Velocity of Money: Accelerating Profits in the Markets

Dec 31, 2024

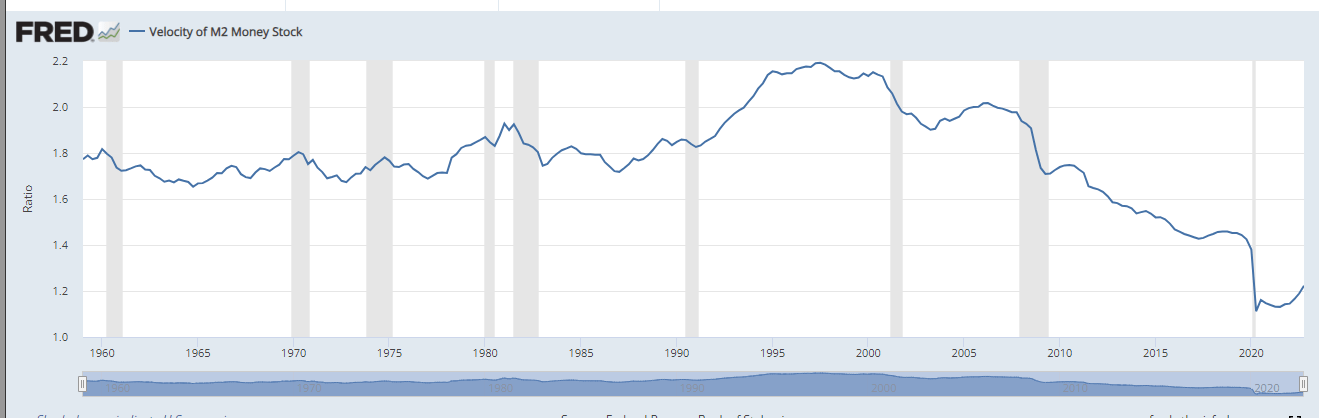

The Historical Perspective: A Decline in Motion

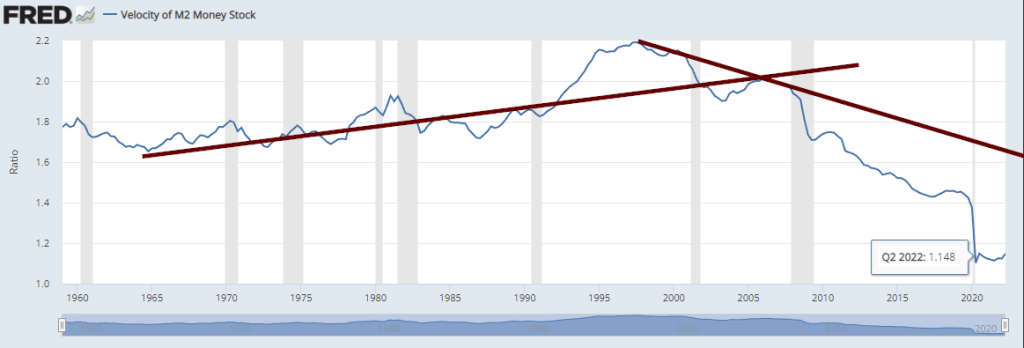

The velocity of money is not just a statistic; it is the pulse of an economy, the rhythm of its transactions, and the measure of its vitality. It tells us how often money changes hands, how quickly it circulates, and how effectively it fuels economic activity. Yet, as we examine its trends over the past decades, a troubling pattern emerges: The velocity of money has declined steeply since the Federal Reserve’s massive intervention in 2009.

This decline is not merely a technical anomaly but a reflection of deeper structural and psychological shifts in the economy. Historically, a healthy economy is marked by an upward-trending velocity of money, where transactions are frequent, confidence is high, and cash flows dynamically through the system. However, the post-2009 era has been defined by stagnation in velocity, even as the money supply has ballooned.

The chart below illustrates this stark reality: the economy struggles to sustain itself without constant monetary infusions. This is a critical insight, as it challenges the traditional view that inflation is solely a function of money supply. Instead, the velocity of money emerges as a more nuanced and accurate measure of real inflation. One analysis notes, “The velocity of money helps determine if inflation will be an issue. Rising values are equated with inflationary forces and vice versa”.

A rising velocity of money is typically associated with higher prices, but these higher prices are often warranted because they signal an improving economy. Money moving faster reflects increased demand, higher production, and greater economic activity. Conversely, a declining velocity signals the opposite: reduced spending, hoarding of cash, and a slowdown in economic momentum.

The Federal Reserve’s interventions in 2009, while necessary to stabilize the financial system, inadvertently set the stage for this decline. By flooding the economy with liquidity, the Fed created an environment where money supply grew, but velocity stagnated. This disconnect between money supply and velocity has profound implications for inflation, growth, and market dynamics.

The Equation of Exchange: Understanding the Mechanics

To grasp the velocity of money’s role in the economy, we turn to the equation of exchange:

MV = PY

Where:

– M represents the money supply

– V is the velocity of money

– P signifies the price level

– Y stands for real output

This equation is not just a formula but a framework for understanding how money flows through the economy. It shows that the velocity of money is not an isolated variable but a critical component of the broader economic system.

Let us illustrate this with a practical example:

Suppose an economy’s total value of goods and services (real output) is $9,000, and the average price level is 2. If the velocity of money is 3, we can calculate the corresponding money supply as follows:

M * 3 = 2 * $9,000

M * 3 = $18,000

By dividing both sides by 3, we find:

M = $18,000 / 3

M = $6,000

In this scenario, the money supply amounts to $6,000. This calculation highlights the interconnectedness of money supply, velocity, and economic output. A higher velocity means that the same amount of money can support a larger volume of transactions. In comparison, a lower velocity requires a larger money supply to achieve the same level of economic activity.

This relationship underscores the importance of velocity in determining the health of an economy. As one source explains, “The velocity of money measures the number of times that one unit of currency is used to purchase goods and services within a given time”. It is not just about how much money exists but how effectively it is being used.

The Implications of Declining Velocity

The decline in the velocity of money has far-reaching implications for markets, inflation, and economic policy. When velocity slows, it signals a breakdown in money flow through the economy. Transactions become less frequent, demand weakens, and economic activity slows. This creates a deflationary environment where prices fall, profits shrink, and growth stagnates.

This phenomenon is particularly troubling in the context of modern monetary policy. Central banks, including the Federal Reserve, rely on tools like interest rate cuts and quantitative easing to stimulate the economy. However, these tools are less effective when velocity is low. One analysis notes, “The velocity of money is the rate in an economy in which money is exchanged and is calculated by dividing the GDP by money supply”. Even an expanding money supply cannot generate the desired economic activity if money is not circulating.

The relationship between velocity and inflation is also critical. A rising velocity typically increases inflation as more transactions drive up demand and prices. Conversely, a declining velocity suppresses inflation, even in the face of monetary expansion. This dynamic complicates the work of policymakers, who must balance the need for growth with the risk of inflation.

Accelerating Profits: The Market Perspective

For investors, the velocity of money offers valuable insights into market dynamics and profit opportunities. A rising velocity signals a robust economy where businesses thrive, consumers spend, and markets grow. This creates opportunities for profit across various asset classes, from equities to real estate.

Conversely, a declining velocity presents challenges and opportunities. Traditional growth strategies may falter in a low-velocity environment, but defensive investments, such as bonds and dividend-paying stocks, can provide stability. Additionally, sectors that benefit from monetary expansion, such as technology and infrastructure, may outperform even in a sluggish economy.

Understanding the velocity of money is not just about predicting economic trends; it is about positioning oneself to profit from them. By monitoring velocity and its implications, investors can make informed decisions that align with the broader economic climate.

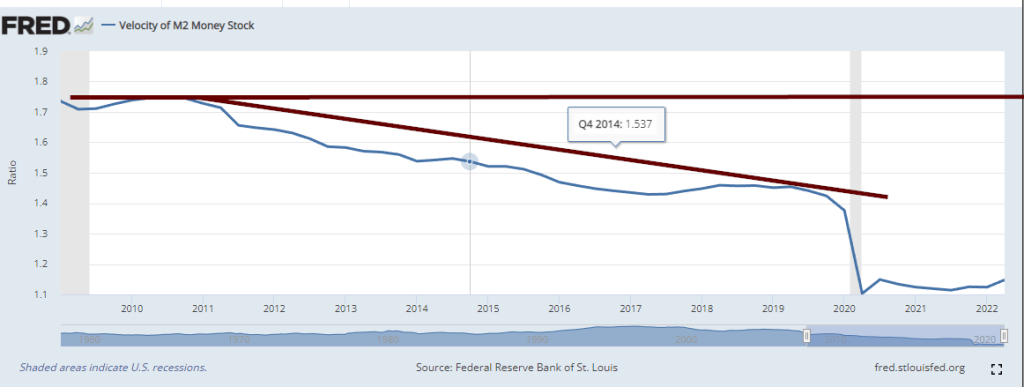

The velocity of Money from Feb 2009

If you look at the above chart, the economy has been sick since 2009, indicating that no matter what the Fed states, it will continue to juice the economy with money. They intervene occasionally to create the illusion that they are doing the right thing. One can also then argue that almost every inflationary move since 2009 has been artificially created, as there has been no uptick in the VM.

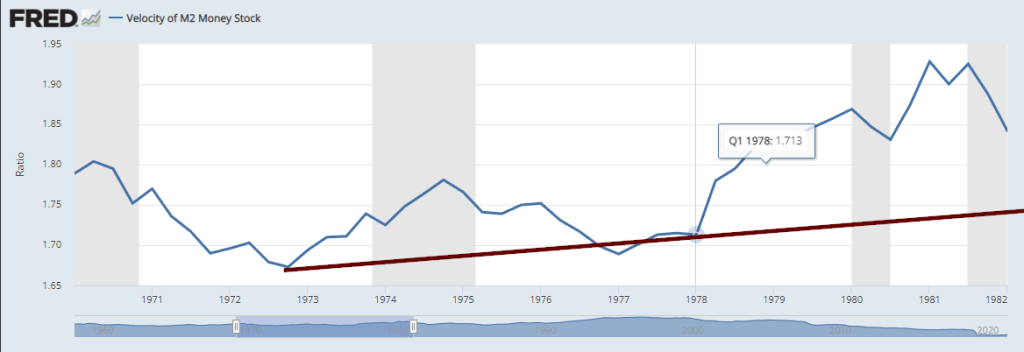

The velocity of money from 1970 to 1982

Now, look at the velocity of money during the inflationary period that started in the 70s and ended in the 80s. VM was rising. Yet since the advent of the internet (when it went mainstream roughly in the mid-90s), one could argue that inflation based on the VM formula has declined. One could also say that all the inflationary events had a specific trigger behind them, for example, limiting the supply of critical goods, disrupting supply chains, and using psyops to create the illusion that you need to buy now or lose big tomorrow.

The Tulip Mania occurred when complicated money principles were quite strong. If one knows how to use MP effectively, one could lay the groundwork to create inflationary forces in any market segment.

This is the danger of having large amounts of money; you can manipulate the trend by artificially using these massive amounts to create or destroy demand.

2024 Economic Outlook Through the Lens of the Velocity of Money

As we enter 2024, the economic landscape remains uncertain, with the velocity of money serving as a sobering barometer. The persistent decline in the velocity of M2 stock paints a grim picture—an economy teetering on the precipice, unable to find its footing amidst the relentless onslaught of macroeconomic headwinds.

If left unchecked, this worrying trend could catalyze a perfect storm of inflationary pressures, rendering the current market rallies mere mirages in a vast desert of financial turmoil. The data speaks volumes—most stocks languish below their 200-day moving averages, a stark reminder that only a select few titans are propping up the market indices, their dominance a double-edged sword that could prove unsustainable.

In this climate of uncertainty, Friedrich Nietzsche’s words resonate with profound clarity: “That which does not kill us makes us stronger.” The philosopher’s assertion that adversity breeds resilience could serve as a rallying cry for investors navigating these turbulent waters. Just as Nietzsche championed the virtues of perseverance and self-mastery, investors must also cultivate an unwavering resolve, embracing the present challenges as opportunities to forge a more resilient financial future.

Echoing this sentiment is the indomitable spirit of Jesse Livermore, the legendary trader whose exploits have etched an indelible mark on the annals of investment history. Livermore’s uncanny ability to read the ebb and flow of market sentiment, coupled with his unwavering conviction in the face of adversity, serves as a guiding light for those seeking to navigate the treacherous currents of the 2024 economy.

As money velocity continues to wane, Livermore’s mantra of “watching the market, not the ticker” takes on renewed significance. Investors would be wise to heed his counsel, eschewing the siren song of fleeting market fluctuations in favour of a more holistic, long-term perspective that recognizes the inherent cyclicality of economic forces and the necessity of patient, disciplined action.

Decoding the Velocity of Money: Insights from Visionary Minds

The velocity of money, a key metric measuring how quickly currency circulates in an economy, reflects economic health and the collective financial psyche. Today’s sluggish velocity suggests not an immediate inflationary crisis but a deeper issue: an economy struggling to thrive in a normalized interest rate environment—a weakness incompatible with true resilience.

Drawing on the insights of historical thinkers enriches our understanding. Sigmund Freud’s analysis of human behaviour finds an economic parallel in how stagnant velocity reveals collective financial anxiety, inhibiting the free flow of capital essential to growth. Peter Lynch’s focus on stock-picking fundamentals shines here, offering a blueprint for identifying undervalued opportunities in a hesitant market.

John D. Rockefeller’s long-term vision underscores the importance of perseverance in uncertain times, reminding investors to prioritize enduring value creation. Meanwhile, Aristotle’s principle of the “golden mean” advocates for a balanced velocity that is optimal for sustaining economic health.

Ultimately, the velocity of money is more than a statistic—it’s a diagnostic tool for understanding the economic landscape. Investors can navigate volatility with prudence and confidence by synthesising wisdom across disciplines.

Leveraging the Velocity of Money for Market Timing

The velocity of money (VM), or the rate at which money changes hands, offers valuable insights for market timing. Historically, rising VM has aligned with bull markets, while declining VM has often preceded recessions.

The 1970s saw soaring VM alongside strong market growth during high inflation, only to falter as inflation was curbed in the early 1980s. Post-2008, VM remained low despite monetary stimulus, with uneven stock market gains dominated by tech giants.

Visionaries like Jesse Livermore would see a spike in VM during market euphoria as a warning to take profits, while a drop in VM amid fear signals a buying opportunity. Contrarily, John Bogle championed passive, long-term investing, cautioning against overreliance on any single indicator. Charlie Munger’s focus on patience suggests that low VM periods offer a chance to acquire undervalued, high-quality assets with long-term potential.

While VM provides a window into market psychology and momentum, it’s no substitute for a disciplined, diversified strategy. Timing the market solely on VM is risky, but incorporating it into a broader investment approach can enhance decision-making and long-term success.