Richard Russell’s Dow Theory Signals: A Bold Challenge to Convention

Jan 6, 2025

Our view continues to diverge from the traditional Dow Theory, which we believe no longer holds the same weight in today’s dynamic market. The theory, once a staple, now seems almost obsolete. While less nervous than in October and early November of 2022, the Crowd has yet to hit the euphoria point. Still, the risk of reaching it is palpable, with bullish sentiment readings at 50. A level of 55 or higher would signal an unmistakable shift into euphoric territory, an omen that warrants caution. To further illuminate why the Dow Theory’s relevance has waned, we’ll draw on historical data and provide tangible examples to back up our assertion, making the timeline clear and accessible for all to follow.

Dow Utilities vs. Dow Theory: A Revealing Examination

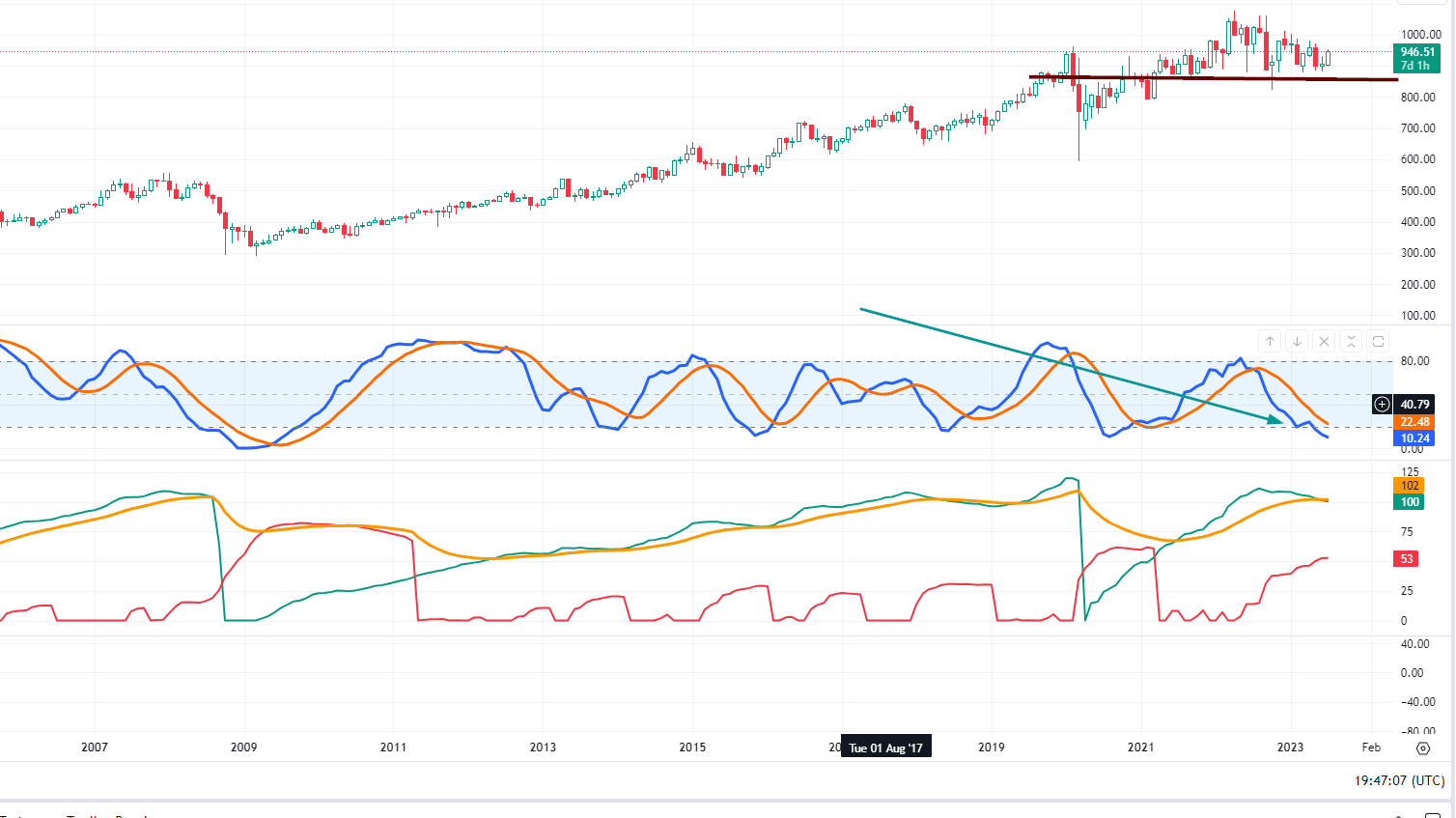

The Tactical Investor’s Alternative Dow Theory positions the utility sector as the true market leader during upward and downward trends. As reflected in the monthly chart above, the industry is consolidating, signalling that the ongoing rally may end. Investors should watch for a definitive buy signal from the utility sector, which would mark a crucial turning point, suggesting a potential market correction ranging from mild to significant. Until such a signal materializes, market volatility will likely persist. A bullish MACD crossover could hint at a bottom, signalling an opportune moment for those ready to embrace the market’s next move.

Richard Russell Dow Theory: Sell Signal? Or a Signal to Stay the Course?

March 2020

March 2020 revealed a market still gripped by anxiety but poised to defy conventional wisdom. Historically, no bull market has ever closed its doors on such a sour note. The likely scenario? A continued upward trend, not a sudden drop. At the time, the anxiety index was near hysteria levels, but it has since improved—yet the masses remain cautious, far from euphoric. The market still lacks full embrace from the general public, and until that happens, any pullbacks should be viewed through a bullish lens. Though more investors have tilted toward the bullish side since November and October, the neutral and bearish camps still outnumber the optimists. Only when the bullish crowd swells beyond 60% will we start to rethink our stance; until then, the market’s most probable path is upward. Neutral investors? They’re the ones who have yet to take a stand—waiting for the ideal moment to either strike or be caught off guard.

Alternative Dow Theory vs Richard Russell’s Dow Theory

Oct 2016

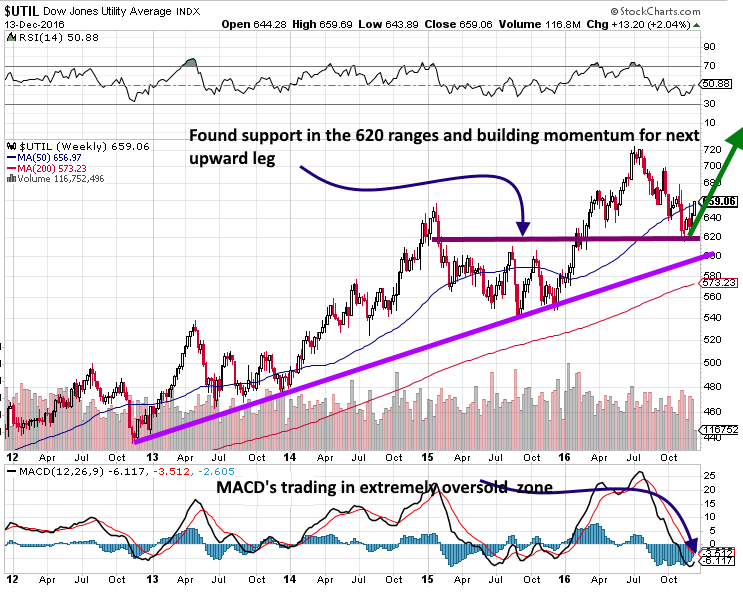

As we alluded to in the alternative Dow Theory article, the Dow utilities lead the way up or down.

It looks like the Utilities are coiling up to break out again. This suggests that the Dow industrials will follow in their footsteps. If you look at the utilities, you will see that, in general, they tend to lead the way up and down and are a better barometer of what to expect from the markets than the Dow transports. The utilities are coming out of a correction, so the Dow will likely experience a sentence sometime in the 1st part of next year before rallying higher. The correction should fall in the 5-10% range. We use the utilities as a secondary indicator. Our primary indicator is the trend; as the trend is up, we would view substantial pullbacks as a buying opportunity.

Markets Rally When Sentiment is Lowest: The Hidden Truth of Bullish Trends

It’s a paradox that many fail to grasp—markets often rally when sentiment is most negative. Yes, the day will come when this bull market faces a significant correction, but that moment is still on the horizon. History teaches us that no bull market has ever peaked without the masses finally jumping in, euphoric and blinded by greed. Some of the loudest critics, often the most outspoken and seemingly wise, like to say “the truth hurts” when discussing market trends. But isn’t the truth meant to liberate? Isn’t it supposed to set you free?

These so-called experts hide behind their misleading proclamations, only to sound like the desperate ramblings of someone losing touch with reality. They are not threats but contrarian indicators—providing you with valuable data. When these naysayers finally relent and embrace the market, you’ll know the end is near. Please keep your eyes on sources like Disqus, where these doomsayers frequently broadcast their panic. Remember, when the experts are panicking, that’s precisely when you should buy.

The Dow Utilities: The Market’s Leading Indicator of What’s to Come

The utility sector is on the verge of breaking out, setting the stage for the broader Dow to follow suit. As the utilities lead the charge, expect the Dow to follow its lead into bullish territory. However, like the utility sector, the Dow is primed for a correction before it can soar. This potential dip, likely to occur in the first quarter of next year, should be viewed not with fear but as an opportunity. When the market takes a breather, it’s not a sign of doom; it’s the necessary pause before the next wave of upward momentum. Stay alert and prepared, for the best opportunities are often born from these brief moments of market hesitation.

The Trend is Bullish: Embrace Strong Pullbacks

Nov 2015

The trend (as per our trend indicator) is still bullish and shows no signs of weakening. Until it changes direction, the market is not likely to crash. We can already tell you what will happen when the markets start to pull back. They will sing the same song, something we had already described in past articles when we discussed Brexit, the possibility of a Trump win, etc. The naysayers will rush out again, proclaiming that all hell will break loose.

They are not students of history and refuse to learn from it; instead, they seem almost to take masochistic pride in repeating the same mistakes repeatedly in the hopes that they will be correct. One day, they will be right, but anyone who had listened to them would have been bankrupt several times by then.

As the markets drop, the Dr’s of Doom will scream louder and louder; momentarily, these guys will appear to have finally struck Gold. Then, the brief period of joy will vanish, and their songs will turn into pain as the market suddenly puts at a bottom and rallies upwards. Like cockroaches, they will disappear in the woodwork, waiting for the next moment to sing the same miserable tune of gloom. Please don’t fall for this rubbish; even rubbish has some value; it can be used as compost. Don’t fall into the stock market crash hysteria; expect an extreme Trump Rally.