What is a Bull and Bear Market: Explained Concisely

Updated in May 2024

The best approach to discuss topics of this nature is against a historical backdrop, and the reason for this is simple: by learning from history, you avoid repeating the mistakes of your forefathers. Instead, you become ready and prepared to act on this data when a similar situation presents itself.

Before delving into the ethics and psychology of bear market investing, let’s first clarify the question: “What is a Bull and Bear Market?” In simple terms, fixating on both aspects of this question is futile and a waste of time. Disregard the bear part since bear markets are actually long-term opportunities. Applying the fundamental principles of mass psychology and technical analysis can alter your perspective on bear markets. Only those who succumb to fear perceive bear markets as something negative.

Regarding stock market crashes, some investors see them as nothing but buying opportunities. While I agree with this sentiment, I have a few additional points about bear market investments and strategies.

As someone who studies mob psychology in the market, I believe the real problem lies in perceptions. Even though the market is currently overvalued and corporate profits are based on the drop in the US dollar, many investors continue to be driven by euphoria and illusions.

It’s important to remember that the market can turn on a dime, and being prepared with bear market investments and strategies can help you weather the storm. Don’t be fooled by the illusions of a bull market, and make sure to have a diversified portfolio that can weather the ups and downs of the market. By staying informed and prepared, you can come out on top in even the most challenging market conditions.

The Importance of Being Unbiased in Bear Investments

Let’s talk about being bearish. You see, in the world of finance, it’s essential to be unbiased, especially when it comes to investing in bear markets. The markets are unpredictable, and no one can accurately predict their direction. That’s why you need to be flexible and open to both sides of the market.

If you’re always a bull or always a bear, you’re setting yourself up for failure. You need to be willing to move into the neutral camp when it’s necessary. It’s the only way to win in the market. You must be willing to adjust your investment strategy according to the market’s conditions.

The market is currently experiencing a bull rally, but that doesn’t mean it will last forever. In fact, it’s vital to remember that what goes up must come down. Greed drives the market higher, and riding the wave is tempting. But it’s essential to remember that every upswing will eventually come to an end.

If you’ve made a fortune through bearish bets, consider giving back to those who may have suffered misfortunes due to market volatility. Remember, you took that money from someone else. It’s only fair to give back when you can.

George J. Paulos on Bear Bets

Editor/Publishe

Alternatives for Financial Freedom

Proprietor, www.freebuck.com

The Potential for Profit in Bear Market Investments

After a spectacular year-long rally in the stock market, investors are exuberant. Stock market bears have become an endangered species, but reports of their extinction are greatly exaggerated. Indeed, many reasons exist to believe that a return to bear market conditions may be imminent. If the markets turn down again, it won’t be pretty but bearish investors may be able to harvest impressive profits by betting on lower prices.

Bearish Techniques

Regardless of market conditions, most investors are overwhelmingly bullish. They have been trained to hold stocks through thick and thin. The bear market of 2000-2003 proved that the average investor would hold stocks through devastating declines, much like a deer in headlights. Few investors are even aware of techniques such as short selling, put options, or inverse funds that allow profiting within bear markets.

For savvy traders, a fast-moving bear market can provide stellar profits using these techniques.

The Potential for Resentment

But a bear market implies that most investors are losing. Severe losses can lead to extreme resentment against those traders who profit from these environments. If you are a profitable bear trader, you should be sensitive to those losing while winning. The money that you are making is the money they are losing.

Cultural Attitudes Towards Bear Market Investments

Cocktail conversations about stocks are typically brag sessions about being long a stock that went to the moon. When was the last time you heard someone brag about a spectacular short sale? The next time you are at a party, try telling your best short-sale story and see your reaction. Hopefully, your friends will be polite.

The most popular form of bear market investing is short selling. In this practice, the investor sells borrowed stock from a broker with the obligation to purchase it back later, presumably at a lower price, with the profit being the difference between the sale price and the repurchase price.

Even though there is nothing illegal or unethical about short-selling, it is still regarded in popular culture as a rogue practice. Many people consider it unpatriotic to sell short the country’s finest firms and profit from their troubles. Short sellers have always created resentment, particularly during bear markets when most investors have lost large sums of money.

Short selling and optimism

Stock investing is often viewed as an optimistic pursuit and for good reason. Investing in the stock market is, by its nature, a bet on the future success of a company or industry. Most people, particularly Americans, have a natural tendency to be optimistic, which makes it easy to understand why short selling, a practice that involves betting against a company’s success, is so mistrusted.

Short sellers are often seen as pessimistic or even unpatriotic, but this couldn’t be further from the truth. Short sellers are simply identifying a trend and profiting from it. Jesse Livermore, one of the most famous short-sellers in Wall Street history, emerged from the 1929 crash with almost $100 million.

The story of Jesse Livermore

Jesse Livermore’s success caused resentment among those who had lost fortunes in the crash, and some even blamed him and other short-sellers for the crash itself. In response to investor outrage, stock exchanges enacted rules to limit short selling that remains in place to this day. After the crash, Livermore often received personal threats and was forced to hire bodyguards.

Unfortunately, Livermore’s fortunes took a turn for the worse when he mistimed an investment strategy a few years later and lost his entire fortune. He eventually committed suicide, making his story a cautionary tale of the potential pitfalls of short selling.

The Battle of the Bears and Bulls on Wall Street

The Perils of Being a Bearish Analyst

Other well-known bears have been teased and ridiculed during bull markets, then shunned and reviled when their bearish predictions came true. Jim Grant, a bearish analyst, endured years of ribbing by Louis Rukeyser on the Wall $treet Week television show during the long bull market. The same Mr Rukeyser fired “Perma bear” analyst Gail Dudack just months before the stock market peak in April 2000. Unfortunately, Ms Dudack disappeared into obscurity just as her bearish forecasts proved correct. Professional stock analysts know that a bearish outlook may permanently ruin a promising career. This may be why bullish analysts vastly outnumber bearish ones. There is little room on Wall Street for a bear.

The Wall Street Industrial Complex

Stock market bears are always battling the perpetually bullish “Wall Street Industrial Complex”. These institutions are designed to sell securities to the public, so they always promote stocks as safe and sound places to invest capital. Trading commissions by short-sellers generate little revenue for the brokerage industry.

In fact, trading commissions generally are only a small part of industry investment profits. Management fees, investment banking, research, media, and many related activities make up big money in the investment industry. These institutions need a constant inflow of new capital to survive. A continuously bullish marketing message can lure investors into buying these products and services.

Overall, the story highlights the challenges bearish analysts face and their outlook on the stock market. It also sheds light on the underlying motivations of the Wall Street Industrial Complex, which is driven by a need for new capital and profits rather than a genuine concern for the safety and well-being of investors.

The challenges faced by bearish analysts in the stock market

Bearish analysts face challenges in the stock market, as they are often teased and ridiculed during bull markets and shunned when their bearish predictions come true. This was the case with Jim Grant, who endured years of ribbing on the Wall Street Week television show during the long bull market. Gail Dudack, a “Perma bear” analyst, was fired just months before the stock market peak in April 2000 and disappeared into obscurity as her bearish forecasts proved correct.

The Power of Bullish Messaging in the Investment Industry

The Wall Street Industrial Complex perpetually promotes stocks as safe and sound places to invest capital, and institutions are designed to sell securities to the public. Trading commissions by short-sellers generate little revenue for the brokerage industry, as management fees, investment banking, research, media, and other related activities make up the bulk of investment industry profits. To survive, these institutions need a constant inflow of new capital, which can only be achieved through a continuously bullish marketing message that lures investors to buy their products and services.

The Role of Financial Media in Shaping Investor Sentiment

The financial media, which receives most of its advertising revenue from the investment industry, reinforces this bullish message through 24-hour “news” channels that are little more than non-stop infomercials for stock investing. As a result, most common investors reflect the bullish perspective of the information they receive from the media.

The Importance of Independent Thinking in Short Selling

While stock investing is an essential part of a healthy economy, it is important to remember that there is a time to buy and a time to sell. The media will tell you that anytime is the right time to buy, but it will never tell you when to sell. Successful investors listen to the message of the markets, not the talking heads on the cable news network. Short sellers must think independently and not be influenced by the media-controlled stock market pop culture.

The Responsibility of Bear Investors in Times of Economic Distress

It is crucial to remember that other investors may deeply resent all of the money made by selling their favourite stocks short. Short sellers must be careful about describing their investment success, be sensitive and generous to losing people, and refrain from bragging about their short-selling triumphs. In a bear market, those who profit from economic distress must give back to society and help those hurt by deteriorating economic conditions. This helps to diffuse any resentment that may arise from benefiting from a bear market.

George J. Paulos

Editor/Publisher

Alternatives for Financial Freedom

Proprietor, www.freebuck.com

Email

Copyright © 2004 George J. Paulos, All rights reserved

Alan Lunt on What is a Bull and Bear Market

Contributor

www.tacticalinvestor.com

Brr Bear’s Discerning Appetite

After a particularly harsh winter, Brr Bear wakes up and heads out to find his next meal. His hunger is insatiable initially, eagerly accepting any morsel he encounters. However, as time goes on and the season progresses, he becomes more selective in his food choices. Brr Bear has just had his first taste in the market, but some of the morsels did not sit well with him. The shorts on the QQQs and Diamonds caused real stomach cramps, and he regurgitated everything he had gained from the futures pit. The time has come to be more discerning.

Just like with the bulls, when everyone has thrown in the towel, a market turn is coming. The Bears should glint their eyes, but instead, they stand back, watching as the first drops of honey hit the ground. The perception is that the Bears are market pessimists and not friendly people, as they want the market to do what it does nearly half the time – go down. In reality, the saying “buy and hold” makes a person both a bull and a bear, and they end up getting nowhere. It’s helpful to have a known bias.

The Importance of a Known Bias

It’s helpful to have a known bias regarding the stock market. Brr Bear understands this well as he becomes more discerning in his food choices. Similarly, in the market, he realizes that he can’t just accept any investment opportunity that comes his way. The shorts on the QQQs and Diamonds have taught him this lesson.

When everyone else has thrown in the towel, a market turn is coming. The Bears should be excited at this prospect but often get a bad reputation for being market pessimists. However, they are simply being selective in their investment choices. In contrast, “buy and hold” may make a person both a bull and a bear, but they end up getting nowhere.

Brr Bear reminds us that it’s essential to listen to the message of the markets and not the talking heads on the news. Only a continuously bullish message can lure investors into buying products and services from the investment industry. Short sellers must think independently and not be influenced by the media-controlled stock market pop culture.

The Bull and Bear Market: Understanding the Basics

A bear market usually implies economic distress, and those who profit from this distress are obligated to give back to society. Brr Bear understands this and encourages his fellow bear investors to give generously to charity and work for the public good. This creates good karma and diffuses any resentment generated by profiting from a bear market.

As Brr Bear becomes more discerning in his food choices, he realizes that being selective in the market is crucial. When everyone else throws in the towel, a market turn is coming, and the Bears should be excited at this prospect. However, they often get a bad reputation for being market pessimists, while in reality, they are simply being more cautious.

It’s essential to listen to the message of the markets and not just the talking heads on the news. Short sellers must think independently and not be influenced by the media-controlled stock market pop culture. It’s helpful to have a known bias. Still, it’s also important to remember to give back during a bear market to help those hurt by deteriorating economic conditions.

The Art of Being a Bear and a Bull in the Market

After a long winter, the bear awakens from hibernation, ready to go and rummage for his meal. While initially accepting any morsels with glee, as the season progresses, he becomes more discerning and picks and chooses his fodder. Similarly, the bear had just had his first taste in the market, and some of the morsels were not agreeable. The shorts on the QQQs and Diamonds returned stomach cramps, and he regurgitated everything he had from the futures pit. Now it’s time to be discerning.

The top market players are those who can recognise when to be a bear or a bull, knowing when to buy and when to sell. Admired by many and envied by some, they should not be pilloried for being correct. Forgetting to sell has caused many to lose money, and the true bear gets wounded by his contemporaries if he has made money in a declining market. He is perceived to be the vulture picking at the bones of the unfortunate when in reality, all he is doing is stocking up for his coming winter.

If Nicoli Kondratieff is more accurate than Alan Greenspan, and we are in the first stages of K-winter, then the time of the bear is coming. The bear knows what it’s like to have slim pickings and won’t advertise his gains too much. He has lived on the same planet where the wins of others have been rammed down his throat. He won’t repeat the mistake of gloating too much.

The Importance of Recognising Bias in Market Investments

The market is full of bias, both bullish and bearish. Investors need to recognise their biases to make wise investment decisions. The market is full of misinformation and advertising, and financial media outlets push investment opportunities that serve their advertising revenue. Successful investors listen to the message of the markets, not the talking heads on cable news networks. They know there is a time to buy and a time to sell. The media will tell you that anytime is the right time to buy but will never tell you when to sell.

Bears should give generously to charity and work for the public good. Bear investors should not be influenced by media-controlled stock market pop culture. In a bear market, economic distress is prevalent, and those who profit from this distress have an obligation to give back to society and help those who have been hurt by deteriorating economic conditions. For bears like me, it will be a time to watch and help wherever we can after pocketing all that lovely spondulie.

“It is less important to redistribute wealth than it is to redistribute opportunity.”

— Arthur Vandenberg, American journalist and senator (1884-1951)

© 2004 Alan Lunt

www.tacticalinvestor.com

Stock Market Outlook – August 2020

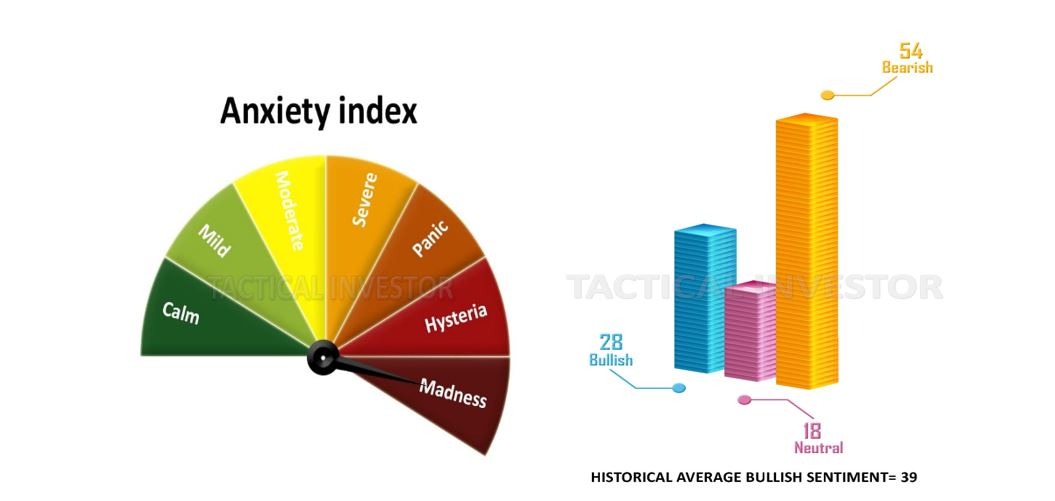

Every now and then, the stock market can surprise even the most astute experts. As the market enters a new phase, projections made by former experts might not hold up. Both the bulls and bears are likely to be caught off guard, but those that will take the biggest hit are the ones sitting on the sidelines, the neutrals. So, be prepared for the unexpected. However, don’t let these sudden market fluctuations blind you because, despite some crazy gyrations, the overall trend remains positive.

Until the trend changes, pullbacks should be welcomed as an opportunity. The greater the deviation from the norm, the better the chance for profit. Focus on the long game because the market is rife with hot money, and volatility is here to stay. The key to success is to ignore the noise and concentrate on the bigger picture.

Based on our trend indicator, the current trend in the stock market is positive. However, the sentiment among investors is not entirely bullish. In light of this, the best course of action is to embrace all strong pullbacks, mild or wild. It’s essential to focus on the long game and not be swayed by the noise and volatility that may arise in the short term. Investors can navigate market fluctuations and come out on top by staying focused on the bigger picture.

Other Articles of Interest