When Inflation is High, the Fed Aims to Slow the Economy

Dec 11, 2024

Introduction

Inflation is like a slow-rising tide that, over time, drowns purchasing power and reshapes economic priorities. It subtly distorts market behaviour, forcing consumers and businesses to make decisions they wouldn’t ordinarily consider. The Federal Reserve, tasked with maintaining stability, must act decisively when inflation accelerates, striking a balance between cooling the economy and avoiding a full-blown recession.

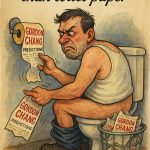

Voltaire famously remarked, “Paper money eventually returns to its intrinsic value: zero,” hinting at the dangers of unchecked inflation. The fear of monetary erosion drives people into frenzied actions, whether hoarding goods or speculating wildly, creating a self-fulfilling cycle of financial anxiety. This ties into mass psychology—panic begets more panic. The astute investor must recognize this behaviour as an opportunity. As Sol Palha, an advocate of contrarian strategies, explains, “Fear and uncertainty often fuel the best opportunities for gain.” Understanding this psychological impact on markets is crucial for navigating inflationary times.

Warren Buffett’s business partner, Charlie Munger, offers another perspective: “It’s not greed that drives the world, but envy.” In times of high inflation, consumers and investors alike are driven by comparative loss. They see their neighbours or competitors adapting faster, investing in assets that appreciate while cash loses value. This sense of falling behind compels irrational decisions, often exacerbating market volatility.

This environment makes the Federal Reserve’s role critical. By raising interest rates, tightening credit, and using other tools to temper inflation, the Fed aims to cool demand and restore balance. However, as Munger reminds us, “In economics, there is always a time lag between cause and effect,” meaning the Fed’s actions often take months or even years to materialize fully. In the interim, uncertainty breeds further instability, leading to mass hesitation in markets—a prime stage for the bold investor willing to act against the crowd.

Definition of High Inflation

High inflation is not just a rise in prices; it is a psychological shock to the system that alters behaviour at every level of society. Historically, periods of high inflation have led to wild, unpredictable swings in both markets and consumer choices. As Nathan Rothschild put it, “The time to buy is when there’s blood in the streets,” signalling that during extreme periods of economic unrest, those who maintain clarity of thought and act decisively stand to gain the most.

During periods of high inflation, mass psychology plays a pivotal role. Consumers rush to buy goods before prices rise, a phenomenon known as “anticipatory consumption.” This behaviour leads to shortages, causing even more panic. Businesses, too, behave irrationally, often raising prices not out of necessity but because they expect rising costs—further fueling the inflationary spiral.

At its core, inflation feeds on itself. As Sol Palha has noted in his market analysis, “Uncertainty is often more dangerous than fear because it creates paralysis in decision-making.” This psychological paralysis during inflationary periods can be both a curse and a blessing. While most investors hesitate, those who move decisively, driven by deep understanding rather than panic, can capitalize on the irrationality of the masses.

Experts like Milton Friedman argue that inflation is purely a monetary phenomenon caused by overexpansion of the money supply. While rooted in solid economic theory, his viewpoint misses the nuance of human behavior. Inflation also feeds on fear and uncertainty, leading to irrational market actions that simple monetary policy can’t always address. Paul Volcker understood this and implemented aggressive monetary tightening in the 1980s, which effectively curbed runaway inflation but came with short-term pain—a lesson in balancing economic theory with the psychological reality of markets.

High inflation is not just an economic problem but a behavioural challenge. Understanding the forces at play, both in terms of policy and psychology, allows for better positioning during times of financial upheaval. As history has shown, those who keep their wits about them in such environments stand to gain the most.

Explanation of Mass Psychology and Its Influence on Economic Behavior

Mass psychology shapes how individuals and societies react to economic stimuli, including inflation. It explores the collective emotions, beliefs, and behaviours that influence financial decisions. During periods of high inflation, understanding the psychology of consumers and investors becomes crucial for predicting market trends and policy effectiveness.

The Impact of High Inflation on Consumer Sentiment and Spending Habits

As prices soar during high inflation, consumers may experience a range of emotions, from anxiety about their purchasing power to frustration over the affordability of necessities. This can lead to changes in spending habits, with consumers prioritizing essential goods, seeking cheaper alternatives, or delaying purchases altogether. Crowd psychology suggests that these collective behaviour shifts can amplify inflation’s impact, creating self-fulfilling prophecies.

The Role of Media and Public Perception in Shaping Inflation Expectations

The media acts as a lens through which the public interprets economic events. During high inflation, media coverage can influence public perception by highlighting the success stories of savvy investors or the struggles of those affected by rising prices. This, in turn, can shape inflation expectations, which play a crucial role in actual inflationary trends. When individuals anticipate higher inflation, they may demand higher wages, leading businesses to raise prices, thus creating a self-reinforcing cycle.

Contrarian Strategies for Navigating High Inflation Environments

Contrarian investors recognize that high inflation can distort asset prices and market sentiment. They may exploit this by temporarily investing in undervalued sectors or assets out of favour. For example, contrarians might invest in inflation-resistant holdings like real estate or commodities during soaring inflation, anticipating their value to hold firm or appreciate relative to other assets.

Examples of Successful Contrarian Investors During High Inflation Periods

History provides examples of investors who thrived during high inflation by adopting contrarian strategies. Investor George Soros, known for his contrarian views, successfully navigated the high inflation of the 1970s by investing in gold and other commodities, anticipating their value as a hedge against eroding fiat currencies. Similarly, Warren Buffett’s value investing approach during high inflation periods focused on acquiring undervalued stocks and taking advantage of market fears to build long-term wealth.

Innovative Out-of-the-Box Thinking and Inflation

Confronted with the challenges of high inflation, innovative thinking becomes imperative for both businesses and investors. It requires a willingness to explore unconventional strategies and embrace new opportunities.

Businesses can employ creative strategies to mitigate the impact of high inflation. For instance, they may explore vertical integration, bringing previously outsourced functions in-house to control costs better. Alternatively, they might embrace automation and technology to enhance efficiency and reduce labour costs.

Case Studies of Businesses That Thrived During High Inflation Periods

History offers examples of businesses that flourished during high inflationary times. During the high inflation of the 1970s, Walmart capitalized on consumers’ heightened price sensitivity by providing a wide range of affordable goods, solidifying its position as a leading retailer. Similarly, tech giants like Microsoft and Apple navigated high inflation in the 1980s by focusing on innovation, creating new markets and disrupting existing ones, ultimately driving long-term success.

Overcoming Inflation through Market Investing

The stock market offers a potential hedge against high inflation. Investing in equities provides an opportunity to maintain and grow purchasing power. As companies raise prices to keep pace with inflation, their profits may increase, translating to higher stock prices and dividends for investors.

Strategies for Selecting Inflation-Resistant Investments

Inflation-resistant investments inherently protect against the eroding effects of inflation. Real estate, for instance, benefits from rising rents during inflationary periods. Commodities like gold and silver have historically served as stores of value, offering a hedge against inflation. Equities in companies with strong pricing power, such as those in the consumer staples sector, can also provide a buffer against inflation.

The Power of Compounding in Mitigating the Effects of Inflation Over Time

Compounding, often called the “eighth wonder of the world,” becomes a potent force in mitigating inflation over the long term. By reinvesting dividends and allowing capital to grow, investors can harness the magic of compounding to outpace inflation. Even during periods of high inflation, a well-diversified portfolio with a long-term horizon can help investors stay ahead of rising prices.

Insights from Wise Men

Warren Buffett, the Oracle of Omaha, has long recognized the corrosive effects of inflation on investments. He asserts that inflation acts as a “tax” on capital, eroding the value of money over time. To counter this, Buffett advocates investing in productive assets, particularly those with pricing power, which can generate returns that outpace inflation.

Buffett’s approach to high inflation is twofold. First, he seeks companies with substantial competitive advantages, or “economic moats,” that enable them to pass on price increases to consumers. Second, he favours businesses with efficient cost structures, ensuring they can weather inflationary storms. By focusing on these criteria, Buffett positions his investments to withstand the headwinds of inflation.

Benjamin Graham, often regarded as the father of value investing, emphasized the importance of fundamental analysis during high inflationary times. He advocated investing in companies trading below their intrinsic value, considering their assets, earnings power, and growth prospects. Graham believed that a margin of safety was crucial to protect against the uncertainties of inflation.

Graham’s philosophy revolves around intrinsic value, representing a company’s worth. During high inflation, he cautioned against speculative investments, urging investors to focus on businesses with solid fundamentals. By identifying undervalued companies, Graham believed investors could capitalize on market inefficiencies and protect their capital from the ravages of inflation.

C. John Maynard Keynes, a pioneering economist, developed theories that reshaped our understanding of economic fluctuations, including inflation. Keynes argued that high inflation could be a symptom of excessive aggregate demand, leading to a situation where demand outstrips supply, driving up prices.

Keynes advocated for the government to play an active role in managing inflation. He proposed that fiscal and monetary policies could influence aggregate demand and inflation. For instance, during high inflation, Keynesian policies might involve raising interest rates to curb borrowing and spending, thereby cooling down the economy.

Conclusion

In the face of inflationary pressures, individuals must cultivate knowledge and adaptability as the Federal Reserve manages inflation’s volatile effects. Armed with the insights explored in this essay, readers are better positioned to prepare for periods of high inflation, protect their wealth, and even seize the opportunities that often arise during such uncertain times. As Voltaire noted, “Doubt is an uncomfortable condition, but certainty is a ridiculous one.” By embracing this discomfort with a proactive and strategic mindset, individuals can confidently navigate turbulent economic waters, turning potential obstacles into stepping stones.

Understanding inflation is not just about grasping its historical significance or immediate consequences—it is about recognizing the interplay of human behaviour, policy, and market reactions. The lessons from past inflationary episodes and the wisdom of economists like Friedman and Volcker reveal that inflation is both an economic and psychological challenge. It demands coordinated responses at the policy level and from each of us as investors and participants in the economy. By staying informed, thinking critically, and maintaining discipline, individuals can face inflation resiliently, safeguarding their financial futures even in uncertainty.