Bad Banks: How Financial Institutions Exploit the Helpless

Updated May 31, 2024

How do you get the majority to embrace a particular narrative? In this instance, we have bulls, bears, and neutrals. There are three separate groups with three different views. Well, you punish all three of them, and you punish them so severely that there is only one outcome to embrace, but the outcome is so obscene that now and then, they will question it, so you punish them again and again.

The bulls are questioning the rally as they banked some profits, hoping to buy back at a lower level, but the markets never pulled back. So, while they did not short the markets, they are getting punished for their stance and losing money on the long positions they closed.

Bears die young

90% of the bears that shorted the markets during the coronavirus selloff got hammered when the Dow reversed course so fast, and they believed the reversal would fail. They assumed this market would at least release some steam before trending higher. This pullback would allow them to recoup those losses, but it has not come to pass.

The neutrals take the biggest beating; they are sitting in cash. They are getting hammered for being savers as interest rates are almost zero, and they lose on banking any profits as the markets soar.

Sneaky Fed: The Deceptive Path Led by Bad Banks

In effect, the Fed is employing the most dangerous strategy of all; it’s now negatively using high-level Mass Psychology on everyone. Friend and foe are now all targets, so anyone relying on just one tool will be blown out of the water. We will expand on this more, but for now, investors need to steel themselves to view sharp pullbacks that will be triggered for no reason and randomly as opportunities.

It is time to prepare for psychological warfare, and the only way to prepare for this warfare is to understand that the underlying theme is deception. So, what you think is not happening and vice versa. The markets will not crash, but they will appear to be in crash mode for brief periods, and then they will reverse just as fast. If you prepare for this, the attack mode is straightforward; embrace every pullback until the trend turns neutral or negative.

Trying to gauge the short-term direction is almost a waste of time because everything is controlled on short timelines. So, the best strategy in such a manipulated environment is to focus on the longer trend. The short-term trend is being manipulated because the Fed wants individuals to embrace the market yesterday and not tomorrow. And don’t bother asking why. It does not matter; you don’t fight the Fed, no matter how strong you think you are.

We are not stating that it’s guaranteed that the Dow will go to 28K before pulling back; we don’t have a crystal ball. We are saying that if the Dow closes above the stated levels, the odds are above average that it could hit those levels. Given the Fed’s new strategy, we are focusing on the underlying trend as we have to change our line of attack. This plan is simple: we will focus on the long side, and when the Markets let out steam while everyone howls, we will smile and pile into top-quality stocks.

Bad Banks: Examples of Financial Exploitation

The banking industry has a long history of scandals and unethical practices that have eroded public trust and caused significant financial harm to consumers and investors. Here are some notable examples:

Wells Fargo Account Fraud Scandal (2016)

From 2011 to 2015, Wells Fargo employees created millions of fraudulent savings and checking accounts without customers’ consent. This practice, driven by aggressive sales targets and a toxic corporate culture, resulted in customers being charged unwarranted fees and damage to their credit scores. The bank was fined $185 million and faced ongoing legal and reputational consequences.

HSBC Money Laundering (2012)

HSBC was found to have facilitated money laundering for drug cartels and terrorist groups while also violating international sanctions. The bank’s lax anti-money laundering controls allowed the transfer of billions of dollars of illicit funds. HSBC paid a record $1.9 billion fine but avoided criminal prosecution, leading to criticism of regulators for being too lenient on “too big to fail” institutions.

Goldman Sachs and 1MDB Scandal (2018)

Goldman Sachs was implicated in misappropriating billions of dollars from Malaysia’s 1MDB state investment fund. The bank helped raise $6.5 billion for 1MDB, much of which was allegedly embezzled. Goldman Sachs eventually agreed to pay nearly $3 billion in fines and to recoup $1.4 billion in assets linked to the bonds it had underwritten.

Libor Rigging Scandal (2012)

Multiple central banks, including Barclays, UBS, and Royal Bank of Scotland, were found to have manipulated the London Interbank Offered Rate (Libor), a key global interest rate benchmark. This manipulation affected trillions of dollars in financial products, from mortgages to complex derivatives. The scandal resulted in billions in fines and criminal charges against several bankers.

JPMorgan Chase “London Whale” Trading Loss (2012)

JPMorgan Chase incurred over $6 billion in trading losses due to high-risk derivative bets by a trader nicknamed the “London Whale.” The bank initially downplayed the issue as a “tempest in a teapot” but later admitted to deficient internal controls and misleading regulators. This incident highlighted the risks of banks’ proprietary trading and influenced the Volcker Rule’s implementation.

These examples underscore the need for robust regulation, increased transparency, and stronger consumer protections in the banking sector. They also highlight the importance of individual vigilance and diversification when dealing with financial institutions.

Seizing Opportunities in a Manipulated Market

While market manipulation presents challenges, it also creates opportunities for astute investors. Here’s how to identify and capitalize on these opportunities:

Recognize Artificial Corrections

Sharp pullbacks may occur without fundamental reasons in a manipulated market. These artificial corrections can provide excellent entry points for long-term investors. Warren Buffett’s advice to “be fearful when others are greedy, and greedy when others are fearful” is particularly relevant in these situations.

Focus on Value Amid Volatility

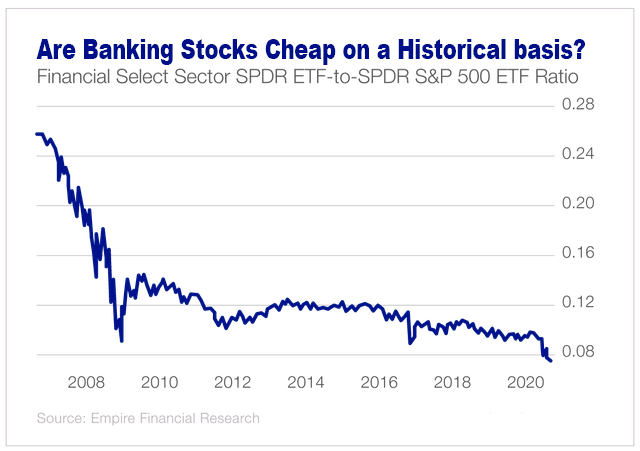

Market manipulation often leads to the mispricing of assets. Use fundamental analysis to identify undervalued stocks or sectors. For instance, as mentioned in the essay, US bank stocks are historically cheap and may offer significant upside potential over the next 12-24 months.

Exploit Market Overreactions

Manipulated markets tend to overreact to news and events. This overreaction can create opportunities to buy quality assets at a discount or short overvalued ones. Develop a watchlist of quality companies and set price alerts to capitalize on these overreactions.

Implement Dollar-Cost Averaging

Given the unpredictable nature of manipulated markets, a dollar-cost-averaging strategy can be effective. This approach involves regularly investing a fixed amount, regardless of market conditions, which can help mitigate the impact of short-term volatility.

Utilize Options Strategies

Options can be powerful tools in a manipulated market. For example, selling put options on stocks you’d like to own can generate income and potentially allow you to buy shares at a discount. Similarly, covered call strategies can enhance returns on existing positions.

Diversify Across Asset Classes

Don’t put all your eggs in one basket. Diversify across different asset classes, including stocks, bonds, real estate, and alternative investments like precious metals or cryptocurrencies. This diversification can help protect your portfolio from sector-specific manipulations.

By adopting these strategies, investors can turn market manipulation from a threat into an opportunity, enhancing their long-term returns while managing risk in an uncertain environment.

Brace yourself Mentally

So, prepare yourself mentally to deal with sharp gyrations from time to time, for the rewards will be huge. We are now in a different market: technical analysis, fundamental analysis, and any time a single study will fail. This is psychological warfare of the highest order. The order is to subtly change the masses’ perception so they will think and believe they have arrived at a conclusion already chosen for them.

Hence, let’s look to exit these June puts at the best possible price you can get. Our other plays are holding up very well. Murphy’s law might kick in, but we can’t sit and focus on a tiny event. With our new data, we must focus on the long-term, not the short-term game. The other option for those willing to take on more risk is to hold them and take a risk that the market will suddenly revert to the norm, let out some steam quickly and before trending higher.

US Banks, Including Bad Banks stocks, are cheap.

Historically, US bank stocks are very cheap, and 12 to 24 months from today, a large percentage of these chaps should be trading at least 50% higher. KEY still makes for a good play, and we are issuing two more plays, one in the Trend portfolio and one in the ETF portfolio.

What is the best time to buy US bank stocks?

According to a study by Tobias Levkovich, Citigroup’s Chief US Equity Strategist, purchasing disliked bank stocks has often proved beneficial. Levkovich observed that when US bank stocks received low ratings and faced negative investor sentiment, they tended to outperform the overall market in the subsequent year. Conversely, when bank stocks received high ratings and positive emotions, they tended to underperform.

Investing.com’s research further supports the notion that the banking sector is a contrarian investment opportunity. The study suggests investors should consider buying bank stocks when out of favour. This advice stems from the sector’s historical volatility, oscillating between extreme optimism and extreme pessimism. When market sentiment toward banks turns pessimistic, their stocks often trade below their book value, which can be an appealing prospect for value investors.

Moreover, a report from JPMorgan highlights that US banks are currently undervalued relative to other sectors. The report argues that the US banking sector possesses robust capitalization, healthy balance sheets, and a favourable position to benefit from the anticipated rise in interest rates.

Other Articles of Interest