Master Fearless Investing: Leaving the Panicking to the Silly Fools

Aug 13, 2024

Introduction: Understanding the Beast and the Stupidity of Giving into Fear

A market correction is a decline of 10% or more in the price of a security from its recent peak. This downturn is a transient phase, lasting from a few weeks to several months, characterized by the market’s self-adjusting mechanism.

A vivid illustration of this phenomenon unfolded in 2020. The onset of the COVID-19 pandemic triggered a rapid and severe market correction. The S&P 500 plummeted by 34% in just over a month. Fueled by uncertainty and panic, this plunge showcased the market’s vulnerability. However, markets are resilient entities, and true to form, the correction was not a protracted downturn. The market swiftly rebounded, recovering its losses by August 2020.

Market corrections are akin to the unpredictable twists in a captivating narrative. As markets correct themselves, investors navigate fluctuations, uncertainty, and opportunity. Rather than a flaw, the correction becomes an integral part of the financial story, revealing the market’s ability to recalibrate and find equilibrium.

Market corrections often extend beyond economic indicators. Sentiment, perception, and external shocks play crucial roles. The COVID-19-induced correction was not merely a reaction to economic data but a response to a global health crisis that reverberated across society. This underscores the interconnectedness of financial markets with the broader world, where geopolitical events and societal shifts can send ripples through the economic fabric.

Understanding market corrections requires acknowledging that they are part of a broader narrative shaped by various factors. Investors must discern underlying themes and plot twists to make informed decisions. The year 2020’s correction, while intense, ultimately became a chapter in the larger story of market resilience.

The Causes and Impacts of Market Corrections

Market corrections have many roots. Economic indicators, political unrest, or waves of panic can act as catalysts for a correction. The COVID-19 pandemic is a poignant example of how external shocks can trigger such adjustments. Markets become arenas where economic data, sentiments, and perceptions influence financial tides.

Trepidation often permeates the investment landscape in the face of these corrections. However, it’s crucial to recalibrate this perspective. Market corrections present a blend of challenge and opportunity. As prices decline, investors are offered a chance to acquire valuable stocks at discounted rates, akin to a grand scale in the financial marketplace. This shift in perspective transforms corrections from disruptions to potential stepping stones for those who can navigate the undulating market terrain.

Historical corrections, such as the Dotcom bubble burst in the early 2000s, reveal the transformative power inherent in these market adjustments. Once riding high on speculative fervour, tech companies saw a steep drop in share prices during this correction. However, this period wasn’t solely marked by despair; it was a crucible of opportunity. Visionary investors who seized the moment, like those who invested in Amazon and Apple, witnessed substantial long-term gains. This historical precedent underscores the importance of a strategic and discerning approach during market corrections.

The impact of market corrections extends beyond economics, reaching into investors’ psyches. Navigating the choppy waters of a correction demands a balance between emotional resilience and strategic insight. The waves of panic often accompanying corrections can lead to impulsive decision-making, a pitfall investors must skillfully navigate. Understanding that market corrections are part of the natural rhythm of financial cycles enables investors to approach them with a measured perspective, recognizing the challenges and the opportunities they present.

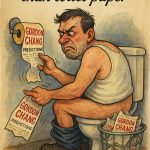

Moreover, corrections often act as a recalibration mechanism for markets, clearing away excesses and fostering a healthier financial ecosystem. The Dotcom bubble burst serves as a stark illustration of this corrective function. The speculative excesses that inflated the bubble were punctured during the correction, allowing the market to realign with more sustainable valuations. In this sense, corrections act as a natural laxative, flushing out irrational exuberance and setting the stage for a more balanced market environment.

The Art of Navigating Market Corrections

Resisting the allure of panic is crucial. Market corrections are inherent to the investment cycle, akin to the ebb and flow of a financial tide. Recognizing them as a natural occurrence enables investors to approach them with composure, avoiding impulsive reactions that could lead to financial missteps.

Diversification is a strategic instrument. The 2008 financial crisis stands as a compelling chapter in the history of market corrections, illuminating the efficacy of this principle. As the housing market plunged into crisis, sectors like healthcare and utilities remained steadfast, providing a stabilizing counterbalance. Investors with diversified portfolios found themselves shielded from the full brunt of the impacts. This historical testament underscores the importance of not placing all investment eggs in one basket, creating a resilient shield against the unforeseen fluctuations that characterize market corrections.

Understanding risk tolerance is crucial. In the face of market uncertainty, the ability to assess one’s risk appetite becomes a strategic compass. Investors must evaluate their comfort level with the inherent volatility of markets and align their portfolios accordingly. A tailored approach that considers individual risk preferences allows investors to weather the storm of corrections with a greater sense of confidence and resilience.

Staying informed is essential. The dynamic nature of financial markets demands a continuous flow of information. With up-to-date knowledge, investors can better discern between market noise and substantive signals. This information edge becomes particularly crucial during corrections, empowering investors to make informed decisions amid the turbulence.

Embracing a long-term perspective is fundamental. Corrections, though marked by short-term turbulence, are but ripples in the broader canvas of a financial journey. Investors who anchor themselves in a long-term vision avoid being swayed by the turbulent waves of momentary downturns. This panoramic outlook allows for a more measured response, transcending the immediacy of market corrections and aligning with the enduring rhythm of financial markets.

The Power of Patience and Long-Term Planning

Patience is a vibrant hue, adding depth and resilience to an investor’s approach. The allure to sell during price downturns can be overpowering, driven by the instinct to mitigate losses. However, history is a testament to the power of patience. The cyclical nature of markets reveals that they rebound after a correction, tracing an upward trajectory over time. Patience, therefore, becomes a strategic ally, allowing investors to weather the storm with a steady hand and a long-term vision.

Viewing market corrections through the lens of opportunity is a pivot in mindset. Rather than succumbing to the fear-inducing allure of immediate gains or losses, investors can embrace these periods as openings to acquire quality stocks at discounted prices. This shift in perspective transforms market corrections from adversities to potential stepping stones for long-term gains.

A compelling illustration is the 1987 Black Monday crash. During this event, investors faced a test of resolve. Those who held onto their stocks, resisting the impulse to sell amidst the chaos, witnessed a remarkable turnaround. A year after the crash, they experienced a 5% return. The narrative deepens three years later, with those who maintained their patience enjoying a substantial 23% return. This historical vignette underscores the principle that patience is not just a virtue but a formidable strategy.

Long-term planning complements patience and guides investors through market corrections. While the immediacy of market fluctuations may tempt impulsive reactions, a well-thought-out long-term plan acts as a north star, providing direction amid uncertainty. Long-term planning involves examining financial goals, risk tolerance, and investment horizon, creating a roadmap beyond the transient waves of market corrections.

In long-term planning, the significance of a diversified portfolio echoes once more. The artistry of allocating assets across a spectrum of investments shields against the impacts of a correction and aligns with the overarching strategy of long-term wealth creation. Diversification becomes the architect’s tool, constructing a resilient financial structure. This strategic approach and the patience to see it through positions investors to navigate market corrections with a measured and purposeful stride.

Mass Psychology and Market Corrections: A Revealing Connection

Mass psychology influences the ebb and flow of financial tides. The connection between collective human behaviour and market corrections is fascinating, shedding light on the powerful role emotions play in shaping economic landscapes. The fear of financial loss is a prominent catalyst capable of triggering widespread panic selling, a phenomenon that often amplifies the impact of market corrections.

Fear-induced selling during corrections creates a domino effect, contributing to the intensification of downturns. It’s a vivid manifestation of how collective sentiments can drive market movements. In these moments, the market becomes a mirror reflecting the prevailing emotional climate rather than a purely rational entity. Fueled by external events or economic indicators, the fear of loss can tip the scales, setting off a chain reaction across the financial landscape.

Conversely, optimism emerges when prices rebound. This collective positive sentiment becomes a fuel, accelerating the market’s recovery. The optimism, characterized by a renewed faith in economic stability, propels investors to re-enter the market, contributing to a positive feedback loop that reinforces the upward trajectory.

Understanding the interplay between mass psychology and market corrections becomes a strategic advantage for investors navigating turbulent periods. It recognizes that economic indicators do not solely drive markets but are deeply intertwined with collective emotions. Investors who grasp this connection can anticipate shifts in sentiment, allowing for a more informed and measured response to market corrections.

Diversification becomes a shield against the contagion of mass panic. A portfolio spread across various assets mitigates risk and provides a buffer against the collective emotions that drive abrupt market movements. It becomes a pragmatic response to the realization that market corrections, influenced by mass psychology, are manifestations of broader emotional currents.

The symbiosis of patience and long-term planning takes on a new dimension when viewed through mass psychology. Patience becomes a counter-narrative to the collective impatience that often characterizes market corrections. Long-term planning, with its