Apr 11, 2024

Riding the Market Tides: What is a Bull Market? What is a Bear Market?

Introduction

In investing, understanding the cyclical nature of markets is crucial for making informed decisions. Two key concepts that every investor should grasp are bull and bear markets. These terms describe the overall sentiment and direction of the market, and recognizing their characteristics can help investors navigate the complexities of mass psychology. As the renowned economist John Maynard Keynes once said, “The market can remain irrational longer than you can remain solvent.” This essay will explore the intricacies of bull and bear markets and how investors can leverage insights from mass psychology to achieve success.

What is a Bull Market?

A bull market is characterized by a sustained period of rising stock prices, typically accompanied by widespread optimism and investor confidence. During a bull market, the economy is usually strong, with low unemployment rates and robust corporate earnings. Historical examples of bull markets include the dot-com boom of the late 1990s and the recovery following the 2008 financial crisis. As Warren Buffett, one of the most successful investors of all time, famously said, “Be fearful when others are greedy, and greedy when others are fearful.” Understanding the mass psychology of a bull market is essential for making prudent investment decisions.

The Psychology of a Bull Market

During a bull market, investors often experience a range of emotions, from optimism and euphoria to the fear of missing out (FOMO). As prices continue to rise and the market experiences sustained growth, more investors enter the market, believing they can make quick profits. This influx of capital further fuels the market’s upward momentum, creating a positive feedback loop.

However, this market exuberance can lead to irrational decision-making and overconfidence. Investors may begin to overlook fundamental analysis and risk management, instead focusing on short-term gains and chasing the latest market trends. This behaviour can result in overvalued assets and unsustainable growth as investors become increasingly detached from the underlying value of the securities they are buying.

Former Federal Reserve Chairman Alan Greenspan famously coined the term “irrational exuberance” to describe this phenomenon. In a 1996 speech, Greenspan questioned whether asset values had become inflated due to excessive optimism and speculative fervour. His words warned about the potential dangers of unchecked market enthusiasm.

As the bull market continues, some investors may experience a sense of invincibility, believing that the market will continue to rise indefinitely. This can lead to the formation of market bubbles, where asset prices become significantly overvalued relative to their intrinsic worth. History has shown that such bubbles eventually burst, leading to sharp market corrections and significant losses for those caught off-guard.

To navigate the psychological challenges of a bull market, investors must maintain discipline and a long-term perspective. Abigail Johnson, CEO of Fidelity Investments, emphasizes this point: “Success in investing doesn’t correlate with IQ. You need the temperament to control the urges that get other people into trouble in investing.”

This means sticking to a well-defined investment strategy, maintaining a diversified portfolio, and regularly rebalancing to ensure asset allocations align with one’s risk tolerance and financial goals. It also involves being mindful of market valuations and not getting caught up in the hype surrounding “hot” stocks or sectors.

By staying grounded and focusing on fundamental analysis, investors can make more informed decisions and avoid the pitfalls of irrational exuberance. This approach may require going against the grain and resisting the temptation to follow the crowd, but it can ultimately lead to more sustainable, long-term success in the market.

What is a Bear Market?

In contrast to a bull market, a bear market is defined by a prolonged period of declining stock prices, typically accompanied by widespread pessimism and investor fear. Bear markets often coincide with economic downturns, high unemployment rates, and weak corporate earnings. Historical examples include the Great Depression of the 1930s and the global financial crisis of 2008. Benjamin Graham, the father of value investing, advised investors to maintain a long-term perspective during bear markets: “In the short run, the market is a voting machine, but in the long run, it is a weighing machine.”

The Psychology of a Bear Market

Investors often succumb to panic and herd mentality during a bear market, leading to significant selling pressure. As prices continue to fall, fear and despair can take hold, resulting in capitulation and a sense of hopelessness. This emotional response can lead to irrational decision-making, causing investors to sell their assets at a loss, further exacerbating the market downturn.

However, Warren Buffett states, “The most common cause of low prices is pessimism – sometimes pervasive, sometimes specific to a company or industry. We want to do business in such an environment, not because we like pessimism, but because of the prices it produces.” Buffett’s quote highlights the potential opportunities that arise during bear markets, as the widespread pessimism can lead to undervalued assets.

Savvy investors recognize that bear markets are a natural part of the economic cycle and that historically, markets have always recovered from downturns. Investors can identify high-quality assets trading at discounted prices by maintaining a long-term perspective and focusing on fundamental analysis. This approach requires discipline, patience, and a contrarian mindset, as it involves going against the prevailing market sentiment.

It’s essential to note that timing the market bottom is extremely difficult, if not impossible. Instead of trying to predict the exact turning point, investors should focus on gradually accumulating undervalued assets over time, taking advantage of dollar-cost averaging. This strategy involves investing a fixed amount of money at regular intervals, regardless of market conditions, which can help mitigate the impact of short-term volatility.

Ultimately, bear markets test the resolve and long-term vision of investors. By staying disciplined, maintaining a well-diversified portfolio, and seizing opportunities created by market pessimism, investors can navigate these challenging times and emerge stronger when the market recovers.

Contrarian Investing: Buying During Panic and Selling During Euphoria

Contrarian investing involves going against the prevailing market sentiment. By buying during panic and selling during euphoria, investors can capitalize on the irrational behavior of the masses. When fear grips the market, value opportunities often emerge as asset prices become discounted. John Templeton, another renowned investor, advised, “Invest at the point of maximum pessimism.” Conversely, when euphoria takes hold, it may be prudent to take profits and recognize unsustainable growth. As Abigail Johnson notes, “In investing, what is comfortable is rarely profitable.”

Avoiding Overstaying Your Welcome

Investors must learn to identify market sentiment and adapt their strategies to navigate bull and bear markets successfully. Sentiment indicators, such as the VIX (volatility index) and the put-call ratio, can provide insights into market sentiment. Monitoring media coverage and public opinion can also help gauge the prevailing mood. As Benjamin Graham wisely stated, “The intelligent investor is a realist who sells to optimists and buys from pessimists.”

Adapting Investment Strategies

As market conditions change, investors should be prepared to adjust their portfolio allocations and implement risk management techniques. During bull markets, increasing exposure to growth-oriented assets may be appropriate while maintaining a well-diversified portfolio. Conversely, a more defensive approach may be warranted during bear markets, focusing on stable, income-generating assets. John Maynard Keynes emphasized the importance of adaptability: “When the facts change, I change my mind. What do you do, sir?”

Leveraging Mass Psychology for Success

Investors must cultivate emotional discipline and patience to succeed in bull and bear markets. Investors can make more rational decisions by focusing on fundamentals and intrinsic value rather than short-term price fluctuations. Embracing contrarian thinking, when appropriate, can also lead to profitable opportunities. As Warren Buffett advises, “Be fearful when others are greedy and greedy when others are fearful.”

Conclusion

Understanding the dynamics of bull and bear markets is essential for successful investing. By recognizing the mass psychology associated with each market phase, investors can make more informed decisions and avoid the pitfalls of irrational behaviour. As the wise men and women featured in this essay have demonstrated, a disciplined, long-term approach, combined with the ability to think independently, is the key to navigating market cycles. By applying these insights, investors can prosper in both bull and bear markets.

Mindful Exploration: Nurturing the Mind and Soul

Alarming Surge in Sexual Violence in Germany

Embracing Investing Psychology: Profiting from Negativity

Corn-Eating Hamster Cannibals: Unveiling the Mystery

Food for Thought Meaning: Exploring Intellectual Depths

Fragile Foundations: Central Banks Assault on Strong Currency

Chinese Recession 2016: Examining Its Impact on the Markets

Unveiling Mass Hysteria Cases: Insights into Noteworthy Examples

What is a Hedge Fund: Beyond the Basics, Embracing Volatility

Home Run with Homeschooling Ideas

Americans with No Emergency Funds: Progress & Challenges

Hookah Lounge: A Captivating Experience for Relaxation and Socialization

Anxiety Sensitivity Index Does Not Support Stock Market Crash

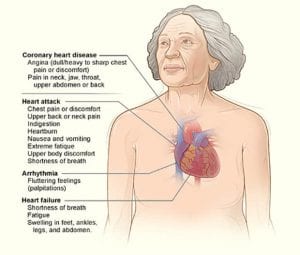

Unveiling the Silent Threat: Women and Heart Disease

Homeschooling Benefits: A Comprehensive Guide

Google News Trends Unveiled: Gossip Promoted as News