What is a Bull Market Simple Definition?

At its core, a bull market is a period of time in financial markets when asset prices rise continuously. It is characterized by optimism, investor confidence, and expectations that strong results will continue for an extended period. As the famous investor Sir John Templeton once said, “Bull markets are born on pessimism, grow on scepticism, mature on optimism, and die on euphoria.

The Anatomy of a Bull Market

A bull market often begins quietly, emerging from the depths of a market downturn. As Warren Buffett wisely advised, “Be fearful when others are greedy, and be greedy when others are fearful.” Savvy investors who dare to buy quality assets when prices are low during a bear market are often rewarded as the bull gains steam.

As the market recovery takes hold, more participants jump in, fueling further price increases. Positive sentiment and excitement build, drawing in even more investors. This creates a positive feedback loop, where rising prices attract more buyers, driving higher prices. The bull market, by definition, is a market going up, attracting more buyers and investment.

Wisdom from the Giants

Numerous investing legends have opined on the nature of bull markets over the years. Benjamin Graham, known as the father of value investing, stressed the importance of not getting swept up in the euphoria, stating, “Most of the time, common stocks are subject to irrational and excessive price fluctuations in both directions as the consequence of the ingrained tendency of most people to speculate or gamble… to give way to hope, fear and greed.”

Peter Lynch, the famed manager of Fidelity’s Magellan Fund, emphasized the need to do your homework and understand what you’re buying, even in a raging bull market. He said, “Never invest in any idea you can’t illustrate with a crayon.” Even in a rising market, the fundamentals of a good business and a reasonable price still apply.

Historical Bull Markets

Some of the most famous bull markets in history include:

– The post-World War II boom in the U.S. from 1949 to 1966

– The 1980s bull market fueled by falling interest rates and technological optimism

– The 1990s dot-com boom

– The recovery from the 2008 financial crisis through the 2010s

In each case, a bull market simply means a sustained rise in prices over many months or years, driven by positive economic fundamentals and investor enthusiasm. As mutual fund pioneer John Templeton described, the bull market lifecycle progresses from pessimism to scepticism to optimism to euphoria.

Investors with the foresight and courage to invest during these bull markets would have seen their wealth grow tremendously. For example, the S&P 500 index gained over 400% during the post-World War II boom from 1949 to 1966. An investor who put $10,000 into the market in 1949 would have seen their investment grow to over $50,000 by 1966, not accounting for dividends.

Similarly, the 1990s bull market, driven by the rapid growth of the internet and technology sectors, saw the S&P 500 index gain over 200%. A $10,000 investment in 1990 would have grown to over $30,000 by the early 2000s. More recently, the bull market from 2009 to 2020, the longest in history, returned over 300%.

Of course, investing at the beginning of a bull market is easier said than done. It requires going against the prevailing sentiment at the time, which is usually pessimistic after a bear market. But those who have a long-term perspective, invest regularly regardless of market conditions, and have the fortitude to hold through downturns have historically been rewarded. As Warren Buffett famously said, “Be fearful when others are greedy, and be greedy when others are fearful.” The tremendous wealth-building power of bull markets shows the wisdom of this approach.

In each case, a bull market simply means a sustained rise in prices over many months or years, driven by positive economic fundamentals and investor enthusiasm. As mutual fund pioneer John Templeton described, the bull market lifecycle progresses from pessimism to scepticism to optimism to euphoria.

Recognizing the End of a Bull

One of the most challenging things is recognizing when a bull market has run its course. Famed investor Bernard Baruch warned, “The main purpose of the stock market is to make fools of as many men as possible.” Overconfidence and irrational exuberance are hallmarks of a bull market peak.

Other red flags include excessive valuations compared to historical norms, a concentration of leadership in a few stocks, heavy inflows of less sophisticated investors, and a surge in initial public offerings of unproven companies. As Warren Buffett cautioned, “A pin lies in wait for every bubble.”

Participating in a Bull Market Wisely

While bull markets can offer tremendous opportunities for wealth creation, it’s important to participate with discipline. Some key tips:

– Have a long-term perspective and don’t get caught up in short-term gyrations

– Stick to an asset allocation aligned with your risk tolerance

– Avoid chasing the most popular investments or trying to time the market

– Rebalance regularly to control risk

– Focus on quality assets with strong underlying fundamentals

As the investing great Shelby Davis said, “You make most of your money in a bear market; you just don’t realize it at the time.” The patience and discipline to endure downturns and not get shaken out of the market is key to long-term success.

The Bottom Line

To sum up our bull market, it is a period of rising prices and increasing optimism. While bull markets can be incredibly profitable, it’s essential to understand both the opportunities and the risks. Investors can successfully navigate bull markets by learning from the wisdom of investing giants, focusing on fundamentals, investing for the long run, and controlling greed. As Sir John Templeton understood, the four most dangerous words in investing are “This time it’s different.”

Inspiring Fresh Thoughts: Thought-Provoking Reads

What Does Serendipity Mean? It Favors the Informed

How To Get Financial Freedom Fast: Escape the Herd for Lasting Success

The Dance of Investor Sentiment: Unveiling the Impact on ETF Flows and Long-Run Returns

Robot Love: Machine Affection or Mechanical Risks

6 brilliant ways to build wealth after 40: Start Now

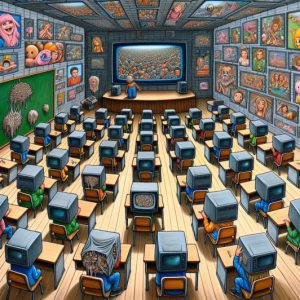

Why Is the US Education System So bad: Rubbish In, Rubbish Out Phenomenon

How can bond funds help with portfolio diversification more than individual bonds?

Russia vs USA: Timeline of US Actions Provoking Russia

Harmony Sex Doll: Redefining Intimacy and Companionship

October 1987 Stock Market Crash: The Astute Get Rich, While the Rest Suffer

Black Monday 1987: Turning Crashes into Opportunities

The Golden Symphony: Unveiling the Dynamics of the Gold to Silver Ratio

Golden Gains: The Key Advantages of Investing in Gold

Best ETF Strategy: Avoid 4X Leveraged ETFs like the Plague

Student Loan Refinance: A Smart Move Towards Financial Freedom – Poise in Debt Reduction

Why is investing in a mutual fund less risky than investing in a particular company’s stock?