The Decline of Central Bank Assets

Feb 9, 2023

Central bankers worldwide hold a significant portion of their countries’ financial assets, which they use to manage their respective economies and stabilize financial markets. Recently, however, the value of these assets has been decreasing, leading to concerns about their ability to fulfil their responsibilities effectively.

The primary cause of this decline is the rising inflation and interest rates, which have decreased the value of bonds and other fixed-income assets that central bankers typically hold. Higher inflation erodes the value of these assets, while rising interest rates reduce their appeal to investors, as they offer lower returns. This has resulted in a decrease in demand for these assets, which in turn has contributed to their declining value.

The decline in the value of central bank assets is a cause for concern, as it reduces their ability to intervene in financial markets and stabilize the economy. In the event of a financial crisis, central bankers can sell these assets to provide liquidity to the market and prevent a meltdown. However, if the value of these assets has decreased, they may not be able to provide the same level of support as before.

Furthermore, the decline in the value of central bank assets can also affect their credibility, as it calls into question their ability to manage their own financial resources effectively. This can reduce trust in the central bank and its ability to implement monetary policy effectively, which can negatively impact the broader economy.

However, the crucial question remains: will they focus on what is happening now or on the rear outlook (examining old data)?

The Fed and other central bankers’ assets worldwide are losing value (they purchased bonds earlier at much higher prices). In one way, the Fed cuts off its nose to spite its face.

Britain’s move highlights a dramatic shift in countries including the U.S., where central banks are no longer significant contributors to government revenues. The U.S. Treasury will see a “stunning swing,” going from receiving about $100 billion last year from the Fed to a potential annual loss rate of $80 billion by year-end, according to Amherst Pierpont Securities LLC.

The Reserve Bank of Australia posted an accounting loss of A$36.7 billion ($23 billion) for the 12 months through June, leaving it with a A$12.4 billion negative-equity position.

Dutch central bank Governor Klaas Knot, warned last month he expects cumulative losses of about 9 billion euro ($8.8 billion) for the coming years.

The Swiss National Bank reported a loss of 95.2 billion francs ($95 billion) for the first six months of the year as the value of its foreign-exchange holdings slumped — the worst first-half performance since it was established in 1907. https://cutt.ly/rNiT4bB

Sweden’s central bank expects to report a loss of 81 billion Swedish crowns ($7.72 billion) for 2022 due primarily to higher market interest rates, it said on Wednesday. “The unrealised loss is mainly due to globally rising market interest rates, which has reduced the market value of the Riksbank’s assets,” it said in a statement. https://rb.gy/l5qzul

Bond Market Liquidity issues

Liquidity in the bond markets is drying up, and the Fed could soon be forced to intervene like the BOE and BOJ. Then we have the crises many developing nations face; some will be unable to pay interest on their loans. Pension funds are also facing liquidity crunches; they were supposed to invest their client’s funds in safe assets but decided to use complex instruments to boost their returns. Which is another sneaky way of stating they used derivatives to juice their returns. Wage inflation also shows signs of topping, which applies to rental prices. Hence if the Fed chooses to focus on real-time data instead of relying on old data, they would see that the path of least damage now is to adopt a less aggressive tone.

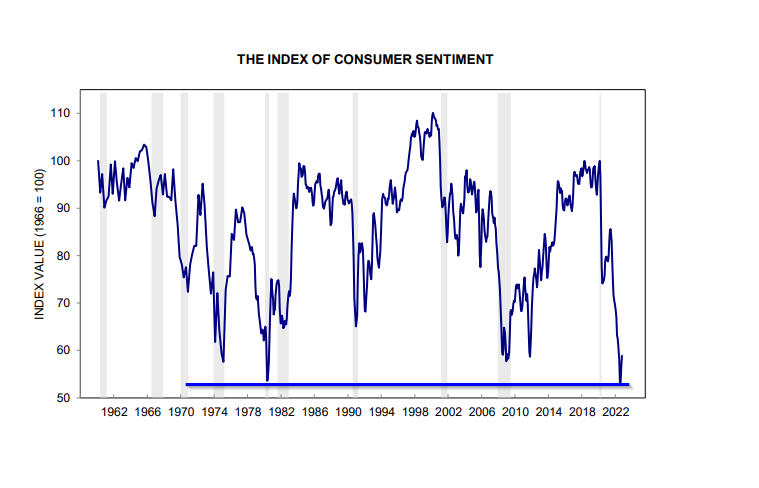

Source: http://www.sca.isr.umich.edu/files/chicsh.pdf

This index is at an all-time low. This is a remarkable development in light of the official data indicating that we are not even in a recession. However, during 2008-2009, when readings were slightly higher, we were on the verge of a depression. Instead of calling it that, the great recession phrase came into play (in an attempt) to downplay the severity of the situation. However, now the psyops is so great that everything is just “wunderbar.“

To summarise

For example, during periods of economic growth and low inflation, central bank assets may have increased in value, while during periods of economic slowdown or financial crisis, the value of these assets may have decreased.

One of the primary challenges facing central bankers is maintaining the value of their assets while also achieving their monetary policy goals. For example, if central bankers raise interest rates to combat inflation, this may reduce the value of their assets as the yield on bonds and other fixed-income assets decreases.

The decline in the value of central bank assets can have various consequences, including reduced ability to support the financial system, reduced confidence in the central bank and its ability to manage monetary policy, and potential negative impacts on the broader economy.

To address these challenges, central bankers may need to diversify their portfolios, implement more effective risk management strategies, and increase transparency and accountability in their operations.