Stock market crash 2022: Reason No. 1

Updated Jan 2023

In addition to the many reasons we have provided in previous updates, two extra factors could lead to a more robust correction in the 4th quarter. Tactical Investor April 2022

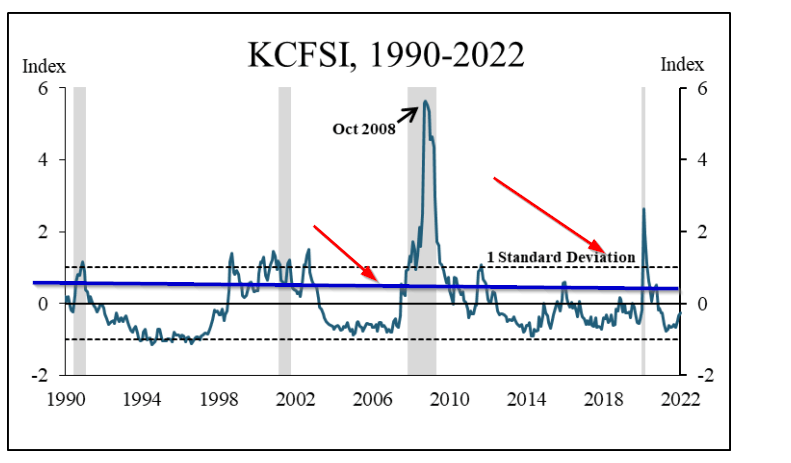

The current Kansas City financial stress index (KCFSI) reading contradicts popular belief. It shows that despite challenges such as increased prices and the conflict in Ukraine, the economic outlook is not as dire as its being portrayed. These readings can be seen as a positive sign from a contrarian viewpoint. It’s not uncommon for financial stress levels to rise above one standard deviation, but it’s rare for them to do so during economic stability. The housing market crash of 2008 and the COVID crash are notable exceptions.

Source: https://www.kansascityfed.org

The COVID-19 pandemic had only a minimal impact on the KCFSI, as it pushed the index slightly below 3.00. However, it is possible that the events of 2022, which could continue into 2023, could drive the index past 3.00 and create a significant buying opportunity. Currently, the reading stands at a low of -0.27.

On the other hand, the Gnosis Panoptes (G.P.) index has been reaching new highs continuously since December, with almost a new high every month, which is an unusual occurrence. This trend suggests that there could be several unexpected and significant developments in the next 3 to 18 months.

The more substantial correction expected in the 4th quarter would qualify as something unique. Our analysis suggests that the KCFSI index signalled the peak of the U.S. market in March 2022, and the current rally in the USD could be the last significant one for decades. Meanwhile, there will be a growing divide among nations, with China and Russia at the forefront – China through its financial influence and Russia through its military power. This could lead to increased global polarization.

Random musings

Stock market crash 2022: Reason No. 2

The monthly charts are trading in highly overbought ranges, but the weekly charts are trading in insanely oversold zones. This setup almost always leads to a stock market crash, type of situation but only after the markets mount a strong rally. This setup has never failed to deliver, and the only question is whether the subsequent correction will be wild or highly intense.

The massacre setup calls for the index (in this case, the Dow) to test its old highs (the two red arrows pointing at the blue line drawn over the price chart). Ideally, it generates a negative divergence signal while testing its old highs or trading to new highs (this is even better). As the weekly charts are trading in the oversold ranges, the MACDs in the monthly charts should experience a bullish crossover in the overbought ranges.

After that, the MACDs almost always move into the extreme zones of the overbought ranges. When this development coincides with a surge in bullish readings, it almost always indicates that a top is close at hand. The most important part of this setup calls for the crowd to be ecstatic. If they are not euphoric, the massacre scenario will not bear fruit.

The secret to long-term financial success is embracing temporary paper losses, or drawdowns, with open arms. The ones who succumb to fear and panic will always come out on the losing end, while those who stay calm and collected will reap the rewards in the end. The trend is king, and those who ride the wave instead of fighting it will come out on top.

Contrary to popular belief, stock market crashes do not always start with a roar of euphoria. The next crash’s third and most devastating wave will begin with euphoric enthusiasm, but this time, it’s likely to bring about anti-inflationary forces. However, if the Western leaders persist in their foolish policies, they could nullify these forces to the detriment of their economies. The intelligent countries, those who use their brains instead of their backsides, will thrive in this deflationary environment.

Unfortunately, Western societies take pride in electing the most foolish and corrupt leaders to the highest offices. Just look at the countless absurd policies and regulations implemented post-COVID. There is a direct correlation between stupidity in leadership and price increases. A dangerous form of brain damage plagues Western leaders.

In finance, the real definition of inflation is an increase in the money supply, and the price rise is only a symptom. The true inception of inflation started the day we abandoned the Gold standard. Despite what some may believe, hyperinflation is not something to fear. Our stance has been consistent for months now – hyperinflation is not a concern.

If the events of 2022 unfold as anticipated, the following outcomes are possible:

- A significant portion of the population may be forced to re-enter the workforce due to the depletion of their savings, including a substantial number of baby boomers.

- Decreased demand for various commodities, such as natural gas and petrol, may lower prices.

- In a state of panic, the public may demand that central bankers take action to stabilize the markets. This could lead to a lowering of interest rates and the creation of an additional 5 trillion USD by the Federal Reserve.

- Historically, crashes have been orchestrated events, particularly since the abandonment of the gold standard. Prices may not decrease in certain parts of the world, as the ongoing conflict between the West and Russia and China may impact the global market.

Historical Sentiment values

Conclusion

The sheeple who follow the herd will be left in the dust, while the bold contrarians who march to the beat of their drum will come out on top. The key to success in this game is to have the courage to swim against the tide, bet against the consensus, and embrace the unexpected. The naysayers and doubters will tell you it’s impossible, but those who dare to defy the odds will reap the rewards.

In a world where everyone is rushing to buy the latest hot stock or trendy asset, the true opportunity lies in doing the opposite. By zigging when others zag, you can avoid the stampede and position yourself for outsize gains. The key is to have the conviction and patience to ride out the storm and stay the course, no matter how much the crowd may scream otherwise.

So embrace your inner contrarian, and seize the day when the masses are throwing in the towel and the markets are plunging. That’s when the real money is made, and the true winners are crowned. The market is merciless, the masses mindless, and only the trend player wins, for they clearly understand this concept: “the trend is your friend, and everything else is your mortal foe.”

A few months ago, many individuals complained that being in cash was burning a hole through their pockets. We were constantly barraged with emails asking for more plays. And voila, now it is all quiet. Looking at this from a Mass Psychology angle indicates that a bottom is close at hand. Market update March 9, 2022

We are going to pay closer attention to how new subscribers react. Individuals that are with us for less than 15 months, in general, tend to overreact to the news and daily prices. The most reactive are subscribers that have been with us for less than nine months. Their actions have helped provide powerful confirmations that a bottom was close at hand many times. Their reactions during the COVID crash were quite interesting; within nine days of fear levels spiking, the markets put in a bottom. Let’s see if this proves to be true this time around.

It always looks terrible in the heat of the moment. Can anyone state that they did not feel it was different “this time” when the markets crashed during the COVID pandemic? It always feels like it is different. History never repeats itself (exactly), but it does rhyme. So, the only information one should focus on is that a massive amount of hype is being used to make the situation look even worse. All the good news is being ignored, and every piece of negative data is pounced on. This is the same approach they took during the COVID crisis. Market update March 9, 2022

stock market crash in 2022 will be a wake-up call for passive investors

The crash expected in the 4th quarter will be a wake-up call for all passive investors. These chaps should be called hopers, for they hope the individuals they entrusted their money with are good investors. Given the intensity of the current correction, which we predicted last year, the ensuing correction could be delayed until the end of the 4th quarter or the 1st quarter of 2023.

However, we believe this market surge will be short-lived. True contrarians should be ready to pounce on the opportunities that will present themselves during the inevitable market crash. This is a time for the bold and daring investors, those willing to take calculated risks, to reap the rewards of their foresight and preparedness.

Forget the conventional wisdom and ignore the talking heads on TV. They have no idea what’s coming and will be caught off guard, just like everyone else. The true contrarian sees the writing on the wall and is poised to strike when the masses run for exits. Don’t be a passive investor, be a trend player and always stay ahead of the curve. The future belongs to those who take control of it.

Other Articles of Interest

Losing Money in the Market: Strategies to Minimize the Risk

Why Is Inflation Bad for the Economy? Demystifying the Menace

The Dow Jones Industrial Average Expected To Trend Higher

Stock Market Blues? The easy trade is over

Semiconductor Industry News: Key Technical Developments

Unveiling the 1929 Crash Chart: Decoding Market Turbulence

The Dynamics of Bull & Bear Markets: Mastering Trend Analysis

Negative Thinking: How It Influences The Masses

The Limits of Herd Behavior in Markets

Lagging Economic Indicator: Understanding Its Significance

Semiconductor Outlook: Trends & Future Expectations

Trading Journal: The invaluable tool for traders

Stock market experts know Nothing

Best Investment Ideas; Focus on the strategy first