The End of Jobs or the Inception of a New Trend?

Updated January 2024

Mass Psychology (MP) differentiates itself from contrarian investing by acknowledging that the crowd isn’t always wrong. There are instances where individuals, by chance or oversight, find themselves on the right side of the fence. However, these instances are fleeting and rarely result in securing gains, as individuals continuously seek the guidance of the next guru or expert. MP focuses on extremes, identifying market tops during mass euphoria and vice versa.

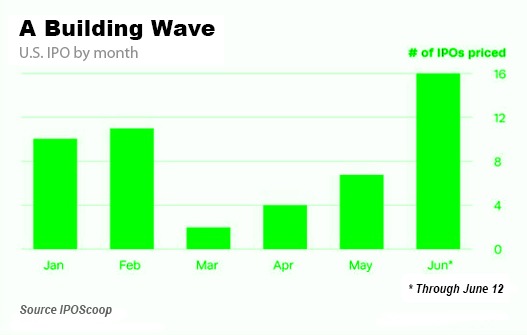

The IPO market is heating up, fueled by hot money and creating even more hot money. This is a positive long-term signal, but it also indicates that the masses will eventually embrace this bull market like a long-lost love. Greed overrules everything, and we are approaching a point where any company associated with Artificial Intelligence (AI) will soar; it will be the dot.com bubble on steroids. However, for now, view this as an affirmation that the trend is gaining traction.

In 2023, the number of IPOs in the United States increased by 15% compared to 2022. However, the proceeds saw a nearly threefold jump, primarily driven by a series of high-profile deals. A total of 153 deals raised US$22.7 billion, with more than 85% of them choosing US exchanges for listing. Although there were seven deals in 2023, raising over US$500 million, up from four in 2022, smaller deals continued to dominate IPO activity on US exchanges. Brazil experienced a two-year hiatus in IPO listings, marking the longest period without new listings in over two decades. In Canada, the main exchange witnessed only one IPO each in 2022 and 2023, an unprecedented low over the past two decades. Throughout the Americas, challenging conditions for capital raising emerged, attributed to weak IPO trading performance, increasing interest rates, and geopolitical uncertainties.

Fast forward to 2024, the rise of AI and robotics continues to disrupt traditional job markets. Automation increasingly replaces human labour in various sectors, from manufacturing to customer service. AI-powered systems can now perform complex tasks that were once thought to be exclusive to humans. For instance, AI can now generate music from text prompts, create videos from text, and even remember information like a human brain.

This trend is not without its consequences. As AI and robotics become more sophisticated, the demand for human labour in specific sectors is decreasing. This could potentially lead to job losses and increased unemployment. However, it’s important to note that this doesn’t necessarily mean the end of jobs. Instead, it signifies a shift in the types of jobs that will be available.

As traditional jobs become automated, new opportunities are emerging in fields related to AI and robotics. These include AI programming, robotics engineering, data analysis, and more jobs. Additionally, as AI takes over routine tasks, humans are freed up to focus on more complex and creative tasks. This could lead to creating jobs that we can’t even imagine today.

In conclusion, while the rise of AI and robotics disrupt traditional job markets, it doesn’t necessarily mean the end of jobs. Instead, it marks the beginning of a new trend where the job market evolves to accommodate technological advancements. The key to navigating this transition successfully will be adaptability and a willingness to learn and grow with the changes.

Navigating the Transformative Wave: The End of Jobs or the Dawn of a New Trend?

Rapid technological advancements are reshaping the job market landscape, driven by automation, artificial intelligence (AI), and robotics. These transformative forces have the potential to significantly alter traditional employment sectors.

A prime example is seen in manufacturing, where automation now handles tasks once performed by humans, potentially leading to job losses. In customer service, AI-powered chatbots efficiently manage inquiries, outperforming human operators with 24/7 availability and multitasking capabilities.

Retail is witnessing the rise of self-checkout systems and automated inventory management, reducing the demand for human cashiers and stock clerks. Similarly, the transportation industry faces potential job displacement with the development of self-driving vehicles.

Even healthcare is not immune, with AI systems diagnosing diseases and robots assisting in surgeries, challenging the traditional roles of doctors and surgical assistants.

Yet, as these technologies replace specific jobs, they also spawn new ones. The demand for AI specialists, data analysts, and robotics engineers has surged. Moreover, automation frees humans to focus on complex and creative tasks, giving rise to unforeseen job opportunities.

In essence, while technological advancements disrupt conventional job markets, they concurrently create fresh possibilities. Success in navigating this transition lies in adaptability, a willingness to learn, and embracing the changes. The prospect of the end of jobs as we know them could signify the dawn of a new era in work.

Now, let’s incorporate a historical perspective into this discussion, acknowledging that the COVID era laid the foundation for the onset of the end of the jobs era.

The end of jobs: Some Jobs are never coming back

Certainly, it’s quite amusing when individuals who seem to lack expertise confidently express their opinions on subjects where even a monkey with darts might offer more insightful responses. Initially, it’s crucial to recognize that we are contending with mass hysteria, signifying a scenario where everyone tends to act at a slower pace. The fact that people aren’t completely immobilized is, in itself, a miracle, considering the intensity of the challenges posed by this situation.

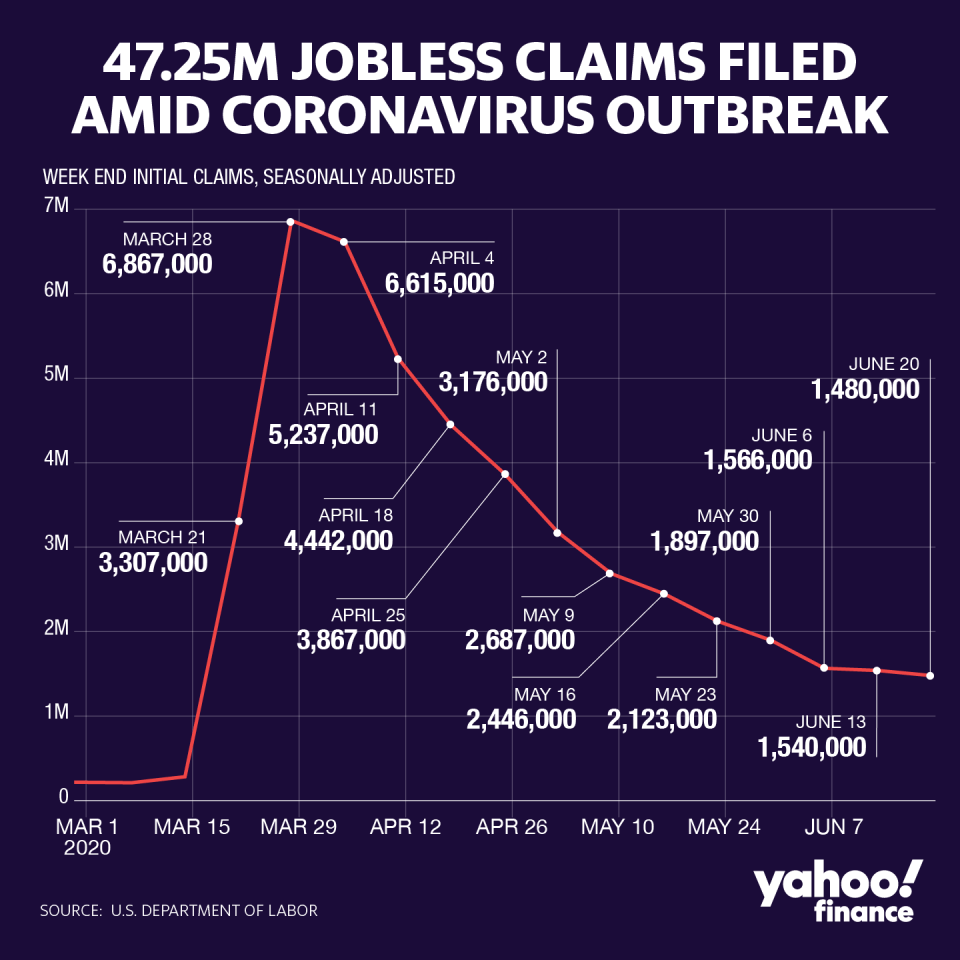

Moreover, a substantial number of these jobs are unlikely to make a comeback; COVID acted as the catalyst, propelling the AI/robotics program forward, and it is now firmly on track. Furthermore, trends rarely move in a singular direction, so it wouldn’t be surprising if the figures surge beyond the 3 million range before experiencing a downturn. In technical analysis, this would be considered establishing a lower high, indicative of a bearish development. In this context, it suggests that unemployment claims will persist in a downward trend, albeit with occasional fluctuations.

As time progresses, many of the unemployed individuals may start to perceive the universal income option as their sole recourse, a concept gradually gaining momentum. Both the corporate world and governments are likely to champion this agenda, presenting it as the beginning of a new era. Once the universal concept gains acceptance, the promotion of Augmented Reality (AR) will follow, leading to individuals experiencing a reality within a reality – akin to the concept depicted in the movie “Inception,” only this time, it will be a tangible reality.

You ask why? Simple answer with so many individuals out of the way, these guys will be able to exploit the system to the max. So, is there no hope for humanity? Off course there is, but not for the whole of humankind. We will discuss this in future updates.

We are seeing early signs that the top players are already in the stages of testing out new psychological ploys. We will discuss this in future if these early signals are validated. Don’t confuse the top players for so-called top players you see on TV. For example, compared to the real top shadowy players, Buffett and Bezos are nothing but fat sardines waiting to be eaten if they move out of line. These guys don’t reveal their hand easily, and they never show their faces, but one spots them via their mode of operation. In other words, one can notice signs of activity by their actions.

“Renaissance Macro’s Neil Dutta emphasized, ‘Jobless claims are not falling fast enough.’ Recent developments, including increasing COVID case counts, rising hospitalizations, economic progress slowdowns in crucial states, and government job cuts, all point to one conclusion: Phase 4 of fiscal stimulus must be more substantial.

While improvements are anticipated in the next 3-4 weeks, it’s expected that the news will worsen before any positive change. In response, consider mitigating risks by withdrawing some investments and preparing for potential opportunities in August.” https://yhoo.it/3g39Dto

Market Maneuvers: Discrediting Experts and Accelerating AI Advancements

A novel strategy emerging in this market involves discrediting numerous former experts, creating an illusion of the crowd being right for a specific duration. Subsequently, a shift occurs, portraying contrarians as insightful, disrupting the normal order through disorder. Amid the ensuing confusion, AI and robots will rapidly advance. The promised better tomorrow will be presented so enticingly that resisting its allure will be challenging for the majority, although regrettably, this optimistic future won’t extend its benefits to the masses.

This ploy of using every disaster to push more money into the system is going to be employed by central bankers worldwide. While central bankers from other nations might complain that the US is distorting things by increasing the money supply, they are doing the same thing. Look around, nation after nation is announcing some sort of stimulus program. Hot money will continue flooding the system and indirectly entering the markets. Market Update June 30, 2020

Since the last update, several nations have either announced new stimulus packages or lowered rates at the same time, and the Trump administration has stated that they are ready for round 2

As soon as the Senate gets back [from its current break], we will sit down on a bipartisan basis with the Republicans and the Democrats,” Secretary Steven Mnuchin said Thursday on CNBC. “It will be our priority to ensure that we pass the next legislation between the 20th and the end of the month.” https://cutt.ly/Qpprqn1

Helicopter money is here, and nobody is complaining about it. They want more and more. It may seem surreal to those that have some semblance of common sense left, but at this stage and for several years to come, nobody is going to give a damn about the national debt. What will catch the level-headed individuals with their pants down is that the dollar will not crash; this is the most favoured outcome or the outcome based on old-school logic, and hence, the odds of it coming to pass are very low. As we stated before, the dollar could surge to new highs.

Other Articles of Interest

Stock market crash 2020 predictions

US bank stocks and Psychological Ploys in the stock market

US jobless claims No Longer Connected To Stock Market

Easy Money Environment Fosters Price manipulation

How to Become A Better Trader?

Market Timing Strategies: All fluff or?

Define Fiat Money: The USD Is A Great Example

Deflation Economics: The Art of Twisting Data

BTC vs Gold: The Clear Winner Is …