Apr 6, 2023

The Changing Landscape of Stock Markets: Contrarian Perspectives on the Easy Trade

The easy trade is over; yesterday’s action partially confirms it. This does not mean that markets can’t run higher; it simply implies that you will need to work harder for your coin from here onwards. In other words, volatility levels will surge. Dec 4th update, 2022

Stock markets are always evolving, and the recent years have seen significant changes in the way they function. The so-called “easy trade” is a term often used to describe the stock market’s performance over the last few years. However, recent market action has partially confirmed that this era of easy gains is over. This article seeks to provide a contrarian view of the current state of the stock market, with an emphasis on the potential for volatility in the short-term timelines.

The End of Easy Trade

The easy trade is over; that much is clear. Market activity over the past few days has shown that traders will need to work harder for their gains from here onwards. Volatility levels are set to surge, which could mean significant losses for those unprepared for the new reality. Despite this, it is still possible for markets to run higher; it will just require more effort and strategic thinking to achieve the same level of success.

Short-Term Outlook

The indices have closed below last Friday’s low, indicating that the short-term outlook has weakened. It is unlikely that they will trade past their recent highs, and any future rallies will likely result in lower highs in December. However, the daily charts are close to trading in the extremely oversold ranges, and an interim bottom is likely. The ideal scenario is for the indices to rally to the end of the month before dropping lower into January 2023.

Divergences and Opportunities

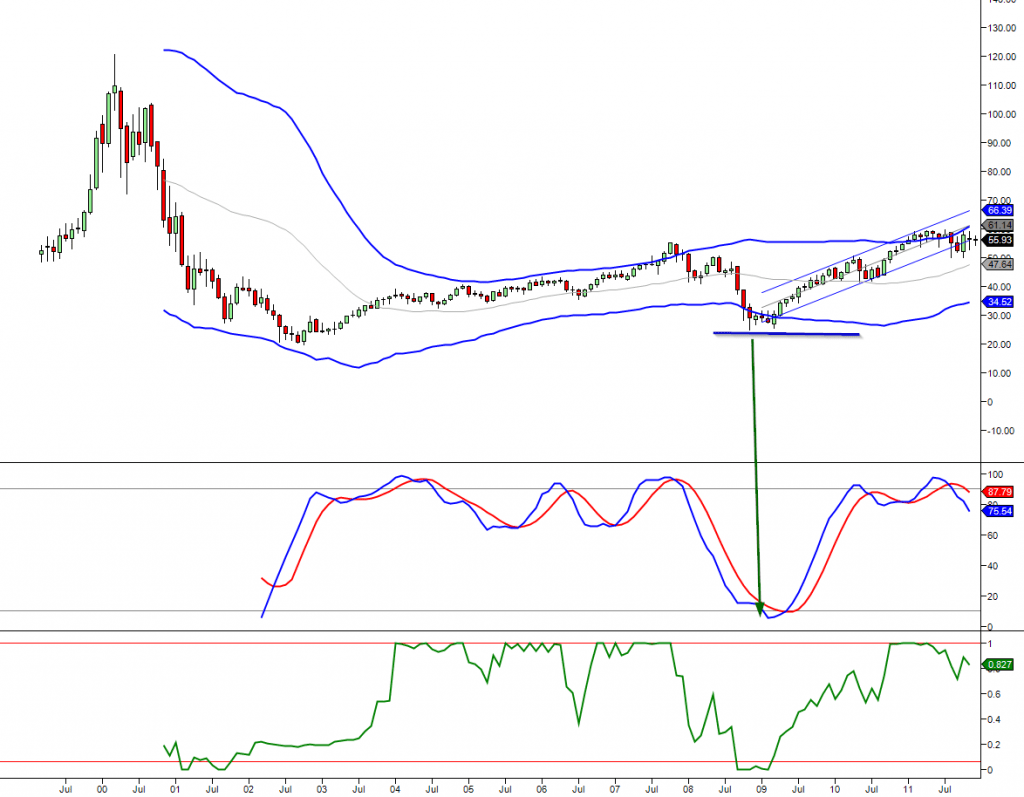

The current situation presents a crucial juncture for traders. The two expected corrections this year seem to have merged into one significant correction, mixed with rallies ranging from mild to somewhat strong. This setup often leads to divergences, with at least one index putting in a bottom well before the rest. In this case, that index is likely to be the Nasdaq, the weakest index. This divergence usually occurs 75 to 120 days before the other indices bottom. If this pattern plays out, the other indices will likely trend lower for 75-120 days after the Nasdaq bottoms. This could lead to short-term explosive moves lasting between 6 to 9 months.

Historical Precedents

The above pattern has occurred in other instances, such as the 2008-2009 timelines, where the Nasdaq bottomed out in November 2008, while the other indices bottomed out in March 2009. A similar pattern occurred in 1974, when the Nasdaq bottomed out almost four months ahead of the Dow. One of the reasons why more emphasis is placed on the 1973-1974 pattern is the similarity of events, such as war and inflation. However, regardless of historical precedents, much volatility is expected until March to April 2023 timelines.

Conclusion

The Nasdaq continues to lag the pack, but if it exhibits signs of strength, it will improve the stock market’s overall (bullish) outlook. It needs to close above the 11750-11900 range; the closer to the latter, the better. Secondly, the MACDs need to experience a bullish crossover; until then, expect much volatility.

Thirdly it should not close below 10,900 on a weekly basis. If it does, the Nasdaq is unlikely to trade past 12,300. Market Update Dec 4, 2022

The recent market action has shown that traders will need to work harder for their gains going forward. The easy trade is over, and volatility levels are set to surge. However, it is still possible to make gains in the stock market with strategic thinking and careful planning. Diversification is key to success, and traders should not fixate on one sector only. Instead, they should invest in many industries and types of stocks to succeed in the long run. The current situation presents both challenges and opportunities, and traders should be prepared for short-term volatility but also be ready to seize any long-term opportunities that arise.

FAQs

| Question | Traders must work harder for their gains as the easy trade ends, and volatility levels will increase. Strategic thinking and diversification are crucial for success. Investing in multiple industries and types of stocks is essential to succeed in the long run. While short-term volatility may occur, the current situation presents challenges and opportunities, and traders should be prepared to seize any long-term opportunities. |

|---|---|

| The End of Easy Trade | The easy trade is over, and volatility levels are set to surge. Traders will need to work harder for their gains, but there’s still potential for markets to run higher with strategic thinking and effort. |

| Short-Term Outlook | Indices have closed below last week’s low, signalling a weakened short-term outlook. Recent highs are unlikely to be surpassed, and future rallies may result in lower highs in December. Daily charts are nearing highly oversold ranges, suggesting an interim bottom is probable. Ideally, the indices will rally by month-end before declining into January 2023. |

| Divergences and Opportunities | Traders face a crucial juncture as two expected corrections have merged into one significant correction with mild to strong rallies. The weakest index, the Nasdaq, is likely to put in a bottom before the others, leading to a divergence. This pattern could result in explosive moves lasting 6 to 9 months after the other indices bottom. |

Read, Learn, Grow: Other Engaging Articles You Shouldn’t Miss