Maximizing Returns with Equal Weighted S&P 500 ETF

Updated May 01, 2024

Most traders focus on major indices like the S&P 500 or the Dow, and with the advent of exchange-traded funds (ETFs), investing in these markets has become increasingly convenient. There is a wide range of S&P 500 ETFs, but the key lies in identifying the underlying trend. Once the trend is established, selecting the appropriate ETF becomes more straightforward.

The ability to recognize trends is a powerful tool for investors. It allows them to make informed decisions and position themselves accordingly. By focusing on technical analysis, investors can identify stocks in the S&P 500 that are trending upwards but may temporarily trade in oversold ranges. This creates opportunities to buy stocks with potential for upside while managing risk.

Here’s a list of some popular Equal-Weighted S&P 500 ETFs to consider:

- Invesco Equal Weighted S&P 500 ETF ETF (RSP)

- SPDR Equal Weighted S&P 500 ETF (SPYV)

- iShares Equal Weighted S&P 500 ETF (EWSP)

- Goldman Sachs Equal Weight U.S. Large Cap Equity ETF

- Vanguard S&P 500 Equal Weight ETF

- Invesco S&P 500 Equal Weight Health Care ETF (RSPH)

These ETFs offer a unique twist on the traditional market-cap-weighted S&P 500 ETFs, providing equal exposure to each component stock.

Changing Perspective: A Critical Advantage

A common pitfall for many investors is the tendency to follow the crowd and make decisions based on preconceived notions. Successful investing requires an objective perspective, free from the influence of prevailing sentiments. By altering the angle of observance, investors can identify opportunities that others may overlook.

The masses often react to fear, a powerful emotion frequently exploited by those with financial interests. However, recognizing fear as a motivator for market movements can be advantageous. As the saying goes, “Fear is a useless emotion.” Investors who view fear as an opportunity can benefit from the herd’s reaction and make more informed decisions.

Understanding Today to Predict Tomorrow

Truly understanding market trends requires focusing on the present. Many investors make the mistake of fixating on future events while neglecting the underlying factors at play in the current market. By closely observing today’s dynamics, investors can gain insights into the future. The key lies in identifying the problem, as the solution often presents itself.

Applying Technical Analysis to Equal-Weighted S&P 500 ETFs

Equal-weighted S&P 500 ETFs offer a unique opportunity to invest in various companies within the index. Unlike traditional market-cap-weighted ETFs, equal-weighted ETFs provide a more balanced exposure to the constituent stocks. This approach can help mitigate the dominance of large-cap stocks and give a broader representation of the market.

When considering equal-weighted S&P 500 ETFs, investors can use technical analysis to identify stocks that exhibit upward solid trends within the index. Investors can time their entries effectively by combining trend analysis with a focus on oversold conditions. This strategy allows for the potential capture of gains as the identified stocks move towards a less oversold range.

Case Study: A Practical Example

Consider the Invesco S&P 500 Equal Weight ETF (RSP), which aims to track the performance of the S&P 500 Equal Weight Index. By construction, this ETF provides equal exposure to each component stock, regardless of market capitalization. As a result, the fund’s performance is driven by the collective performance of its diverse holdings.

During the market downturn in early 2020 caused by the COVID-19 pandemic, the RSP ETF experienced a sharp decline, which was in line with the broader market. However, as the market rebounded, the ETF recovered and reached new highs. Investors who utilized technical analysis to identify the upward trend and bought during the oversold conditions of the downturn would have benefited from the subsequent recovery.

From this point, we will illustrate our actions in real time by sharing excerpts from past updates. Remember, those who don’t learn from history will repeat its mistakes.

For example, this is what we stated to our subscribers in June 2017

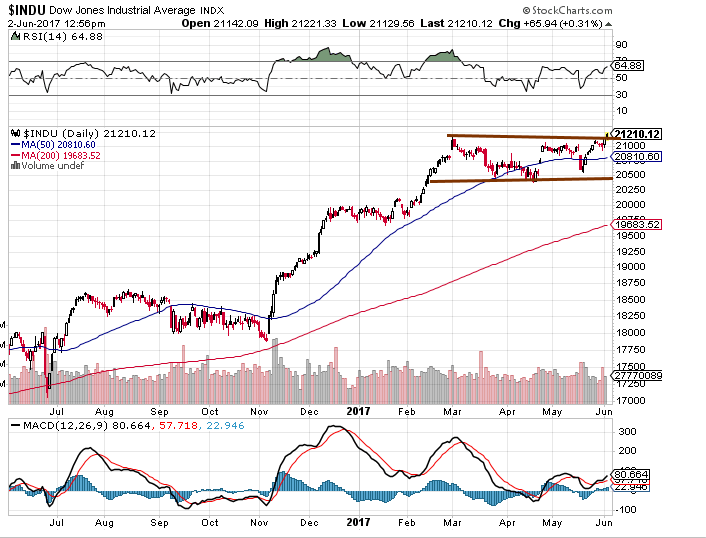

We issued the target of Dow 21K in Dec 2016, well before the development. It has been doing practically nothing after the Dow traded to 21K. The bulls and the bears are both trying to determine the future via fundamentals and or technical analysis and failing marvellously, we might add. What is taking place is very simple; the market (up to the present, at least) has and is still going through a silent correction. This correction could become more vocal towards the last stage, and we are pretty close to the last stage of this correction. The market has been trending sideways, which is one of the ways a market can let out a massive dose of steam while making it appear that it has not shed anything.

The chart illustrates how the Dow is trending sideways (tight channel formation). At the same time, several technical indicators (one of which is shown in the above picture) are trading in the oversold ranges. This is what a silent correction looks like; typically, the resultant move is up. As we have stated many times, the ideal set-up would be for the Dow to shed 1000 points quickly over a few days. The trend for the Dow and SPX is positive, so any strong pullback has to be viewed through a bullish lens.

2017 was interesting, and the 2018-2019 period could prove to be interesting too

2017 is turning out to be exciting; nothing that should be is, and everything that shouldn’t be is coming to pass. The stock market is a perfect example of this; the higher the market trends, the more nervous the crowd becomes. In an ordinary world, the opposite would hold. Market Update May 19, 2017

When you look at the chart and the charts below, the crowd’s reaction to this bull market differs from almost every other bull market in history.

What Was The TI Dow Theory saying back in 2017

In the last update, we confirmed that several Dow stocks, such as APPL, HD, DIS and NKE, all confirmed that the Dow has the potential to run a lot higher. We also looked at over 150 random stocks; over 60% were trading in the oversold ranges on the monthly charts. This market is now a stock picker; in other words, you cannot just buy any stock and hope it will trade higher because the trend is positive. A lot of stocks are going to experience crash-like symptoms as the market surges to new highs.

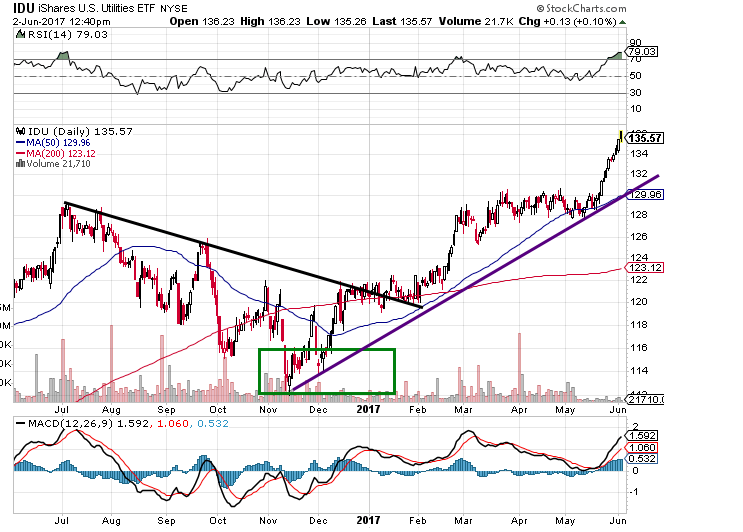

Our theory has always been that the Utilities lead the way and not the transports; that’s why several years ago we penned our first article openly stating that the Dow theory was dead. And the utilities have lived up to expectations; they predicted the market direction far more accurately than the Dow transports have over the past nine years.

Notice that the utilities experienced a correction from June 2016 to Nov 2016 and then reversed course. As they lead the way up or down, the consensus would be for the Dow and Transports to correct or consolidate. At the moment, that is exactly what the markets are doing. Market Update May 19, 2017

Two Interesting S&P 500 ETFs (March 2020 Update)

The first one is SPY, and it’s meant for investors who prefer to trade the indices.

The second one is a leveraged one and suitable for traders willing to take on more risk.

The best time to buy ETFs and Stocks is when

There is blood in the streets, and the masses are running around like headless chickens, which happens to be now. The coronavirus pandemic has created a buying opportunity of epic proportions.

Just 15 days ago, people would have eagerly welcomed the current prices, but now, after 15 days, many are ready to give up. The volatility is expected to persist until the end of the month, mainly due to the significant surge in V readings, which soared by a staggering 650 points, reaching an all-time high. It’s worth contemplating that the Federal Reserve has lowered rates by 150 basis points within two weeks, which is an extraordinary development. Yet, it has been overshadowed by the current wave of hysteria. As mentioned, companies are likely to pursue their share buyback programs aggressively.

Once the panic subsides, it will create an unprecedented feeding frenzy. The combination of zero interest rates, a two trillion dollar injection by the Federal Reserve, and several billion-dollar stimulus packages aimed at boosting the economy will propel the market to extraordinary heights that are difficult to fathom. The zero interest rates will also force many individuals with fixed incomes to venture into speculative investments, as they possess substantial cash reserves on the sidelines.

Insiders have been capitalizing on this substantial market pullback by purchasing shares. The sell-to-buy ratio is a helpful indicator of the intensity of their buying activity. A reading of 2.00 is considered normal, while below 0.90 is considered exceptionally bullish. Currently, the ratio is a staggering 0.35, indicating that insiders are enthusiastically buying shares.

As for today’s readings, based on the high transaction volume, Vickers’ benchmark NYSE/ASE One-Week Sell/Buy Ratio is 0.33, and the Total one-week reading is 0.35. Insiders are not simply buying shares; they are voraciously devouring them. Insiders have exhibited similar behaviour in the past, such as in late December 2018 after the Christmas Eve stock crash, in early 2016 during a market correction, and in late 2008/early 2009 during the depths of the Great Recession correction. Those were remarkable times to buy stocks. Insiders appear to be suggesting that the present moment offers a similar opportunity. https://yhoo.it/2TV0cE2

Conclusion: Equal Weighted S&P 500 ETF

Identifying trends and utilizing equal-weighted S&P 500 ETFs provides a disciplined framework for investing. Investors can make informed decisions by recognizing market directions and employing technical analysis. This approach allows for the potential capture of gains across a diverse range of companies within the S&P 500, reducing the concentration of risk associated with individual stocks.

A critical aspect of successful investing is maintaining a detached perspective, free from the influence of fear or herd mentality. By focusing on present market dynamics and utilizing tools like equal-weighted ETFs, investors can benefit from identified trends and improve their overall investment performance.

Other Good Reads

Risk and Opportunity; When To Buy & When To Run