richard Thaler, Nobel laureate in behavioural economics, offers insight into the psychological underpinnings of this phenomenon:

1. Risk Aversion: “The 2008 financial crisis and subsequent economic uncertainties have induced lasting changes in consumer and business psychology. Increased risk aversion has led to more precautionary saving, dampening money circulation.”

2. Expectations and Spending Behavior: During periods of economic uncertainty, people’s expectations about future economic conditions can significantly impact their spending decisions. This psychological factor can create a self-fulfilling prophecy, where reduced spending leads to lower velocity, reinforcing economic sluggishness.

Economic Implications

The slowdown in money velocity has significant implications for economic prosperity:

1. Reduced Economic Activity: A lower velocity indicates that each dollar generates less output as transactions slow down and money remains idle.

2. Impact on Inflation: Despite increased money supply, inflation has remained persistently low, contradicting traditional economic theories.

3. Challenges for Monetary Policy: Dr. Jerome Powell, the current chair of the Federal Reserve, notes, “The breakdown of the traditional relationship between money supply growth and inflation has forced us to reconsider our models and policy approaches.”

Factors Contributing to Low Velocity

1. Near-Zero Interest Rates: Between 2008 and 2013, nominal interest rates on short-term bonds reached near-zero levels, making money the preferred risk-free liquid asset.

2. Liquidity Trap: Nobel laureate Dr. Paul Krugman argues that the U.S. entered a liquidity trap post-2008, in which conventional monetary policy lost effectiveness.

3. Global Economic Factors: Former Fed Vice Chair Dr. Stanley Fischer states, “Globalization and technological advancements have fundamentally altered how money moves through the economy, complicating our understanding of velocity.”

Policy Implications and Future Outlook

To address the sluggish velocity of money, policymakers are considering various approaches:

1. Targeted Fiscal Policies: Government spending on infrastructure and job creation programs to stimulate economic activity.

2. Innovative Monetary Tools: Developing new strategies to encourage spending and investment.

3. Psychological Interventions: Dr Thaler suggests: “Policymakers should consider behavioural interventions that can boost consumer confidence and encourage more active participation in the economy.”

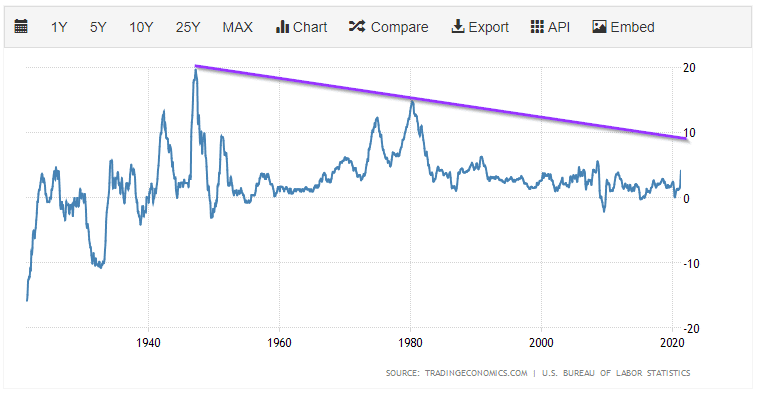

The 107-year chart of the CPI illustrates that it would have to trade past 10 to break its downtrend line, suggesting that inflation might not be something to fret over from a historical perspective.

The Declining Velocity of Money: Causes, Implications, and Potential Solutions

The velocity of money, a crucial economic indicator, has been experiencing a significant slowdown in recent years, raising concerns about its impact on economic growth and prosperity. Despite expansionary monetary policies, the velocity has plummeted to historically low levels.

Dr. Eswar Prasad, professor of economics at Cornell University, explains: “The declining velocity of money reflects a fundamental shift in how economic agents interact with the financial system and each other. It’s not just about policy; it’s about changing behaviours and technological disruptions.”

Causes of the Declining Velocity:

1. Unprecedented Money Demand: Dr. Kenneth Rogoff, professor of economics at Harvard University, notes: “Near-zero interest rates have made cash a preferred risk-free asset, leading to increased hoarding.”

2. Behavioral Shifts: Dr. Annamaria Lusardi, professor of economics at George Washington University, observes: “Financial literacy plays a crucial role. Better-informed consumers make different decisions about saving and spending, impacting velocity.”

3. Income Inequality: Dr Thomas Piketty, professor at the Paris School of Economics, argues: “Rising wealth concentration can significantly reduce overall spending propensity, slowing down money circulation.”

4. Technological Advancements: Dr. Nouriel Roubini, professor at NYU’s Stern School of Business, points out: “Fintech innovations have changed transaction patterns, sometimes in ways that reduce traditional measures of velocity.”

Implications:

1. Economic Growth Challenges: Dr. Carmen Reinhart, professor of economics at Harvard Kennedy School, warns: “Persistently low velocity can lead to a liquidity trap, making monetary policy less effective in stimulating growth.”

2. Deflationary Risks: Dr. Paul Krugman, Nobel laureate economist, cautions: “With sluggish velocity, we face increased risks of deflationary spirals, which are notoriously difficult to escape.”

3. Labor Market Effects: Dr. David Autor, professor of economics at MIT, notes: “Slower money circulation can dampen job creation, potentially exacerbating structural unemployment issues.”

Potential Solutions:

1. Targeted Fiscal Policies: Dr. Olivier Blanchard, former chief economist at the IMF, suggests: “Carefully designed public investment programs could help jumpstart velocity by directly injecting money into high-multiplier sectors.”

2. Innovative Monetary Tools: Dr. Raghuram Rajan, a professor at the University of Chicago Booth School, proposes that “central banks might need to consider more direct methods of money injection, possibly even ‘helicopter money’ in extreme scenarios.”

3. Addressing Income Inequality: Dr. Emmanuel Saez, professor of economics at UC Berkeley, emphasizes: “Progressive taxation and enhanced social safety nets could help redistribute income in ways that boost overall spending propensity.”

4. Encouraging Financial Innovation: Dr Cathie Wood, CEO of ARK Invest, argues: “Embracing and regulating new financial technologies could lead to more efficient money circulation in the digital age.”

In conclusion, the declining velocity of money presents complex challenges requiring multifaceted solutions. As Dr. Joseph Stiglitz, Nobel laureate economist, summarizes: “Addressing this issue demands a holistic approach, combining fiscal, monetary, and structural policies tailored to our rapidly evolving economic landscape.”