Financial Experts As Good As Monkeys With Darts

Clear proof that the so-called Financial Experts on Wall Street would make no money were it not for the gullible masses they can milk. Overall hedge funds have been having a very hard time playing this market. They cannot deal with the extreme volatility as they try to outguess the market; they seem to get whacked on both ends of the trade. Look at how many funds jumped into Valeant Pharmaceuticals assuming that it was safe to follow other experts; the blind lead the mute. In the land of the blind, the one-eyed Jackass reigns supreme

Pershing Square (Bill Ackman): 21,591,122 shares, 6.33% (added 5 million shares on February 5)

ValueAct Holdings (Jeff Ubben): 14,994,261 shares, 4.39%

Paulson and Co. (John Paulson): 13,265,900 million shares, 3.89% (added 4.375 million shares in Q4)

Brahman Capital: 8,117,753, 2.38% (added 4.1 million shares in Q4)

Viking Global (Andreas Halvorsen): 7,793,397, 2.28% (added 2.8 million shares in Q4)

Lone Pine Capital (Steven Mandel): 5,829,079 shares, 1.71% (sold 1.63 million shares in Q4)

Hound Partners (Jonathan Auerbach): 4,881,835, 1.43% (added 983,187 in Q4)

Iridian Asset Management: 4,324,602, 1.27% (added 1.6 million shares in Q4)

Okumus Fund Management (Ahmet Okumus): 1,875,600, 0.55% (bought position in Q4)

Coatue Management (Philippe Laffont): 1,673,007, 0.49% (bought position in Q4)

If they haven’t changed their positions, as a group, then they’ve seen more than $1.25 billion on paper wiped out since Friday’s close. Bill Ackman, the founder of Pershing Square, has lost more than $321 million in his position since Friday’s close. To date, he’s suffered losses estimated at north of $2 billion on his Valeant investment. Others are likely feeling the pain, too. http://www.businessinsider.com/hedge-funds-in-valeant-2016-2/

Financial Experts like Ackerman are taking a beating

Ackerman is taking it to the Chin. He is getting hammered on his short position on Herbal life and now in his long position on Valeant. His overall take on of both stocks is correct, but this once again proves that the stock market is not ruled by logic but by emotion. You need to sit down and gauge how the masses will react, and not on what you deem is the right course of action. Emotions, not Logic drive the market.

The same line of thinking can be applied to the markets; the experts assume that the markets should tank based on the data being released, and that is probably why they will not tank. Right now a correction is being falsely marketed as the beginning of a new bear; however, the only new bear market that has started is a bear on common sense.

This is why Wall Street Fraud Is never prosecuted

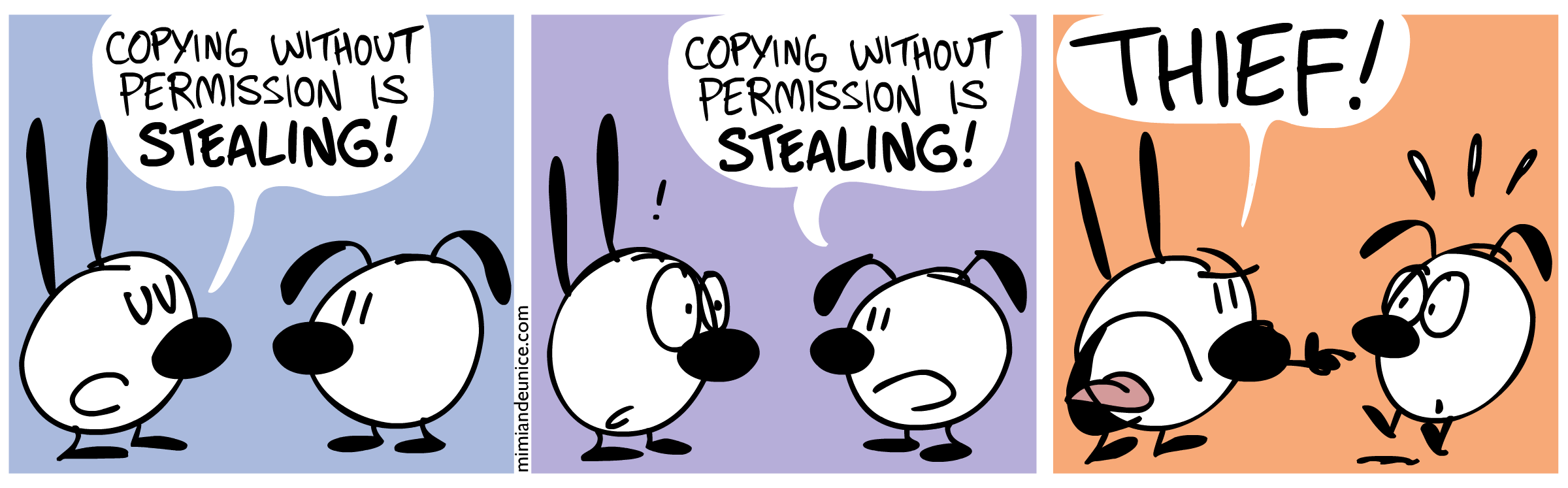

Financial experts Vs Monkeys

Give a monkey enough darts and they’ll beat the market. So says a draft article by Research Affiliates highlighting the simulated results of 100 monkeys throwing darts at the stock pages in a newspaper. The average monkey outperformed the index by an average of 1.7 per cent per year since 1964. That’s a lot of bananas!

What is all this monkey business? It started in 1973 when Princeton University professor Burton Malkiel claimed in his bestselling book, A Random Walk Down Wall Street, that “A blindfolded monkey throwing darts at a newspaper’s financial pages could select a portfolio that would do just as well as one carefully selected by experts.”

“Malkiel was wrong,” stated Rob Arnott, CEO of Research Affiliates, while speaking at the IMN Global Indexing and ETFs conference earlier this month. “The monkeys have done a much better job than both the experts and the stock market.” Full Story

Other Stories of Interest

Yen knocked down by Yuan to become 4th most used currency (April 1)

Fed’s main objective to Manipulate Masses & Markets (March 31)

China Punishes 300,000 Officials for corruption & U.S.A punishes none (March 28)

China Emerging Superpower hosts most billionaires in the world (March 28)

Next Subprime Crisis: Auto Bond delinquencies (March 28)

Despite Challenges outlook positive for stable Economic Growth (March 27)

Fossil fuel’s Death; Electric cars will outsell Fossil powered Cars (M