The Supertrend: A Mass Psychology Perspective

Dec 4, 2023

Introduction

In investment and portfolio management, the concept of Supertrend considers the influence of mass psychology and behavioural psychology. It advocates for a prudent approach to managing portfolios, emphasizing the importance of understanding more significant trends and the psychology behind investor behaviour.

One key aspect of Supertrend is the recognition of smaller trends within larger ones. These smaller trends are often driven by the Fear of Missing Out (FOMO), where investors are tempted to jump on board popular investment opportunities without thoroughly analyzing the underlying factors. Supertrend suggests that a monthly portfolio review is sufficient, discouraging constant monitoring and reactive decision-making.

In the context of the AI industry, many companies are embracing AI without a clear strategy, particularly when it comes to investments in high-end chips like those offered by NVIDIA. However, the Supertrend perspective highlights the significance of software advancements alongside hardware. Upcoming software developments have the potential to enhance system integration and chip capacity, which may be overlooked in the race to acquire the latest hardware.

Another critical aspect is how mass psychology can potentially impact the semiconductor industry. NVIDIA, a prominent player in the AI chips market, has focused its resources on AI technology. However, some experts argue that this approach contradicts the principle of diversification. This concentration of efforts creates opportunities for significant buyers like Amazon, Microsoft, and OpenAI to explore chip design and potentially develop their chips. OpenAI, in particular, plans to examine proprietary designs when the timing is right. Acquisitions in the industry, such as Cerebras or Graphene, could also play a role in accelerating this journey.

SuperTrend Ally: Where the Trend Becomes Your Friend

In essence, the concept of Supertrend advocates a prudent approach to portfolio management. It suggests that a monthly review of the Supertrend portfolio suffices rather than constantly monitoring investments. This approach also underscores smaller trends within larger ones, often mistaken for the primary trend, driven by the Fear of Missing Out (FOMO).

Many companies are embracing the initial phase of AI without a clear strategy, heavily investing in NVIDIA’s high-end chips without a concrete monetization plan. What often goes unnoticed is the paramount importance of software in addition to hardware. Upcoming software advancements are poised to enhance system integration and chip capacity.

Furthermore, NVIDIA’s high-stakes gamble on AI, focusing all resources on one technology, contradicts the wisdom of diversification. The potential for major buyers to develop their chips poses a significant challenge, especially given NVIDIA’s status as a fabless semiconductor manufacturer. Savvy corporations with substantial capital, such as Amazon, Microsoft, and Open A.I., have already ventured into chip design. Open A.I., in particular, intends to explore proprietary designs when the time is ripe.

To expedite this journey, acquisitions like Cerebras or Graphene could be on the horizon.”

Sam Altman, the CEO of OpenAI, has recently stated that although the organization is not currently developing its own AI chips, they are not ruling out the possibility of doing so in the future. OpenAI is exploring various options to scale up its AI capabilities to meet the increasing global demand. Currently, they are relying on computing power from their partner, Microsoft, but they are considering the prospect of developing custom chips. However, this potential move might disrupt their close partnership with Microsoft. Altman also mentioned the global shortage of advanced processors, such as Nvidia’s GPUs, which are used for AI tasks. He expressed optimism that competition could alleviate the shortage and lower prices.

Google has already introduced its A.I. chip and continues its efforts to enhance it. Meanwhile, IBM has unveiled a new chip, as discussed later.

For supertrend players, the focus shifts away from the short-term noise, and they patiently await stocks to release built-up pressure before entering positions. Importantly, they avoid falling victim to FOMO (Fear of Missing Out).

We maintain our earlier stance that many current A.I. companies may not endure, and dominant players could transform, from Dobermans to chihuahuas. NVDA appears significantly overpriced, especially with multiple companies expressing intentions to develop their chips and the recent restrictions on chip exports to China. We won’t be surprised if NVDA’s stock eventually declines to the upper $200 range. However, it could initially test recent highs, triggering a negative divergence signal before the decline.

Conclusion

In conclusion, the Supertrend approach to portfolio management emphasizes a measured strategy with monthly reviews, steering away from constant monitoring and FOMO-driven decisions. In the realm of AI investments, the focus extends beyond hardware, highlighting the crucial role of software advancements. The concentration of efforts by major players like NVIDIA may face challenges from competitors exploring chip design, potentially disrupting the industry landscape.

The narrative shifts to OpenAI’s contemplation of developing its A.I. chips, posing a potential divergence from its close partnership with Microsoft. The global shortage of advanced processors is acknowledged, with optimism for competition to alleviate scarcity and reduce prices.

As the industry evolves, Supertrend players maintain a disciplined approach, avoiding short-term noise and patiently waiting for opportune moments. The caution extends to the evaluation of A.I. companies, recognizing the potential for shifts in dominance and the need for sustained innovation.

The stance on NVIDIA suggests a cautious outlook, considering the intentions of other companies to develop their chips and geopolitical considerations. The prediction foresees a possible decline in NVDA’s stock to the upper $200 range, fueled by factors like increased competition and restrictions on chip exports to China. Vigilance is advised, anticipating potential signals of a downturn despite potential near-term highs.

Unearth Unique and Valuable Reads

Home Run with Homeschooling Ideas

Americans with No Emergency Funds: Progress & Challenges

Hookah Lounge: A Captivating Experience for Relaxation and Socialization

Anxiety Sensitivity Index Does Not Support Stock Market Crash

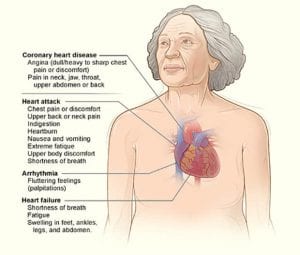

Unveiling the Silent Threat: Women and Heart Disease

Homeschooling Benefits: A Comprehensive Guide

Google News Trends Unveiled: Gossip Promoted as News

Benefits Of Homeschooling: US Education System Is Crumbling

Neocon Perceptions and the Illusion of Nuclear Warfare

Stocks To Buy Today Reddit – Focus on the Trend, Ignore the Noise

12 Best Tropical Paradises to Visit for Your Dream Getaway

Neocon 2023: Debunking the Nuclear War Myth

Gold Spot Price History: Will Gold Continue Trending Upwards

Mastering the MACD Strategy: A Powerful Tool for Investors