Unlocking the Definition and Formula for Velocity of Money

Updated April 25, 2024

The velocity of money measures how fast money circulates in an economy, indicating economic vibrancy and development. It’s calculated by dividing the GDP by the money supply. A higher velocity suggests a more active economy where transactions occur frequently.

Velocity fluctuates with the business cycle. In economic upturns, confidence leads to increased spending and higher velocity. In downturns, spending slows, and velocity decreases. Velocity correlates with GDP and inflation; it typically rises with them during growth and falls during contractions or low inflation.

This metric helps analyze economic health and the impact of monetary policy. It’s affected by various factors, including consumer behaviour, technological changes, and global economic events. Understanding money velocity is essential for grasping economic dynamics and informing policy decisions.

The best way to demonstrate the above is via an example

if real output is $9,000 the price level is 2, and the velocity of money is 3, then the money supply is?

To determine the money supply, we can use the equation of exchange:

MV = PQ

Where:

M = Money supply

V = Velocity of money

P = Price level

Q = stands for the quantity of goods and services produced.

Given:

– Real output (Q) is $9,000

– Price level (P) is 2

– Velocity of money (V) is 3

Let’s plug these values into the equation and solve for M:

MV = PQ

M * 3 = 2 * $9,000

M * 3 = $18,000

Now, divide both sides by 3 to isolate M:

M = $18,000 / 3

M = $6,000

Therefore, if the actual output is $9,000, the price level is 2, and the velocity of money is 3, then the money supply is $6,000.

The Federal Reserve’s Stance on the Velocity of Money Formula

According to the equation for the velocity of money, assuming a constant velocity, when the money supply (M) grows at a faster rate than actual economic output (Q), the price level (P) is expected to increase to compensate for this difference. In line with this perspective, it was projected that inflation in the U.S. would be approximately 31 per cent per year between 2008 and 2013. During this period, the money supply grew at an average pace of 33 per cent per year, while output experienced an average growth rate of just below 2 per cent. However, contrary to these projections, inflation remained persistently low, below 2 per cent.

Understanding Persistently Low Inflation: A Multi-Faceted Approach

Persistently low inflation has been a perplexing phenomenon in many economies, driven by various factors. To comprehend this economic trend, it is crucial to examine the key contributors:

1. Velocity of Money: The velocity of money, which measures the rate at which money circulates in the economy, has been unpredictable and often deviated from theoretical expectations. For example, despite a significant increase in the money supply, the U.S. experienced low inflation between 2008 and 2013 due to a decline in money velocity.

2. Economic Conditions and Confidence: The global financial crisis of 2008 led to economic uncertainty, reducing consumer and business confidence. This translated into decreased spending and investment, slowing the transmission of money supply growth into inflation.

3. Central Bank Actions: Central banks have employed various monetary policy tools, such as adjusting interest rates and quantitative easing, to manage inflation and influence the money supply.

4. Labor Market Conditions: High unemployment or underemployment can lead to wage stagnation, suppressing consumer spending and keeping inflation low.

5. Productivity and Technology: Advances in technology and productivity can result in cost savings for businesses, which may be passed on to consumers through lower prices, curbing inflation.

6. Global Trade Dynamics: International trade affects domestic inflation through competition and the availability of cheaper imports, keeping domestic prices in check.

7. Government Policies: Fiscal policies, including taxation and government spending, can influence economic activity and inflation.

8. Consumer Behavior: Shifts in consumer preferences towards saving over spending can reduce the velocity of money and dampen inflationary pressures.

Two renowned experts in the field, Milton Friedman and Ben Bernanke, have provided valuable insights into inflation dynamics. Friedman famously stated that “inflation is always and everywhere a monetary phenomenon,” emphasizing the central role of money supply in driving persistent inflation. However, Bernanke, the former Federal Reserve Chairman, has highlighted the importance of considering short-term factors and the complexities of the modern economy in understanding inflation.

Real-world examples, such as Japan’s “Lost Decade” and the post-2008 era in the U.S., demonstrate the challenges of managing inflation in the face of economic uncertainties and unconventional monetary policies.

The Velocity of Money: A Concerning Decline and AI Disruption

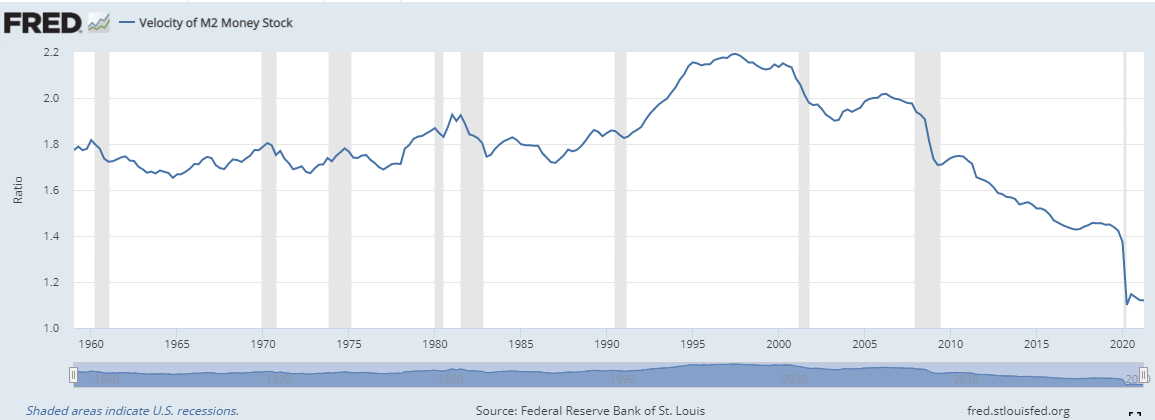

The observed trend in the velocity of money raises concerns about the authenticity of the economic recovery from its inception. If we examine the velocity of money, it appears to have experienced a significant decline, reaching new lows before stabilizing. This begs the question: What could be the underlying cause? One plausible explanation could be that the market is already factoring in the disruptive potential of artificial intelligence (AI). The advent of AI threatens established business practices and numerous industries that have been slow to adapt, including large banks, law firms, many mega-corporations, and even governmental institutions, which are considered the most significant contributors to this issue.

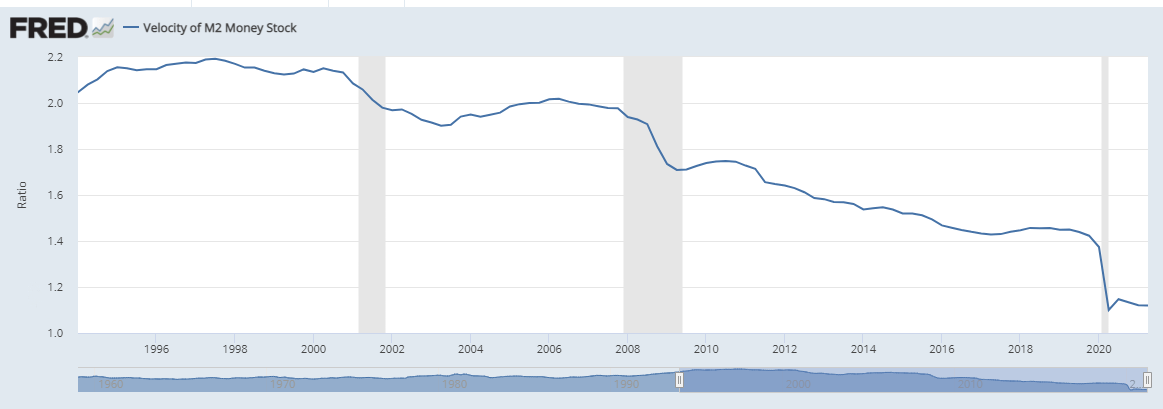

Let’s zoom in

The Sluggish Velocity of Money: Implications for Economic Prosperity

The velocity of money, a crucial economic indicator, has been experiencing a significant slowdown in recent years, raising concerns about its impact on economic growth and prosperity. Despite the Federal Reserve’s expansionary monetary policies, which have substantially increased the money supply, the velocity of money has plummeted to a mere 4.4 rotations per year, a stark contrast to its historical levels.

Economists have been puzzled by this phenomenon, as conventional economic theory suggests that increasing the money supply should lead to higher inflation and economic output. However, the reality has been quite different. The U.S. gross domestic product (GDP) has grown sluggishly while inflation has remained persistently low.

One possible explanation for this discrepancy is the unprecedented increase in money demand. Between 2008 and 2013, the nominal interest rate on short-term bonds reached near-zero levels, making money the preferred risk-free liquid asset over short-term government bonds. As a result, individuals and the private sector chose to hoard cash rather than spend it, leading to a substantial decline in the velocity of money.

According to a linear regression model, a one percentage point decrease in 10-year Treasury note interest rates was associated with an average decline of 0.17 points in the velocity of the monetary base. However, the actual deterioration in velocity during the 2008-2013 period was a staggering 5.85 points, 69 times larger than predicted.

The slowdown in money velocity has significant implications for economic prosperity. A lower velocity indicates that each dollar in the economy generates less output as transactions slow down and money remains idle. This can lead to reduced consumer spending, decreased business investment, and slower economic growth.

The situation has only worsened in recent years. According to data from the Federal Reserve Bank of St. Louis (FRED), the velocity of money has further declined from 1.53 in 2014 to 1.12 in 2021, indicating a persistent and troubling trend.

Policymakers and economists are grappling with the challenge of reigniting the velocity of money and stimulating economic growth. Some potential solutions include targeted fiscal policies, such as government spending on infrastructure and job creation programs, and innovative monetary policy tools that encourage spending and investment.

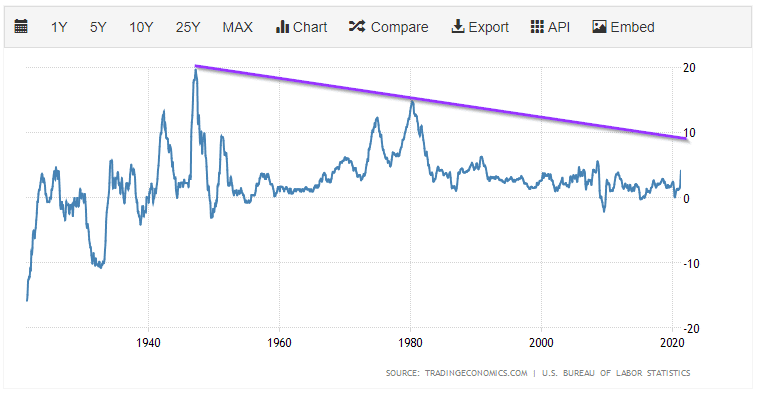

The 107-year chart of the CPI illustrates that it would have to trade past 10 to break its downtrend line, suggesting that inflation might not be something to fret over from a historical perspective.

The key points to focus on are:

The velocity of money continues to fall, which implies that all is not well. In other words, remove the money supply, and this magic cycle of prosperity will increase in smoke. Whatever happens, the Fed will not stop pumping money into this economy. They might hit the brakes on one program, but they will press the pedal to the metal on another. From a much higher vantage point, this development foreshadows the demise of the human workforce.

When discussing inflation, it matters what reference points are used. Randomly selecting points to match one’s argument amounts to curve fitting. Theoretically, if one does that, rubbish can smell like roses.

The Declining Velocity of Money: Causes, Implications, and Potential Solutions

The velocity of money, a crucial economic indicator, has been experiencing a significant slowdown in recent years. This decline has raised concerns about its impact on economic growth and prosperity. Despite the Federal Reserve’s expansionary monetary policies, which have substantially increased the money supply, the velocity of money has plummeted to a mere 4.4 rotations per year, a stark contrast to its historical levels.

Causes of the Declining Velocity of Money:

1. Unprecedented increase in money demand: During the 2008-2013 period, the nominal interest rate on short-term bonds reached near-zero levels, making money the preferred risk-free liquid asset over short-term government bonds. As a result, individuals and the private sector chose to hoard money rather than spend it.

2. Behavioral shifts: Consumer confidence, investment decisions, saving habits, credit access, and technological changes significantly impact the velocity of money. Pessimistic outlooks may lead to increased saving and reduced spending, while optimistic views can result in more spending and a faster velocity of money.

3. Income inequality: High-income inequality can contribute to a lower velocity of money, as wealthier individuals and entities are more likely to save than spend.

4. Technological advancements: Digital payment systems and financial technology innovations have expanded financial inclusion, potentially increasing the velocity of money. However, they can also introduce market volatility and affect consumer and investor behaviour.

Implications of the Declining Velocity of Money:

1. Slower economic growth: A lower velocity indicates that each dollar in the economy is generating less output as transactions slow down and money remains idle. This can lead to reduced consumer spending, decreased business investment, and slower economic growth.

2. Deflationary risks: With a lower velocity of money, there’s a risk of deflation. Fewer transactions can lead to a drop in price levels, which is the opposite of the inflation that monetary stimulus efforts aim to achieve.

3. Unemployment: A slower velocity of money can negatively impact job creation due to reduced economic activity, potentially leading to higher unemployment rates.

4. Monetary policy challenges: When the velocity of money is low, traditional monetary policy tools, such as interest rates and money supply, may become less effective.

Potential Solutions:

1. Targeted fiscal policies: Government spending on infrastructure and job creation programs can stimulate economic activity and increase the velocity of money.

2. Innovative monetary policy tools: Central banks may need to consider alternative measures to encourage spending and investment, such as negative interest rates or direct cash transfers to households.

3. Addressing income inequality: Policies aimed at reducing income inequality, such as progressive taxation and increased access to education and training, can help improve the velocity of money by ensuring more income is circulated within the economy.

4. Encouraging technological adoption: Promoting the adoption of digital payment systems and financial technology innovations can help increase financial inclusion and potentially boost the velocity of money.

Conclusion

The velocity of money is supposed to rise when GPD rises and economic activity expands. It is also believed to increase when consumers spend more. But it’s not. Perhaps this is why economics has been called the dismal science and why monkeys armed with darts can outperform experts and economists with PhDs.

Einstein viewed quantum entanglement as “spooky action”; perhaps that name should have been reserved for economics. It’s spooky how experts in the field of economics get paid so well when they are almost always wrong.

In conclusion, the declining velocity of money poses significant challenges to economic growth and stability. Understanding this phenomenon’s underlying causes and implications is crucial for policymakers and economists in developing effective strategies to address the issue. By implementing targeted fiscal policies, innovative monetary tools, and measures to reduce income inequality and encourage technological adoption, we can work towards restoring the vitality of the economic engine and ensuring sustainable prosperity for all.

Articles That Cover a Spectrum of Timeless Topics

Quantitative Easing: Igniting the Corruption of Corporate America

Uranium Market Outlook: Prospects for a Luminous Growth Trajectory

Stock Investing for Kids: Surefire Path to Success!

An Individual Who Removes the Risk of Losing Money in the Stock Market: A Strategic Approach

Palladium Forecast: Unveiling the Stealth Bull Market

I Keep Losing Money In The Stock Market: Confronting the Stupidity Within

Analyzing Trends: Stock Market Forecast for the Next 6 Months

Market Mastery: The Best Investing Books for Your Success

Example of Groupthink: Mass Panic Selling at Market Bottom

Contrarian Thinking: The Power of Challenging the Status Quo

Mastering Technical Analysis Of The Financial Markets

Contrarian Outlook: A Pathway to Breakthrough or Breakdown

Financial Freedom Book: A Pinch of Salt, a Splash of Whiskey

Unleashing the Power of Small Dogs Of the Dow