Economic deflation

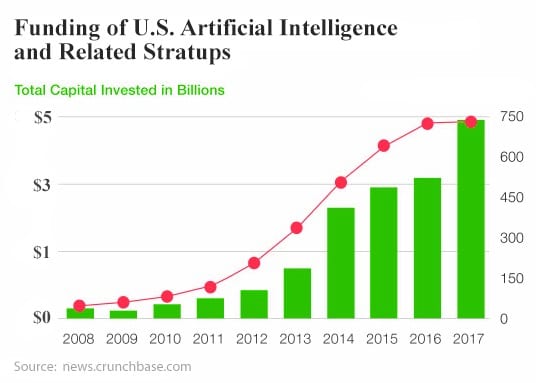

Venture funding for AI is surging, as evidenced by the chart below, and the trend is showing no signs of letting up; in fact, the movement is so powerful that one can almost start with certainty that technology-driven deflation is going to be a potent force to reckon with. Imagine small companies having the power to do what Amazon does but on a different scale. For example, flippy the burger bot replaces several workers saving a business up to 100K annually.

“We are excited about the impact Miso’s AI-based solutions will have on the restaurant industry. Humans will always play a critical role in the hospitality side of the business… We don’t know the new roles in the industry yet.”

The Bot will never get tired, never need uniforms, and it won’t get sick or complain. It is the perfect worker for small business burger joints looking to reduce costs and improve their services. As far as the big players are concerned, it has the potential to reduce their overhead by billions. Lastly, companies won’t have to worry about paying a minimum wage of up to $15 an hour and providing benefits.

Economic deflation: Little Ceaser Bot

Pizza chain Little Caesars has been awarded a patent for an AI-based robotic system to help assemble Pizzas significantly faster. The patent includes two robots, one stationary arm and another fully-fledged robot chef to handle the dough and take care of oven duties.

According to the company’s explanation in the patent, the robot would free Little Caesars from the monotony of repetitive tasks and allow them to “perform other value-added tasks.” Presumably, that’s the same thinking that gave us Flippy, the burger-flipping robot.

Still, there are other robots already doing the things this particular one can’t — Zume Pizza in Silicon Valley, for example, can shape the dough and bake the pizzas at a rate of 372 an hour.

If Little Caesars were to ever combine their robot with Pizza Hut’s self-driving pizza delivery truck, the only human force we’ll ever need will be a single human to load the pizzas into the car. Full Story

Could the pizza bot move like Flippy? Time will tell

If stagflation were an issue, you would not have manufacturers creating pizza and burger bots. These bots are being created in many cases because finding workers is getting harder and harder.

“Now he moves like a ninja and is more reliable,” says David Zito, the CEO of Miso Robotics, which created Flippy.

“We’ve been trained since childhood that robotics were coming in the future,” notes Louise Perrin, an accountant who works nearby. “To be a part of it, to see it and watch it happen live in front of you … is absolutely incredible.”

“I had to come in and see Flippy,” she says. “I’d heard the buzz. The concept of a robot flipping your burger is awesome.”

Economic deflation & Central Bankers’ action

The shrinkage of the U.S. Federal Reserve’s balance sheet has played a significant role in exerting upward pressure on borrowing costs as parts of the U.S. economy have shown signs of decelerating, a study from the Kansas City Federal Reserve released on Wednesday showed.

The model developed for the study showed the level of reserves plays “an important role in determining the federal funds-IOR spread over the medium- and longer-term and that repo rate dynamics play a relatively less important role,” A. Lee Smith, a Kansas City Fed senior economist and the author of the study, wrote. Full Story

The China Factor

It is premature to say China is coursing toward a Japan-like falling-prices drama. Yet recent data warrant a moderately sized blip on investor radar screens. In November, consumer prices slid 0.3% from a month earlier, while producer prices fell 0.2%. On a year-on-year basis, producer prices advanced just 2.7% in November, the weakest reading in two years (consumer prices are up 2.2% from a year ago).

Bond traders are taking no chances. Earlier this week, 10-year yields dropped to 3.27%, the lowest in more than 18 months. And they have every reason for gloom considering the headwinds blowing China’s way — and how they may intensify next year. Full Story

Contactless payments

The perfect blend of speed, security, and contactless payment options makes it easy for restaurant owners to improve the dining experience while cutting costs. Rather than digging through their purse or wallet, customers can tap their phone, wristband or key fob over a contactless reader on a payment terminal and complete a transaction within seconds. No PIN or signature is required for a quick and convenient payment.

Card-not-present payment options have drawn much attention within the past few years – and rightfully so. By enabling diners to complete online transactions, card-not-present payment options cater directly to the fast-paced lifestyles of today’s restaurants.

Although it costs more for restaurant owners to process online payments, that doesn’t diminish the value of card-not-present payment options. The majority of diners order more online or through an app than they do in person. These additional orders more than make up for the higher fees associated with the card-not-present transaction. fastcasual

Robot Chefs and Labgrown meat

Around 77pc of the tasks carried out by waiters and waitresses can be automated, according to a study by the Center for an Urban Future in New York. When including food preparation, the study claims machines can do 87 per cent of the roles carried out by fast-food workers.

There are plenty of examples. French startup Ekim, for instance, wants to speed up the way pizza is made using a pizzaiolo robot. The three-armed autonomous device is capable of creating a pizza every 30 seconds.

“It’s excellent, I would say there’s no difference between the one created by the robot and human,” said Paul Yong, a guest at last week’s launch event.

According to a recent report from the Brookings Institution, food service workers are among the most vulnerable to losing their jobs to robots. It said 36mn Americans hold positions with high exposure to automation – meaning 70 pc of their tasks could be replaced by machines using existing technology. Cooks, waiters and other food service staff were named alongside short-haul truck drivers and clerical office workers.

Lab meat

Complimentary samples of the new product, developed in partnership with Beyond Meat and dubbed “Beyond Fried Chicken,” will be available at the KFC in Smyrna, Georgia, on Tuesday. Customers can also buy nuggets and boneless wings made from the non-meat.

“I think we’ve all heard ‘it tastes like chicken’ – well our customers are going to be amazed and say, ‘it tastes like Kentucky Fried Chicken!'” president and chief concept officer for KFC US Kevin Hochman said in a statement.telegraph

Economic deflation: How To Invest

Economic deflation is when the general price level of goods and services in an economy declines over time. Deflation can occur for various reasons, such as reduced consumer demand, an increased supply of goods and services, and technological advances that reduce production costs. While deflation may seem like a positive development for consumers, it can have serious adverse effects on the economy, such as a decline in business investment and a rise in unemployment rates.

Investing during deflationary periods can be challenging because traditional investments like stocks and bonds may lose value as prices decline. However, investors can consider a few investment strategies during deflationary periods. These strategies include investing in bonds with fixed interest rates, high-quality dividend-paying stocks, and investing in assets that tend to hold their value during deflation, such as gold, real estate, and collectables.

Another critical strategy for investing during deflation is to maintain a long-term investment horizon. While deflationary periods can be challenging in the short term, they can also present unique investment opportunities for long-term investors. In particular, long-term investors can take advantage of undervalued assets and companies likely to perform well in the long run.

Research

Here are some links to articles that discuss investing during deflationary periods:

- “Investing in a Deflationary Environment” by Carla Fried, The New York Times (2014): https://www.nytimes.com/2014/03/22/your-money/investing-in-a-deflationary-environment.html

- “Investing During Deflationary Times” by Geoff Considine, Forbes (2016): https://www.forbes.com/sites/geoffconsidine/2016/01/25/investing-during-deflationary-times/?sh=7ed77a7840b4

- “Investing During a Deflationary Period” by Tim Parker, Investopedia (2022): https://www.investopedia.com/articles/investing/021216/investing-during-deflationary-period.asp

- “How to Invest During Deflation” by Kent Thune, The Balance (2022): https://www.thebalance.com/investing-during-deflation-3140405

- “Investing in Deflationary Times” by Matthew Boesler, Bloomberg (2015): https://www.bloomberg.com/news/articles/2015-04-02/investing-in-deflationary-times

Articles of Interest

Business Investment & Stock Market Uncertainty (Jan 31)

Dow 30 Stocks; what are they saying about the markets (Jan 30)

Stock Market Bull 2019; Follow The Trend & Avoid The Noise (Jan 29)

Long Term Trends & Bull Market Bear Market Nonsense (Jan 16)

Bull & Bear Market 2019: which one will prevail (Jan 14)

Stock Market Crash-Media Lies And Ignorant Experts (Jan 11)

Market Correction Vs A Back Breaking Market Correction (Jan 3)