Unraveling U.S. Government Lies: Exposing the Truth Behind Deceptive Narratives

Updated Aug 17, 2023

Through a historical narrative, we shed light on how the U.S. government deceives by using central banks to create a false sense of prosperity. The reality is that today’s average American faces greater economic challenges than their grandparents did. The American dream has sadly turned into a nightmarish reality.

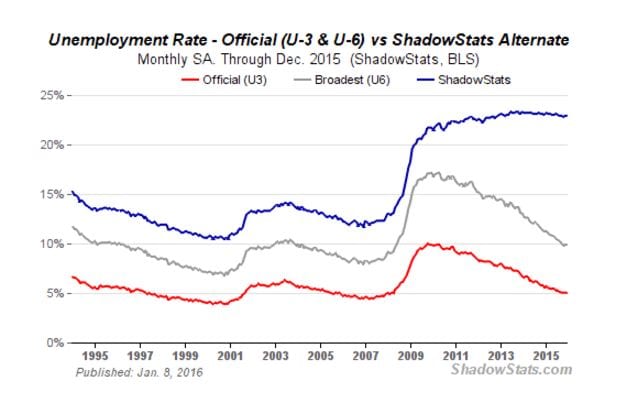

The latest employment data concealed a sombre narrative. While the unemployment rate remained stable at 5.1%, a mere 59.2% of the American population is employed. The distinction lies in the fact that the unemployment rate considers only those without a job and actively seeking employment. A potentially more precise measure of economic health is the labour force participation rate, encompassing individuals who have abandoned the job search, are uninterested or are unable to work. Regrettably, this rate declined to 62.4% during the previous quarter. Full story

The information provided by the BLS does not provide an accurate depiction of the actual situation. While the BLS reports an unemployment rate of around 5%, alternative statistics from sources like Shadow Statistics indicate that the unemployment rate reached 22.9% as of December 2015.

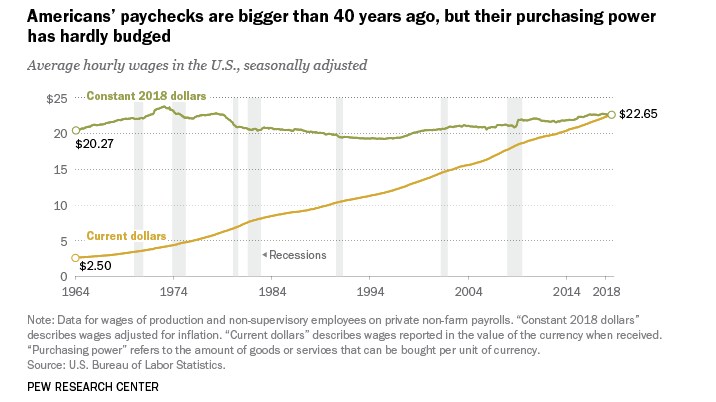

U.S. Government Lies and Wage Stagnation: Exploring Critical Economic Realities

Since the year 2000, Real wages have experienced a steady decline. In fact, the equivalent of $22.41 in today’s currency holds the same purchasing power as an hourly wage of $4.03 in 1973.

Student debt presents a looming crisis poised to detonate. The debt has reached a staggering $1.3 trillion, increasing at a rapid pace of approximately $2,800 every second. As of June 2015, Bloomberg reported that 11.5% of this debt had fallen into delinquency for at least 90 days. Currently, 40 million Americans carry some form of student loan, and a concerning 70% of college students graduate while burdened with debt, with no guarantee of securing employment upon graduation. The Department of Education forecasts that by 2025, this debt will escalate to nearly $2.5 trillion. A potential colossal default in this arena could overshadow the financial crisis 2008.

Maximizing Gains in a Shifting Market: A Strategic Approach to Investing

The Federal Reserve’s actions appear to favour penalizing savers while rewarding those who engage in speculation. In response, the logical course of action is to partake in speculation, but with a caveat: a well-defined and effective strategy is imperative. Optimal success comes from curating a select list of robust stocks and judiciously capitalizing on significant market retracements. The notable market downturn witnessed in January of 2016 sets the ideal stage to implement this strategic approach.

Our subscribers rely steadfastly on The Trend Indicator, a tool that has accurately predicted every pinnacle and nadir of the ongoing bullish trend. The methodology is elegantly straightforward: During upward trends, seize opportunities presented by pullbacks to initiate fresh positions. Conversely, when trends shift downward, it is prudent to liquidate existing positions—keeping it concise and effective.

Engaging Reads Worth Exploring:

Stock Market Crash History: Learn from the Past or Be Doomed

How to Invest When the Stock Market Crashes: Embrace the Fear, Buy the Opportunity

Third Wave Feminism is Toxic: Its Impact on America

A Crisis of Beliefs: Investor Psychology and Financial Fragility

Copper ETF 3X: Rock On or Get Rolled Over

Death Cross: More Than Meets the Eye in Market Signals

Which of the Following Is True of Portfolio Diversification?

What is the Average Student Loan Debt in the US? Understanding the Crisis

Student Debt Crisis Solutions: Halting the Madness is Essential

Dogs of the Dow 2023: Howl or Howl Not?

Navigate Student Loans: Discover, Settle, Excel

Early Retirement Extreme Book: Dive into the Facts, Skip the Book

What Is Blue Gas? Unveiling the Energy Mystery

From Student Loans to Financial Freedom: A Post-Graduation Roadmap