Lagging Economic Indicators: Time to Thrive, Not Just Survive

Updated Oct 2, 2023

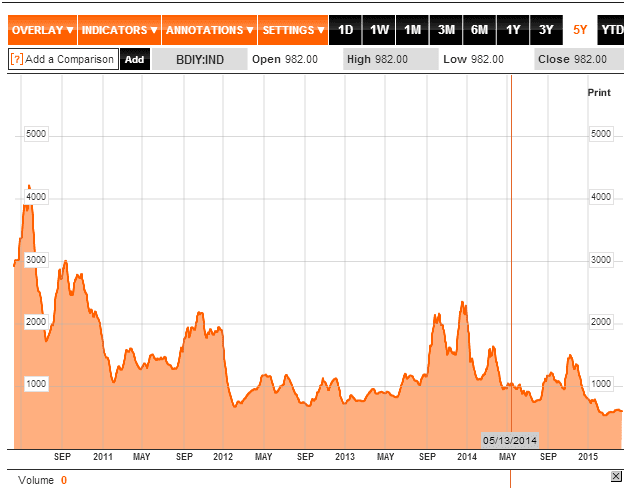

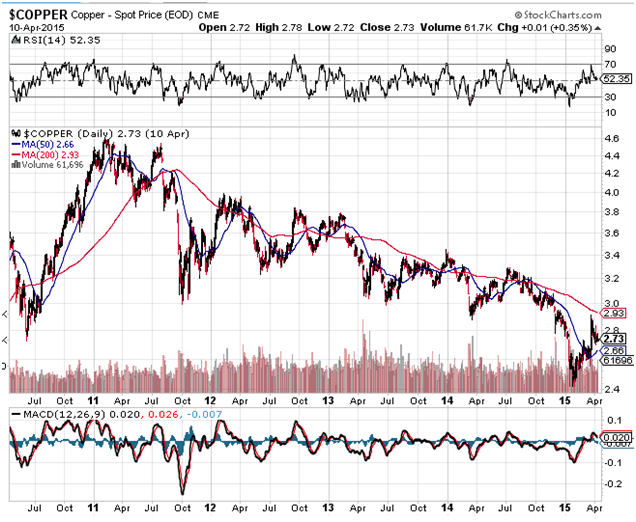

We will delve into this concept against a historical backdrop, drawing upon data from the April 15, 2015, market update to illuminate key points. This approach serves a dual purpose: firstly, the failure to learn from history can lead to repeating past mistakes, and secondly, it provides real-time insights into our actions. Intriguingly, a similar pattern is unfolding as of October 2023. The Baltic Dry Index is currently trading in the highly oversold zone on long-term monthly charts, and the same holds true for copper. This implies that they are building momentum for a potential rally.

Two Key Lagging Economic Indicators: The Fall of Market Oracles

Once hailed as market oracles, two key indicators have lost their lustre, and the days of their uncanny predictive power are now mere relics. In the past, the Baltic Dry Index (BDI) stood as a beacon, foretelling market movements with astonishing accuracy. Whether it soared to new heights or plunged to new lows, the BDI acted as a precursor for the broader market’s direction, a trusty compass for investors.

However, the tide has turned, and the BDI’s once-mighty influence has crumbled. The markets now march to a different beat, and the BDI’s forecasts have lost their resonance. It’s a bitter pill to swallow, watching a time-tested indicator become as worthless as toilet paper, as it sinks to new nadirs while the market soars to dazzling heights.

This shift underscores the power of market manipulation, a sobering reality for seasoned investors. Yet, in the ever-evolving landscape of finance, adaptation is the key to survival. It echoes one of the fundamental tenets of the Tactical Investor: “Adapt or Die.” The future may be uncertain, but the resilience of those who embrace change remains unwavering.

Time-Tested Tools: A World Turned Upside Down

In an era where markets defy gravity to reach unprecedented heights, two key lagging economic indicators, one of which is copper plummets to unfathomable lows, the masterminds of deception must indeed find amusement in the chaos they sow. Once revered for their market insights, experts now find themselves penning lengthy treatises predicting doomsday scenarios based on the plummeting fortunes of these two time-tested indicators. However, the reality is far from their dire prophecies.

As the world hurtles into the maximum overdrive phase of the global currency wars, the old finance rules and laws no longer offer guidance. They are relics of a bygone era. To cling to them in the face of this new paradigm is to court folly. In their well-meaning panic, the experts may find themselves on a one-way journey to the madhouse long before their grim forecasts materialize.

In this brave new world, the concept of logic and established market rules crumbles like a house of cards. One must heed the rallying cry to thrive: “Adapt or Die.” It’s a simple choice, and the path to adaptation begins with shedding the old, discarding cherished notions that no longer serve, and embracing the unknown. Understanding may come with time, but the old must make way for the new.

To the untrained eye, it may appear as chaotic as a free-for-all brawl, but a meticulously planned operation unfolds with cold-blooded precision beneath the surface. As the spider lures the daft fly into its lair, this new world also beckons, enticing those who dare to adapt and thrive.

Farewell to Once-Mighty Indicators: A Surreal Reality?

It’s sad to see two erstwhile stalwart indicators, which once held sway over market sentiment, relegated to the shadows of obsolescence. The hope lingers that, one day, these indicators may stage a triumphant return in a world less tainted by manipulation. However, the question begs: why have these tools lost their efficacy? The answer is glaringly apparent—we no longer navigate in the realm of reality. We are nestled in a surreal landscape where the lines between fact and fiction blur into obscurity.

In this topsy-turvy realm, the surreal has become our reality, and the genuine has taken on an air of the surreal. A peculiar dissonance exists as the masses, while sensing all is not well, choose to believe in the data disseminated by the Masters of Deception (MOD). Rather than trusting their instincts, they believe in this manufactured reality.

This is a critical insight for those who navigate the currents of trend and perception. In any given scenario, it’s not the objective truth that holds sway; it’s what individuals perceive as truth that wields the most significant influence. This is why, in any discourse or negotiation, the fundamental question should be, “What does the other party perceive?”

Understanding their perspective unlocks the door to effective action, for people see what they desire, not necessarily what exists. This knowledge elucidates the audacity of the Masters of Deception, who operate openly and arrogantly, secure in the knowledge that they control the narrative.

To master any situation, one must see through the eyes of the opponent, for their perception often diverges vastly from your own. Pay heed to their answers, for therein lies the key. Dreamers sing their own songs, and you unravel the enigma of their motives by listening. In a world where reality bends to the beholder’s perception, understanding their tune becomes your greatest advantage.

Economists and the Art of Complexity

Economists often possess a knack for taking simple ideas and cloaking them in layers of complexity, all to shroud their lack of understanding. Rarely will you encounter an economist who communicates in straightforward, plain language; such an approach would instantly expose their vulnerabilities. It’s a curious paradox that complex problems often result from a lack of thought, and the most straightforward solutions are often the most effective.

These convolutions often arise when individuals ill-equipped to see beyond their narrow perspective are placed in positions of authority. To them, everything appears intricate, tangled in a web of intricacy. But complexity often masks a deficiency of insight, and those who truly understand a problem can distil it down to its most basic elements.

So, with a pinch of scepticism or perhaps a whole jar, consider the world of economics and its penchant for complexity.

Concluding Thoughts on Lagging Economic Indicators

In economics, simplicity often conceals its wisdom beneath layers of complexity. Economists, the architects of these intricate webs, thrive in the language of convolution, obscuring the essence of their ideas. A deliberate complexity that veils their absence of understanding, they rarely communicate in the plain language of truth. For to reveal simplicity would be to expose their vulnerability.

The enigma lies in the paradox that complex problems typically arise from a lack of thought and insight. In contrast, the most potent solutions often emerge from the depths of simplicity. When the uninitiated ascend to positions of authority, they gaze upon a landscape of tangled intricacies. To them, everything appears labyrinthine, a Gordian knot to unravel.

However, the discerning eye discerns a lack of substance within this complexity. It’s a shroud concealing the absence of proper understanding. Those who navigate these intricate passages with mastery possess the power to distil the essence, stripping away layers until the core is revealed.

So, with a dash of scepticism, or perhaps a deluge, one must view the world of economics, where complexity reigns supreme.

Compelling Piece Worth Delving Into

Hillary Clinton’s Lies: The Truth Behind the Controversies

Was Obama Overtly Supporting New World Order Agenda

Mental Manipulation & Mind Control-endemic & out of Control

Freedom & Independence-almost extinct & forgotten concepts

It’s not time to sell the DAX- Buy Instead

Experts Sell Gilead sciences stock-Sentiment Analysis States time to buy

Gold 25K Target Prediction: Hell Is Closer

Insanity prevails-Loan Defaults Spike: Ford offers longer Financing

Gold Bug Investing Strategies: Using Fiat To Jump Into Pms

NonFinancial Costs Common Among Financial Fraud Victims: FINRA

Stock Markets & Economy Rarely trend in Unison

Mainstream Media Lies Help Trigger Stock Market Losses

Financial Experts vs. Burros: Two Perspectives on Investing

Brexit Success: Manufacturing Activity Surges to 25 year high

ETF Trading Strategies: Dangers of Following The Crowd

Two Key Indicators No Longer Work