The Silent Bull: How to Play It Before It Takes Off

April 9, 2025

The Paradox of the Invisible Rally

It doesn’t roar. It doesn’t announce itself. There’s no fanfare, no euphoric CNBC headline screaming “New Bull Market Begins.” The silent bull doesn’t walk through the front door—it seeps in, camouflaged by noise, shrouded in disbelief. You don’t see it in the numbers at first. You feel it in the rhythm, in the subtle change of character. It creeps through the shadows of a bear narrative that overstayed its welcome.

Markets, like myths, move in cycles—but not the clean, clockwork ones you read about in textbooks. They churn in strange weather. They invert logic. The biggest moves tend to come when consensus is asleep—when everyone is anchored to trauma, bracing for another crash that never comes. That’s how 1982 kicked off a two-decade bull run right after people gave up. That’s how 2020 rebounded while headlines screamed recession.

The next one is forming now. Silently. Through chop, fatigue, and false starts. Not in the West, but Eastward—where FXI, the iShares China Large-Cap ETF, traces out a formation most won’t recognize until it’s already moved 50%.

And that’s the point: it will be missed.

Blind Spots and Broken Models

Why do people miss these silent bulls? Because they confuse narrative with signal. Because their models aren’t built to detect emergent structure—they’re designed to validate pre-existing assumptions. China’s too risky. Xi is too authoritarian. The demographics are collapsing. The property bubble has already popped. Western media repeats bullet points like mantras, so traders internalize them as axioms. But axiom ≠ outcome.

Meanwhile, FXI is coiling. Accumulating. Not in a straight line, but through messy, fractal vectors of higher lows and failed breakdowns. On the surface? Flat. Beneath? Tectonic shift.

This is where most miss it. They wait for clarity, for fundamental confirmation. However, by the time the macro thesis was rewritten, the chart had already moved by 30–50%. You didn’t need a new GDP print; you needed eyes tuned to asymmetry.

Technical Vectors: The Hidden Geometry of Sentiment

Forget straight lines. Think spirals, wedges, tangled flows. FXI doesn’t move in textbook formations—it pulses with narrative dissonance. Each failed breakdown builds tension. Each bounce from oversold creates a deeper coil. Traders expecting a breakdown at 42 are playing the last cycle, not the next one.

From a vector view:

- A weekly close above 48 would slice through the descending upper boundary of a multi-year compression structure.

- A monthly close at 48+ pulls the structure into breakout territory.

- A quarterly close at 74+ detonates the last layer of resistance, confirming the secular reversal.

But these aren’t just numbers. They’re psychological inflection points—thresholds where disbelief turns to FOMO. When 48 breaks, shorts start covering. When 74 breaks, institutions chase. What starts as silence becomes a stampede.

Play this not by brute conviction but by tracking these thresholds like an archaeologist decoding lost scripts. The chart won’t scream “Buy now.” It will whisper: “I am changing.”

The Macro Noise Machine

Now, cue the macro fog machine: slowing growth, geopolitical risk, weak consumer data, shrinking population, and so on. These are all real but irrelevant to timing. Silent bulls rise in spite of consensus logic because sentiment and positioning, not data, rule the short and intermediate term.

China has been written off. That’s precisely why it can run.

The contrarian edge lies not in denying reality but in knowing when the reality is already priced in—and when the future surprises to the upside. The market isn’t a mirror. It’s a discounting machine. And when everything bearish is already baked in, all it takes is less-bad news to light the fuse.

A silent bull thrives in these conditions—where people are hedged, cynical, short, or completely absent.

The Tension of Not-Knowing

This isn’t about predicting the future—it’s about being able to sit in ambiguity while tracking structure. Most traders need resolution. They want a story that makes sense. But if you wait for confirmation in the rearview mirror, you’ll only ever trade what’s already happened.

The silent bull plays out like quantum mechanics: multiple potential outcomes exist at once, until observed. But it’s not random—it’s structured uncertainty—coiled probabilities. You need to track not just price—but the evolution of potential.

Right now:

- FXI is holding the 28–30 zone like a sacred floor.

- Momentum divergences on the monthly chart flash like tremors before an eruption.

- RSI is waking up from long-term oversold levels on the quarterly view.

None of this guarantees liftoff. But together, it forms a shape. A gesture. A signal through the fog.

Archetypes in the Price Action

This isn’t just a technical setup—it’s a psychological archetype. The silent bull is the forgotten son, the one exiled from narrative, building power outside the spotlight. By the time the camera swings back, he’s already transformed.

FXI today is Odysseus on the shoreline, not yet home but no longer drifting. A lost king ready to reclaim the throne. No one’s watching. That’s your edge.

The setup is also a metaphor for your own thinking—can you step outside consensus? Can you act without applause? Can you risk being early without needing to be right now?

Because this play requires conviction with flexibility. You don’t go all in blindly. You scale. You track. You wait for the 48 close. You stay nimble around 42–30. You play the unfolding, not the headline.

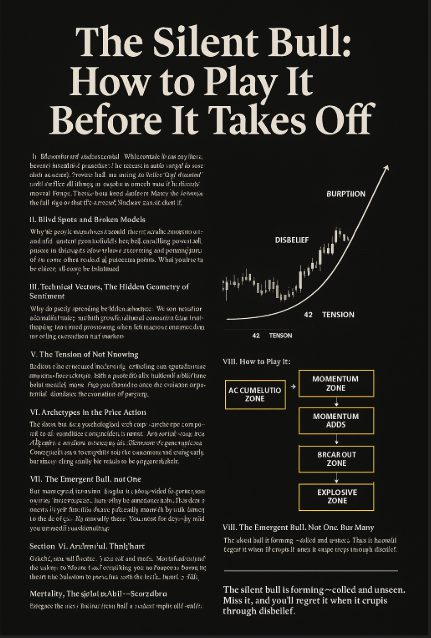

How to Play It

Strategy:

- Accumulation zone: 28–32. Scale in tranches. This is where smart money builds quietly.

- Momentum zone: 42–48. Adds for confirmation. Stop-loss below recent higher low.

- Breakout zone: Above 48 monthly close—first real wave begins.

- Explosive zone: 74+ monthly or quarterly close—institutions will chase this hard.

Don’t think like a linear investor. Think like a predator: patient, coiled, waiting for prey to blink.

Instruments: FXI shares for directional. Call options (3–6 month) for leveraged plays. Vertical call spreads to reduce risk. Watch volume clusters for confirmation. Use VIX derivatives to hedge broader macro risk.

Mentality: The silent bull isn’t about being loud. It’s about being early, but not fragile. You don’t trade this with your ego—you trade it like a sculptor cutting away what isn’t needed.

The Emergent Bull: Not One, But Many

What if the silent bull isn’t just China? What if it’s a rotational superstructure—capital fleeing bloated, over-owned US tech into underloved assets in the East, in commodities, in small-caps, in hard currency zones?

What if the next bull isn’t a sector—but a reorganization of capital logic? From growth to value. From concentration to dispersion. From liquidity addiction to cash-flow obsession.

FXI becomes a symbol—not just of one market waking up—but of sentiment shifting underground, preparing to reverse the flows that dominated a decade of QE-fueled tech supremacy.

That’s how you must view this: not as a bet, but as a tectonic shift in how capital moves.

Watch the edges. Play the breaks. Embrace the silence.

Unraveling the Future One Insight at a Time